OpenAI models train financial times content, a powerful combination that has the potential to revolutionize the way we analyze and understand financial information. By leveraging the vast amount of data available in the Financial Times, these models can extract valuable insights, predict trends, and identify investment opportunities.

Imagine a world where financial reports are automatically generated, market sentiment is analyzed in real-time, and investment decisions are informed by AI-powered tools.

This is the exciting future that OpenAI models and the Financial Times are bringing to life. This blog post will explore the potential benefits of this collaboration, the challenges involved, and the ethical considerations that need to be addressed.

OpenAI Models and Financial Times Content

The integration of OpenAI models with Financial Times content opens up exciting possibilities for extracting valuable insights and enhancing financial analysis. These models can leverage the vast repository of financial news, articles, and data published by the Financial Times to provide a deeper understanding of market trends, company performance, and economic developments.

Sentiment Analysis

Sentiment analysis, a key application of OpenAI models, can analyze the tone and sentiment expressed in Financial Times articles, providing valuable insights into market sentiment and investor confidence. By processing the text, OpenAI models can identify positive, negative, or neutral sentiment, allowing analysts to gauge market reactions to specific events, company announcements, or economic indicators.

This information can be used to make informed investment decisions or to understand the potential impact of news events on different sectors.

Topic Modeling

Topic modeling, another powerful application of OpenAI models, can identify and extract key themes and topics from Financial Times content. By analyzing large datasets of articles, reports, and data, OpenAI models can identify recurring patterns and themes, providing a comprehensive overview of the most discussed topics in the financial world.

This information can be used to understand emerging trends, identify investment opportunities, or to track the evolution of specific industries or sectors.

Trend Prediction

OpenAI models can also be used to predict future trends based on historical data and current events covered in Financial Times content. By analyzing past trends and patterns, these models can identify potential future developments in financial markets, economic indicators, or company performance.

This information can be used to make informed investment decisions, to anticipate potential risks, or to develop strategies for navigating future market volatility. For example, an OpenAI model could analyze historical data on oil prices, economic indicators, and geopolitical events to predict potential fluctuations in oil prices in the coming months.

Training OpenAI Models on Financial Times Content: Openai Models Train Financial Times Content

Training OpenAI models on Financial Times content can unlock a wealth of possibilities for financial analysis, news interpretation, and market insights. This process involves carefully preparing the data, selecting the appropriate model, and fine-tuning training parameters to achieve optimal performance.

Data Preparation

The first step in training an OpenAI model on Financial Times content is data preparation. This involves collecting, cleaning, and formatting the data in a way that is suitable for the model.

- Data Collection:The Financial Times provides a vast archive of articles, market data, company reports, and economic analyses. This data can be accessed through their website or API, and it can be downloaded in various formats such as text files, CSV files, or JSON files.

- Data Cleaning:The collected data may contain errors, inconsistencies, or irrelevant information. This requires cleaning the data to ensure its accuracy and reliability. This can involve removing duplicates, correcting spelling errors, and standardizing data formats.

- Data Formatting:The data should be formatted in a way that is compatible with the chosen OpenAI model. This may involve converting text data into numerical representations, tokenizing words, and creating training and validation sets.

Model Selection

The choice of OpenAI model depends on the specific task and the type of Financial Times content being used.

- GPT-3:This is a powerful language model that can be used for tasks such as text generation, translation, and summarization. It is suitable for analyzing and summarizing Financial Times articles, generating financial reports, and creating chatbot responses.

- DALL-E 2:This model is capable of generating images from text descriptions. It can be used to create visualizations of financial data, such as charts and graphs, or to generate images that illustrate financial concepts.

- Codex:This model is designed for code generation and can be used to automate financial tasks such as data analysis, trading algorithms, and financial modeling.

Training Parameters

The training parameters determine how the OpenAI model learns from the data.

- Learning Rate:This parameter controls how quickly the model adjusts its weights during training. A higher learning rate can lead to faster convergence but may also result in overfitting.

- Batch Size:This parameter determines the number of data samples used in each training iteration. A larger batch size can improve training stability but may also increase training time.

- Epochs:This parameter defines the number of times the model iterates over the entire training dataset. More epochs can lead to better performance but may also increase the risk of overfitting.

Challenges in Training OpenAI Models on Financial Data

Training OpenAI models on financial data presents unique challenges due to the specific characteristics of this data.

- Data Quality:Financial data is often complex and prone to errors, inconsistencies, and biases. Ensuring data quality is crucial for training accurate and reliable models.

- Biases:Financial data can reflect existing biases and inequalities in the market. Training models on biased data can perpetuate these biases and lead to unfair or discriminatory outcomes.

- Ethical Considerations:The use of OpenAI models in finance raises ethical concerns, such as the potential for market manipulation, privacy violations, and the impact on human employment.

Examples of Training OpenAI Models on Financial Times Content

- Market Data Analysis:An OpenAI model trained on historical market data can be used to predict future price movements, identify trends, and assess risk.

- Company News Interpretation:An OpenAI model trained on company news articles can be used to extract key insights, analyze sentiment, and assess the impact of events on company performance.

- Economic Report Summarization:An OpenAI model trained on economic reports can be used to summarize key findings, identify trends, and assess the implications for financial markets.

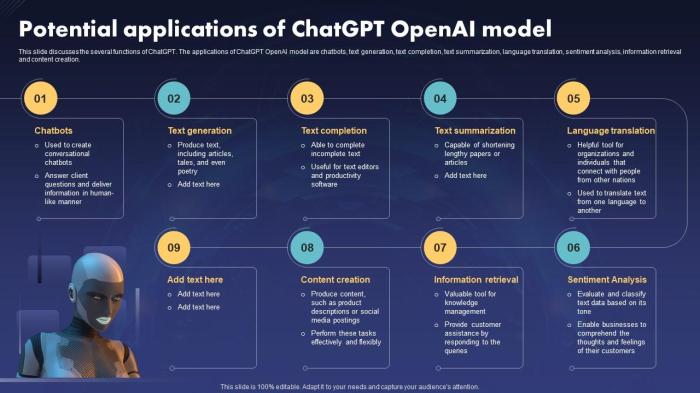

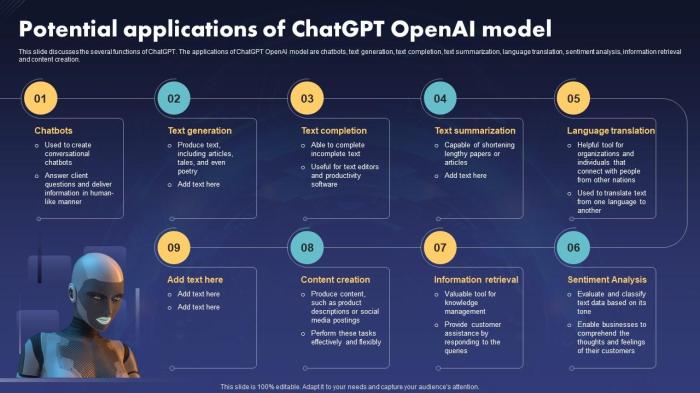

Applications of OpenAI Models in Financial Analysis

OpenAI models, with their ability to process and analyze vast amounts of data, are revolutionizing the field of financial analysis. By leveraging the power of natural language processing (NLP) and machine learning (ML), these models can extract valuable insights from financial data, automate complex tasks, and identify potential investment opportunities.

Analyzing Financial Data for Investment Opportunities

One of the most promising applications of OpenAI models in financial analysis is their ability to identify investment opportunities by analyzing financial data from sources like the Financial Times. Imagine a scenario where an investor wants to identify undervalued companies in the tech sector.

An OpenAI model can be trained on a massive dataset of Financial Times articles, reports, and financial statements related to tech companies. The model can then analyze this data to identify patterns, trends, and potential indicators of undervaluation. For instance, the model might detect a company with strong fundamentals but a recent decline in stock price due to a temporary market downturn.

This information could be used to make informed investment decisions.

Utilizing OpenAI Models for Various Financial Tasks

OpenAI models can be employed for a wide range of financial tasks, as illustrated in the following table:| Task | Description | Example ||—|—|—|| Risk Assessment| Evaluating the potential risks associated with investments or financial decisions. | Analyzing news articles and reports to identify potential risks related to a company’s operations or industry.

|| Portfolio Optimization| Creating and managing investment portfolios that align with specific risk tolerance and return objectives. | Using sentiment analysis to identify undervalued stocks and recommending adjustments to a portfolio based on market trends. || Fraud Detection| Identifying fraudulent activities in financial transactions or data.

| Analyzing patterns in transaction data to detect anomalies that could indicate fraudulent behavior. || Financial Reporting| Generating financial reports, summaries, and insights from raw data. | Summarizing key financial metrics and trends from a company’s annual report.

|

Generating Financial Reports and Insights

OpenAI models can also be used to generate financial reports, summaries, and insights based on Financial Times content. For example, an OpenAI model could be trained on a dataset of Financial Times articles related to the energy sector. The model could then generate a report summarizing the key trends and challenges facing the energy sector, including the impact of renewable energy, geopolitical tensions, and technological advancements.

Obtain a comprehensive document about the application of mistral releases first generative ai model that is effective.

This report could provide valuable insights for investors and industry professionals.

Ethical and Regulatory Considerations

The application of OpenAI models to analyze Financial Times content raises significant ethical and regulatory considerations. These models, while powerful, are not without their limitations, and their use in financial analysis requires careful consideration of potential biases, fairness, and transparency.

Moreover, the regulatory landscape surrounding AI in finance is rapidly evolving, necessitating a proactive approach to compliance and responsible AI practices.

Ethical Implications of OpenAI Models

The use of OpenAI models for analyzing financial data raises several ethical concerns, including:

- Bias in Data and Algorithms:OpenAI models are trained on vast datasets, which may contain inherent biases. These biases can be reflected in the model’s outputs, leading to unfair or discriminatory outcomes. For instance, a model trained on historical financial data might perpetuate existing gender or racial disparities in investment opportunities.

- Transparency and Explainability:The complex nature of deep learning models can make it challenging to understand the rationale behind their decisions. This lack of transparency can hinder trust and accountability, particularly in financial contexts where decisions have significant consequences.

- Fairness and Equity:The use of OpenAI models in financial analysis should ensure fairness and equity for all users. This requires addressing potential biases in the data and algorithms and ensuring that the models do not perpetuate existing inequalities.

Regulatory Landscape of AI in Finance

The regulatory landscape surrounding AI in finance is evolving rapidly, with agencies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) actively exploring how to regulate the use of AI in financial markets. Key areas of focus include:

- Data Privacy and Security:Financial institutions must comply with data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). This includes ensuring that data used to train AI models is collected and processed ethically and securely.

- Compliance and Risk Management:Financial institutions need to develop robust frameworks for managing the risks associated with AI, including model bias, data integrity, and algorithmic transparency. This includes establishing clear governance structures and processes for monitoring and evaluating AI systems.

- Responsible AI Principles:The development and deployment of AI in finance should adhere to principles of fairness, accountability, transparency, and human oversight. This includes ensuring that AI systems are designed and used in a way that promotes responsible and ethical financial practices.

Risks and Challenges

The use of OpenAI models in financial analysis presents several risks and challenges:

- Model Bias and Inaccuracy:As mentioned earlier, OpenAI models can exhibit biases based on the data they are trained on. This can lead to inaccurate predictions and biased financial decisions. For example, a model trained on data from a particular economic period might not accurately predict market behavior in a different economic environment.

- Data Integrity and Security:The use of AI in finance relies heavily on the integrity and security of financial data. Data breaches or manipulation could have significant consequences for financial markets and investors.

- Algorithmic Transparency and Explainability:The lack of transparency in AI models can make it difficult to understand the rationale behind their decisions. This can hinder accountability and trust in AI-driven financial analysis.

- Regulatory Uncertainty:The regulatory landscape surrounding AI in finance is still evolving, creating uncertainty for financial institutions and AI developers.

Mitigation Strategies

To mitigate the risks and challenges associated with the use of OpenAI models in financial analysis, several strategies can be employed:

- Data Quality and Bias Mitigation:Financial institutions should invest in data quality initiatives and employ techniques to mitigate bias in training data. This includes using diverse and representative datasets and employing fairness-aware algorithms.

- Model Validation and Monitoring:Regular validation and monitoring of OpenAI models are essential to ensure their accuracy and reliability. This includes testing models against diverse scenarios and monitoring their performance over time.

- Transparency and Explainability:Financial institutions should strive to enhance the transparency and explainability of AI models. This includes developing methods for interpreting model outputs and providing clear explanations for decisions.

- Regulatory Compliance and Responsible AI Practices:Financial institutions should proactively engage with regulators and adopt responsible AI principles. This includes developing clear policies and procedures for the use of AI in financial analysis.

Future Directions and Innovations

The integration of OpenAI models with the Financial Times’ vast repository of financial data presents exciting possibilities for revolutionizing financial analysis. These models can leverage the power of natural language processing (NLP) and machine learning (ML) to extract insights, identify trends, and make predictions with unprecedented accuracy.

This section explores some of the most promising future directions and innovations in this space.

Real-Time Data Integration

Integrating OpenAI models with real-time data feeds will allow for dynamic analysis and forecasting. This means financial professionals can access up-to-the-minute information and receive instant insights on market movements, economic indicators, and company performance. For example, imagine an OpenAI model analyzing real-time stock prices, news feeds, and social media sentiment to provide a real-time risk assessment for a specific investment.

Natural Language Processing for Market Sentiment Analysis, Openai models train financial times content

OpenAI models can be trained on a massive dataset of financial news articles, social media posts, and online forums to analyze market sentiment. This can help investors understand the overall market mood and identify potential shifts in investor behavior. For example, an OpenAI model could analyze Twitter posts about a specific company to identify potential bullish or bearish sentiment, providing valuable insights for investment decisions.

AI-Powered Financial Tools

OpenAI models can be used to develop sophisticated AI-powered financial tools, such as automated portfolio management systems, risk assessment algorithms, and fraud detection systems. These tools can leverage the power of machine learning to optimize investment strategies, identify potential risks, and detect fraudulent activities.

Imagine an AI-powered investment advisor that can personalize investment portfolios based on individual risk tolerance and financial goals, or a fraud detection system that can analyze transaction data to identify suspicious patterns.

Financial Literacy and Accessibility

OpenAI models can play a crucial role in promoting financial literacy and accessibility. They can be used to create personalized financial education tools that explain complex financial concepts in simple and understandable language. Imagine an AI-powered chatbot that can answer basic financial questions, provide guidance on budgeting and saving, or offer personalized investment advice.

These tools can help individuals make informed financial decisions and gain greater control over their finances.