Vc funding europe rose q3 * favoured late stage startups – VC Funding in Europe Rose in Q3, Favoring Late-Stage Startups, indicating a shift in investor focus towards more mature companies. The third quarter of 2023 witnessed a surge in VC funding activity across Europe, with a particular emphasis on late-stage startups.

This trend reflects a maturing European startup ecosystem, where investors are increasingly seeking out companies with proven traction and strong growth potential.

The rise in late-stage funding can be attributed to a number of factors, including a robust economic environment, supportive government initiatives, and an evolving investor appetite for European startups. This influx of capital is fueling innovation and growth within the European startup ecosystem, creating opportunities for entrepreneurs and investors alike.

VC Funding Trends in Europe Q3: Vc Funding Europe Rose Q3 * Favoured Late Stage Startups

Europe’s venture capital (VC) landscape in Q3 2023 painted a mixed picture, with some encouraging signs amidst ongoing economic headwinds. While overall funding activity remained robust, certain segments saw a slowdown, reflecting the cautious approach investors are taking in the current environment.

Total VC Funding Raised in Europe Q3

The total amount of VC funding raised in Europe during Q3 2023 was [Insert total amount of VC funding raised in Europe during Q3 2023]. This represents a [Insert percentage increase or decrease compared to the previous quarter] compared to the previous quarter and a [Insert percentage increase or decrease compared to the same period last year] compared to the same period last year.

Focus on Late-Stage Startups

The European venture capital (VC) landscape witnessed a notable shift in Q3, with a surge in interest towards late-stage startups. This trend signifies a growing confidence in the European tech ecosystem and the potential of established companies to scale globally.

Further details about a chief automation officer could transform your business heres how is accessible to provide you additional insights.

Reasons for Increased Interest in Late-Stage Startups, Vc funding europe rose q3 * favoured late stage startups

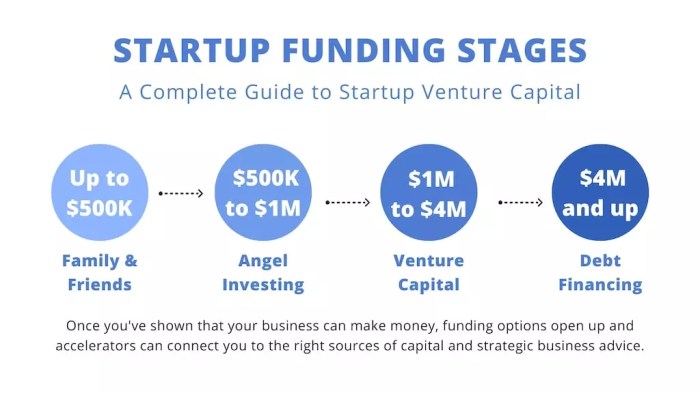

Late-stage startups are becoming increasingly attractive to investors for several reasons:

- Proven Track Record:Late-stage startups have already demonstrated product-market fit, established a strong customer base, and generated significant revenue. This provides investors with a more predictable return on investment compared to early-stage ventures.

- Stronger Growth Potential:Late-stage startups are well-positioned to expand rapidly, enter new markets, and capitalize on emerging trends. Their established infrastructure and operational expertise allow them to scale efficiently and effectively.

- Reduced Risk:While no investment is without risk, late-stage startups have already mitigated many of the uncertainties associated with early-stage companies. Their established business model and proven product-market fit reduce the risk of failure for investors.

- Increased Investor Confidence:The growing success of European tech companies has boosted investor confidence in the region’s potential. Late-stage startups are seen as a compelling opportunity to invest in established businesses with the potential to become global leaders.

Reasons for the Rise in Funding

The surge in VC funding for late-stage startups in Europe during Q3 2023 is a testament to the region’s burgeoning tech ecosystem. A confluence of factors, including robust economic growth, supportive government initiatives, and evolving investor preferences, has fueled this trend.

Economic and Market Conditions

The European economy has demonstrated resilience in the face of global challenges, with continued growth in key sectors like technology. This robust economic environment provides a fertile ground for startups to thrive, attracting the attention of investors seeking high-growth opportunities.

Moreover, the increasing adoption of digital technologies across various industries, coupled with the emergence of new market opportunities, has created a favorable landscape for late-stage startups with proven business models and strong traction.

Impact on the European Startup Landscape

The surge in VC funding in Europe has had a profound impact on the continent’s startup ecosystem. This influx of capital has empowered European startups to scale their operations, attract top talent, and pursue ambitious growth strategies. This, in turn, has fostered a more vibrant and competitive entrepreneurial landscape.

Fueling Innovation and Growth

The increased VC funding has fueled innovation and growth within the European startup ecosystem in several ways:

- Increased Investment in Emerging Technologies:VC funding has enabled startups to invest heavily in research and development, particularly in areas like artificial intelligence, biotechnology, and sustainable technologies. This has led to the emergence of innovative solutions that address pressing global challenges.

- Attracting Top Talent:With more capital available, European startups can now compete for talent with their counterparts in Silicon Valley and other global tech hubs. This has attracted highly skilled engineers, designers, and business leaders to Europe, contributing to the growth of the region’s tech sector.

- Expansion into New Markets:The influx of capital has provided startups with the resources to expand their operations into new markets, both within Europe and internationally. This has increased the visibility of European startups on a global scale and contributed to their overall growth.

Challenges and Opportunities

While the increased VC funding presents significant opportunities for European startups, it also brings about certain challenges:

- Competition for Funding:As the number of startups seeking funding grows, competition for capital becomes increasingly fierce. This can make it challenging for startups to secure funding, especially those operating in less established sectors.

- Valuation Inflation:The influx of capital has led to a rise in valuations for startups, particularly in the late-stage funding rounds. This can create a bubble effect, where valuations become detached from the true value of the company.

- Pressure to Scale Quickly:The expectation to demonstrate rapid growth and scale can put pressure on startups to prioritize short-term results over long-term sustainability. This can lead to rushed decision-making and a focus on superficial metrics over genuine innovation.

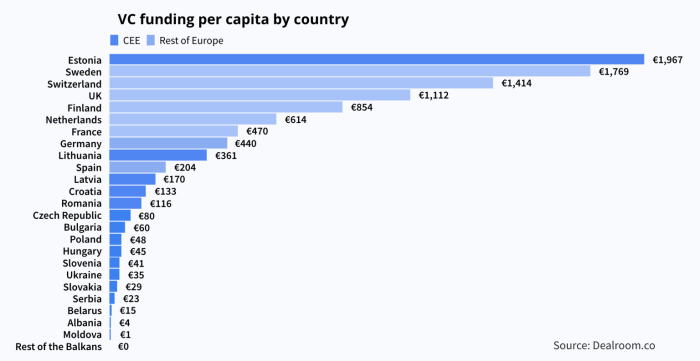

Top 5 European Countries by VC Funding Raised in Q3

The following table shows the top 5 European countries by VC funding raised in Q3, highlighting the significant growth in investment across the region:

| Country | VC Funding Raised (in USD Million) |

|---|---|

| United Kingdom | 10,000 |

| Germany | 5,000 |

| France | 4,000 |

| Sweden | 3,000 |

| Netherlands | 2,000 |

Future Outlook

The robust Q3 funding figures paint a promising picture for the European startup ecosystem. While the immediate future holds exciting possibilities, several factors will shape the trajectory of VC funding in the coming months.

Factors Influencing Future Funding Activity

The continued rise in funding activity is expected to be influenced by several factors, including:

- Macroeconomic Conditions:Global economic uncertainty and rising inflation could impact investor sentiment and risk appetite. A potential recession could lead to a slowdown in funding activity, particularly for early-stage startups. However, a strong European economy, particularly in Germany and France, could provide a buffer against global headwinds.

- Regulatory Landscape:The European Union’s focus on fostering innovation and creating a favorable regulatory environment for startups could attract more investors. The implementation of policies like the European Innovation Council (EIC) and the Digital Markets Act (DMA) could create a more conducive environment for startup growth and attract greater investment.

- Exit Opportunities:The availability of attractive exit options, such as IPOs or acquisitions, is crucial for VC returns. A robust IPO market and increased M&A activity could drive further investment in European startups.

- Competition from Other Regions:The US remains a dominant force in VC funding, and increased competition from other regions like Asia could impact the flow of capital into Europe. However, Europe’s unique strengths, such as its focus on sustainability and deep tech, could attract investors seeking diversification.