Norwegian Wealth Fund Warns AI Risks Billions From Tech. The world’s largest sovereign wealth fund, known for its cautious investment approach, is raising concerns about the potential impact of artificial intelligence on its tech holdings. The fund, which manages over $1.3 trillion in assets, has decided to reduce its exposure to tech stocks, citing the uncertainty and volatility associated with AI’s rapid development.

This move highlights the growing awareness among investors of the potential risks and opportunities presented by AI. While AI has the potential to revolutionize various industries and drive economic growth, its rapid evolution raises concerns about its impact on existing businesses, job markets, and financial stability.

The Norwegian Wealth Fund’s Investment Strategy: Norwegian Wealth Fund Warns Ai Risks Billions From Tech

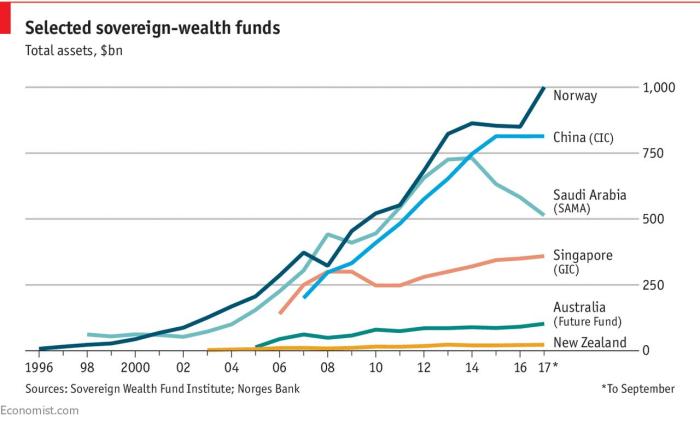

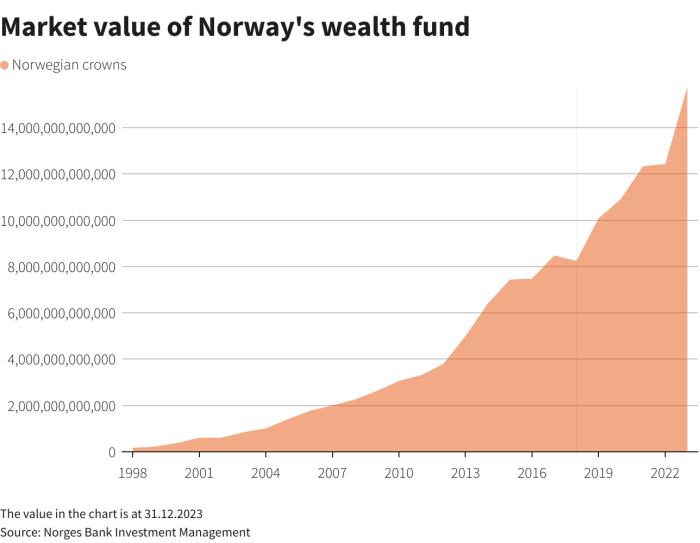

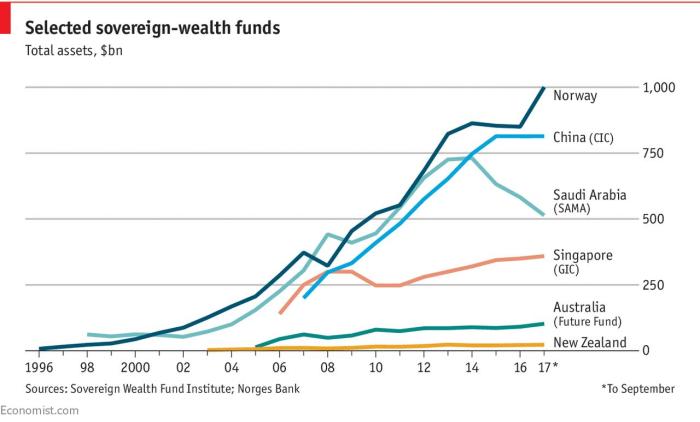

The Norwegian Government Pension Fund Global, commonly known as the Norwegian Wealth Fund, is one of the world’s largest sovereign wealth funds, with a portfolio exceeding $1.3 trillion as of 2023. The Fund’s investment strategy is guided by the principle of long-term sustainability and aims to generate returns for future generations of Norwegians.

The Fund’s Investment Approach

The Norwegian Wealth Fund adopts a passive investment approach, aiming to replicate the performance of broad market indices. This approach emphasizes diversification across various asset classes, minimizing risk and maximizing returns over the long term. The Fund invests in a wide range of assets, including equities, fixed income, real estate, and renewable energy infrastructure.

Asset Class Diversification

The Fund’s portfolio is meticulously diversified across various asset classes to mitigate risk and enhance returns. The Fund’s current portfolio allocation is approximately 67% in equities, 28% in fixed income, and 5% in real estate and renewable energy infrastructure.

Historical Performance

The Norwegian Wealth Fund has consistently generated positive returns over the past decades, demonstrating its effective investment strategy. Since its inception in 1990, the Fund has achieved an average annual return of around 6%, significantly outperforming many other investment funds.

Recent Portfolio Adjustments

In recent years, the Fund has made adjustments to its portfolio, reducing its exposure to tech stocks. This decision reflects the Fund’s risk management approach, aiming to balance potential growth with overall portfolio stability. The Fund’s investment committee believes that the tech sector is subject to significant volatility and may not be as attractive as other sectors in the current economic climate.

Understand how the union of inside google deepmind ai safety strategy lila ibrahim can improve efficiency and productivity.

AI’s Impact on Global Markets

Artificial intelligence (AI) is rapidly transforming the global economy, presenting both significant opportunities and risks. Its impact is being felt across various industries, from finance and technology to healthcare and beyond. As AI continues to evolve, it is crucial to understand its potential consequences and navigate the ethical and regulatory challenges associated with its development and deployment.

AI’s Influence on Various Industries, Norwegian wealth fund warns ai risks billions from tech

AI’s influence is transforming various industries, offering both potential benefits and challenges.

- Finance:AI is revolutionizing financial services, enabling faster and more accurate risk assessments, fraud detection, and investment strategies. For instance, AI-powered algorithms are being used to analyze vast amounts of financial data, identifying patterns and trends that can inform investment decisions.

This can lead to improved portfolio performance and more efficient risk management. However, it also raises concerns about algorithmic bias, the potential for market manipulation, and the need for robust cybersecurity measures to protect sensitive financial data.

- Technology:The technology industry is at the forefront of AI development and deployment. AI is driving innovation in areas such as natural language processing, computer vision, and robotics. AI-powered applications are being used to develop self-driving cars, personalized digital assistants, and advanced cybersecurity systems.

However, there are concerns about job displacement as AI automates tasks previously performed by humans, and the need for ethical guidelines to ensure responsible development and deployment of AI technologies.

- Healthcare:AI is transforming healthcare by enabling more accurate diagnoses, personalized treatment plans, and drug discovery. AI-powered tools are being used to analyze medical images, predict patient outcomes, and develop new therapies. This has the potential to improve patient care, reduce costs, and accelerate medical breakthroughs.

However, there are ethical considerations regarding data privacy, algorithmic bias, and the potential for AI to exacerbate existing healthcare inequalities.

The Norwegian Wealth Fund’s Concerns Regarding AI

The Norwegian Wealth Fund, one of the world’s largest sovereign wealth funds, has expressed significant concerns regarding the potential risks associated with AI investments. Recognizing the transformative power of AI, the Fund acknowledges its potential to disrupt various sectors and create significant value, but also acknowledges the inherent uncertainties and potential downsides.

The Norwegian Wealth Fund’s Concerns Regarding AI Investments

The Norwegian Wealth Fund’s concerns regarding AI investments stem from several factors:

- Unpredictability of AI’s Impact:The rapid evolution of AI makes it challenging to predict its long-term impact on industries and asset valuations. The Fund is wary of the potential for AI-driven disruptions to significantly alter the value of its tech stock holdings and other assets.

- Ethical and Societal Implications:The Fund is mindful of the ethical and societal implications of AI, particularly concerns related to job displacement, data privacy, and potential misuse. The Fund seeks to ensure its investments align with ethical principles and contribute positively to society.

- Regulatory Uncertainty:The regulatory landscape surrounding AI is still evolving, creating uncertainty for investors. The Fund is concerned about the potential for unforeseen regulations to negatively impact its AI-related investments.

- Market Volatility:AI advancements can lead to significant market volatility, as investors grapple with the implications of rapid technological change. The Fund seeks to manage its exposure to AI-related investments prudently to mitigate potential losses.

Mitigation Strategies for AI Risks

The Norwegian Wealth Fund, recognizing the potential risks associated with AI investments, needs to implement strategies to mitigate these uncertainties and ensure its portfolio remains robust. This involves a multi-pronged approach, encompassing portfolio diversification, responsible AI development, and proactive risk management.

Portfolio Diversification

Portfolio diversification is a crucial strategy for managing AI-related uncertainties. The Norwegian Wealth Fund can diversify its portfolio by investing in various AI-related sectors, including hardware, software, data, and services. This approach reduces exposure to specific AI technologies or companies, mitigating the impact of potential disruptions or failures.

- Investing in companies developing AI hardware, such as specialized processors and chips, can provide exposure to the underlying infrastructure of AI systems.

- Investing in software companies developing AI algorithms and platforms can offer exposure to the core capabilities of AI systems.

- Investing in data companies that collect, manage, and analyze data essential for AI training and development can provide exposure to the fuel powering AI systems.

- Investing in service companies that leverage AI to enhance their operations or provide new services can offer exposure to the applications of AI across various industries.

Responsible AI Development

Promoting responsible AI development is critical for mitigating potential risks associated with AI investments. The Norwegian Wealth Fund can actively support companies committed to ethical AI practices, including transparency, accountability, and fairness.

- The fund can invest in companies that adhere to ethical AI guidelines, such as those developed by the OECD or the IEEE.

- The fund can engage with portfolio companies to encourage them to adopt responsible AI practices and promote transparency in their AI development processes.

- The fund can support research and development initiatives focused on responsible AI, including research on AI ethics, bias detection, and explainability.

Risk Management Framework

The Norwegian Wealth Fund needs to develop a robust risk management framework specifically tailored to AI investments. This framework should encompass risk identification, assessment, monitoring, and mitigation strategies.

- The fund can establish a dedicated team of experts to identify and assess AI-related risks, including technological, regulatory, ethical, and social risks.

- The fund can implement a comprehensive monitoring system to track the performance of AI investments and identify early warning signs of potential problems.

- The fund can develop contingency plans to address potential risks, such as the emergence of new regulations, changes in market dynamics, or ethical controversies.

Collaboration and Partnerships

The Norwegian Wealth Fund can leverage collaboration and partnerships to mitigate AI risks. This involves engaging with other investors, policymakers, and industry leaders to share knowledge, develop best practices, and promote responsible AI development.

- The fund can participate in industry forums and working groups focused on AI investment and risk management.

- The fund can collaborate with other investors to develop common standards and guidelines for responsible AI investment.

- The fund can engage with policymakers to advocate for policies that promote responsible AI development and mitigate potential risks.

The Future of AI and Investment

The rapid advancements in AI are poised to fundamentally reshape the financial landscape, presenting both exciting opportunities and significant challenges for investors. AI’s ability to analyze vast datasets, identify patterns, and make predictions at speeds far exceeding human capabilities is already impacting investment strategies, portfolio management, and even the role of human investors themselves.

The Long-Term Implications of AI for Financial Markets and Investment Strategies

The integration of AI into financial markets is expected to bring about significant changes in the long term. AI algorithms are becoming increasingly sophisticated in their ability to analyze market data, identify trends, and predict future price movements. This enhanced analytical power will likely lead to:* Increased Market Efficiency:AI-driven algorithms can process information and execute trades at speeds that are impossible for humans to match, potentially leading to more efficient markets with tighter spreads and reduced volatility.

Personalized Investment Strategies

AI can tailor investment strategies to individual investor profiles, risk tolerances, and financial goals, offering more customized and potentially higher-performing investment solutions.

Improved Risk Management

AI can analyze vast amounts of data to identify potential risks and develop strategies to mitigate them, leading to more robust and resilient portfolios.

Enhanced Due Diligence

AI can automate the process of due diligence, helping investors to make more informed decisions by analyzing large datasets and identifying potential red flags.

The Potential for AI to Reshape the Role of Human Investors and Portfolio Managers

The rise of AI in finance raises questions about the future role of human investors and portfolio managers. While AI can automate many tasks, human judgment and intuition will likely remain essential in several areas:* Strategic Decision-Making:AI can provide data-driven insights, but human investors will still be responsible for making strategic decisions about asset allocation, investment horizons, and overall portfolio strategy.

Ethical Considerations

AI algorithms can be susceptible to biases, and human investors will need to ensure that AI-driven investment decisions align with ethical principles and social responsibility.

Client Relationships

Building and maintaining strong client relationships will continue to be a crucial role for human advisors, who can provide personalized guidance and emotional support.

Advantages and Disadvantages of Investing in AI-Driven Companies

The increasing adoption of AI in various industries has led to the emergence of numerous AI-driven companies. Investing in these companies presents both potential benefits and risks: