Meta leads uk payment scams uk finace claims – Meta leads UK: payment scams and finance claims are becoming increasingly prevalent, posing a significant threat to both individuals and businesses. The rise of online marketing and the demand for targeted leads have created a fertile ground for scammers to operate, exploiting unsuspecting victims through sophisticated schemes.

From phishing emails and fake payment platforms to fraudulent invoices and impersonation tactics, these scams are becoming increasingly sophisticated, leaving victims facing financial ruin and damaged credit scores.

This blog post delves into the alarming reality of meta leads scams in the UK, examining the various types of scams, their impact on finance claims, and practical steps to protect yourself from becoming a victim. We’ll also explore the role of technology in combating these scams and the importance of raising awareness and education to empower individuals and businesses to stay safe in the digital age.

The Rise of Meta Leads in the UK

Meta leads have become increasingly popular in the UK, playing a crucial role in online marketing strategies for businesses across various sectors. This growth can be attributed to several factors, including the rise of social media advertising and the growing demand for targeted leads.

Factors Contributing to the Rise of Meta Leads

The increasing popularity of meta leads in the UK is driven by several factors that have shaped the digital marketing landscape.

- Rise of Social Media Advertising:Social media platforms like Facebook, Instagram, and LinkedIn have become powerful advertising channels, allowing businesses to reach highly targeted audiences based on demographics, interests, and behavior. Meta leads leverage these platforms to generate qualified leads through targeted campaigns.

- Demand for Targeted Leads:Businesses are increasingly seeking to reach specific customer segments with their marketing efforts. Meta leads provide a solution by enabling businesses to generate leads from audiences that are most likely to convert into paying customers.

- Data-Driven Insights:Meta platforms offer sophisticated analytics tools that provide businesses with valuable insights into lead generation campaigns. This data helps businesses optimize their campaigns, target the right audiences, and measure the effectiveness of their efforts.

Benefits of Meta Leads for Businesses

Meta leads offer a range of benefits for businesses looking to enhance their lead generation efforts.

- Increased Reach:Meta platforms boast a vast user base, providing businesses with access to a wide range of potential customers. Meta leads leverage this reach to generate a significant number of leads.

- Cost-Effectiveness:Compared to traditional marketing methods, meta leads offer a cost-effective way to generate leads. Businesses can target specific audiences and optimize their campaigns to maximize their return on investment.

- Data-Driven Insights:Meta platforms provide businesses with detailed analytics that help them understand their target audience, measure campaign performance, and make data-driven decisions to improve their lead generation strategies.

Understanding Payment Scams Targeting Meta Leads

Meta leads are a valuable asset for businesses, but they are also a prime target for scammers. Scammers are increasingly using sophisticated techniques to trick businesses into making fraudulent payments, resulting in significant financial losses. It is crucial to understand the common types of payment scams and how to protect your business from falling victim to them.

Common Types of Payment Scams Targeting Meta Leads

Scammers use various tactics to defraud businesses, and understanding these methods is essential for prevention. The most common types of payment scams targeting meta leads in the UK include:

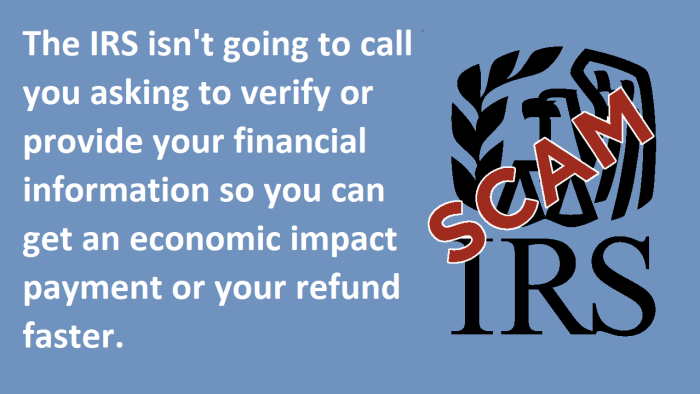

- Phishing Schemes: Scammers often impersonate legitimate businesses or individuals to trick businesses into providing sensitive information, such as bank account details or credit card information. This information is then used to make unauthorized payments or steal funds.

- Fake Payment Platforms: Scammers create fake payment platforms that mimic legitimate online payment gateways, such as PayPal or Stripe.

They use these platforms to collect payment details from businesses and then disappear with the money.

- Fraudulent Invoices: Scammers send fraudulent invoices to businesses, claiming to be for services or products that were never ordered. They often use legitimate-looking invoices with official-sounding company names and logos to make them appear authentic.

Techniques Used by Scammers to Lure Victims

Scammers use various techniques to convince businesses to fall for their scams. These include:

- Impersonating Legitimate Businesses: Scammers often create websites and emails that look very similar to those of legitimate businesses, making it difficult for businesses to spot the scam. They may even use the names of well-known brands to gain credibility.

- Offering Enticing Discounts: Scammers often offer enticing discounts or special offers to lure businesses into making a quick payment.

They may promise significant savings or exclusive deals to entice businesses into making a hasty decision.

- Creating a Sense of Urgency: Scammers often create a sense of urgency to pressure businesses into making a quick payment. They may claim that the offer is only available for a limited time or that there is a limited supply of the product or service.

Examples of Payment Scams

- Phishing Scheme Example: A scammer might send an email to a business, pretending to be a customer service representative from a well-known online payment platform. The email might ask the business to update their payment information, including their bank account details.

Obtain recommendations related to einride brings futuristic electric self driving trucks to uae that can assist you today.

If the business provides their information, the scammer can then use it to make unauthorized payments or steal funds.

- Fake Payment Platform Example: A scammer might create a fake payment platform that looks very similar to a legitimate platform like PayPal. They might advertise the platform on social media or through online ads, claiming to offer lower transaction fees or faster payment processing.

If a business uses the platform to make a payment, the scammer will disappear with the money.

- Fraudulent Invoice Example: A scammer might send a fraudulent invoice to a business, claiming to be for a service or product that the business never ordered.

The invoice might look very legitimate, with an official-sounding company name and logo. If the business pays the invoice, they will lose money.

The Impact of Payment Scams on UK Finance Claims

Payment scams have become increasingly prevalent in the UK, causing significant financial damage to individuals and businesses alike. Victims of these scams often suffer substantial financial losses, face damaged credit scores, and become embroiled in complex legal disputes. Moreover, these scams have a detrimental impact on the UK finance industry, increasing fraud prevention costs and eroding consumer trust.

Financial Consequences for Victims

Payment scams can have severe financial consequences for victims, leading to substantial losses and long-term financial instability. Victims may lose significant sums of money, depleting their savings and hindering their ability to meet financial obligations. The financial impact can be particularly devastating for individuals who rely on their savings for retirement or those who have borrowed money to invest in fraudulent schemes.

- Lost Funds:Victims of payment scams can lose significant sums of money, including savings, investments, and even funds intended for essential expenses like rent or mortgage payments. The financial loss can be devastating, forcing individuals to make difficult choices and potentially leading to debt.

- Damaged Credit Scores:When victims of payment scams are unable to repay loans or credit card debt, their credit scores can suffer. This can make it difficult to obtain future loans or credit cards, impacting their ability to access essential financial services and potentially leading to higher interest rates on future borrowing.

- Legal Disputes:Victims of payment scams may need to engage in lengthy and expensive legal battles to recover their lost funds. This can be a stressful and time-consuming process, further adding to the financial burden on victims.

Impact on the UK Finance Industry

Payment scams have a significant impact on the UK finance industry, increasing fraud prevention costs and eroding consumer trust. Financial institutions are forced to invest heavily in fraud detection and prevention measures, diverting resources from other areas of their operations.

The rise in scams can also damage the reputation of the finance industry, making consumers hesitant to trust financial institutions and potentially leading to a decline in financial activity.

- Increased Fraud Prevention Costs:Financial institutions are investing heavily in sophisticated fraud detection and prevention technologies to combat payment scams. This includes employing specialized personnel, developing advanced algorithms, and implementing robust security measures. These investments can significantly increase operating costs for financial institutions.

- Decline in Consumer Trust:Payment scams can erode consumer trust in financial institutions, making them hesitant to use online banking services or engage in online transactions. This can lead to a decline in financial activity, impacting the overall profitability of the finance industry.

Challenges Faced by Financial Institutions

Combating payment scams is a complex challenge for financial institutions, due to the sophistication of scams and the lack of awareness among consumers. Scammers are constantly evolving their tactics, making it difficult for financial institutions to stay ahead of the curve.

Additionally, many consumers are not aware of the risks associated with online payments, making them vulnerable to scams.

- Sophistication of Scams:Scammers are increasingly using sophisticated techniques, such as social engineering, phishing, and malware, to deceive victims. This makes it difficult for financial institutions to detect and prevent these scams effectively.

- Lack of Awareness Among Consumers:Many consumers are not aware of the risks associated with online payments, making them vulnerable to scams. This lack of awareness can be attributed to factors such as a lack of education and the fast-paced nature of online transactions.

Protecting Yourself from Meta Leads Payment Scams

The rise of meta leads in the UK has unfortunately attracted scammers seeking to exploit unsuspecting individuals. While the benefits of meta leads are undeniable, it’s crucial to be vigilant and implement protective measures to safeguard yourself from falling victim to payment scams.

This section will provide practical advice on how to identify suspicious activities and report suspected scams to the appropriate authorities.

Identifying Suspicious Activities

Recognizing red flags in websites, emails, and social media posts is essential to prevent falling prey to meta leads payment scams. Scammers often employ deceptive tactics to lure victims into fraudulent schemes. Here are some key indicators of suspicious activity:

- Unrealistic Offers:Be wary of offers that seem too good to be true, such as unusually high returns or extremely low prices. Scammers often use such enticements to attract unsuspecting individuals.

- Pressure Tactics:Legitimate businesses rarely pressure you into making immediate decisions. If a website, email, or social media post urges you to act quickly or threatens limited-time offers, it could be a scam.

- Lack of Transparency:Legitimate businesses provide clear and detailed information about their products or services. If a website, email, or social media post lacks essential details, it’s a red flag.

- Poor Website Design:A website with poor design, grammatical errors, or outdated information might indicate a scam.

- Unfamiliar Contact Information:Be cautious if a website, email, or social media post uses a generic email address or phone number. Legitimate businesses typically use professional contact information.

- Unsecured Websites:Always check the website’s URL. Look for the “https” prefix, which indicates a secure connection. Avoid websites that use “http” as they may not be secure.

Reporting Suspected Scams, Meta leads uk payment scams uk finace claims

If you suspect you have encountered a meta leads payment scam, it’s crucial to report it to the appropriate authorities. This helps prevent others from falling victim to the same scam and assists in bringing perpetrators to justice. Here’s how to report suspected scams:

- Financial Conduct Authority (FCA):The FCA regulates financial services in the UK. You can report suspected scams to the FCA through their website or by calling their helpline.

- Action Fraud:Action Fraud is the UK’s national fraud and cybercrime reporting center. You can report suspected scams online or by calling their helpline.

- Your Bank:If you have been a victim of a meta leads payment scam, contact your bank immediately. They can assist in reversing the transaction or investigating the scam.

- Social Media Platforms:Report suspicious accounts or posts to the respective social media platforms.

Protecting Yourself from Meta Leads Payment Scams

Taking proactive steps can significantly reduce your risk of falling victim to meta leads payment scams. Here are some preventive measures:

- Verify Information:Before engaging with any meta leads provider, thoroughly research their legitimacy. Check online reviews, testimonials, and independent sources to verify their credibility.

- Use Secure Payment Methods:Avoid using debit or credit cards for online transactions unless the website is secure. Consider using secure payment gateways like PayPal, which offer buyer protection.

- Be Cautious of Links:Never click on links in unsolicited emails or social media messages. Always double-check the URL before clicking.

- Keep Software Updated:Ensure your computer and mobile devices have the latest security updates to protect against malware and phishing attacks.

- Monitor Your Bank Accounts:Regularly check your bank statements for any suspicious transactions. Report any unauthorized activity immediately.

- Educate Yourself:Stay informed about the latest scams and phishing tactics. Subscribe to online security resources and newsletters.

The Role of Technology in Combating Scams

The fight against meta leads payment scams requires a multifaceted approach, and technology plays a crucial role in detecting, preventing, and mitigating these fraudulent activities. Advancements in artificial intelligence (AI) and machine learning (ML) are empowering financial institutions and cybersecurity experts to identify suspicious patterns and predict potential scams with greater accuracy.

Furthermore, blockchain technology offers a secure and transparent platform for financial transactions, reducing the risk of fraud and enhancing trust in online payments.

Artificial Intelligence and Machine Learning in Scam Detection

AI and ML algorithms are increasingly being deployed to analyze vast amounts of data, identifying anomalies and patterns indicative of fraudulent activities. These technologies can analyze transaction data, user behavior, and communication patterns to detect red flags associated with meta leads payment scams.

- Real-time anomaly detection:AI algorithms can monitor transactions in real time, identifying unusual spending patterns or deviations from typical user behavior. This enables immediate intervention and prevents fraudulent transactions from being completed.

- Predictive modeling:ML models can learn from historical data to predict future fraudulent activities. By analyzing past scam patterns, these models can identify potential victims and warn them about potential scams before they occur.

- Automated fraud investigation:AI-powered tools can automate the process of investigating suspected scams, freeing up human investigators to focus on more complex cases. These tools can analyze data from multiple sources, including social media, websites, and financial transactions, to identify evidence of fraud.

Blockchain Technology for Secure Financial Transactions

Blockchain technology, known for its decentralized and immutable nature, offers a secure and transparent platform for financial transactions. This technology can help combat meta leads payment scams by:

- Enhanced security:Blockchain transactions are encrypted and tamper-proof, making it extremely difficult for fraudsters to manipulate or alter transaction records.

- Increased transparency:All transactions on a blockchain are publicly viewable, enhancing transparency and accountability. This makes it more challenging for scammers to operate under the radar.

- Smart contracts:Blockchain-based smart contracts can automate financial transactions, eliminating the need for intermediaries and reducing the risk of human error or fraud.

Examples of Existing Technologies and Solutions

Financial institutions are increasingly implementing technologies to combat scams, including:

- Fraud detection systems:Many banks and payment processors use sophisticated fraud detection systems powered by AI and ML to identify and prevent fraudulent transactions in real time.

- Two-factor authentication (2FA):2FA adds an extra layer of security by requiring users to provide two forms of identification, such as a password and a code sent to their mobile device. This makes it more difficult for scammers to gain unauthorized access to accounts.

- Biometric authentication:Using fingerprint, facial, or iris scanning for authentication can further enhance security and make it more challenging for fraudsters to impersonate legitimate users.

Raising Awareness and Education: Meta Leads Uk Payment Scams Uk Finace Claims

The fight against meta leads payment scams requires a multifaceted approach, and a crucial element is raising awareness among consumers and businesses alike. This involves equipping them with the knowledge and tools to identify, avoid, and report these fraudulent activities.

Educating Consumers

Educating consumers about meta leads payment scams is essential to prevent them from falling victim. A well-informed public is less likely to be tricked by deceptive tactics.

- Disseminating Information:Widely distributing information about meta leads payment scams through various channels is crucial. This could include public service announcements, social media campaigns, and educational materials on websites and in community centers.

- Recognizing Red Flags:Providing consumers with a list of red flags to watch out for can empower them to make informed decisions. These red flags could include unrealistic promises, high-pressure sales tactics, requests for personal financial information, and suspicious websites or email addresses.

- Reporting Scams:Encouraging consumers to report any suspected scams to the relevant authorities is vital. This helps authorities track patterns, identify perpetrators, and take action to prevent further harm.

Educating Businesses

Businesses are also susceptible to meta leads payment scams, and educating them on how to protect themselves and their customers is equally important.

- Due Diligence:Businesses should conduct thorough due diligence on any new partners or vendors, especially those offering meta leads. This includes verifying their legitimacy, checking online reviews, and requesting references.

- Secure Payment Systems:Implementing secure payment systems that protect customer data is essential. This includes using encryption, strong passwords, and multi-factor authentication.

- Employee Training:Training employees to identify and report potential scams is crucial. This could involve providing them with information about common scam tactics and best practices for handling suspicious contacts.