Fintech growth fund funding gap, a term that might sound complex, actually describes a critical challenge facing the rapid evolution of the financial technology sector. Imagine a world where brilliant ideas for new financial tools and services struggle to find the necessary investment to take off.

This is the reality of the fintech growth fund funding gap, a situation where the demand for funding for fintech startups significantly outpaces the available capital.

The gap arises from a confluence of factors. Investors may be hesitant to back early-stage fintech companies due to the perceived risk and complexity of the industry. Regulatory hurdles can also deter funding, while the sheer volume of promising fintech ventures vying for attention makes it difficult for investors to choose the most promising candidates.

The consequences of this gap are far-reaching, potentially hindering the growth of promising startups, slowing down innovation, and ultimately impacting the pace of financial technological advancements.

Defining the Fintech Growth Fund Funding Gap

The fintech growth fund funding gap refers to the disparity between the amount of capital required by fintech startups and the actual funding available from venture capitalists and other investors. This gap can be significant, hindering the growth and development of promising fintech companies.

Factors Contributing to the Fintech Growth Fund Funding Gap

Several factors contribute to the fintech growth fund funding gap, including:

- Increased Competition:The fintech industry is highly competitive, with numerous startups vying for investor attention and limited capital. This intense competition makes it challenging for startups to stand out and secure funding.

- Regulatory Uncertainty:The regulatory landscape for fintech is constantly evolving, creating uncertainty for investors. This uncertainty can make investors hesitant to commit capital to startups operating in a volatile regulatory environment.

- High Failure Rates:Fintech startups face high failure rates due to factors such as intense competition, rapid technological advancements, and evolving customer needs. This risk aversion can deter investors from committing significant capital to early-stage fintech companies.

- Long Time to Market:Many fintech solutions require significant time and resources to develop, test, and deploy. This extended time to market can make investors hesitant to invest in startups that may not generate returns quickly.

Fintech Sectors Experiencing the Funding Gap

The fintech growth fund funding gap is particularly pronounced in certain sectors, including:

- Insurtech:Insurtech startups are facing challenges in securing funding due to the complex nature of the insurance industry and the high cost of developing and deploying insurance solutions. Investors may be hesitant to invest in insurtech companies that require significant time and resources to reach profitability.

- Regtech:Regtech startups focus on developing technologies that help financial institutions comply with regulatory requirements. While there is a growing need for regtech solutions, investors may be cautious about investing in this sector due to the highly specialized nature of regtech and the potential for regulatory changes.

- Lending Technologies:Fintech companies developing innovative lending solutions face challenges in securing funding due to concerns about credit risk and the potential for regulatory scrutiny. Investors may be hesitant to invest in lending technologies that involve significant exposure to credit risk.

Impact of the Funding Gap on Fintech Growth

The funding gap in fintech poses a significant challenge to the growth and development of the industry. It can stifle innovation, limit market competition, and hinder job creation, ultimately impacting the broader economic landscape.

Impact on Fintech Startups

The funding gap presents a formidable hurdle for fintech startups. Limited access to capital can significantly impact their ability to scale operations, develop new products, and compete effectively in the market. This can lead to:

- Slower Growth:Startups with limited funding may struggle to keep pace with their competitors, leading to slower growth and potentially missing out on critical market opportunities.

- Limited Innovation:Without sufficient funding, startups may be forced to prioritize short-term survival over long-term innovation, hindering their ability to develop cutting-edge solutions.

- Increased Risk of Failure:Startups with limited funding are more vulnerable to economic downturns and market fluctuations, increasing the risk of failure and impacting the overall health of the fintech ecosystem.

Impact on Market Competition

The funding gap can exacerbate existing market inequalities, leading to a less competitive and less innovative fintech landscape. This can result in:

- Domination by Larger Players:Well-funded established players may have an unfair advantage over startups, potentially stifling competition and innovation.

- Limited Consumer Choice:A lack of competition can lead to limited consumer choice and potentially higher prices for financial services.

- Reduced Technological Advancements:A less competitive market may hinder the development and adoption of new technologies, slowing down the pace of innovation in the fintech sector.

Impact on Job Creation and Economic Growth

The funding gap can have a ripple effect on the broader economy, impacting job creation and economic growth within the fintech sector. This can lead to:

- Reduced Job Opportunities:A lack of funding can limit the growth of fintech startups, leading to fewer job opportunities in the sector.

- Slower Economic Growth:The fintech sector is a key driver of economic growth and innovation. A funding gap can hinder its development, slowing down overall economic growth.

- Missed Opportunities:The funding gap can prevent the development of innovative solutions that could address critical economic and social challenges.

Factors Influencing Funding Availability: Fintech Growth Fund Funding Gap

The availability of funding for fintech growth funds is influenced by a complex interplay of factors, including regulatory frameworks, investor sentiment, market conditions, and macroeconomic trends. These factors can significantly impact the attractiveness of fintech investments, driving fluctuations in funding availability.

Regulatory Frameworks

Regulatory frameworks play a crucial role in shaping investor confidence and influencing funding decisions. Clear and predictable regulations create a stable environment that encourages investment, while complex and evolving regulations can deter investors.

- Regulatory Clarity:Well-defined regulatory frameworks provide clarity for investors, enabling them to assess risks and potential returns more effectively. For example, the introduction of the Payment Services Directive (PSD2) in Europe fostered innovation in the payments sector by creating a level playing field for new entrants and promoting competition.

- Regulatory Stability:Consistent regulatory frameworks with minimal changes provide a stable environment for investors, reducing uncertainty and encouraging long-term investments. However, frequent changes or unpredictable regulatory shifts can create uncertainty and discourage investment. For example, the ongoing debate surrounding the regulation of cryptocurrencies can impact investor sentiment and funding availability for fintech companies operating in this space.

Investor Sentiment

Investor sentiment towards fintech is a significant driver of funding availability. Positive sentiment, driven by factors such as strong growth prospects and increasing adoption of fintech solutions, leads to greater investment appetite.

- Fintech Growth Prospects:Investors are drawn to fintech companies with strong growth potential and a clear path to profitability. Positive industry trends, such as the increasing adoption of digital banking and mobile payments, contribute to positive investor sentiment.

- Market Demand:High demand for fintech solutions, driven by consumer preferences and changing market dynamics, increases investor confidence and encourages funding. For example, the growing popularity of neobanks and digital wealth management platforms has led to increased investment in these sectors.

Market Conditions

Broader market conditions, including interest rates, economic growth, and investor risk appetite, also impact funding availability.

- Interest Rates:Low interest rates generally encourage investment as borrowing costs are lower. However, rising interest rates can make it more expensive to fund growth, potentially leading to reduced funding availability. For example, the recent rise in interest rates has impacted venture capital funding for fintech companies.

- Economic Growth:Strong economic growth typically leads to increased investor confidence and a higher appetite for risk, which can benefit fintech companies seeking funding. However, economic downturns can lead to decreased funding availability as investors become more cautious.

Macroeconomic Trends

Macroeconomic trends, such as global economic uncertainty, geopolitical tensions, and technological advancements, can influence funding availability.

- Global Economic Uncertainty:Economic instability or uncertainty can lead to increased risk aversion among investors, potentially reducing funding availability for fintech companies. For example, the ongoing trade war between the US and China has created uncertainty in the global economy, which has impacted investor sentiment and funding decisions.

- Technological Advancements:Emerging technologies, such as artificial intelligence (AI) and blockchain, are creating new opportunities for fintech innovation and attracting investment. However, the rapid pace of technological change can also create challenges for investors, as they need to navigate new and evolving markets.

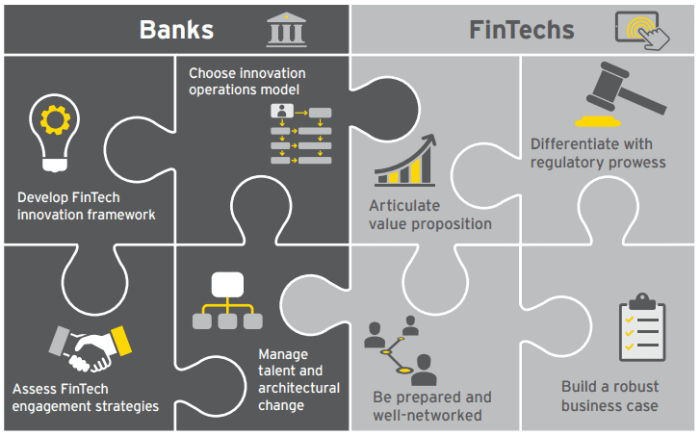

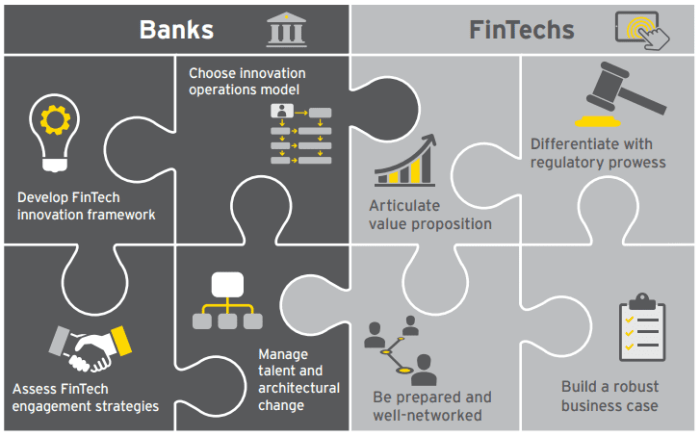

Strategies for Bridging the Gap

The fintech growth fund funding gap poses a significant challenge to the growth and innovation of the fintech sector. Addressing this gap requires a multi-pronged approach involving a combination of strategies to foster collaboration, enhance access to capital, and create an environment conducive to fintech growth.

Strategies to Enhance Funding Availability

Strategies to enhance funding availability for fintech startups are crucial to bridging the funding gap. This involves initiatives that address the specific needs of early-stage fintech companies and create a more supportive ecosystem for their growth.

Find out about how startup bayezian reveals ai breakthrough for male fertility diagnosis can deliver the best answers for your issues.

- Increased Investor Education:Educating investors about the unique characteristics and potential of fintech startups can help to dispel misconceptions and foster greater confidence in their investment potential. This can be achieved through workshops, conferences, and online resources that highlight the growth trajectory and innovation potential of the fintech sector.

- Venture Capital (VC) Fund Specialization:The creation of specialized VC funds dedicated to fintech investments can provide a dedicated pool of capital specifically tailored to the needs of early-stage fintech companies. These funds can leverage their expertise in the sector to identify promising startups and provide the necessary guidance and support for their growth.

- Angel Investor Networks:Fostering angel investor networks focused on fintech can provide a valuable source of seed funding and mentorship for startups. Angel investors, with their expertise and connections, can play a crucial role in supporting the initial stages of fintech development.

Case Studies and Examples

Understanding the fintech growth fund funding gap requires examining real-world situations. This section delves into case studies of fintech startups facing funding challenges and success stories of companies overcoming obstacles. Insights from investors and fund managers provide valuable perspectives on navigating this gap.

Fintech Startups Facing Funding Challenges

The funding gap significantly impacts fintech startups, particularly those in early stages. Many promising ventures struggle to secure funding due to various factors, including:

- Lack of Traction:Early-stage fintech startups often lack the established user base and revenue streams that attract investors. This can be a significant barrier to securing funding.

- Competition:The fintech sector is highly competitive, with numerous established players and new entrants. This makes it challenging for startups to differentiate themselves and attract investor attention.

- Regulatory Uncertainty:The rapidly evolving regulatory landscape in fintech can create uncertainty for investors, making them hesitant to commit capital.

Success Stories of Fintech Companies Overcoming Funding Obstacles

Despite the challenges, several fintech companies have successfully navigated the funding gap and achieved significant growth. These success stories offer valuable lessons for aspiring entrepreneurs:

- Strong Value Proposition:Companies with a clear and compelling value proposition that addresses a specific market need are more likely to attract funding. For example, Stripe, a payments processing company, focused on simplifying online payments, a critical need for businesses, which led to significant investor interest.

- Experienced Team:Investors seek companies with a team of experienced professionals who have a proven track record in the fintech industry. Square, a mobile payments company, was founded by Jack Dorsey, a serial entrepreneur with experience in technology and finance, which attracted early investors.

- Strategic Partnerships:Collaborating with established players in the industry can provide startups with access to resources, networks, and credibility. Plaid, a financial data aggregation platform, partnered with major financial institutions, which helped build trust and credibility with investors.

Insights from Investors and Fund Managers

Investors and fund managers offer valuable perspectives on the fintech funding gap:

“The funding gap is a real challenge for fintech startups, especially those operating in emerging markets. Investors often prioritize companies with established track records and strong revenue streams. However, there are opportunities for startups with innovative solutions and strong teams to attract funding,” said [Name of Investor], a partner at a venture capital firm.

“The funding gap is not insurmountable. Startups can overcome these challenges by demonstrating a clear value proposition, building a strong team, and establishing strategic partnerships. Investors are increasingly looking for companies with a long-term vision and a commitment to social impact,” said [Name of Fund Manager], a managing director at a fintech investment firm.

Future Trends and Predictions

The fintech funding landscape is constantly evolving, shaped by emerging technologies, shifting investor preferences, and macroeconomic factors. Understanding these trends is crucial for fintech companies seeking to secure funding and navigate the future of the industry.

Impact of Emerging Technologies

Emerging technologies are reshaping the fintech funding landscape, creating new opportunities and challenges for both startups and investors.

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML are transforming how fintech companies operate, from risk assessment and fraud detection to personalized financial advice. These technologies are also enabling the development of new financial products and services, attracting investors seeking to capitalize on this technological disruption.

- Blockchain and Decentralized Finance (DeFi):Blockchain technology is disrupting traditional financial systems, creating new opportunities for decentralized finance (DeFi). DeFi applications are attracting significant investor interest, particularly in areas such as lending, borrowing, and trading. The decentralized nature of DeFi platforms also presents unique challenges for traditional investors, requiring new approaches to due diligence and risk management.

- Open Banking and Application Programming Interfaces (APIs):Open banking initiatives are increasing data accessibility and interoperability within the financial sector. This trend is enabling the development of innovative fintech applications that leverage open APIs to provide personalized financial services and streamline financial processes.

Future Trajectory of the Fintech Growth Fund Funding Gap

The fintech growth fund funding gap is likely to persist in the coming years, influenced by several factors:

- Increased Competition:The fintech industry is becoming increasingly competitive, with a growing number of startups vying for investor attention. This competition is putting pressure on funding availability, as investors seek to allocate capital to the most promising ventures.

- Regulatory Uncertainty:Regulatory changes and uncertainty can impact investor confidence and investment decisions. While regulations are essential for ensuring financial stability and consumer protection, they can also create challenges for fintech companies seeking to scale their operations.

- Economic Volatility:Economic downturns and market volatility can impact investor risk appetite, leading to a decrease in funding for early-stage fintech companies.

Strategies for Fintech Companies to Adapt to Evolving Funding Dynamics, Fintech growth fund funding gap

Fintech companies need to adapt to the evolving funding landscape to secure the necessary capital for growth. Some key strategies include:

- Demonstrating Strong Unit Economics:Investors are increasingly focused on unit economics, seeking companies with sustainable business models and a clear path to profitability. Fintech companies need to demonstrate strong unit economics, including metrics such as customer acquisition cost (CAC), customer lifetime value (CLTV), and gross profit margin.

- Building Strong Partnerships:Collaborating with established financial institutions and other industry players can provide fintech companies with access to valuable resources, including funding, distribution channels, and regulatory expertise.

- Leveraging Alternative Funding Sources:Fintech companies can explore alternative funding sources beyond traditional venture capital, such as crowdfunding, angel investors, and debt financing.

- Focusing on Specific Niches:Specializing in specific niches within the fintech industry can help companies differentiate themselves from competitors and attract investors seeking to invest in specialized solutions.