European startup funding to drop * but theres cause for hope – European Startup Funding Drops, But Hope Remains: The European startup scene is facing a challenging period, with funding levels declining across the board. While the current economic climate and investor sentiment have contributed to this downturn, there are still reasons to be optimistic about the future of European startups.

This article explores the current trends, the challenges faced by startups, and the factors that offer hope for the future.

The decline in funding is a significant issue for European startups. It can lead to slower growth, difficulty attracting talent, and increased pressure to achieve profitability. However, the European startup ecosystem is resilient and innovative, with new trends and opportunities emerging.

There is a growing focus on sustainable and impact-driven startups, which are attracting increasing investment. Additionally, governments and institutions are playing a more active role in supporting startups through initiatives and programs.

European Startup Funding Trends

The European startup ecosystem has witnessed a significant shift in recent years, with a notable decline in funding activity. While Europe remains a hub for innovation and entrepreneurship, the funding landscape has become increasingly challenging, prompting concerns about the future of the region’s startup scene.

Funding Decline and Contributing Factors

The decline in European startup funding is a multifaceted issue, driven by a combination of factors, including macroeconomic conditions, investor sentiment, and market competition.

- Macroeconomic Conditions:The global economic slowdown, coupled with rising inflation and interest rates, has made investors more cautious about deploying capital. This has led to a decrease in the availability of funding for startups, particularly in the later stages of growth.

Notice europe surpasses us in private spacetech investment for first time seraphim space research for recommendations and other broad suggestions.

- Investor Sentiment:The recent downturn in public markets, particularly in the technology sector, has impacted investor sentiment, making them more risk-averse. This has led to a decline in the number of deals and a shift towards later-stage companies with proven track records.

- Market Competition:The European startup market is becoming increasingly competitive, with a growing number of startups vying for a limited pool of capital. This has made it more challenging for startups to secure funding, particularly in sectors with high levels of competition.

Funding Statistics

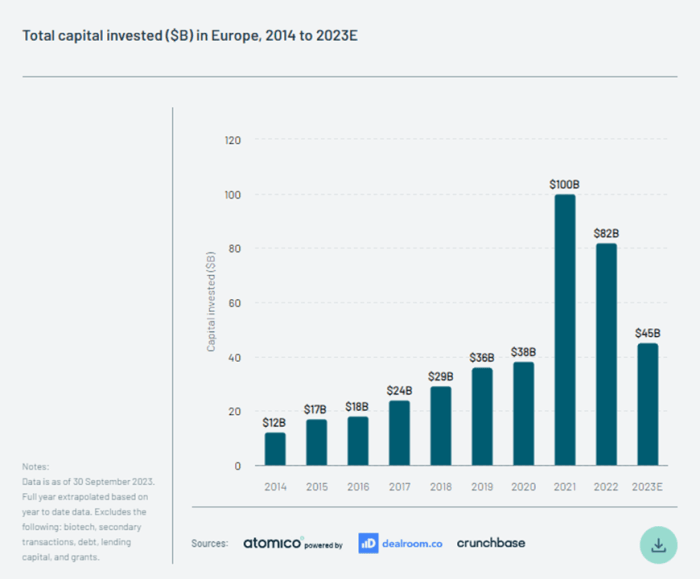

Data and statistics paint a clear picture of the decline in European startup funding. According to data from Dealroom, total venture capital investment in European startups declined by 28% in 2022 compared to 2021. The number of deals also decreased significantly, with a 20% drop in the same period.

Impact on Startups

The decline in funding has had a significant impact on European startups. Many startups have been forced to scale back their operations, delay expansion plans, or even shut down altogether. This has created challenges for the growth and development of the European startup ecosystem.

Impact of Funding Decline on Startups

The recent decline in European startup funding has significant implications for the region’s entrepreneurial ecosystem. While the overall funding landscape remains strong, the reduced availability of capital could hinder the growth and development of promising startups.

Consequences of Reduced Funding

The decline in funding can have several consequences for European startups, including:

- Slower Growth:Startups may experience slower growth as they have less capital to invest in expansion, marketing, and product development. This can make it harder for them to gain market share and compete with established players.

- Difficulty Attracting Talent:With less funding, startups may struggle to offer competitive salaries and benefits, making it challenging to attract and retain top talent. This can hinder their ability to build strong teams and execute their vision.

- Increased Pressure to Achieve Profitability:Startups with limited funding may face increased pressure to achieve profitability quickly. This can lead to short-term decision-making that may not be in the best long-term interests of the company.

Examples of Startups Affected by the Funding Downturn

Several European startups have been affected by the funding downturn. For instance,

“In 2023, [Startup Name], a [Industry] startup, announced layoffs and a scaling back of its operations after failing to secure a Series B funding round. The company cited the challenging funding environment as a major factor in its decision.”

“Another example is [Startup Name], a [Industry] startup that saw its valuation decline significantly in 2023. The company attributed the decline to the broader market slowdown and the reduced appetite for risk among investors.”

Strategies for Startups to Navigate the Funding Landscape

The current funding environment presents challenges for European startups, but with strategic planning and execution, entrepreneurs can still secure the necessary resources to grow their ventures. This section will Artikel actionable strategies to navigate the current funding landscape, attract investors, optimize pitch decks, build relationships with potential funders, and explore alternative financing options.

Attracting Investors

Attracting investors in a challenging funding environment requires a well-defined strategy that highlights the startup’s value proposition and potential for growth.

- Identify the Right Investors:Conduct thorough research to identify investors who specialize in your industry and have a track record of supporting early-stage companies. Target investors who align with your startup’s mission and values.

- Develop a Compelling Story:Investors want to invest in companies with a strong narrative and a clear vision. Craft a compelling story that articulates your startup’s problem, solution, market opportunity, and competitive advantage. Highlight your team’s expertise and experience, emphasizing their passion and commitment to the venture.

- Build a Strong Network:Attend industry events, conferences, and workshops to connect with potential investors. Engage with investors on social media platforms and build relationships through networking.

- Leverage Existing Relationships:Tap into your personal and professional network to identify potential investors. Ask for introductions and leverage existing connections to gain access to investors.

Optimizing Pitch Decks

A well-crafted pitch deck is essential for capturing investors’ attention and securing funding.

- Focus on the Problem and Solution:Clearly articulate the problem your startup solves and present your solution in a concise and compelling manner. Use visuals and data to support your claims and make the information easily digestible.

- Highlight Market Opportunity:Demonstrate the size and growth potential of your target market. Provide data and research to support your claims and showcase the demand for your product or service.

- Showcase Traction and Metrics:Investors are interested in seeing evidence of your startup’s progress. Highlight key metrics, such as user growth, revenue, or customer acquisition cost.

- Present a Clear Funding Request:State your funding needs and how you plan to utilize the funds. Be transparent about your financial projections and provide a clear roadmap for future growth.

Building Strong Relationships with Potential Funders, European startup funding to drop * but theres cause for hope

Building strong relationships with potential funders is crucial for securing funding.

- Engage in Meaningful Conversations:Go beyond simply pitching your idea. Engage in meaningful conversations with investors to understand their investment criteria and priorities.

- Demonstrate Transparency and Trust:Be upfront about your startup’s challenges and opportunities. Provide investors with access to relevant information and be responsive to their questions.

- Follow Up Regularly:Stay in touch with investors after meetings and provide updates on your startup’s progress.

Exploring Alternative Financing Options

Diversifying funding sources is essential in a challenging funding environment.

- Bootstrapping:Consider bootstrapping your startup by utilizing personal savings, revenue generated from sales, or pre-orders. This can help reduce your reliance on external funding.

- Crowdfunding:Explore crowdfunding platforms like Kickstarter or Indiegogo to raise funds from a large number of individuals. Crowdfunding can help validate your idea and build a community around your startup.

- Government Grants and Subsidies:Research government grants and subsidies available to startups in your industry. These programs can provide valuable financial support and resources.

- Angel Investors:Connect with angel investors who are willing to invest in early-stage companies. Angel investors typically provide smaller amounts of funding but can offer valuable mentorship and guidance.

- Venture Debt:Consider venture debt financing, which provides non-equity funding in exchange for interest payments. Venture debt can help bridge funding gaps and provide flexibility.

The Role of Governments and Institutions

European governments and institutions play a crucial role in fostering a vibrant startup ecosystem. Recognizing the importance of innovation and entrepreneurship, they have implemented various initiatives, programs, and policies aimed at supporting startups and driving economic growth.

Government Initiatives and Programs

Governments across Europe have established a wide range of programs and initiatives designed to support startups at different stages of their development. These initiatives often provide financial assistance, mentorship, access to networks, and other resources to help startups succeed.

- Grant Programs:Many governments offer grant programs to startups, providing funding for research and development, product development, and market entry. For example, the European Innovation Council (EIC) offers grants of up to €2.5 million to support high-impact startups with disruptive technologies.

- Loan Programs:Governments also offer loan programs to startups, providing access to capital for growth and expansion. These loans often come with favorable terms, such as lower interest rates and longer repayment periods, to reduce the financial burden on startups.

- Tax Incentives:Governments may provide tax incentives to startups, such as tax breaks on profits, research and development expenses, or investments. These incentives can encourage entrepreneurship and make it more attractive for investors to invest in startups.

- Incubator and Accelerator Programs:Governments often support incubator and accelerator programs, which provide startups with mentorship, networking opportunities, and access to resources, such as office space and equipment.

Policy Measures to Foster Innovation

In addition to specific programs, governments have implemented policy measures to create a favorable environment for startups. These policies aim to reduce regulatory burdens, promote research and development, and facilitate access to talent.

- Regulatory Simplification:Governments are working to simplify regulations and reduce bureaucratic hurdles for startups. This includes streamlining the process for registering a business, obtaining permits, and complying with legal requirements.

- Research and Development Support:Governments are investing in research and development (R&D) to drive innovation and create new technologies. They provide funding for universities, research institutions, and startups to conduct R&D projects.

- Talent Development:Governments are investing in education and training programs to develop a skilled workforce for the startup ecosystem. This includes supporting STEM education, promoting entrepreneurship skills, and facilitating the movement of skilled professionals across borders.

Successful Government-Backed Programs

Several government-backed programs have made a significant impact on the European startup ecosystem. These programs have provided funding, mentorship, and other resources to thousands of startups, contributing to the growth of the European tech sector.

- The European Innovation Council (EIC):The EIC is a €3 billion program that supports high-impact startups with disruptive technologies. The EIC provides grants, equity investments, and access to a network of experts and mentors.

- The European Institute of Innovation and Technology (EIT):The EIT is a network of knowledge and innovation communities that supports startups in various sectors, including health, energy, and food. The EIT provides funding, mentorship, and access to a network of partners and experts.

- The Startup Europe Initiative:The Startup Europe Initiative is a platform that connects startups, investors, and other stakeholders across Europe. The initiative provides resources, networking opportunities, and support to help startups scale their businesses.

The Future of European Startup Funding: European Startup Funding To Drop * But Theres Cause For Hope

The recent dip in European startup funding has sparked concerns, but it’s crucial to remember that this is a cyclical phenomenon. The startup ecosystem is inherently dynamic, and funding trends ebb and flow. Looking ahead, the future of European startup funding holds both challenges and opportunities, with a landscape shaped by evolving investor preferences, emerging funding models, and the ongoing efforts of governments and institutions.

Investor Preferences and Funding Models

Investor preferences are constantly evolving, driven by macroeconomic factors, market trends, and technological advancements. While traditional venture capital remains a mainstay, alternative funding models are gaining traction, offering startups more diverse avenues for securing capital.

- Focus on Profitability and Unit Economics:Investors are increasingly emphasizing profitability and unit economics over rapid growth. This shift reflects a desire for sustainable business models that can generate returns in the long term. Startups that can demonstrate strong unit economics and a clear path to profitability will be more attractive to investors.

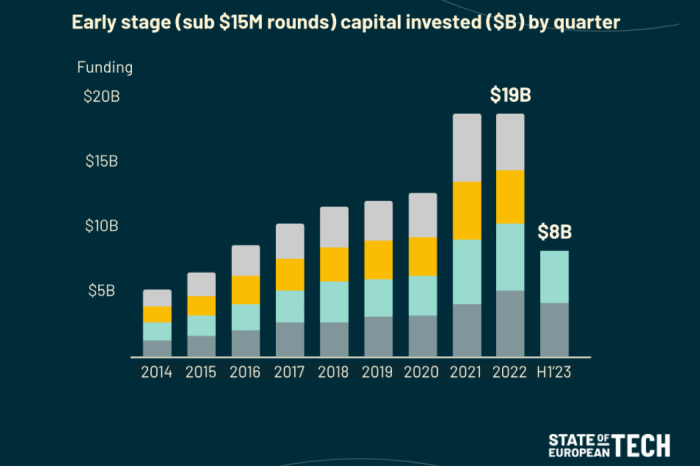

- Increased Interest in Later-Stage Companies:As the overall funding environment becomes more cautious, investors are showing a greater preference for later-stage companies with proven traction and established revenue streams. Early-stage startups may face more challenges in securing funding, especially in sectors with high competition or uncertain market potential.

- Growth of Alternative Funding Models:Beyond traditional venture capital, alternative funding models like crowdfunding, revenue-based financing, and venture debt are gaining popularity. These models offer startups greater flexibility and access to capital, especially in the early stages of development. Crowdfunding platforms like Kickstarter and Indiegogo allow startups to raise funds directly from the public, while revenue-based financing provides capital based on a percentage of future revenue.

Venture debt offers a less dilutive alternative to equity financing, providing startups with working capital while maintaining ownership.

Key Factors Shaping the Future

Several key factors will influence the trajectory of startup funding in Europe.

- Economic Conditions:The overall economic climate plays a significant role in investor sentiment and funding activity. Periods of economic uncertainty or recession can lead to a decrease in funding, as investors become more risk-averse. Conversely, a strong economy and favorable market conditions can stimulate investment and boost startup activity.

The recent economic slowdown and geopolitical tensions have created a challenging environment for startups, but a rebound in economic growth could revitalize the funding landscape.

- Government Support and Regulations:Government policies and regulations can significantly impact the startup ecosystem. Supportive policies, such as tax incentives for angel investors, grants for early-stage startups, and initiatives to foster innovation, can create a more favorable environment for startup growth. However, overly burdensome regulations can stifle innovation and make it more difficult for startups to access funding.

Governments can play a crucial role in promoting a startup-friendly environment by fostering a culture of entrepreneurship, supporting research and development, and simplifying regulations.

- Technological Advancements:Technological innovation is a key driver of startup activity. Emerging technologies, such as artificial intelligence, blockchain, and biotechnology, are creating new opportunities for startups and attracting significant investment. Startups operating in these sectors have the potential to disrupt existing industries and create new markets.

However, the rapid pace of technological change also poses challenges, as startups need to adapt quickly to stay ahead of the curve. Access to talent, infrastructure, and funding will be crucial for European startups to capitalize on the opportunities presented by technological advancements.