Uk universities urged reduce equity stakes spinouts – UK Universities Urged to Reduce Equity Stakes in Spinouts: A call for change is echoing through the halls of academia, urging universities to reconsider their heavy involvement in spinouts. This shift in perspective is driven by a desire to foster a more independent and thriving ecosystem for innovation.

The traditional model of universities holding significant equity stakes in spinouts is facing scrutiny, with experts suggesting that a more hands-off approach might be beneficial for both the universities and the companies they nurture.

The rationale behind this call for reduced equity stakes is rooted in the potential for conflict of interest and the limitations imposed on spinout growth. While universities undoubtedly play a vital role in fostering innovation and nurturing entrepreneurial ventures, their significant equity stakes can create a sense of dependency and hinder the spinouts’ ability to attract external investment and forge their own path to success.

The Call for Reduced Equity Stakes

The UK government and some leading figures in the academic community are calling for UK universities to reduce their equity stakes in spinouts. This move is driven by concerns about the potential conflicts of interest that arise when universities hold significant ownership in companies they have helped to establish.

It’s also argued that a more balanced ownership structure could lead to greater innovation and commercial success for spinouts.

Examples of Universities Reducing Equity Stakes

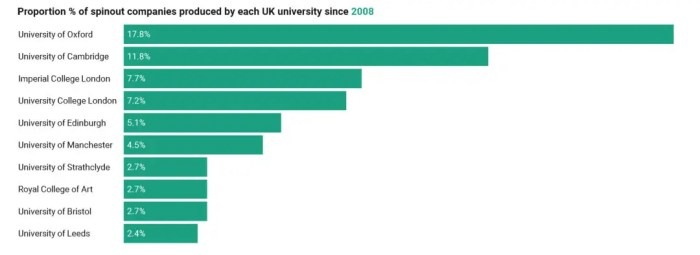

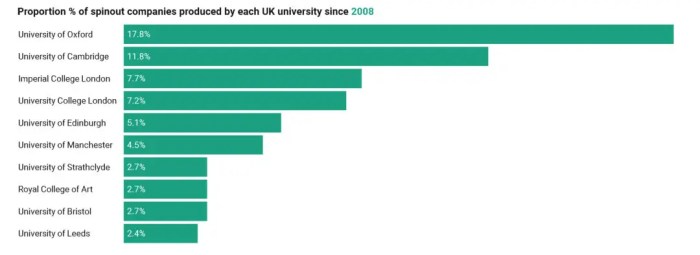

Several universities have already taken steps to reduce their equity stakes in spinouts. The University of Oxford, for example, has established a new model where it takes a smaller stake in spinouts and focuses on providing support and guidance to help them grow.

The University of Cambridge has also implemented a similar approach, aiming to foster a more entrepreneurial ecosystem that encourages external investment.

Potential Benefits of Reducing Equity Stakes

- Increased Access to Funding:Reducing equity stakes can make spinouts more attractive to external investors, leading to increased funding opportunities. This can be crucial for scaling up operations and achieving commercial success.

- Enhanced Spinout Independence:By holding a smaller stake, universities can create a more independent environment for spinouts, allowing them to make decisions without the influence of university interests. This can lead to more innovative and commercially driven ventures.

- Reduced Conflict of Interest:Lower equity stakes can mitigate potential conflicts of interest between universities and their spinouts. This can enhance the integrity of research and development activities and ensure that spinouts are not unfairly disadvantaged.

Current Equity Stakes and Their Impact: Uk Universities Urged Reduce Equity Stakes Spinouts

Universities in the UK are increasingly involved in the creation and development of spinouts, companies founded based on university research and intellectual property. This involvement often involves holding equity stakes, reflecting a strategic shift towards a more entrepreneurial approach within academia.

However, the level of equity stakes held by universities in spinouts varies widely, and the potential implications of these stakes require careful consideration.

Current Trends in University Equity Stakes

The trend in university equity stakes in spinouts in the UK is a complex one. While there’s no definitive consensus on the percentage of equity stakes universities typically hold, a recent study by the Higher Education Funding Council for England (HEFCE) found that the average stake held by universities in spinouts was around 20%.

However, this average can be misleading, as some universities hold significantly larger stakes, often exceeding 50%, while others maintain minimal involvement.

- Universities with strong research capabilities and a focus on commercialization often hold larger equity stakes. This strategy allows them to exert greater control over the spinout’s direction and potentially reap larger financial rewards.

- On the other hand, universities with limited resources or a more research-centric focus may prefer smaller stakes, allowing them to focus on research activities without being heavily involved in the operational aspects of the spinout.

Drawbacks of Significant Equity Stakes

While universities holding equity stakes in spinouts can bring potential benefits, such as financial returns and commercialization of research, there are also significant drawbacks to consider.

- Conflict of Interest:Universities holding large equity stakes in spinouts could potentially create conflicts of interest, particularly in research and development activities. This could lead to concerns about bias or favoritism towards the spinout, potentially compromising the university’s commitment to academic integrity.

- Operational Burden:Managing significant equity stakes in spinouts can be a considerable operational burden for universities. It requires specialized expertise in finance, business development, and legal matters, which may strain existing resources and divert attention from core academic activities.

- Financial Risk:Holding large equity stakes in spinouts exposes universities to significant financial risk. Spinouts are inherently high-risk ventures, and their success is not guaranteed. Universities could face substantial financial losses if a spinout fails to perform as expected.

Financial and Operational Implications of Equity Stakes

The financial and operational implications of university equity stakes in spinouts are multifaceted.

- Financial Returns:Universities hope to generate financial returns from their equity stakes in spinouts. These returns can be substantial, especially if the spinout is successful. However, it’s crucial to remember that these returns are not guaranteed and can vary significantly depending on the spinout’s performance.

- Operational Involvement:Universities holding equity stakes often have a degree of operational involvement in the spinout. This involvement can range from providing guidance and expertise to actively participating in management decisions. The level of involvement depends on the university’s strategy and the specific terms of the equity stake.

Browse the implementation of esa euclid spacecraft map dark universe thales alenia space in real-world situations to understand its applications.

- Resource Allocation:Universities need to carefully consider how they allocate resources to manage their equity stakes in spinouts. This involves balancing the potential benefits of financial returns with the costs of managing the investment and the potential risks involved.

Alternative Models for University Involvement

The traditional model of university involvement in spinouts, where universities hold equity stakes, has been subject to increasing scrutiny. This model, while fostering initial investment, can also create conflicts of interest and limit the spinout’s independence. To address these concerns, alternative models for university involvement are emerging, each offering distinct benefits and drawbacks.

Alternative Models and Their Comparison

These alternative models offer different ways for universities to support spinouts without relying solely on equity stakes.

- Grant Funding:Universities can provide grants or research funding to support spinout development. This model allows universities to contribute to spinout success without taking an equity stake, promoting greater independence. However, grant funding may be limited in scope and duration, potentially hindering long-term development.

- Mentorship and Advisory Services:Universities can offer mentorship and advisory services, leveraging the expertise of faculty and staff to guide spinout development. This model fosters collaboration and knowledge transfer, but it may not provide the same level of financial support as equity stakes.

- Incubator Programs:Universities can establish incubator programs, providing dedicated space, resources, and support services to nurture early-stage spinouts. This model offers a structured environment for spinout development, but it may require significant investment from the university.

- Joint Ventures:Universities can partner with private companies or venture capitalists to form joint ventures, sharing the risks and rewards of spinout development. This model combines university expertise with private sector resources, but it can lead to complexities in governance and decision-making.

Hypothetical Model for Balanced Support

A hypothetical model could combine the strengths of different approaches to achieve a balance between university support and spinout independence. This model could involve:

Providing a combination of grant funding, mentorship, and incubator services tailored to the specific needs of each spinout.

This model would allow universities to contribute to spinout success without taking an equity stake, while also fostering collaboration and knowledge transfer.

Establishing a clear governance structure that defines the roles and responsibilities of the university and the spinout.

This would help to mitigate potential conflicts of interest and ensure that the spinout retains its independence.

Developing a transparent and equitable system for sharing intellectual property rights, ensuring that the university benefits from its research while allowing the spinout to commercialize its technology.

This approach would ensure that both the university and the spinout benefit from their collaboration, fostering a mutually beneficial relationship.

The Role of Government and Funding Agencies

The role of government and funding agencies in promoting university spinouts is multifaceted and crucial. These entities play a significant role in shaping the environment for university-driven innovation and entrepreneurship.

Impact of Current Policies on University Equity Stakes

Current policies have a significant impact on the equity stakes universities hold in their spinouts.

- Tax Incentives: Many countries offer tax incentives for universities to invest in spinouts, encouraging universities to hold larger equity stakes. However, these policies can sometimes create unintended consequences, such as universities prioritizing financial returns over the long-term success of the spinout.

- Research Funding: Government funding agencies often require universities to share intellectual property rights with the spinout, which can lead to universities having a greater stake in the company. This can be beneficial in terms of ensuring the commercialization of research, but it can also limit the spinout’s ability to attract private investment.

- Regulations: Regulations governing university spinouts can influence the level of equity stake universities hold. Some regulations encourage universities to maintain significant equity stakes, while others promote more hands-off approaches.

Impact on Spinout Growth and Innovation

The call for reduced equity stakes in university spinouts raises concerns about the potential impact on their growth and innovation. While universities play a crucial role in fostering research and development, the level of involvement and equity stakes can have a significant impact on the trajectory of a spinout company.

Spinouts Thriving with Minimal University Involvement, Uk universities urged reduce equity stakes spinouts

Spinouts that have achieved success with minimal university involvement often demonstrate strong entrepreneurial drive and a clear vision for their product or service. These companies typically leverage their own resources and networks to secure funding, build their teams, and navigate the market.

Examples include:

- Genentech:Founded in 1976, Genentech is a biotechnology company that achieved significant success with minimal involvement from its founding university, the University of California, San Francisco. Genentech focused on developing novel therapeutic proteins and quickly established itself as a leader in the biotech industry.

- Google:While founded by two Stanford University graduates, Google’s growth and innovation were largely driven by its own entrepreneurial spirit and ability to attract top talent. The company’s early success was fueled by its innovative search engine technology and a strong focus on user experience.

Challenges Faced by Spinouts with Reduced University Support

Spinouts with reduced university support may face several challenges, particularly in their early stages:

- Access to Resources:Universities often provide spinouts with access to research facilities, equipment, and expertise. Reduced involvement may limit access to these resources, hindering their ability to conduct research and develop their products or services.

- Networking Opportunities:Universities facilitate connections with potential investors, industry partners, and other stakeholders. Reduced involvement may limit access to these networks, making it harder for spinouts to secure funding and establish partnerships.

- Brand Recognition:University affiliation can enhance brand recognition and credibility, especially for early-stage companies. Reduced involvement may make it more challenging to build brand awareness and attract customers.

The Future of University Spinouts in the UK

The UK’s university spinout ecosystem is poised for significant transformation as the debate around equity stakes intensifies. This shift will reshape the landscape of university-industry collaboration, influencing how research translates into commercial ventures and ultimately driving innovation.

The Evolving Landscape of University-Industry Collaboration

The relationship between universities and industry is undergoing a dynamic evolution. Traditionally, universities played a more passive role, primarily focusing on research and knowledge creation. However, the increasing importance of commercialization and the drive for economic growth have propelled universities to become active players in the innovation ecosystem.

This evolution is driven by several factors, including:

- Growing Emphasis on Commercialization:Universities are increasingly recognizing the economic and societal impact of commercializing their research. This shift is evident in the rise of dedicated technology transfer offices and the development of robust intellectual property management strategies.

- Increased Funding for Innovation:Governments and funding agencies are actively supporting university spinouts through grants, seed funding, and tax incentives. These initiatives aim to stimulate innovation and create high-growth businesses.

- Collaboration with Industry:Universities are fostering stronger partnerships with industry through joint research projects, technology licensing agreements, and the establishment of research centers. This collaborative approach accelerates the translation of research into real-world applications.

Key Factors Influencing the Future of Spinouts

The future of university spinouts in the UK will be shaped by a complex interplay of factors: