Climate tech investment boom vc explains – Climate Tech Investment Boom: VC Explains – The world is waking up to the urgent need for climate action, and investors are pouring money into companies developing innovative solutions. This surge in climate tech investment is driven by a confluence of factors, including government policies, technological advancements, and a growing public awareness of the climate crisis.

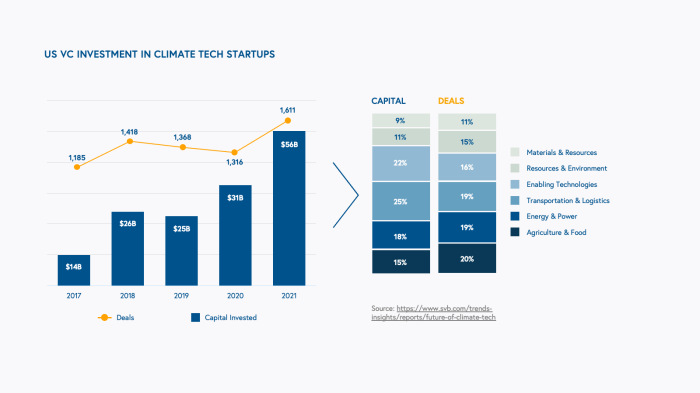

Venture capitalists are playing a key role in this boom, actively seeking out promising startups in sectors like renewable energy, carbon capture, and sustainable agriculture. These investors bring not only capital but also expertise and connections, helping to accelerate the development and deployment of climate-friendly technologies.

The Rise of Climate Tech

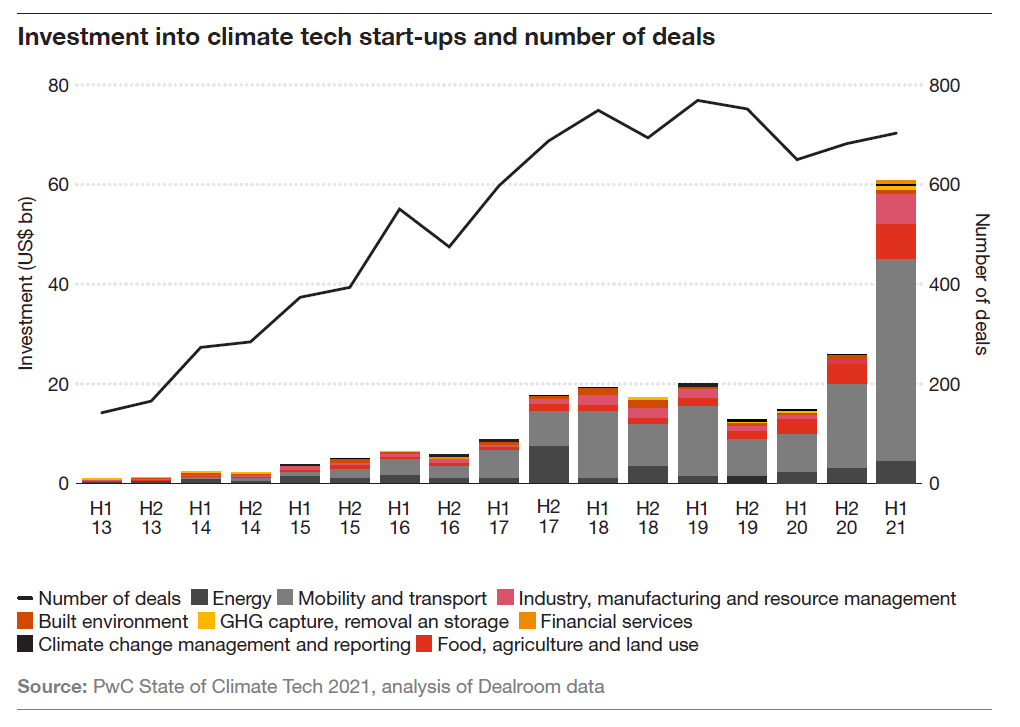

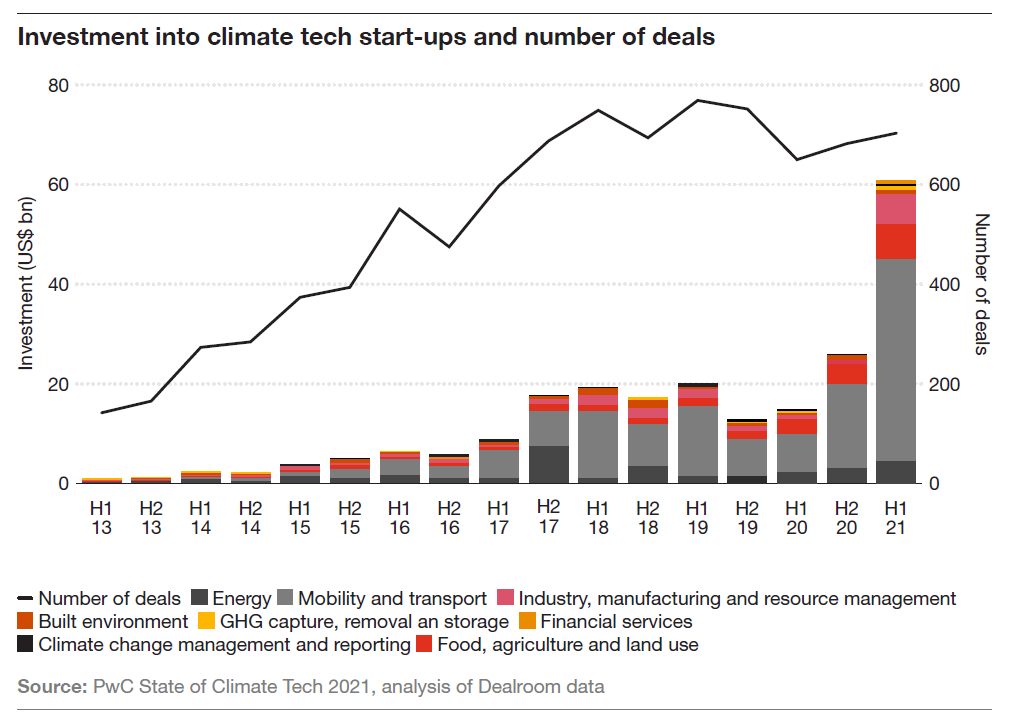

The climate tech sector is experiencing a dramatic surge in investment, driven by a confluence of factors, including the urgency of addressing climate change, technological advancements, and increasing public awareness. This investment boom is fueling the development of innovative solutions across a range of climate-focused industries.

Factors Driving Climate Tech Investment

The surge in climate tech investment is a result of a combination of factors, each playing a crucial role in propelling the sector forward.

In this topic, you find that german energy kite power startup launch ireland is very useful.

- Government Policies:Governments worldwide are increasingly implementing policies aimed at reducing greenhouse gas emissions and promoting clean energy. For example, the US Inflation Reduction Act of 2022 provides significant tax credits and incentives for clean energy projects, driving private investment in the sector.

- Technological Advancements:Advancements in renewable energy technologies, such as solar and wind power, have significantly reduced their costs, making them increasingly competitive with traditional fossil fuels. Similarly, breakthroughs in battery storage, carbon capture, and other climate tech areas are opening up new possibilities for tackling climate change.

- Increasing Public Awareness:The growing awareness of the urgency of climate change, fueled by scientific evidence and extreme weather events, has led to a surge in public demand for climate solutions. This demand has spurred investors to allocate capital towards climate tech companies, as they seek to align their investments with societal values and contribute to a sustainable future.

Climate Tech Sectors Attracting Investment

The climate tech investment boom is evident across a wide range of sectors, each addressing a specific aspect of the climate crisis.

- Renewable Energy:Renewable energy technologies, such as solar, wind, and hydropower, are attracting significant investment as they offer a clean and sustainable alternative to fossil fuels. The global renewable energy market is expected to reach $2.2 trillion by 2025, driven by factors like declining costs and increasing government support.

- Carbon Capture:Carbon capture technologies, which aim to remove carbon dioxide from the atmosphere or prevent its release from industrial processes, are gaining momentum as a critical tool for mitigating climate change. The global carbon capture market is expected to reach $120 billion by 2030, with significant investment flowing into companies developing and deploying these technologies.

- Sustainable Agriculture:Sustainable agriculture practices, such as regenerative farming, precision agriculture, and vertical farming, are gaining traction as investors seek to address the environmental impacts of traditional agriculture. These practices aim to increase food production while reducing water consumption, fertilizer use, and greenhouse gas emissions.

Key Trends in Climate Tech Investment: Climate Tech Investment Boom Vc Explains

The climate tech investment landscape is rapidly evolving, driven by increasing awareness of the urgency of climate change and the emergence of innovative solutions. Investors are recognizing the immense potential of climate tech to mitigate climate change and create sustainable economic growth.

Several key trends are shaping the future of climate tech investment, reflecting the growing maturity of the sector and the increasing focus on impact.

Later-Stage Investment

As climate tech companies mature and demonstrate their viability, investors are increasingly interested in later-stage investments. This shift is evident in the growing number of Series C, D, and even later-stage funding rounds in climate tech. The trend toward later-stage investments reflects a growing confidence in the long-term potential of the sector.

- For example, in 2022, the climate tech company, Scale AI, raised a $300 million Series E funding round, demonstrating the significant capital available for mature companies.

- Another example is Carbon Engineering, a company developing direct air capture technology, which secured a $1.1 billion Series D funding round in 2021.

Rise of Climate-Focused Funds, Climate tech investment boom vc explains

A growing number of venture capital funds are specifically focused on climate tech. These funds provide dedicated capital and expertise to support the development and scaling of climate solutions. This trend is fueled by the increasing recognition that climate change presents both a significant risk and a tremendous opportunity for investment.

- For example, Lowercarbon Capital, a climate-focused venture capital firm, has invested in over 40 companies developing technologies to reduce greenhouse gas emissions.

- Another example is Climate Capital, a fund focused on investing in climate-resilient infrastructure, which has deployed over $1 billion in capital.

Impact Investing

Impact investing, which focuses on generating both financial returns and positive social and environmental impact, is becoming increasingly important in climate tech. Investors are seeking to align their investments with their values and contribute to a more sustainable future.

- For example, The Climate Pledge Fund, a $2 billion fund established by Amazon and Global Optimism, invests in companies developing technologies to reduce carbon emissions and preserve the environment.

- Another example is Mission Driven Finance, a non-profit organization that provides capital and support to impact-driven businesses, including those in the climate tech sector.

Regional Variations in Climate Tech Investment

Climate tech investment is happening across the globe, with different regions experiencing varying levels of activity. The following table provides a snapshot of the investment landscape in key regions:

| Region | Key Trends | Examples |

|---|---|---|

| North America | Strong focus on later-stage investments, emergence of climate-focused funds, growing importance of impact investing. | Scale AI, Carbon Engineering, The Climate Pledge Fund. |

| Europe | Increasing investment in clean energy, sustainable agriculture, and circular economy solutions. | Northvolt, Biometric, Circularise. |

| Asia | Rapid growth in renewable energy, electric vehicles, and smart cities technologies. | BYD, CATL, Alibaba Cloud. |

Prominent Climate Tech Startups

The climate tech investment boom has led to the emergence of numerous innovative startups developing solutions to combat climate change. These companies are attracting significant venture capital funding and are making a tangible impact on the world. Here are some examples of prominent climate tech startups and their contributions.

Climate Tech Startups Addressing Climate Change

These startups are tackling various aspects of climate change, from renewable energy generation and storage to carbon capture and sustainable agriculture.

- Carbon Engineering: This company is developing a technology for direct air capture (DAC), which removes carbon dioxide from the atmosphere. Their technology involves using large fans to draw air into a system that chemically captures CO2, which can then be stored or used to produce fuels.

Carbon Engineering has received significant funding from investors like Bill Gates and has partnered with companies like Occidental Petroleum to scale up their operations.

- Beyond Meat: This company is a leader in the plant-based meat industry, offering alternatives to traditional meat products. Beyond Meat’s products are made from pea protein and other plant-based ingredients, and they are designed to mimic the taste and texture of meat.

The company has gained popularity for its commitment to reducing the environmental impact of meat production, which is a major contributor to greenhouse gas emissions.

- Sunrun: This company is a leading provider of residential solar panels and energy storage systems. Sunrun’s mission is to make solar energy accessible and affordable for homeowners. The company has installed millions of solar panels across the United States, helping to reduce carbon emissions and lower energy bills.

- Tesla: While not strictly a climate tech startup, Tesla is a major player in the electric vehicle (EV) market and has made significant contributions to reducing carbon emissions from transportation. The company’s electric cars and energy storage solutions are helping to accelerate the transition to a cleaner energy future.

The Future of Climate Tech Investment

The climate tech investment boom is still in its early stages, and the future holds immense potential for continued growth. As the urgency to address climate change intensifies, investments in climate solutions are expected to soar, driven by a confluence of factors, including technological advancements, policy changes, and evolving investor sentiment.

Factors Shaping the Future of Climate Tech Investment

The future of climate tech investment will be shaped by a complex interplay of forces, with some driving growth and others presenting challenges.

- Technological Advancements: Continued innovation in areas such as renewable energy, carbon capture, and sustainable agriculture will drive investment, offering investors promising returns and contributing to the fight against climate change. For instance, advancements in battery technology, particularly in terms of cost and performance, are expected to accelerate the adoption of electric vehicles and renewable energy storage.

- Policy Changes: Governments worldwide are enacting policies to incentivize climate tech development and deployment. This includes carbon pricing mechanisms, subsidies for renewable energy, and regulations promoting energy efficiency. For example, the European Union’s Green Deal, a comprehensive plan to achieve climate neutrality by 2050, is expected to mobilize significant investment in climate tech.

- Investor Sentiment: Growing awareness of climate change and its risks is shifting investor sentiment towards sustainable investments. Institutional investors, such as pension funds and insurance companies, are increasingly incorporating environmental, social, and governance (ESG) factors into their investment decisions. This shift is driving capital towards climate tech companies, making them more attractive investment opportunities.

A Scenario for Climate Tech Investment in the Next 5-10 Years

Based on current trends, climate tech investment could evolve significantly in the next 5-10 years, following a trajectory marked by increased investment, a shift towards later-stage companies, and a greater focus on impact.

- Increased Investment: Climate tech investments are projected to reach unprecedented levels. According to a report by PwC, global investment in climate tech could reach $1 trillion annually by 2030, driven by the increasing demand for climate solutions and the growing availability of capital.

- Focus on Later-Stage Companies: As the sector matures, investment will shift towards later-stage companies with proven technologies and business models. This will involve more venture capital and private equity investments in companies ready for scale-up and market expansion.

- Emphasis on Impact: Investors will increasingly prioritize investments that demonstrate a tangible impact on climate change mitigation and adaptation. This means focusing on companies that offer measurable and verifiable solutions, such as renewable energy projects with quantifiable emissions reductions.