European startup funding angel seed investors up pitchbook valuations report – European Startup Funding: Angel, Seed, and PitchBook Valuations – Navigating the European startup scene is a journey filled with opportunities and challenges, especially when it comes to securing funding. This dynamic landscape is shaped by the active participation of angel investors and seed investors, who play a pivotal role in propelling innovative ventures forward.

PitchBook’s latest report on European startup valuations provides valuable insights into the current trends, highlighting the factors influencing valuation multiples and funding rounds across various sectors.

Understanding the strategies of angel and seed investors, the intricacies of pitching and fundraising, and the lessons learned from successful startups are crucial for aspiring entrepreneurs seeking to secure the necessary capital to fuel their growth. This exploration delves into the heart of the European startup funding ecosystem, offering practical guidance and illuminating the path towards success.

European Startup Funding Landscape

The European startup ecosystem is thriving, with a growing number of innovative companies attracting significant investment. However, the funding landscape is complex and constantly evolving, presenting both opportunities and challenges for entrepreneurs. This section will delve into the current state of European startup funding, examining key trends, challenges, and the role of angel and seed investors in this dynamic environment.

Key Trends and Challenges

The European startup funding landscape is characterized by several key trends, including:

- Increasing Investment:Venture capital investment in European startups has been steadily increasing in recent years. According to the European Investment Fund, total venture capital investment in Europe reached a record high of €45 billion in 2021. This surge in investment is fueled by factors such as the growing number of innovative startups, the increasing availability of capital, and the emergence of successful European tech companies.

- Focus on Specific Sectors:Investment is increasingly concentrated in specific sectors, such as fintech, healthcare, and artificial intelligence. These sectors are attracting significant attention from investors due to their potential for growth and disruption.

- Rise of Late-Stage Funding:There is a growing trend towards late-stage funding rounds, with startups raising larger amounts of capital at later stages of development. This shift is driven by the desire to scale rapidly and achieve market dominance.

- Competition from Other Regions:European startups are facing increasing competition for investment from other regions, such as the US and Asia. These regions offer larger markets, more experienced investors, and a more mature startup ecosystem.

Despite the positive trends, European startups face several challenges, including:

- Access to Capital:Access to capital remains a challenge for many European startups, particularly in the early stages. While investment has increased, it is still significantly lower than in the US.

- Talent Pool:Attracting and retaining top talent is another challenge. European startups often struggle to compete with larger companies and startups in the US and Asia for skilled workers.

- Regulatory Environment:The regulatory environment in Europe can be complex and challenging for startups. Regulations related to data privacy, competition, and intellectual property can create hurdles for growth and expansion.

Role of Angel Investors and Seed Investors

Angel investors and seed investors play a crucial role in the European startup ecosystem. They provide essential early-stage funding, mentorship, and connections that help startups get off the ground.

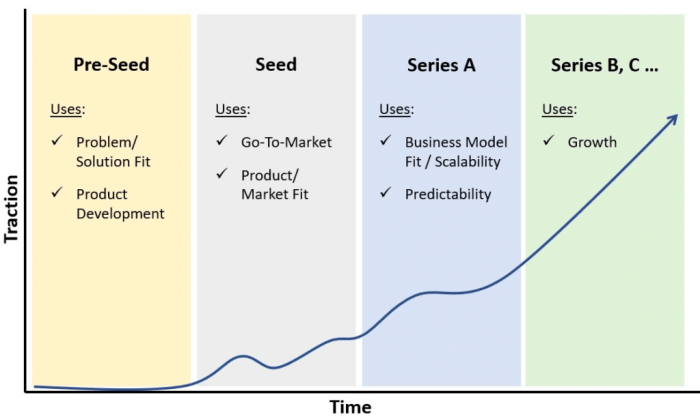

- Early-Stage Funding:Angel investors and seed investors provide the initial capital that many startups need to develop their product or service, test their business model, and gain traction. This funding is often crucial for startups that are not yet ready for larger venture capital investments.

- Mentorship and Network:Angel investors and seed investors often bring valuable experience and expertise to startups. They can provide mentorship, guidance, and connections to other investors, customers, and partners.

- Validation and Credibility:Securing funding from reputable angel investors and seed investors can provide validation for a startup’s business model and credibility in the market. This can help attract future investors and customers.

Comparison with Other Regions

The European startup funding landscape differs significantly from other regions, such as the US and Asia.

- US:The US is the world’s leading startup ecosystem, with a large pool of venture capital, a highly developed tech industry, and a culture of entrepreneurship. US startups have access to significantly more capital, particularly in later stages of development.

- Asia:Asia is rapidly emerging as a major startup hub, with strong growth in countries like China and India. Asian startups are attracting increasing investment, particularly in sectors like e-commerce and mobile technology.

While Europe faces challenges in competing with these regions, it also has unique strengths.

- Strong Research and Development:Europe has a strong tradition of research and development, with world-class universities and research institutions. This provides a fertile ground for innovation and the creation of new technologies.

- Access to Talent:Europe has a large and diverse pool of skilled talent, particularly in areas like engineering, design, and business.

- Global Reach:Europe is a large and diverse market, providing startups with access to a wide range of customers and potential partners.

PitchBook Valuations Report Insights

PitchBook’s latest report on European startup valuations provides a comprehensive overview of the current landscape, highlighting key trends and factors influencing valuation multiples across various sectors. The report delves into the dynamics of funding rounds, investor sentiment, and the impact of macroeconomic factors on startup valuations in Europe.

Valuation Multiples and Funding Rounds

The report reveals significant variations in valuation multiples across different sectors. For example, the median pre-money valuation multiple for SaaS companies in Europe reached 10x revenue in 2022, while for Fintech companies, it was closer to 8x revenue. This disparity can be attributed to factors such as growth potential, market size, and competition within each sector.The report also sheds light on the evolving dynamics of funding rounds.

While Series A rounds continue to dominate the European startup ecosystem, there is a growing trend towards larger Series B and C rounds, reflecting the increasing maturity of the market. This shift indicates that investors are willing to back companies with proven traction and a clear path to profitability.

Impact of Macroeconomic Factors

The global economic landscape has had a significant impact on startup valuations in Europe. Rising interest rates, inflation, and geopolitical uncertainty have created a more cautious investment environment. As a result, investors are demanding stronger fundamentals, including profitability and unit economics, before making investments.

“The current macroeconomic environment has led to a correction in startup valuations across Europe. Investors are now focusing on companies with strong unit economics and a clear path to profitability.”

PitchBook Analyst

This shift in investor sentiment has led to a decline in average valuation multiples across various sectors. However, the report also highlights that strong companies with a proven track record and a clear competitive advantage continue to attract significant investment.

Sector-Specific Trends

The report analyzes valuation trends in specific sectors, providing insights into the dynamics of each industry. For instance, the report notes that valuations in the e-commerce sector have declined significantly due to increased competition and rising customer acquisition costs. Conversely, the healthcare sector has seen continued growth, driven by factors such as an aging population and advancements in technology.

“The e-commerce sector has experienced a decline in valuations due to increased competition and rising customer acquisition costs. However, the healthcare sector has seen continued growth, driven by factors such as an aging population and advancements in technology.”

PitchBook Analyst

The report provides valuable data and insights for entrepreneurs, investors, and other stakeholders in the European startup ecosystem. By understanding the current trends and factors influencing valuations, companies can better position themselves for success in the competitive landscape.

Get the entire information you require about einride brings futuristic electric self driving trucks to uae on this page.

Startup Pitching and Fundraising: European Startup Funding Angel Seed Investors Up Pitchbook Valuations Report

Securing funding is a crucial step for any European startup, especially in the early stages. Understanding the process and crafting a compelling pitch can significantly increase your chances of attracting angel and seed investors. This section provides a comprehensive guide for navigating the fundraising landscape and securing the capital needed to propel your business forward.

Pitch Deck Essentials

A well-structured pitch deck is your primary tool for communicating your startup’s value proposition to potential investors. It should be concise, visually appealing, and effectively convey your business model, market opportunity, and financial projections.

- Problem:Clearly define the problem your startup addresses and its impact on the target market. Use data and statistics to illustrate the problem’s significance.

- Solution:Explain your startup’s unique solution to the problem, highlighting its competitive advantages and how it addresses the market’s unmet needs.

- Market:Describe the size and growth potential of your target market. Include relevant data on market trends, demographics, and competitive landscape.

- Team:Showcase the expertise and experience of your founding team, emphasizing their relevant skills and track record.

- Business Model:Clearly Artikel your revenue model, key metrics, and how you plan to generate profits.

- Financial Projections:Present realistic financial projections, including revenue, expenses, and key performance indicators (KPIs) for the next few years.

- Funding Request:State your specific funding needs and how you plan to use the funds to achieve your milestones.

- Exit Strategy:Artikel your vision for the future of your startup, including potential exit options like acquisition or IPO.

Effective Presentation Skills

A compelling presentation is essential for captivating investors and leaving a lasting impression. Focus on the following elements:

- Storytelling:Craft a narrative that resonates with investors, highlighting the problem, your solution, and the potential impact. Use vivid language and compelling visuals to engage the audience.

- Confidence and Passion:Project confidence and enthusiasm for your startup, demonstrating your belief in its potential. This passion will be contagious and inspire investors.

- Clarity and Conciseness:Use clear and concise language, avoiding technical jargon. Focus on key takeaways and avoid overwhelming investors with too much information.

- Engagement:Engage the audience with questions, interactive elements, and compelling visuals. Encourage questions and create a dialogue.

Building Investor Relationships

Developing relationships with investors is crucial for securing funding. Engage in the following strategies:

- Networking:Attend industry events, conferences, and meetups to connect with potential investors. Leverage your network to secure introductions and referrals.

- Online Platforms:Utilize online platforms like AngelList and Crunchbase to connect with investors and showcase your startup’s profile.

- Due Diligence:Be prepared to answer questions and provide comprehensive information about your business during the due diligence process.

- Transparency and Honesty:Be transparent and honest with investors about your business, challenges, and future plans. Build trust and credibility through open communication.

Navigating the Fundraising Process

The fundraising process can be challenging and time-consuming. Follow these steps to navigate it effectively:

- Define Your Fundraising Goals:Determine your funding needs, the type of investors you seek, and your preferred investment terms.

- Develop a Fundraising Strategy:Artikel your approach to reaching potential investors, including networking events, online platforms, and warm introductions.

- Prepare a Pitch Deck:Craft a compelling pitch deck that effectively communicates your startup’s value proposition and financial projections.

- Practice Your Pitch:Rehearse your pitch to ensure a smooth and confident delivery. Seek feedback from trusted advisors and mentors.

- Connect with Investors:Reach out to potential investors, introducing your startup and inviting them to learn more.

- Manage the Due Diligence Process:Be prepared to provide detailed information and answer questions during the due diligence process.

- Negotiate Investment Terms:Work with investors to negotiate favorable investment terms, ensuring a mutually beneficial agreement.

Success Stories and Case Studies

The European startup ecosystem boasts a multitude of success stories, showcasing the potential for innovation and growth. These startups have not only secured significant angel and seed funding but have also achieved remarkable milestones in their respective industries. Examining these case studies provides valuable insights into the factors that contribute to startup success and the strategies employed by these companies.

Notable European Startups and Their Success Factors, European startup funding angel seed investors up pitchbook valuations report

These case studies highlight the diverse range of successful European startups across various sectors. They demonstrate the power of strong teams, innovative solutions, and effective fundraising strategies in driving startup growth.

- Xentral (Germany):A cloud-based ERP software provider, Xentral secured €15 million in Series A funding led by Target Global in 2022. The company’s success can be attributed to its focus on providing a user-friendly and scalable ERP solution for small and medium-sized enterprises (SMEs).

Xentral’s growth strategy has been centered around developing a strong product-market fit, expanding its customer base, and building a robust team.

- Stash (UK):This fintech startup offers a micro-investing platform that allows users to invest small amounts of money in fractional shares of stocks and ETFs. Stash raised $12 million in a Series A funding round led by Accel in 2021. Stash’s success can be attributed to its innovative approach to making investing accessible to a wider audience.

The company has effectively leveraged technology to simplify the investment process and has built a strong brand identity.

- GoCardless (UK):A payment processing company that specializes in recurring payments, GoCardless has secured over $200 million in funding since its inception. The company’s success is rooted in its ability to provide a reliable and efficient payment solution for businesses. GoCardless has also expanded its operations globally, establishing a strong presence in key markets.

- Wise (UK):Formerly known as TransferWise, Wise is a global money transfer service that allows users to send and receive money internationally at lower costs. The company has raised over $1 billion in funding and has become one of the most successful fintech startups in Europe.

Wise’s success can be attributed to its innovative technology, transparent pricing, and user-friendly platform.

Key Strategies Employed by Successful Startups

These successful startups have employed various strategies to secure funding, build strong teams, and achieve sustainable growth.

- Strong Value Proposition:Successful startups offer a compelling value proposition that addresses a specific market need. They have a clear understanding of their target audience and the problem they are solving.

- Product-Market Fit:Developing a strong product-market fit is crucial for startup success. This involves ensuring that the product or service meets the needs and preferences of the target market.

- Exceptional Team:Successful startups are built on the foundation of a strong and experienced team. The team members possess the skills and expertise needed to execute the company’s vision.

- Effective Fundraising Strategies:Securing funding is essential for startup growth. Successful startups develop a well-structured pitch deck, build relationships with potential investors, and leverage their network to secure funding.

- Strategic Partnerships:Collaborating with strategic partners can provide startups with access to new markets, resources, and expertise. Partnerships can help startups accelerate their growth and expand their reach.

Lessons Learned from Case Studies

The success stories of these European startups offer valuable lessons for aspiring entrepreneurs.

- Focus on Solving a Real Problem:Startups should focus on solving a real problem that resonates with a specific target audience. The problem should be significant enough to justify the creation of a new solution.

- Build a Strong Team:A strong team is essential for startup success. The team should be passionate about the vision and have the skills and experience needed to execute the plan.

- Develop a Clear Value Proposition:The startup’s value proposition should be clear, concise, and compelling. It should communicate the unique benefits of the product or service and why it is better than existing solutions.

- Embrace Innovation:Successful startups are constantly innovating and adapting to changing market conditions. They are not afraid to experiment and try new things.

- Build a Strong Network:Building a strong network of mentors, investors, and industry experts is crucial for startup success. Networking can provide access to resources, advice, and support.