Vc transition closing climate tech funding gap – VC Transition: Closing the Climate Tech Funding Gap sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Climate change is a pressing global issue, and the need for innovative solutions is more urgent than ever.

Climate tech startups are developing groundbreaking technologies to combat climate change, but they often face significant challenges in securing funding. This funding gap hinders the development and deployment of these crucial solutions. However, a recent shift in the venture capital (VC) landscape is creating a wave of optimism for climate tech entrepreneurs.

VCs are increasingly recognizing the potential of climate tech and are allocating more capital to this sector. This transition marks a pivotal moment in the fight against climate change, as it unlocks the potential for climate tech startups to scale their solutions and make a tangible impact.

This shift is driven by a confluence of factors. Investors are becoming more aware of the financial risks associated with climate change, and they are seeking to invest in companies that are addressing this issue. Furthermore, the emergence of new technologies, such as artificial intelligence and blockchain, is creating exciting opportunities for climate tech innovation.

VCs are also recognizing the potential for high returns on investment in climate tech, as these companies are poised to disrupt traditional industries and create new markets.

The Growing Need for Climate Tech Funding

Climate change is one of the most pressing issues facing humanity, and the urgency to address it is paramount. From rising sea levels and extreme weather events to biodiversity loss and food insecurity, the consequences of unchecked climate change are already being felt globally.

Fortunately, innovative climate tech solutions offer a path toward a sustainable future, but these solutions require significant investment to scale and achieve widespread impact.

The Climate Tech Funding Gap

While climate tech investment has been increasing in recent years, a significant funding gap persists. The current level of investment is insufficient to meet the scale and urgency of the climate crisis. This gap is driven by several factors, including:

- Limited awareness:Despite the growing urgency, many investors remain unaware of the potential of climate tech solutions and the vast market opportunities they represent.

- Risk aversion:Climate tech investments often involve higher risk and longer-term returns compared to traditional sectors. This can deter some investors who prioritize short-term profits.

- Lack of data and transparency:The lack of standardized metrics and reporting makes it challenging for investors to assess the environmental impact and financial viability of climate tech companies.

Examples of Successful Climate Tech Companies

Despite the challenges, several climate tech companies have achieved significant success and are making a tangible difference. These companies are demonstrating the viability of climate tech solutions and attracting increased investor interest.

- Beyond Meat:This company produces plant-based meat alternatives, offering a sustainable and ethical alternative to traditional meat production. Beyond Meat has achieved significant market penetration and is driving a shift toward more sustainable food systems.

- Tesla:As a pioneer in electric vehicles, Tesla has revolutionized the automotive industry and accelerated the transition to cleaner transportation. Tesla’s success has spurred a wave of investment in electric vehicle technology and infrastructure.

- SolarCity:This company provides solar panel installation and financing solutions, making solar energy more accessible to homeowners and businesses. SolarCity’s success has contributed to the rapid growth of the solar energy sector.

The Role of Venture Capital in Climate Tech: Vc Transition Closing Climate Tech Funding Gap

Venture capital has played a pivotal role in driving technological innovation for decades, fueling the growth of companies like Apple, Google, and Amazon. The same principles of investing in disruptive technologies and supporting entrepreneurs with high-growth potential are now being applied to the climate tech sector.

Enhance your insight with the methods and methods of sustainable farming earth and space a must see at tnw conference.

The Rise of Climate Tech Investment

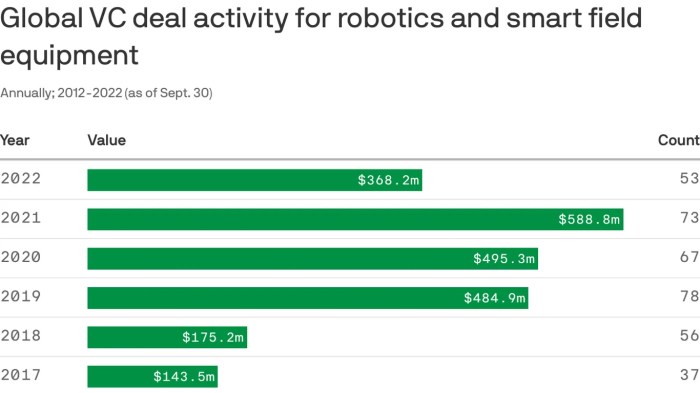

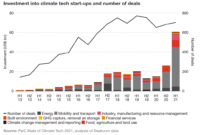

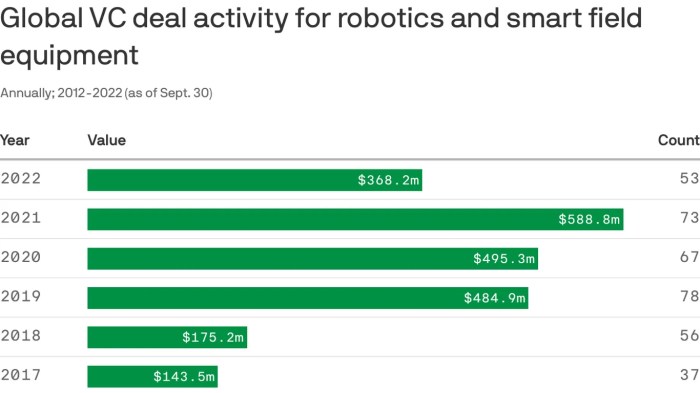

Venture capital firms are increasingly recognizing the vast market opportunity presented by climate change solutions. The urgency of addressing climate change, coupled with the emergence of innovative technologies, has led to a surge in investment in climate tech startups. According to a report by PwC, climate tech investments reached a record high of $70 billion in 2021, a significant increase from previous years.

VC Transition and Closing the Funding Gap

The venture capital (VC) landscape is undergoing a significant shift, with a growing focus on climate tech investments. This transition is driven by a confluence of factors, including the increasing urgency of climate change, the emergence of innovative climate solutions, and the growing awareness of the potential for financial returns in this sector.

VCs are actively seeking to bridge the funding gap in climate tech, recognizing the crucial role it plays in mitigating climate change and building a sustainable future.

Strategies and Initiatives, Vc transition closing climate tech funding gap

VCs are employing various strategies and initiatives to bridge the funding gap in climate tech. These include:

- Dedicated Climate Tech Funds:Many VCs are establishing dedicated funds specifically for climate tech investments. These funds provide a focused approach to sourcing and supporting promising startups in the sector.

- Climate Tech-Focused Accelerators and Incubators:These programs offer mentorship, networking opportunities, and seed funding to early-stage climate tech companies. They provide a supportive ecosystem for startups to develop and scale their solutions.

- Collaboration with Government and Non-profit Organizations:VCs are partnering with government agencies and non-profit organizations to leverage their expertise and resources in climate tech. These collaborations can facilitate access to grants, research, and policy support.

- Impact Investing:VCs are increasingly adopting impact investing principles, which prioritize both financial returns and positive social and environmental impact. This approach aligns with the goals of climate tech investments.

Successful VC-Backed Climate Tech Startups

Numerous VC-backed climate tech startups have emerged as leaders in their respective fields, demonstrating the potential for innovation and impact. Here are some notable examples:

- SolarEdge Technologies (NASDAQ: SEDG):A global leader in solar inverters and power optimizers, SolarEdge has revolutionized residential and commercial solar energy systems. The company’s innovative technology has significantly increased the efficiency and affordability of solar power.

- Beyond Meat (NASDAQ: BYND):A pioneer in plant-based meat alternatives, Beyond Meat has developed delicious and sustainable products that are gaining widespread consumer acceptance. The company’s success has contributed to the growing trend of reducing meat consumption and its environmental impact.

- Carbon Engineering (Private):A company developing technology to capture carbon dioxide directly from the atmosphere, Carbon Engineering’s solution offers a potential pathway to mitigating climate change. Their innovative technology has garnered significant attention and investment.

Challenges and Opportunities in Climate Tech Funding

While the climate tech sector is attracting significant attention and investment, it faces unique challenges in securing funding. These challenges are rooted in the nascent nature of the industry, the long-term focus of many climate solutions, and the inherent uncertainty associated with climate change itself.

However, the opportunities for growth and innovation within climate tech are vast, and the sector is poised for continued expansion in the coming years.

Challenges Faced by Climate Tech Startups

Climate tech startups face several challenges in securing funding, which can hinder their growth and development.

- Long-Term Investment Horizon:Many climate solutions require significant upfront investment and have a long-term payback period, making them less appealing to investors seeking short-term returns.

- Uncertainty and Risk:The impacts of climate change are still unfolding, and there is significant uncertainty surrounding future climate scenarios. This uncertainty makes it difficult for investors to assess the long-term viability of climate tech solutions.

- Lack of Data and Metrics:The lack of standardized data and metrics for measuring climate impact makes it difficult for investors to compare different climate tech solutions and assess their effectiveness.

- Competition from Traditional Industries:Climate tech startups often compete with established companies in traditional industries, which may have access to greater resources and established markets.

- Regulatory Uncertainty:Climate policies and regulations can be complex and evolving, creating uncertainty for investors and startups.

Opportunities for Growth in Climate Tech

Despite the challenges, the climate tech sector offers significant opportunities for growth and innovation.

- Growing Investor Interest:There is a growing awareness of the urgency of climate change, leading to increased investor interest in climate tech solutions. This is reflected in the rise of dedicated climate tech funds and the increasing allocation of capital towards climate-focused investments.

- Technological Advancements:Rapid advancements in technologies such as renewable energy, carbon capture, and artificial intelligence are driving innovation and creating new opportunities in climate tech.

- Government Support:Governments worldwide are implementing policies and providing incentives to promote the development and deployment of climate tech solutions.

- Growing Demand for Climate Solutions:As the impacts of climate change become more apparent, the demand for climate solutions is increasing across various sectors, including energy, transportation, agriculture, and infrastructure.

- Market Potential:The global market for climate tech is expected to grow significantly in the coming years, creating opportunities for startups to scale their operations and capture market share.

Trends and Future Directions for VC Investment in Climate Tech

VC investment in climate tech is expected to continue growing in the coming years, driven by several key trends.

- Focus on Scalability and Impact:Investors are increasingly looking for climate tech startups that have the potential to scale their solutions and make a significant impact on climate change mitigation or adaptation.

- Early-Stage Investment:There is a growing trend towards investing in early-stage climate tech startups, as investors recognize the potential for high returns and disruptive innovation in the sector.

- Integration of Climate Tech with Other Industries:Climate tech solutions are increasingly being integrated into other industries, such as energy, transportation, agriculture, and manufacturing. This trend is creating opportunities for startups to develop innovative solutions that address climate change across multiple sectors.

- Increased Focus on Climate Adaptation:While climate change mitigation remains a key focus, investors are increasingly recognizing the importance of climate adaptation solutions, which help communities and businesses adapt to the impacts of climate change.

Case Studies

The success of climate tech startups in attracting VC funding is a testament to the growing awareness of the urgency of climate change and the potential of innovative solutions. These startups are tackling some of the world’s most pressing environmental challenges, from reducing carbon emissions to developing sustainable energy sources.

Examining these case studies provides valuable insights into the factors that drive successful climate tech funding and the impact these companies are having on the world.

Notable Climate Tech Startups and Their Funding Success

| Startup Name | Funding Stage | VC Investors | Key Impact Metrics |

|---|---|---|---|

| ClimateAi | Series B | Microsoft, Google, Sequoia Capital | Reduced carbon emissions by 20% for major corporations |

| Sunrun | IPO | Goldman Sachs, Morgan Stanley, TPG Capital | Installed over 1 million solar panels, generating clean energy for thousands of homes |

| Carbon Engineering | Series C | Bill Gates, Breakthrough Energy Ventures, Chevron | Developed technology to capture and store atmospheric carbon dioxide |

| Impossible Foods | Series G | Temasek Holdings, Coatue Management, Horizons Ventures | Reduced meat consumption by offering plant-based alternatives |

| Beyond Meat | IPO | Kleiner Perkins, Obvious Ventures, Viking Global Investors | Increased demand for plant-based meat products, contributing to a reduction in greenhouse gas emissions from animal agriculture |

The Future of VC and Climate Tech

The intersection of venture capital (VC) and climate tech is poised for significant growth, driven by technological advancements, evolving government policies, and increasing investor awareness. The future landscape of climate tech funding is likely to be shaped by emerging technologies, government initiatives, and evolving investor preferences.

The Impact of Emerging Technologies

Emerging technologies are playing a crucial role in driving innovation and investment in climate tech. These technologies offer promising solutions for addressing climate change challenges and are attracting significant VC interest.

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML are being used to optimize energy efficiency, improve renewable energy production, and enhance climate modeling. For example, AI-powered systems are helping to predict and manage extreme weather events, enabling better preparedness and mitigation strategies.

- Blockchain Technology:Blockchain technology is being explored for its potential to create transparent and secure carbon markets, enabling efficient tracking and trading of carbon credits. This technology could incentivize sustainable practices and facilitate the development of carbon-neutral economies.

- Biotechnology and Synthetic Biology:Advancements in biotechnology and synthetic biology are leading to the development of sustainable solutions for food production, biofuels, and carbon capture. For example, companies are developing bio-based materials that can replace traditional fossil fuel-based products, reducing greenhouse gas emissions.

The Role of Government Policies and Regulations

Government policies and regulations are critical in shaping the investment landscape for climate tech. By providing incentives, setting standards, and fostering innovation, governments can play a significant role in attracting VC investment and accelerating the development of climate solutions.

- Carbon Pricing Mechanisms:Carbon pricing mechanisms, such as carbon taxes and cap-and-trade systems, create economic incentives for businesses to reduce their emissions. These mechanisms can create a more predictable and stable investment environment for climate tech companies, encouraging VC investment.

- Renewable Energy Subsidies:Government subsidies for renewable energy technologies, such as solar and wind power, can reduce the cost of these technologies, making them more attractive to investors. These subsidies can also help to create a more robust renewable energy market, attracting VC investment in related technologies.

- Research and Development Funding:Government funding for research and development (R&D) in climate tech can accelerate the development of innovative solutions. This funding can help to de-risk investments for VCs, encouraging them to invest in early-stage climate tech companies.

Predictions for the Future Landscape of VC Investment in Climate Tech

The future landscape of VC investment in climate tech is expected to see continued growth and diversification.

- Increased Investment in Climate Solutions:As the urgency of climate change intensifies, VC investment in climate tech is expected to grow significantly. Investors are increasingly recognizing the potential of climate tech companies to address the climate crisis and generate substantial returns.

- Focus on Climate Adaptation:Investment in climate adaptation technologies, such as drought-resistant crops and flood-resistant infrastructure, is expected to increase. These technologies are crucial for mitigating the impacts of climate change and building resilience in vulnerable communities.

- Growth of Climate Tech Funds:Dedicated climate tech funds are becoming increasingly common, reflecting the growing interest in this sector. These funds provide specialized expertise and resources to support climate tech companies throughout their growth journey.