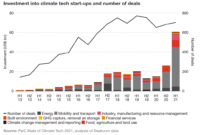

Vc investment 60 billion climate tech last year where – VC investment: $60 billion in climate tech last year – where did it go? This question is on everyone’s mind as the climate tech sector booms. Last year, venture capitalists poured a record-breaking $60 billion into climate tech startups, signaling a significant shift in the investment landscape.

This massive influx of capital is driving innovation and pushing the development of solutions to address climate change, from renewable energy and carbon capture to sustainable agriculture and green transportation. The question is, where is all this money going, and what impact is it having on the fight against climate change?

The answer lies in the diverse landscape of climate tech. From early-stage startups to established companies, VC investment is fueling the development of cutting-edge technologies across a wide range of sectors. This investment is not just about financial returns; it’s about creating a sustainable future.

But with so much money flowing into the sector, it’s important to understand where it’s going and how it’s being used to create real change.

The Rise of Climate Tech Investment

The past year has witnessed a remarkable surge in venture capital (VC) investment in climate tech, reaching a staggering $60 billion. This unprecedented influx of capital signifies a growing recognition of the urgent need to address climate change and the potential of innovative solutions to tackle this global challenge.

Factors Driving Climate Tech Investment

Several factors have contributed to the exponential growth of climate tech investment.

- Increased Awareness and Urgency:Growing scientific evidence and increasingly visible impacts of climate change have heightened public awareness and spurred a sense of urgency to address the issue. This has led to greater demand for climate-focused solutions and increased investor interest in companies tackling these challenges.

- Government Policies and Incentives:Governments worldwide are enacting policies and providing incentives to promote climate-friendly technologies and investments. These measures include tax breaks, subsidies, and regulations that favor clean energy and sustainable practices, making climate tech a more attractive investment proposition.

- Technological Advancements:Rapid advancements in areas such as renewable energy, battery storage, and carbon capture technologies have made climate solutions more cost-effective and efficient. These breakthroughs have created new investment opportunities and attracted capital from a broader range of investors.

- Growing Investor Base:A growing number of institutional investors, including pension funds, sovereign wealth funds, and family offices, are allocating capital to climate tech. These investors are seeking long-term, sustainable returns while contributing to a positive environmental impact.

Trends and Patterns in Climate Tech Investment

Climate tech investment exhibits distinct trends and patterns:

- Focus on Early-Stage Companies:A significant portion of climate tech investment is directed towards early-stage companies developing innovative solutions. This reflects the high-risk, high-reward nature of the sector and the need for capital to support the development of disruptive technologies.

- Sector Diversification:Investment is spread across a diverse range of climate tech sectors, including renewable energy, energy storage, electric vehicles, carbon capture, sustainable agriculture, and climate adaptation technologies. This diversification indicates a broad recognition of the multifaceted nature of climate change and the need for a comprehensive approach to addressing it.

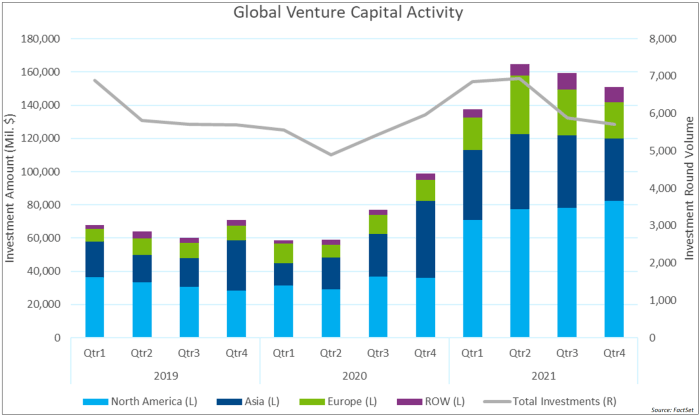

- Geographic Concentration:Climate tech investment is concentrated in certain geographic regions, particularly in the United States, Europe, and China. These regions are home to a significant number of climate tech startups and have robust venture capital ecosystems.

Climate Tech Investment Compared to Other Sectors, Vc investment 60 billion climate tech last year where

Climate tech investment is rapidly catching up to other sectors, such as artificial intelligence and biotechnology. While these sectors have historically received higher levels of investment, climate tech is gaining momentum and attracting significant capital.

- Increased Investment Volume:Climate tech investment has grown significantly in recent years, exceeding the levels seen in other sectors. This suggests a growing recognition of the economic potential of climate solutions and the increasing demand for investment in this space.

- Higher Valuations:Climate tech companies are attracting high valuations, indicating strong investor confidence and a belief in the potential for long-term growth. This is driven by factors such as the large market opportunity, the potential for positive societal impact, and the increasing demand for sustainable solutions.

- Growing Competition:The increasing investment in climate tech has led to a more competitive landscape, with a greater number of startups and investors vying for market share. This competition is driving innovation and accelerating the development of new technologies.

Breakdown of the $60 Billion Investment

The $60 billion invested in climate tech last year represents a significant leap forward in the fight against climate change. This investment is not only a testament to the growing awareness of the climate crisis but also a reflection of the increasing confidence in the potential of climate tech to deliver impactful solutions.

To understand the impact of this investment, it’s crucial to examine its distribution across various sectors, stages of company development, and geographic locations.

Key Areas of Climate Tech Investment

The $60 billion investment in climate tech is not evenly distributed across all areas. Instead, it is concentrated in a few key areas that are considered to be the most promising in terms of their potential to mitigate climate change.

These areas are:

- Renewable Energy:This sector continues to be a major recipient of climate tech investment, with companies developing new technologies for solar, wind, and geothermal energy attracting significant capital. For example, the US-based solar energy company, Enphase Energy, raised $1.3 billion in funding last year, while the Danish wind turbine manufacturer, Vestas, secured $2 billion.

- Energy Storage:As the adoption of renewable energy sources grows, the need for reliable energy storage solutions becomes increasingly critical. This has led to a surge in investment in battery technology, with companies like Tesla and LG Chem receiving substantial funding.

- Carbon Capture and Storage (CCS):CCS technologies play a vital role in reducing greenhouse gas emissions from industrial processes and power plants. Companies developing new and improved CCS solutions are attracting significant investment, as demonstrated by the $1 billion raised by the Canadian company, Carbon Engineering, in 2022.

- Sustainable Transportation:The transportation sector is a major contributor to greenhouse gas emissions. As a result, climate tech investment is flowing into companies developing electric vehicles, autonomous vehicles, and alternative fuels. The American electric vehicle manufacturer, Rivian, raised $13.7 billion in 2021, highlighting the immense interest in this area.

- Agriculture:Agriculture is another significant source of greenhouse gas emissions. Climate tech investment is being directed towards companies developing innovative solutions to improve agricultural practices, such as precision farming, sustainable fertilizers, and alternative protein sources. For example, the US-based company, Impossible Foods, raised $500 million in 2021 to expand its production of plant-based meat alternatives.

Investment Across Company Development Stages

Climate tech investment is not limited to established companies. Early-stage startups are also attracting significant capital, as investors recognize the potential of disruptive innovation in the fight against climate change.

- Seed Stage:Seed-stage companies are often focused on developing new technologies or business models. Investors at this stage are typically looking for high-growth potential and a strong team.

- Series A and Series B:Companies at these stages are typically developing their product or service and scaling their operations. Investors at this stage are looking for companies with proven traction and a clear path to profitability.

- Later Stage:Later-stage companies are often seeking to expand their market share or develop new product lines. Investors at this stage are looking for companies with a strong track record of success and a clear competitive advantage.

Geographical Distribution of Climate Tech Investment

Climate tech investment is not confined to any one region. Instead, it is increasingly becoming a global phenomenon.

- United States:The US remains the leading destination for climate tech investment, with a robust ecosystem of startups, venture capitalists, and government support.

- Europe:Europe is also a major hub for climate tech investment, particularly in areas such as renewable energy, sustainable transportation, and carbon capture and storage.

- Asia:Asia is rapidly emerging as a key player in climate tech investment, with countries like China and India investing heavily in renewable energy, energy storage, and smart cities.

Impact of VC Investment on Climate Tech

The surge in VC investment in climate tech is not just about financial returns; it’s about driving innovation and accelerating the transition to a sustainable future. This influx of capital is fundamentally shaping the landscape of climate tech, pushing the boundaries of what’s possible and driving the adoption of solutions across various sectors.

Role of VC Investment in Fostering Innovation and Entrepreneurship

VC investment plays a crucial role in fostering innovation and entrepreneurship in the climate tech space. By providing early-stage funding, VCs empower entrepreneurs to develop and scale their groundbreaking ideas. This support is essential for bringing disruptive technologies to market, tackling some of the world’s most pressing environmental challenges.

- Accelerating Technology Development:VC funding enables climate tech startups to invest in research and development, leading to faster advancements in areas such as renewable energy, carbon capture, and sustainable agriculture. For example, VC-backed companies like Carbon Engineering and Climeworks are developing innovative carbon capture technologies that have the potential to significantly reduce greenhouse gas emissions.

- Scaling Up Solutions:VC funding helps climate tech companies scale their operations and reach a wider market. This is crucial for achieving widespread adoption of sustainable solutions. For instance, Tesla, a company that initially received VC funding, has become a global leader in electric vehicles, demonstrating the transformative power of VC investment.

- Attracting Talent:VC investment creates attractive opportunities for talented individuals to join the climate tech sector, contributing to a thriving ecosystem of innovation and expertise. Companies backed by VCs are often able to attract top talent due to their potential for growth and impact.

Impact of VC Investment on the Climate Tech Ecosystem

The influx of VC investment is having a significant impact on the overall climate tech ecosystem, driving a positive cycle of innovation, collaboration, and growth.

- Increased Competition:The growing number of VC-backed climate tech startups is fostering healthy competition, driving innovation and pushing companies to constantly improve their offerings. This competition is leading to the development of more efficient and cost-effective solutions, making them more accessible to a wider audience.

- Emerging Partnerships:VC investment is facilitating collaborations between climate tech startups, established corporations, and research institutions. These partnerships are essential for scaling up solutions, integrating technologies into existing infrastructure, and accelerating the transition to a sustainable future. For example, partnerships between energy companies and solar technology startups are enabling the widespread adoption of renewable energy.

Further details about twitter beef musk is hurting shareholders court case wont solve is accessible to provide you additional insights.

- Raising Awareness:VC investment is raising awareness about climate change and the importance of sustainable solutions. The growing number of climate tech startups and their success stories are attracting media attention and public interest, fostering a more climate-conscious society.

Key Players in Climate Tech Investment

The rapid growth of climate tech investment has attracted a diverse range of players, from established venture capital firms to corporate giants seeking to reduce their environmental footprint. These investors are shaping the future of climate tech by providing capital and expertise to innovative companies tackling climate change.

Major VC Firms

These firms have dedicated significant resources to climate tech, establishing themselves as leaders in the space.

- Lowercarbon Capital: Focused on investing in companies developing technologies that reduce greenhouse gas emissions. Their portfolio includes companies in renewable energy, carbon capture, and sustainable agriculture.

- Breakthrough Energy Ventures: Founded by Bill Gates, this firm invests in companies developing technologies that can help achieve net-zero emissions. Their portfolio includes companies in clean energy, sustainable materials, and climate-resilient agriculture.

- Climate Capital: A dedicated climate tech fund, they invest in companies across a range of sectors, including renewable energy, energy efficiency, and sustainable transportation.

- Clean Energy Ventures: This firm invests in early-stage companies developing technologies that can help transition to a clean energy future. Their portfolio includes companies in solar energy, wind energy, and energy storage.

Investment Strategies and Areas of Focus

VC firms employ various strategies when investing in climate tech.

- Seed Stage Investment: Many VC firms focus on investing in early-stage companies with high growth potential. This allows them to play a significant role in shaping the future of climate tech.

- Growth Stage Investment: Some VC firms focus on investing in companies that have already achieved some success and are ready to scale their operations. This allows them to help these companies reach their full potential.

- Sector-Specific Investment: Some VC firms specialize in investing in specific sectors of climate tech, such as renewable energy, sustainable agriculture, or carbon capture. This allows them to develop deep expertise in these areas.

- Impact-Driven Investment: Many VC firms are motivated by the desire to make a positive impact on the world. They prioritize investing in companies that are working to address climate change and other environmental challenges.

Corporate Venture Capital in Climate Tech

Large corporations are increasingly investing in climate tech through their venture capital arms.

- Strategic Investments: Corporate venture capital (CVC) investments often serve a strategic purpose, allowing corporations to gain access to new technologies, acquire expertise, and develop partnerships.

- Sustainability Initiatives: Many corporations are using CVC investments to support their sustainability initiatives. They are investing in companies that can help them reduce their environmental footprint and transition to a more sustainable business model.

- Innovation and Growth: CVC investments can also help corporations drive innovation and growth. By investing in promising startups, corporations can gain access to new ideas and technologies that can help them stay ahead of the competition.

Future Outlook for Climate Tech Investment: Vc Investment 60 Billion Climate Tech Last Year Where

The climate tech investment landscape is poised for continued growth and transformation. As the urgency to address climate change intensifies, the demand for innovative solutions is skyrocketing. This surge in demand is fueling significant investments in climate tech startups, creating a promising future for the sector.

Projected Growth and Trends

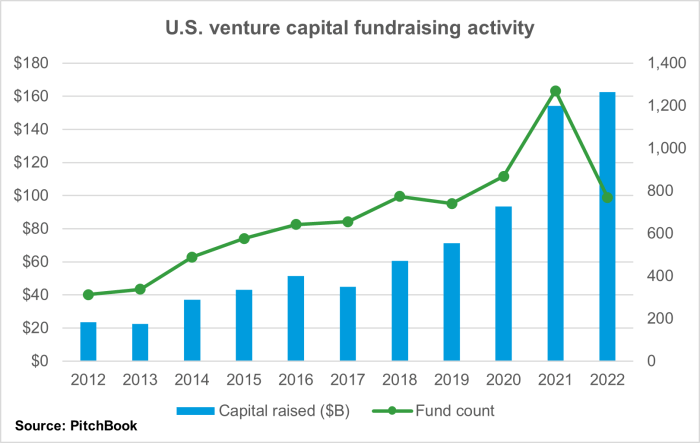

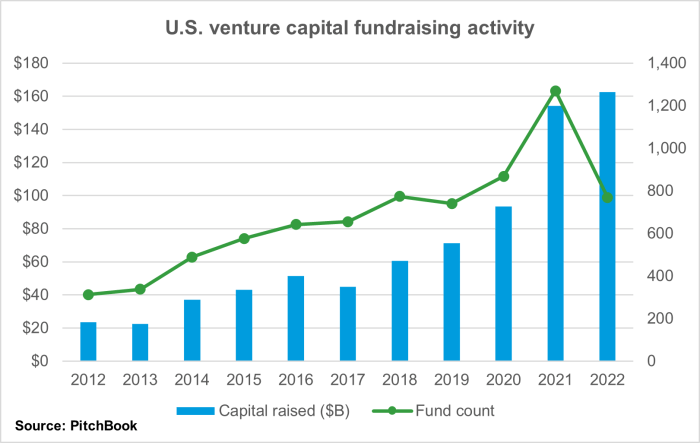

The future of climate tech investment is bright, driven by several key trends:* Increased Venture Capital Activity:Venture capital firms are increasingly allocating capital to climate tech startups, recognizing the immense potential of this sector. This trend is expected to continue, with investments reaching new highs in the coming years.

Focus on Later-Stage Companies

While early-stage startups will continue to attract investments, there is a growing focus on later-stage companies with proven business models and demonstrable impact. This shift reflects the maturity of the climate tech sector and the need for scalable solutions.

Expansion into New Sectors

Climate tech investments are expanding beyond traditional areas like renewable energy and energy efficiency. New sectors like carbon capture and storage, sustainable agriculture, and climate-resilient infrastructure are attracting significant investments.

Growing Role of Institutional Investors

Institutional investors, such as pension funds and insurance companies, are increasingly allocating capital to climate tech. Their long-term investment horizons and risk appetite make them ideal partners for climate tech companies.

Integration of Climate Tech with Other Industries

Climate tech is no longer a standalone sector. It is increasingly integrated with other industries, such as transportation, manufacturing, and finance, creating new opportunities for innovation and investment.

Challenges and Opportunities

While the climate tech investment landscape is promising, several challenges and opportunities exist:* Scaling Up Solutions:One of the key challenges is scaling up climate tech solutions to meet the global demand. This requires significant investments in infrastructure, technology, and workforce development.

Addressing Regulatory Uncertainty

The evolving regulatory landscape for climate tech can create uncertainty for investors. Clear and consistent regulations are crucial to fostering a predictable investment environment.

Attracting and Retaining Talent

The climate tech sector faces a growing demand for skilled talent. Attracting and retaining top talent is essential for driving innovation and achieving climate goals.

Promoting Collaboration

Effective collaboration between governments, businesses, and investors is crucial for driving climate tech innovation. This requires shared goals, open communication, and a commitment to collective action.

Government Policies and Regulations

Government policies and regulations play a critical role in shaping the climate tech investment landscape. Supportive policies can create a favorable environment for investment and innovation.* Carbon Pricing Mechanisms:Carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, incentivize businesses to reduce emissions.

This can create a market for climate tech solutions and attract investments.

Renewable Energy Subsidies

Government subsidies for renewable energy projects can make these investments more attractive to investors and accelerate the transition to a clean energy future.

Climate-Resilient Infrastructure Investments

Investments in climate-resilient infrastructure, such as flood defenses and drought-resistant agriculture, can create new opportunities for climate tech companies and attract investors.

Research and Development Funding

Government funding for climate tech research and development can accelerate innovation and create new technologies with the potential to transform the sector.