VC funding gap puts europes climate targets at risk report warns: Europe’s ambitious climate goals are facing a major hurdle – a significant gap in venture capital funding for climate-focused startups. While the continent boasts a thriving climate tech scene, the level of investment pales in comparison to the United States.

This disparity raises serious concerns about Europe’s ability to achieve its green ambitions, as the lack of funding could hinder the development and deployment of crucial climate solutions.

The report highlights the specific challenges faced by European climate startups in securing funding, including a lack of experienced climate tech investors, a preference for later-stage investments, and a perception that European startups are less innovative than their American counterparts.

These factors contribute to a vicious cycle, where limited funding leads to slower growth, making it harder for startups to attract further investment.

The VC Funding Gap

Europe is facing a critical challenge in its quest to achieve ambitious climate goals: a significant gap in venture capital (VC) funding for climate-focused startups. While the continent boasts a thriving ecosystem of innovative green businesses, the lack of sufficient financial support threatens to derail its progress towards a sustainable future.

Enhance your insight with the methods and methods of eu tech policy predictions .

Comparison of VC Investment in Europe and the US

The disparity in VC investment between Europe and the US is stark. In 2022, US-based climate tech startups attracted a staggering $76 billion in VC funding, while European counterparts received a mere $18 billion. This significant difference highlights the substantial funding advantage enjoyed by American startups in the climate tech space.

Challenges Faced by European Climate Startups in Securing Funding

European climate startups face a multitude of challenges in securing funding:

- Limited VC capital:Europe has a smaller pool of VC capital compared to the US, making it harder for startups to secure funding. This is due in part to a smaller number of large VC funds and a more risk-averse investment culture.

- Early-stage focus:European VC funds tend to focus on early-stage investments, while US funds are more willing to invest in later-stage companies. This makes it difficult for European climate startups to scale up and attract larger investments.

- Lack of awareness:Some investors may not be fully aware of the potential of climate tech or the urgency of tackling climate change. This can lead to a reluctance to invest in this sector.

- Regulatory hurdles:Europe’s stringent regulatory environment can sometimes create barriers for startups, making it more challenging to raise capital.

Key Factors Contributing to the VC Funding Gap in Europe, Vc funding gap puts europes climate targets at risk report warns

Several factors contribute to the VC funding gap in Europe:

- Lack of large-scale exits:The absence of large-scale exits in the European climate tech sector has made it harder to attract new investors and demonstrate the potential for high returns. This is in contrast to the US, where successful climate tech companies have achieved significant valuations and exits.

- Fragmentation of the market:Europe’s fragmented VC market, with a large number of smaller funds, makes it difficult for startups to access a critical mass of capital. This contrasts with the US, where a few large VC funds dominate the landscape.

- Cultural differences:European investors may be more risk-averse than their American counterparts, leading to a reluctance to invest in early-stage climate tech startups.

The Impact of the Funding Gap on Climate Progress: Vc Funding Gap Puts Europes Climate Targets At Risk Report Warns

Europe’s ambitious climate targets face a significant challenge: a lack of venture capital (VC) funding for early-stage climate startups. This funding gap jeopardizes the development and deployment of innovative solutions crucial for achieving a sustainable future.

The Role of Early-Stage Climate Startups in Driving Innovation

Early-stage climate startups are vital for driving innovation and technological advancements in the fight against climate change. These companies are developing groundbreaking solutions in areas such as renewable energy, carbon capture, sustainable agriculture, and green transportation. Their agility and focus on disruptive technologies allow them to explore new frontiers and accelerate the transition to a low-carbon economy.

The Impact of the Funding Gap on Climate Solutions

The lack of VC funding can hinder the development and deployment of crucial climate solutions in several ways:

- Limited Access to Capital:Early-stage climate startups often struggle to secure the necessary funding to scale their operations, develop their technologies, and reach market readiness. This lack of capital can stifle their growth and delay the adoption of their innovative solutions.

- Slowed Innovation:Without sufficient funding, climate startups may be forced to delay or abandon research and development efforts, hindering the advancement of cutting-edge technologies that are critical for tackling climate change.

- Reduced Market Penetration:Insufficient funding can limit the ability of climate startups to expand their market reach and scale their operations, slowing the transition to a more sustainable future.

Examples of Climate Technologies Affected by the Funding Gap

The funding gap can have a detrimental impact on a wide range of climate technologies, including:

- Carbon Capture and Storage (CCS):CCS technologies play a crucial role in mitigating climate change by capturing and storing carbon dioxide emissions from industrial processes. However, these technologies require significant upfront investment, which can be difficult to secure without sufficient VC funding.

- Renewable Energy:The development and deployment of renewable energy technologies, such as solar and wind power, are essential for reducing reliance on fossil fuels. Early-stage startups in this sector often struggle to secure the funding needed to scale their operations and bring their innovations to market.

- Sustainable Agriculture:Climate-smart agricultural practices, such as precision farming and regenerative agriculture, can help reduce greenhouse gas emissions and improve food security. Startups developing these technologies often face funding challenges, limiting their ability to scale and impact the agricultural sector.

Addressing the VC Funding Gap

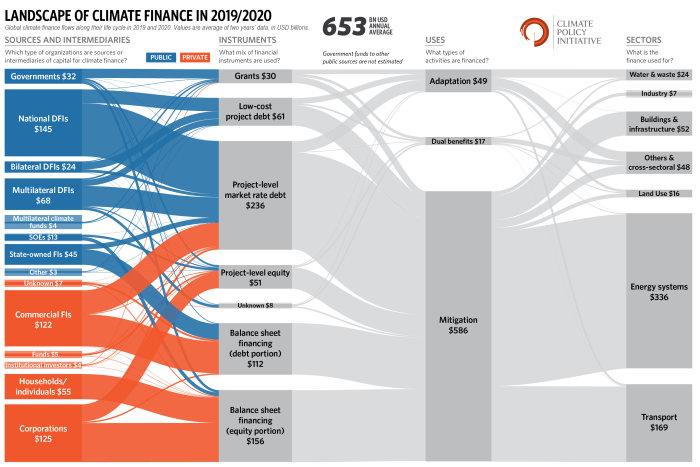

The funding gap in Europe’s climate tech sector is a significant obstacle to achieving ambitious climate goals. Addressing this gap requires a multi-faceted approach, involving a combination of public and private sector initiatives.

Strategies to Attract VC Investment

To bridge the funding gap, a comprehensive strategy is needed to attract more VC investment to the European climate tech sector. This strategy should focus on building a strong ecosystem that fosters innovation, reduces investment risk, and promotes collaboration.

- Strengthening the Climate Tech Ecosystem:This involves creating a supportive environment for climate tech startups, including access to talent, mentorship, and industry expertise. Initiatives like accelerators, incubators, and co-working spaces can provide valuable resources and networking opportunities.

- Improving Data and Transparency:Providing investors with clear and accessible data on the European climate tech landscape can increase confidence and attract investment. This includes data on market size, growth potential, and the impact of climate tech solutions.

- Promoting Public-Private Partnerships:Collaboration between governments, corporations, and investors is crucial to fostering a thriving climate tech ecosystem. Governments can play a role by providing grants, tax incentives, and other forms of support, while corporations can invest in climate tech startups and partner with them on pilot projects.

Policy Initiatives to Incentivize VC Investment

Policy initiatives can play a significant role in incentivizing VC investment in climate tech startups. These initiatives can address the risk perceptions associated with climate tech and create a more favorable investment environment.

- Tax Incentives:Governments can offer tax breaks or credits for investments in climate tech startups. This can reduce the financial burden on investors and encourage them to allocate more capital to this sector.

- Public Procurement:Governments can leverage their purchasing power to support climate tech startups by procuring their products and services. This can provide startups with a guaranteed market and generate early revenue.

- Venture Capital Funds:Governments can establish dedicated venture capital funds that specifically invest in climate tech startups. These funds can provide early-stage capital and support the development of promising companies.

The Role of Stakeholders

Addressing the VC funding gap requires a collective effort from various stakeholders, each playing a critical role in supporting the growth of climate tech in Europe.

- Governments:Governments have a crucial role in creating a favorable policy environment for climate tech startups. This includes providing financial support, implementing regulations that encourage innovation, and promoting collaboration between different stakeholders.

- Corporations:Corporations can contribute by investing in climate tech startups, partnering with them on pilot projects, and incorporating their solutions into their own operations.

- Venture Capital Firms:Venture capital firms can play a critical role by allocating more capital to climate tech startups and providing mentorship and expertise.

- Universities and Research Institutions:Universities and research institutions can contribute by developing cutting-edge climate technologies and fostering a pipeline of talented entrepreneurs.

Case Studies

While the funding gap poses a challenge, Europe boasts a vibrant climate tech scene with promising startups attracting significant investment. These success stories demonstrate the potential of European climate solutions and offer valuable insights into securing funding.

Successful Climate Startups in Europe

These startups showcase the diversity of European climate innovation, from renewable energy and sustainable agriculture to green transportation and carbon capture.

| Startup Name | Focus Area | Funding Raised | Impact |

|---|---|---|---|

| Northvolt | Battery production | Over €6 billion | Developing sustainable battery production in Europe, reducing reliance on Asian suppliers and supporting the transition to electric vehicles. |

| Infarm | Urban agriculture | Over €500 million | Building vertical farms in cities, reducing food miles and promoting sustainable food production. |

| Climeworks | Carbon capture and storage | Over €200 million | Developing technology to capture and store CO2 directly from the atmosphere, offering a solution for mitigating climate change. |

| Sunfire | Green hydrogen production | Over €100 million | Producing green hydrogen using renewable energy, providing a clean alternative to fossil fuels. |

| WindMW | Offshore wind energy | Over €50 million | Developing innovative offshore wind turbines, contributing to the expansion of renewable energy sources. |

Strategies for Securing Funding

These startups have adopted various strategies to attract investors, including:

- Strong team and vision:Founders with relevant expertise and a clear, ambitious vision for addressing climate change.

- Innovative technology and solutions:Developing groundbreaking technologies with demonstrable potential for impact.

- Early traction and partnerships:Securing pilot projects, partnerships, and early customers to validate the business model.

- Strong communication and storytelling:Effectively communicating the startup’s value proposition and impact to investors.

Impact on the Climate Tech Landscape

These startups are contributing to the growth and development of the European climate tech ecosystem by:

- Attracting talent and investment:Creating new jobs and attracting further investment in climate tech.

- Driving innovation:Pushing the boundaries of climate solutions and inspiring other startups.

- Raising awareness:Highlighting the importance of climate action and promoting sustainable solutions.

The Future of Climate Tech in Europe

The current funding gap in climate tech presents a significant obstacle to achieving Europe’s ambitious climate goals. Addressing this gap is crucial for fostering a thriving climate tech ecosystem and ensuring a sustainable future for Europe.

The Importance of Bridging the Gap

A robust climate tech sector is essential for Europe’s transition to a low-carbon economy. By investing in climate tech startups, Europe can unlock innovative solutions to tackle climate change, create new jobs, and boost economic growth. However, the current funding gap is hindering the development of these crucial technologies.

A Call to Action

A concerted effort from VCs, policymakers, and investors is needed to bridge the funding gap and unlock the potential of Europe’s climate tech sector.

- Venture Capitalistsshould prioritize climate tech investments, recognizing the significant returns and societal impact. Increased investment in climate startups will drive innovation and accelerate the development of climate solutions.

- Policymakerscan play a crucial role by creating a favorable environment for climate tech startups. This includes implementing supportive policies, providing tax incentives, and establishing dedicated funding programs.

- Investors, both institutional and individual, should consider allocating a portion of their portfolios to climate tech. By supporting these startups, they can contribute to a more sustainable future and generate attractive returns.

A Vision for a Thriving Climate Tech Ecosystem

With increased investment and support, Europe can become a global leader in climate tech. A thriving ecosystem would attract talent, foster innovation, and drive the development of cutting-edge solutions.

- Increased Investment:A significant increase in VC funding for climate tech startups would fuel innovation and accelerate the development of climate solutions.

- Stronger Policy Support:Supportive policies, tax incentives, and dedicated funding programs would create a favorable environment for climate tech startups to flourish.

- Global Hub for Climate Tech:Europe can become a global hub for climate tech, attracting talent, investment, and partnerships from around the world.

The Impact of Increased Investment

Increased investment in climate startups can have a profound impact on Europe’s future. By supporting the development of innovative solutions, Europe can achieve its climate goals, create a more sustainable economy, and enhance its global competitiveness.

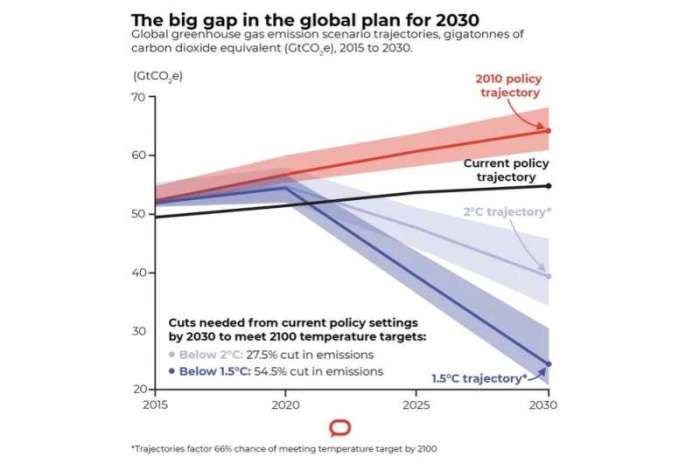

- Accelerated Climate Action:Increased investment in climate tech will accelerate the development and deployment of solutions to reduce greenhouse gas emissions, adapt to climate change, and build a more resilient future.

- Economic Growth and Job Creation:Climate tech is a rapidly growing sector with the potential to create new jobs, stimulate economic growth, and boost innovation across various industries.

- Global Leadership in Sustainability:By investing in climate tech, Europe can become a global leader in sustainability, showcasing its commitment to tackling climate change and inspiring other nations to follow suit.