Vc atomico raises e1b glimmer hope european tech startups – VC Atomico’s €1B raise is a beacon of hope for European tech startups, signaling a potential shift in the global tech landscape. This significant investment signifies a growing confidence in the European tech scene, which has been steadily gaining momentum in recent years.

Atomico, a venture capital firm with a strong track record of backing successful European companies, has made a bold statement with this investment, aiming to fuel the growth of innovative startups across the continent.

The funding will provide crucial support for European startups, enabling them to scale their operations, expand into new markets, and compete with established players in the global tech arena. Atomico’s commitment to European tech is a testament to the region’s burgeoning talent pool, innovative spirit, and potential for disruption.

Atomico’s Investment Strategy

Atomico, a leading venture capital firm, has established itself as a major player in the European tech scene. With a strong focus on backing innovative startups, Atomico’s investment strategy aims to identify and support the next generation of European tech giants.

Atomico’s Investment Focus on European Tech Startups

Atomico’s investment strategy is deeply rooted in its belief in the potential of European tech startups. The firm actively seeks out companies operating in various sectors, including:

- Fintech:Atomico has invested in several fintech companies, such as GoCardless, a payment processing platform, and TransferWise, a cross-border money transfer service. These investments highlight Atomico’s commitment to supporting innovation in the financial technology sector.

- Consumer Tech:Atomico has also invested in consumer-facing tech companies, including Deliveroo, a food delivery platform, and Stash, a mobile-first investing app. These investments demonstrate Atomico’s focus on backing companies that are transforming the way consumers interact with technology.

- Enterprise Software:Atomico’s portfolio includes enterprise software companies like Xentral, a cloud-based ERP system, and Tines, an automation platform for security operations. These investments reflect Atomico’s understanding of the growing demand for innovative solutions in the enterprise software market.

Atomico’s Previous Investments in European Tech Companies

Atomico’s track record of successful investments speaks volumes about its investment strategy. The firm has invested in several notable European tech companies, including:

- Wise (formerly TransferWise):Atomico was an early investor in Wise, a cross-border money transfer service that has become a global leader in its field. Wise’s success demonstrates Atomico’s ability to identify companies with significant growth potential.

- Supercell:Atomico invested in Supercell, a mobile game developer known for popular games like Clash of Clans and Clash Royale. Supercell’s global success showcases Atomico’s investment in companies with strong intellectual property and a loyal user base.

- GoCardless:Atomico’s investment in GoCardless, a payment processing platform, has been instrumental in the company’s growth and expansion. GoCardless’s success highlights Atomico’s ability to support companies in disrupting traditional industries.

Atomico’s Investment Criteria

Atomico’s investment criteria are designed to ensure that they are backing companies with the highest potential for success. The firm focuses on several key factors when evaluating potential startups:

- Team:Atomico believes that a strong team is the foundation of any successful company. They look for founders with a proven track record, a clear vision, and the ability to execute their plans.

- Market Opportunity:Atomico invests in companies that address significant market opportunities with the potential for substantial growth. They prioritize companies with a large addressable market and a clear path to market dominance.

- Product-Market Fit:Atomico looks for companies with a product that meets a real need in the market and has the potential to disrupt existing solutions. They prioritize companies with a strong product-market fit and a clear understanding of their target audience.

- Traction:Atomico prefers to invest in companies that have already achieved some level of traction in the market. This could include early revenue, a growing user base, or positive customer feedback. Traction provides evidence of the company’s ability to execute and achieve its goals.

- Scalability:Atomico invests in companies with the potential to scale their operations and reach a large audience. They prioritize companies with a scalable business model and the ability to expand their reach both domestically and internationally.

How Atomico Evaluates Potential Startups

Atomico employs a rigorous evaluation process to identify and select the most promising startups. The firm’s investment team conducts in-depth due diligence, including:

- Meeting with the Founders:Atomico’s investment team meets with the founders to understand their vision, their team, and their plans for the company. They also assess the founders’ passion, drive, and commitment to their business.

- Analyzing the Market:Atomico conducts thorough market research to understand the size and growth potential of the market that the startup is targeting. They also assess the competitive landscape and identify any potential threats or challenges.

- Evaluating the Product:Atomico evaluates the startup’s product to determine its functionality, usability, and market fit. They also assess the product’s potential for innovation and differentiation in the market.

- Assessing the Business Model:Atomico reviews the startup’s business model to understand its revenue streams, cost structure, and profitability potential. They also assess the company’s ability to scale its operations and achieve sustainable growth.

- Due Diligence:Atomico conducts extensive due diligence on the startup, including financial audits, legal reviews, and technical assessments. This process helps to ensure that the startup is financially sound, legally compliant, and technologically viable.

The Significance of €1B Funding

A €1 billion funding round is a significant event in the European tech ecosystem, particularly for Atomico, a leading venture capital firm focused on European startups. This investment signals a strong belief in the potential of European tech companies and provides a crucial boost to the region’s innovation landscape.

Impact on the European Tech Ecosystem

This funding has the potential to significantly impact the European tech ecosystem by providing capital for growth, fostering innovation, and attracting talent. It acts as a catalyst for the growth of European startups, enabling them to scale their operations, expand into new markets, and create jobs.

Supporting European Startups

The investment can be utilized in various ways to support European startups, including:

- Funding for Research and Development (R&D):The investment can be used to fund R&D activities, allowing startups to develop new technologies and products, and stay ahead of the competition.

- Expansion into New Markets:The funding can support startups in expanding their operations into new markets, both within Europe and globally. This helps them reach a wider customer base and achieve greater market share.

- Talent Acquisition:The investment can enable startups to attract and retain top talent, crucial for their success in a competitive market. This can include hiring engineers, product managers, and marketing specialists.

Attracting More Investors to the European Tech Scene

This funding can attract more investors to the European tech scene by demonstrating the region’s potential for growth and innovation. It creates a positive feedback loop, encouraging further investment and fostering a thriving startup ecosystem.

“This significant investment from Atomico is a clear signal that Europe is a hotbed of innovation and that investors are increasingly recognizing the potential of European tech companies.”

[Name of a relevant industry expert]

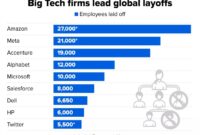

Challenges Facing European Tech Startups

While Atomico’s investment signals a surge of optimism for European tech, startups in the region still face significant hurdles. These challenges stem from a combination of factors, including the unique characteristics of the European market, the competitive landscape, and the overall economic environment.

Understand how the union of tnw conference wrap up highlights can improve efficiency and productivity.

Differences Between European and American Tech Markets

The European and American tech markets differ significantly in several aspects, impacting the growth trajectory of startups.

- Market Fragmentation:Europe is a collection of diverse nations with different languages, cultures, and regulatory frameworks. This fragmentation can make it challenging for startups to scale their operations across the continent.

- Consumer Spending Habits:European consumers tend to be more cautious and price-sensitive compared to their American counterparts. This can affect the adoption and growth of new technologies, particularly those with high upfront costs.

- Access to Capital:While Europe has seen a rise in venture capital funding, the overall investment landscape remains less mature compared to the US. This can limit the funding options available to European startups, especially in later stages of growth.

Impact of Challenges on European Startups

These challenges have a tangible impact on the growth and success of European startups.

- Slower Growth Rates:European startups often experience slower growth rates compared to their American counterparts due to factors such as market fragmentation and consumer spending habits.

- Difficulty in Scaling:Scaling operations across Europe can be challenging due to the diverse regulatory landscape and cultural differences. This can hinder the ability of startups to reach a larger customer base and achieve significant growth.

- Limited Talent Pool:While Europe boasts a strong talent pool, it may not be as concentrated as in the US, particularly in specific tech fields. This can make it difficult for startups to attract and retain top talent.

The Future of European Tech

The recent €1 billion fundraise by Atomico is a testament to the growing potential of European tech. This injection of capital will not only fuel the growth of existing startups but also pave the way for a new generation of innovative companies.

With a strong foundation of talent, research, and a supportive ecosystem, European tech is poised to become a global leader in the coming years.

European Tech Sectors with Growth Potential

The European tech landscape is diverse and dynamic, with several sectors exhibiting immense potential for growth.

- Fintech:Europe is a hotbed for fintech innovation, with companies like Wise, Xentral, and GoCardless leading the charge. The region’s strong financial infrastructure and regulatory environment provide fertile ground for disruptive fintech solutions.

- E-commerce:The rise of online shopping has fueled the growth of e-commerce companies in Europe. Companies like Zalando, ASOS, and The Hut Group have established themselves as major players in the global market. The region’s strong logistics infrastructure and growing online consumer base make it a prime destination for e-commerce ventures.

- HealthTech:Europe is at the forefront of healthcare innovation, with companies like Babylon Health, Kry, and Doctolib revolutionizing patient care. The region’s focus on data privacy and patient-centric healthcare makes it an ideal environment for HealthTech startups.

- CleanTech:Europe is a leader in the fight against climate change, with companies like Northvolt, SolarEdge, and Vestas developing innovative solutions for a sustainable future. The region’s commitment to green energy and its strong research infrastructure make it a key player in the CleanTech revolution.

- Artificial Intelligence (AI):Europe is home to some of the world’s leading AI research institutions, including the University of Oxford and the Technical University of Munich. This research is translating into the development of cutting-edge AI solutions, with companies like DeepMind, Graphcore, and Peltarion emerging as leaders in the field.

Successful European Tech Companies and their Impact, Vc atomico raises e1b glimmer hope european tech startups

Several European tech companies have achieved remarkable success, leaving a lasting impact on their respective industries.

| Company | Industry | Impact |

|---|---|---|

| Spotify | Music Streaming | Revolutionized music consumption with its on-demand streaming service, challenging traditional record labels and paving the way for a new era of music distribution. |

| Wise (formerly TransferWise) | Fintech | Disrupted the international money transfer market with its transparent and low-cost service, making it easier and more affordable for people to send money abroad. |

| Deliveroo | Food Delivery | Pioneered the on-demand food delivery model in Europe, connecting restaurants with hungry customers and transforming the way people order food. |

| Xentral | ERP Software | Developed a comprehensive ERP software solution for small and medium-sized enterprises, helping businesses streamline their operations and improve efficiency. |

| GoCardless | Payment Processing | Simplified recurring payments for businesses with its automated payment processing platform, making it easier for companies to collect payments from customers. |

Impact of VC Funding on Startup Growth: Vc Atomico Raises E1b Glimmer Hope European Tech Startups

Venture capital plays a pivotal role in the early stages of a startup’s journey, acting as a catalyst for growth and innovation. VC funding provides not only financial resources but also valuable mentorship, industry connections, and strategic guidance, helping startups navigate the complexities of their initial years.

Influence on Startup Direction and Strategy

VC funding can significantly influence the direction and strategy of a startup, often shaping its long-term trajectory. The influence of VC funding on startup direction and strategy can be observed in various ways:* Alignment of Goals:VCs invest in startups that align with their investment thesis and portfolio strategy.

This alignment ensures that the startup’s vision and goals are in line with the VC’s expectations, fostering a shared understanding of the path to success.

Market Focus

VCs often guide startups to focus on specific market segments or product lines that align with their investment expertise and market knowledge. This strategic direction can help startups optimize their resources and achieve quicker market penetration.

Operational Efficiency

VCs can provide insights and best practices to enhance operational efficiency, helping startups optimize their processes and resource allocation. This guidance can streamline operations and enable startups to scale more effectively.

Product Development

VCs can influence product development by providing feedback and insights based on their industry knowledge and market understanding. This guidance can lead to product enhancements and feature additions that cater to market demands.

Impact of VC Funding on Startups at Different Stages of Development

The impact of VC funding varies depending on the stage of development of a startup:* Seed Stage:At the seed stage, VC funding primarily provides the capital needed to validate the startup’s initial idea and build a minimum viable product (MVP). The focus is on product development, market testing, and establishing a strong foundation for future growth.

Series A

Series A funding typically focuses on scaling the business, expanding the team, and acquiring customers. VCs provide strategic guidance and support to help startups navigate this critical growth phase.

Series B and Beyond

In later stages, VC funding supports further expansion, market penetration, and strategic acquisitions. VCs play a more active role in guiding the startup’s long-term vision and strategic direction.

“VC funding is not just about money; it’s about the strategic guidance, mentorship, and network access that comes with it.” [Insert relevant source]