Uk lost e2 3b in tax from big tech because rules are no longer fit for purpose – UK Lost £2.3 Billion in Tax From Big Tech: Outdated Rules – that’s the staggering reality of the digital age. While tech giants rake in profits, our tax system struggles to keep up. The UK, like many countries, is grappling with the challenge of how to fairly tax these global behemoths.

The problem? Our current tax rules, designed for a pre-digital era, are simply not equipped to handle the complex, borderless nature of tech companies.

This situation has sparked a heated debate, with some arguing that the UK is losing out on vital revenue while others point to the need for a more nuanced approach to taxation in the digital age. The consequences of this tax gap are far-reaching, potentially impacting public services, infrastructure, and even the economic competitiveness of the UK.

The UK’s Tax Loss

The UK government has reported a significant loss of £2.3 billion in tax revenue from big tech companies, highlighting the need for updated tax regulations. This loss underscores the challenges in taxing these global giants, who often utilize complex financial structures and operate in multiple jurisdictions.

The Magnitude of the Tax Loss

The £2.3 billion tax loss represents a substantial amount of revenue that could have been used to fund public services and infrastructure projects. This figure is based on estimates from the UK government, which has been scrutinizing the tax practices of big tech companies for several years.

Big Tech Companies Involved

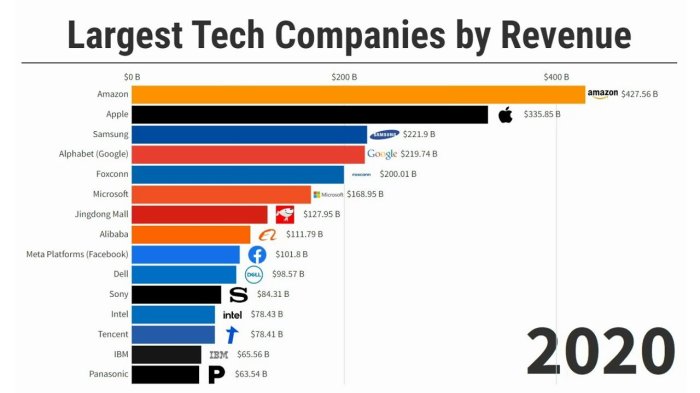

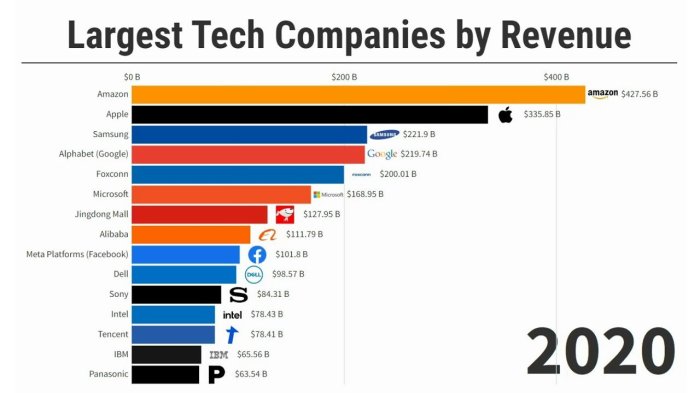

Several major tech companies have been identified as contributing to the UK’s tax loss. These include:

- Amazon: The e-commerce giant has faced criticism for its low tax contributions in the UK, despite generating significant revenue from its UK operations.

- Google: The search engine giant has also been accused of utilizing complex tax structures to minimize its tax liability in the UK.

- Facebook: The social media platform has been criticized for its low tax contributions in the UK, despite its massive user base and advertising revenue.

- Apple: The tech giant has been accused of using offshore subsidiaries to avoid paying taxes in the UK.

Historical Tax Revenue from Big Tech

Historically, big tech companies have paid relatively low taxes in the UK. However, the situation has become increasingly problematic in recent years, as these companies have expanded their operations and generated significant revenue from UK consumers.

“In 2019, the UK government collected £1.8 billion in corporation tax from big tech companies, which is a significant increase from previous years. However, this figure is still significantly lower than the revenue these companies generate in the UK.”

Comparison to Current Situation

The current tax loss of £2.3 billion represents a substantial decrease from the £1.8 billion collected in 2019. This decline is largely attributed to the increasing use of complex financial structures and tax avoidance strategies by big tech companies.

The Outdated Tax Rules

The UK’s current tax rules for big tech companies are facing significant scrutiny due to their inability to effectively capture the true extent of these companies’ profits and tax liabilities. These rules, designed for a traditional business model, struggle to keep pace with the rapidly evolving digital economy, leaving a substantial tax gap that disadvantages the UK’s public finances.

Weaknesses in the Current Tax Rules

The UK’s current tax rules for big tech companies suffer from several weaknesses, making them ill-suited for the modern digital economy. These rules primarily rely on the concept of a “permanent establishment,” which refers to a fixed place of business where a company conducts its operations.

However, this traditional definition fails to adequately capture the activities of many tech giants, who operate primarily online and lack physical offices in the UK.

The Issue of Profit Shifting

A significant issue with the current tax rules is the ease with which big tech companies can shift their profits to low-tax jurisdictions. This practice, known as profit shifting, allows companies to minimize their tax liabilities by routing their profits through subsidiaries located in countries with favorable tax rates.

For example, a tech company may choose to book its intellectual property rights in a low-tax jurisdiction, even though the majority of its revenue is generated in the UK.

Comparison to Other Countries

The UK’s tax rules are not unique in their shortcomings. Many countries face similar challenges in taxing digital businesses. However, some countries have taken more proactive steps to address these issues. For instance, the European Union has proposed a Digital Services Tax (DST) to ensure that digital companies contribute a fairer share of taxes.

The DST would apply to revenue generated from digital services within the EU, regardless of where the company is headquartered.

The Need for Modernization

The UK government recognizes the need to modernize its tax rules to effectively capture the profits of big tech companies. The government has acknowledged that the current rules are outdated and no longer fit for purpose. However, the process of updating these rules is complex and requires careful consideration of international implications.

Examples of Outdated Rules

The current rules often fail to capture the value created by digital companies through intangible assets such as data and algorithms. These assets, which are crucial to the success of many tech giants, are not always adequately accounted for under existing tax rules.

This leads to a misallocation of tax burdens, as companies are not taxed on the full extent of their profits.

Specific Aspects of Outdated Rules

- The current rules rely heavily on physical presence, which is no longer a reliable indicator of economic activity in the digital age. Many tech companies have a limited physical presence in the UK but generate substantial revenue from UK users.

- The rules are not designed to capture the value created by intangible assets such as data and algorithms. These assets are often used to generate revenue and profits but are not always subject to taxation under existing rules.

- The rules make it easy for companies to shift profits to low-tax jurisdictions, which reduces the tax revenue collected by the UK government.

The Impact of Digitalization: Uk Lost E2 3b In Tax From Big Tech Because Rules Are No Longer Fit For Purpose

The rise of digitalization has fundamentally reshaped the global economy, leading to the emergence of tech giants with immense market power. This shift has created challenges for traditional tax models, as these companies operate in a borderless digital realm, exploiting loopholes and minimizing their tax liabilities.

Tax Evasion Strategies of Big Tech

The digital nature of big tech companies allows them to easily shift profits to low-tax jurisdictions, effectively reducing their overall tax burden. These strategies are often legal, but raise ethical concerns regarding their impact on the fairness of the global tax system.

- Profit Shifting:Big tech companies can shift profits to low-tax jurisdictions by creating subsidiaries in countries with favorable tax rates. For example, a company might establish a subsidiary in Ireland, known for its low corporate tax rate, to handle intellectual property rights.

By routing profits through this subsidiary, the company effectively reduces its overall tax liability.

- Intangible Asset Valuation:Big tech companies often leverage intangible assets, such as trademarks, patents, and software, to their advantage. By strategically valuing these assets, they can shift profits to low-tax jurisdictions. For instance, a company might assign a high value to its intellectual property in a low-tax country, thereby shifting profits to that jurisdiction.

- Data Localization:Some big tech companies have been accused of manipulating their data storage and processing to take advantage of tax loopholes. By storing user data in countries with favorable tax policies, companies can avoid paying taxes in the countries where their users reside.

Ethical Implications of Tax Minimization

The strategies employed by big tech companies to minimize their tax liabilities have significant ethical implications. These practices raise concerns about:

- Fairness:Big tech companies are often accused of avoiding their fair share of taxes, while smaller businesses and individuals bear a disproportionate burden. This creates an uneven playing field and undermines the principle of fairness in the tax system.

- Social Responsibility:Big tech companies have a responsibility to contribute to the societies in which they operate. By minimizing their tax liabilities, they are depriving governments of essential resources needed for public services, such as healthcare, education, and infrastructure.

- Public Trust:The use of tax avoidance strategies by big tech companies can erode public trust in the integrity of the tax system. When companies are perceived as exploiting loopholes to avoid paying their fair share, it undermines the public’s willingness to comply with tax regulations.

The Need for Reform

The UK’s tax rules, designed for a traditional economy, are ill-equipped to capture the value generated by digital giants. This outdated system has resulted in significant tax losses, and urgent reform is necessary to ensure a fair and sustainable tax environment.

Redefining the Taxable Presence, Uk lost e2 3b in tax from big tech because rules are no longer fit for purpose

The current rules rely heavily on physical presence, which doesn’t accurately reflect the operations of big tech companies. They operate primarily in the digital realm, generating revenue through data and user engagement, not through physical assets. This disparity creates loopholes for tax avoidance, as companies can shift profits to low-tax jurisdictions.

- Introducing a “Significant Economic Presence” (SEP) test:This would consider factors like user base, revenue generated, and data processing within a jurisdiction to determine a taxable presence. This approach aligns with the evolving nature of business models and ensures that companies contribute proportionally to the economies where they operate.

Explore the different advantages of could europe have a dominant smartphone and is it needed that can change the way you view this issue.

- Expanding the definition of “permanent establishment”:The current definition focuses on physical infrastructure. This should be broadened to include digital infrastructure, such as data centers and servers, which are crucial for the operations of big tech companies.

Addressing the Challenges of Value Attribution

Big tech companies generate revenue from complex and interconnected activities, making it challenging to accurately attribute value to specific jurisdictions. This makes it difficult to determine the appropriate tax liability.

- Adopting a “formula apportionment” approach:This method would divide a company’s global profits based on factors like user base, revenue generated, and data processing in each jurisdiction. This approach offers a more equitable and transparent method for allocating profits for tax purposes.

- Implementing a “digital services tax” (DST):This tax, levied on revenue generated from digital services like advertising, would provide a simpler and more direct way to capture value from big tech companies, even in the absence of a physical presence.

Enhancing Transparency and Cooperation

Transparency in financial reporting and international cooperation are essential for effective tax enforcement.

- Mandating country-by-country reporting:This would require companies to disclose their financial performance and tax payments in each jurisdiction where they operate. This increased transparency would allow tax authorities to monitor activities and identify potential tax avoidance schemes.

- Strengthening international collaboration:Tax authorities need to work together to share information, coordinate enforcement efforts, and develop common standards for taxing digital activities. This collaborative approach can help close loopholes and prevent companies from exploiting differences in tax regulations across jurisdictions.

International Cooperation

The issue of tax avoidance by big tech companies is a global concern, requiring coordinated efforts from multiple countries to ensure fair and equitable taxation. International cooperation plays a crucial role in addressing this challenge, fostering collaboration between nations to harmonize tax rules and prevent multinational corporations from exploiting loopholes in different jurisdictions.

Current Initiatives and Agreements

The international community has taken significant steps towards addressing tax avoidance by big tech companies through various initiatives and agreements. These collaborative efforts aim to establish a more level playing field for taxation and prevent companies from shifting profits to low-tax jurisdictions.

- The Organisation for Economic Co-operation and Development (OECD)has been at the forefront of international tax cooperation, leading the development of the Base Erosion and Profit Shifting (BEPS) project. The BEPS project, launched in 2013, aims to address tax avoidance strategies by multinational enterprises through a comprehensive framework of recommendations.

- The Inclusive Framework on BEPSis a multilateral agreement involving over 140 countries, including developing nations. It provides a platform for member countries to collaborate on implementing the BEPS recommendations and address the tax challenges posed by the digital economy.

- The Pillar One and Pillar Two proposals, developed under the Inclusive Framework, represent significant steps towards reforming the international tax system. Pillar One focuses on allocating taxing rights to market jurisdictions, while Pillar Two aims to ensure a minimum level of taxation for large multinational enterprises.

The Future of Tax and Big Tech

The current tax landscape is struggling to keep pace with the rapid evolution of the digital economy, particularly the rise of big tech companies. These companies operate across borders, generating revenue through complex algorithms and vast data networks, making traditional tax models inadequate.

The UK, like many other countries, is grappling with this challenge, seeking solutions to ensure fairness and sustainability in the future of taxation.

The Future of Taxation and Big Tech

The future of taxation in the UK will likely involve a blend of traditional and innovative approaches, adapting to the unique characteristics of the digital economy. This will require a fundamental shift in how tax systems are designed and implemented, embracing technological advancements and fostering international collaboration.

The future of taxation and big tech in the UK will be shaped by several key factors:

- Technological Advancements:Blockchain technology, for instance, offers potential for greater transparency and efficiency in tax administration. Smart contracts can automate tax compliance processes, reducing errors and delays. Artificial intelligence (AI) can help identify and prevent tax evasion, enhancing tax collection efforts.

These advancements can help streamline tax administration, making it more efficient and responsive to the dynamic nature of the digital economy.

- Data-Driven Tax Systems:The increasing availability of data offers opportunities for more accurate and sophisticated tax models. Data analytics can help authorities better understand the economic activities of big tech companies, including their revenue streams, user base, and global operations. This data can inform the development of more effective tax policies, ensuring that companies contribute their fair share.

- International Cooperation:International cooperation will be crucial in addressing the cross-border nature of digital businesses. Sharing information and coordinating tax policies across jurisdictions will help prevent tax avoidance and ensure a level playing field for all companies. Initiatives like the OECD’s Base Erosion and Profit Shifting (BEPS) project aim to establish international standards for taxing multinational corporations, including big tech players.