These 3 fintech trends are key to building an inclusive future, creating a world where everyone has access to the financial tools and resources they need to thrive. From the rise of open banking to the power of digital payments and the crucial importance of financial education, these trends are shaping a more equitable financial landscape.

These advancements are not only revolutionizing how we manage our finances but also empowering individuals and communities that have been historically underserved by traditional financial institutions. By harnessing the power of technology, we can bridge the financial gap and create a future where everyone has the opportunity to achieve financial well-being.

The Rise of Open Banking and its Role in Financial Inclusion

Open banking is a game-changer in the financial world, empowering consumers and promoting financial inclusion. By allowing consumers to share their financial data with third-party applications, open banking unlocks a world of possibilities for financial management, access to credit, and innovative financial products.

Open Banking Empowers Consumers

Open banking puts consumers in control of their financial data. By granting access to their financial information, consumers can leverage various financial applications and services to manage their money more effectively. This includes tracking spending, budgeting, finding better deals, and comparing financial products.

Open Banking’s Impact on Underserved Communities

Open banking has the potential to significantly benefit underserved communities by improving access to financial products and services. Traditionally, these communities have faced barriers to accessing credit and financial products due to factors such as limited credit history or lack of access to traditional financial institutions.

Open banking can help bridge this gap by providing alternative methods for assessing creditworthiness and offering tailored financial products.

Innovative Fintech Solutions Leveraging Open Banking, These 3 fintech trends are key to building an inclusive future

Several innovative fintech solutions are leveraging open banking to promote financial inclusion.

- Micro-lending Platforms:These platforms use open banking data to assess the creditworthiness of individuals with limited credit history, making microloans more accessible. They analyze transaction data to understand spending patterns and repayment capacity, providing a more comprehensive picture of an individual’s financial situation.

- Financial Literacy Tools:Open banking data can be used to develop personalized financial literacy tools that help individuals better manage their finances. These tools can provide insights into spending habits, identify potential savings opportunities, and offer personalized financial advice.

- Neobanks:These digital-only banks rely heavily on open banking to offer a wide range of financial products and services. They can access data from various sources, including bank accounts, credit cards, and other financial institutions, to provide a more comprehensive view of their customers’ financial situation and offer tailored products.

Understand how the union of uk researchers used ai uncover a whopping 11456 social innovation projects online can improve efficiency and productivity.

The Power of Digital Payments in Bridging the Financial Gap: These 3 Fintech Trends Are Key To Building An Inclusive Future

Digital payment systems are revolutionizing financial landscapes, particularly in developing economies where traditional banking infrastructure is often limited. These systems offer a range of benefits that can empower individuals and businesses, fostering financial inclusion and economic growth.

Benefits of Digital Payments for Individuals and Businesses in Developing Economies

Digital payment systems offer a wide range of benefits for both individuals and businesses in developing economies. These benefits include:

- Increased Access to Financial Services:Digital payments can be accessed through mobile phones, which are widely available in developing countries. This allows individuals without bank accounts to participate in the financial system, accessing services like sending and receiving money, paying bills, and making purchases.

- Reduced Transaction Costs:Traditional banking systems often involve high transaction fees, particularly for cross-border payments. Digital payment systems can significantly reduce these costs, making financial transactions more affordable for individuals and businesses.

- Improved Financial Security:Digital payments can be more secure than cash transactions, as they often involve authentication measures and encryption. This reduces the risk of theft and fraud, promoting financial security for individuals and businesses.

- Enhanced Financial Inclusion:Digital payment systems can help bridge the financial gap by providing access to financial services for underserved populations, including women, rural communities, and low-income individuals.

- Boost to Economic Growth:By facilitating transactions and promoting financial inclusion, digital payments can contribute to economic growth by stimulating trade, investment, and entrepreneurship.

The Role of Digital Payments in Improving Financial Literacy and Promoting Financial Inclusion

Digital payment systems can play a crucial role in improving financial literacy and promoting financial inclusion by:

- Promoting Financial Education:Digital payment platforms can incorporate educational features that provide users with information about financial concepts, budgeting, and savings.

- Simplifying Financial Transactions:The user-friendly interfaces of digital payment systems can make financial transactions easier to understand and manage, fostering greater financial literacy.

- Providing Access to Financial Information:Digital payment platforms can offer users access to their transaction history and financial statements, allowing them to track their spending and manage their finances effectively.

- Facilitating Financial Inclusion:By providing access to financial services for underserved populations, digital payments can promote financial inclusion and empower individuals to participate in the financial system.

Examples of Successful Digital Payment Initiatives that Have Fostered Financial Inclusion

Numerous digital payment initiatives have demonstrated the potential of these systems to foster financial inclusion. Some notable examples include:

- M-Pesa in Kenya:Launched in 2007, M-Pesa is a mobile money service that has revolutionized financial inclusion in Kenya. It allows users to send and receive money, pay bills, and access other financial services through their mobile phones. M-Pesa has been instrumental in increasing financial access, particularly for women and rural communities.

- Bharat Bill Payment System (BBPS) in India:The BBPS is a unified platform that allows users to pay bills for various services, including electricity, gas, and water, through multiple channels, including mobile phones and online platforms. This initiative has significantly simplified bill payments and improved financial inclusion in India.

- Alipay and WeChat Pay in China:Alipay and WeChat Pay are two dominant mobile payment platforms in China. They have transformed the country’s financial landscape by providing a convenient and secure way for users to make payments, transfer money, and access other financial services. These platforms have played a significant role in promoting financial inclusion and driving economic growth in China.

The Importance of Financial Education and Literacy in Building an Inclusive Future

Financial education plays a vital role in empowering individuals to make informed financial decisions, fostering financial well-being, and ultimately contributing to a more inclusive financial system. By equipping individuals with the necessary knowledge and skills, financial education can bridge the gap between those who have access to financial services and those who do not, leading to a more equitable and prosperous society.

Key Areas of Financial Literacy for Financial Inclusion

Financial literacy encompasses a wide range of knowledge and skills essential for managing finances effectively. Here are some key areas of financial literacy that are crucial for financial inclusion:

- Budgeting and Saving:Understanding how to create a budget, track expenses, and save for future goals are fundamental skills for financial stability. Individuals need to know how to prioritize spending, allocate resources effectively, and build a safety net for unexpected events.

- Debt Management:Managing debt responsibly is essential for financial well-being. Individuals should understand different types of debt, interest rates, and strategies for repayment. This includes avoiding high-interest debt, managing credit card balances, and exploring options for debt consolidation or repayment plans.

- Investing:Investing can help individuals grow their wealth over time, but it requires an understanding of different investment options, risk tolerance, and investment strategies. Financial education can empower individuals to make informed investment decisions, diversify their portfolios, and achieve their financial goals.

- Insurance:Understanding the importance of insurance and different types of coverage is crucial for protecting oneself and one’s family from financial hardship. Individuals should be aware of the various insurance options available, including health insurance, life insurance, and property insurance, and how to choose the right coverage for their needs.

- Financial Products and Services:Individuals need to understand the different financial products and services available to them, such as bank accounts, loans, credit cards, and investment accounts. This includes understanding the terms and conditions of these products, the associated fees, and how to choose the best options for their specific needs.

Fintech Initiatives Promoting Financial Education and Literacy

Fintech companies are increasingly recognizing the importance of financial education and literacy in promoting financial inclusion. Many are developing innovative initiatives to provide accessible and engaging financial education resources to a wider audience.

- Gamified Learning Platforms:Fintech companies are using gamification to make learning about finances more interactive and engaging. These platforms use game mechanics, such as points, rewards, and challenges, to motivate users and make learning more enjoyable.

- Personalized Financial Education Tools:Some fintech companies are developing personalized financial education tools that cater to individual needs and goals. These tools can provide tailored advice, track progress, and offer customized learning paths.

- Financial Literacy Programs in Partnership with Schools and Communities:Fintech companies are partnering with schools and community organizations to deliver financial literacy programs to youth and adults. These programs can help build financial skills from a young age and empower individuals to make responsible financial decisions throughout their lives.

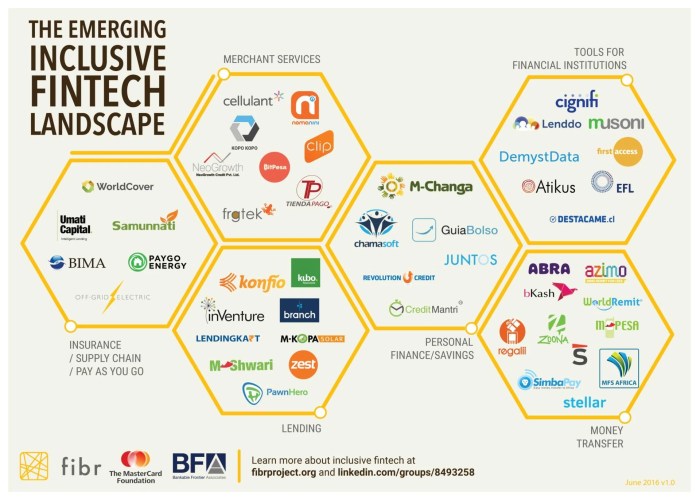

The Impact of Fintech on Financial Inclusion

Fintech, the intersection of finance and technology, has emerged as a powerful force in promoting financial inclusion globally. By leveraging innovative technologies, fintech solutions are breaking down traditional barriers to access financial services, reaching underserved populations and fostering economic empowerment.

The impact of fintech on financial inclusion is particularly pronounced in developing countries, where traditional financial institutions often struggle to reach remote and low-income communities.

The Fintech Landscape in Developed and Developing Countries

The fintech landscape exhibits distinct characteristics in developed and developing countries. In developed economies, fintech companies often focus on providing innovative and personalized financial services to existing customers, leveraging advanced technologies to enhance user experience and efficiency. Examples include robo-advisors, digital payment platforms, and peer-to-peer lending platforms.

In contrast, developing countries often face greater challenges in terms of financial infrastructure, literacy, and access to technology. Fintech solutions in these regions tend to prioritize addressing fundamental needs such as mobile banking, microfinance, and insurance for low-income populations.

- Developed Countries:Fintech companies in developed countries are often characterized by their focus on innovation and customer experience. They leverage advanced technologies such as artificial intelligence and big data to provide personalized financial services, such as robo-advisory and customized investment solutions.

These companies often target existing customers who are already financially literate and have access to technology. Examples include Robinhood, a platform that allows users to invest in stocks and ETFs commission-free, and Stripe, a payment processing platform that enables businesses to accept payments online.

- Developing Countries:Fintech companies in developing countries often face different challenges and opportunities. They focus on providing financial services to underserved populations, such as those living in rural areas or without access to traditional banking. These companies often leverage mobile technology to provide financial services, such as mobile money, microfinance, and insurance.

Examples include M-Pesa, a mobile money service in Kenya, and Bima, a micro-insurance platform in India.

Challenges and Opportunities for Financial Inclusion

While fintech offers significant potential for promoting financial inclusion, several challenges remain. These include:

- Digital Divide:The lack of access to technology and internet connectivity in many developing countries poses a significant barrier to financial inclusion. Bridging the digital divide requires investing in infrastructure and promoting digital literacy.

- Regulatory Uncertainty:In some countries, regulations are still evolving, creating uncertainty for fintech companies and hindering their ability to scale their operations. Clear and supportive regulations are essential for fostering innovation and promoting financial inclusion.

- Data Privacy and Security:The use of personal data by fintech companies raises concerns about privacy and security. Robust data protection regulations and consumer awareness are crucial for building trust and ensuring responsible use of data.

Despite these challenges, fintech offers several opportunities for promoting financial inclusion:

- Increased Access to Financial Services:Fintech solutions, particularly mobile banking and microfinance platforms, have significantly expanded access to financial services for underserved populations in developing countries. These platforms provide convenient and affordable alternatives to traditional banking, enabling individuals to save, borrow, and make payments more easily.

- Financial Literacy:Fintech companies are playing an increasingly important role in promoting financial literacy by providing educational resources and tools. This includes offering online courses, interactive financial calculators, and personalized financial advice. Increased financial literacy empowers individuals to make informed financial decisions and manage their finances effectively.

- Innovation and Product Development:Fintech companies are constantly innovating and developing new products and services tailored to the specific needs of underserved populations. These include micro-insurance products, agricultural financing solutions, and mobile-based payment systems that cater to the unique circumstances of rural communities and low-income individuals.

Emerging Technologies and Financial Inclusion

Emerging technologies, such as blockchain and artificial intelligence (AI), hold immense potential for enhancing financial inclusion.

- Blockchain:Blockchain technology can enable secure and transparent financial transactions, particularly in cross-border payments and remittances. This can reduce costs and improve efficiency, making financial services more accessible to individuals and businesses in developing countries. Blockchain can also facilitate the development of decentralized financial systems, empowering individuals to manage their own finances without relying on intermediaries.

- Artificial Intelligence:AI can be used to personalize financial services, provide financial advice, and automate tasks such as loan approvals and risk assessment. This can help to reduce costs and improve efficiency, making financial services more affordable and accessible to a wider range of people.

AI can also be used to detect and prevent fraud, ensuring the safety and security of financial transactions.