Large language models like gpt 3 arent good enough for pharma finance – Large language models like GPT-3 aren’t enough for pharma finance. While these models can generate impressive text and even summarize complex information, they lack the specialized knowledge and nuanced understanding needed to navigate the intricate world of pharmaceutical finance. The complexities of regulatory compliance, industry-specific data, and risk assessment demand a more tailored approach.

The need for specialized LLMs in pharma finance is evident. These models should be trained on vast datasets specific to the industry, incorporating regulations, financial data, and market trends. Such LLMs could revolutionize pharma finance by automating tasks, improving data analysis, and providing valuable insights to support informed financial decisions.

Limitations of Current LLMs in Pharma Finance

While Large Language Models (LLMs) like GPT-3 have shown remarkable capabilities in generating human-like text, their application in the complex world of pharma finance faces significant limitations. The highly specialized nature of this field, coupled with the sensitivity of financial data and regulatory compliance, presents unique challenges that current LLMs struggle to overcome.

Handling Complex Financial Data

Pharma finance professionals deal with vast amounts of complex financial data, including clinical trial costs, manufacturing expenses, pricing strategies, and regulatory filings. This data is often unstructured, multi-dimensional, and subject to constant change. Current LLMs are not adept at handling this level of complexity.

They lack the ability to:

- Interpret and analyze financial statements, including balance sheets, income statements, and cash flow statements.

- Extract meaningful insights from financial data, such as identifying trends, anomalies, and potential risks.

- Predict financial outcomes based on historical data and current market conditions.

The lack of specialized financial knowledge and the inability to handle complex data structures hinder LLMs’ effectiveness in supporting critical financial decision-making in the pharma industry.

The Need for Specialized LLMs

The pharma finance industry, with its intricate regulatory landscape, complex data sets, and ever-evolving market dynamics, demands a unique approach to data analysis and decision-making. Traditional methods are often slow, prone to human error, and lack the agility required to keep pace with the rapid changes in the industry.

This is where specialized LLMs, specifically designed for pharma finance, come into play.LLMs tailored to the unique requirements of pharma finance can significantly enhance efficiency and decision-making in various aspects of the industry.

Specific Features and Capabilities of Pharma Finance-Specific LLMs

A pharma finance-specific LLM should possess several features and capabilities to effectively address the unique challenges of the industry.

- Deep Understanding of Pharma Finance Terminology and Concepts:The LLM should be trained on a vast corpus of pharma finance-specific data, including regulatory documents, financial statements, clinical trial data, and industry publications. This will enable it to accurately interpret and analyze data, understand complex financial concepts, and generate insights relevant to the industry.

- Advanced Data Analysis and Modeling Capabilities:Pharma finance involves analyzing large and complex datasets, including financial data, clinical trial data, and market research. The LLM should be equipped with advanced data analysis and modeling capabilities to identify trends, patterns, and insights that would otherwise be difficult to uncover.

- Regulatory Compliance and Risk Management Expertise:The pharma industry is heavily regulated, with strict guidelines for financial reporting, data privacy, and clinical trial management. The LLM should be trained on relevant regulations and best practices to ensure compliance and mitigate risk. It should also be able to identify potential compliance issues and provide recommendations for addressing them.

- Natural Language Processing (NLP) for Effective Communication:The LLM should be able to effectively communicate with users, understand complex queries, and provide clear and concise answers in a language easily understood by financial professionals. This includes generating reports, summaries, and presentations that are tailored to the specific needs of the user.

Examples of Enhanced Efficiency and Decision-Making

A pharma finance-specific LLM can enhance efficiency and decision-making in several ways:

- Automated Financial Reporting:The LLM can automate the generation of financial reports, including income statements, balance sheets, and cash flow statements. This can significantly reduce the time and effort required for manual reporting, allowing finance teams to focus on more strategic tasks.

- Risk Assessment and Mitigation:The LLM can analyze financial data and identify potential risks, such as fraud, regulatory violations, and market fluctuations. It can then provide recommendations for mitigating these risks, helping to ensure the financial stability and compliance of the organization.

- Investment Analysis and Portfolio Optimization:The LLM can analyze market data, financial statements, and clinical trial data to identify promising investment opportunities and optimize investment portfolios. This can help pharma companies make more informed investment decisions and maximize their return on investment.

- Clinical Trial Cost Optimization:The LLM can analyze clinical trial data and identify opportunities for cost optimization. This includes identifying potential areas for efficiency improvements, negotiating better pricing with vendors, and optimizing trial design to reduce costs while maintaining quality.

Potential Applications of LLMs in Pharma Finance: Large Language Models Like Gpt 3 Arent Good Enough For Pharma Finance

Large language models (LLMs) are poised to revolutionize pharma finance by automating tasks, enhancing data analysis, and providing valuable insights to support informed financial decisions. LLMs can process vast amounts of data, identify patterns, and generate predictions, making them ideal for addressing complex challenges in the pharmaceutical industry.

Budgeting and Forecasting

LLMs can significantly improve budgeting and forecasting accuracy by analyzing historical data, market trends, and regulatory changes. They can automate tasks like:

- Predictive Modeling:LLMs can build predictive models to forecast revenue, expenses, and drug development costs based on historical data and external factors. For example, an LLM could analyze historical sales data, market research, and clinical trial timelines to predict the launch date and revenue potential of a new drug.

- Scenario Planning:LLMs can simulate various scenarios to assess the impact of different market conditions, regulatory changes, or competitive pressures on financial performance. This allows finance teams to develop contingency plans and make more informed decisions.

- Budget Optimization:LLMs can analyze spending patterns and identify areas for cost optimization. They can recommend budget adjustments based on real-time data and projected needs.

Risk Assessment

LLMs can assist in identifying and mitigating financial risks by analyzing data from various sources, including financial statements, market reports, and regulatory filings.

- Fraud Detection:LLMs can analyze financial transactions and identify patterns that might indicate fraudulent activities. For instance, they can detect unusual spending patterns or discrepancies in financial reporting.

- Regulatory Compliance:LLMs can help pharma companies navigate complex regulatory landscapes by identifying potential compliance risks and suggesting strategies to mitigate them. For example, an LLM could analyze changes in regulations and identify potential implications for drug pricing or clinical trial protocols.

- Market Risk Assessment:LLMs can analyze market data, competitive landscape, and regulatory trends to assess the risk associated with new drug launches, mergers and acquisitions, and other strategic decisions. They can identify potential market disruptions and provide insights for informed decision-making.

Data Analysis and Insights

LLMs can process large volumes of data from various sources, including financial statements, clinical trial data, and market research reports.

In this topic, you find that searching for a job get references is very useful.

- Financial Statement Analysis:LLMs can analyze financial statements to identify trends, anomalies, and potential areas of concern. They can also provide insights into key performance indicators (KPIs) and financial health.

- Clinical Trial Data Analysis:LLMs can analyze clinical trial data to identify potential cost savings, optimize trial design, and predict the success of new drug candidates. For example, they can identify patient subgroups that may respond better to a particular treatment or predict the likelihood of a drug’s approval based on clinical trial data.

- Market Research and Competitive Analysis:LLMs can analyze market research reports, competitor data, and industry trends to provide insights into market opportunities, competitive threats, and potential market disruptions. They can help pharma companies make strategic decisions regarding product development, pricing, and marketing.

Regulatory Compliance

LLMs can help pharma companies navigate the complex regulatory landscape by automating tasks, providing insights into regulatory changes, and identifying potential compliance risks.

- Regulatory Change Monitoring:LLMs can track regulatory changes and provide timely alerts to finance teams. This ensures that companies are aware of new regulations and can adjust their financial plans accordingly.

- Compliance Risk Assessment:LLMs can analyze company policies, procedures, and financial transactions to identify potential compliance risks. They can also suggest strategies for mitigating these risks.

- Regulatory Reporting:LLMs can automate the process of preparing regulatory reports, reducing the risk of errors and ensuring timely submission. They can also help companies comply with evolving reporting requirements.

Ethical Considerations and Risks

The integration of large language models (LLMs) in pharma finance holds immense promise, but it also necessitates a careful consideration of ethical implications and potential risks. This section delves into these crucial aspects, exploring data privacy, security, bias, and the impact on finance professionals and the pharmaceutical industry.

Data Privacy and Security

The training of LLMs often involves vast amounts of data, including sensitive financial information. This raises concerns about data privacy and security. Unauthorized access or breaches could compromise confidential financial data, potentially leading to financial losses, reputational damage, and legal repercussions.

- Data anonymization and encryption:Implementing robust data anonymization and encryption techniques is crucial to safeguard sensitive financial data. This involves removing personally identifiable information and encrypting data at rest and in transit.

- Access control and auditing:Establishing stringent access control measures and regular audits can help prevent unauthorized access and ensure data integrity. Implementing multi-factor authentication and role-based access control can further enhance security.

- Compliance with regulations:Pharma finance organizations must adhere to relevant data privacy regulations such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) to ensure responsible data handling and protection.

Bias in LLMs

LLMs are trained on massive datasets, which may contain biases reflecting societal prejudices. These biases can manifest in the outputs of LLMs, leading to discriminatory or unfair outcomes in financial decision-making.

- Data cleansing and bias mitigation:Identifying and mitigating biases in training data is essential. This can involve data cleansing techniques to remove biased content and incorporating bias mitigation strategies during model training.

- Transparency and accountability:Transparency in model development and decision-making processes is crucial. Providing insights into how LLMs arrive at their conclusions can help identify and address potential biases.

- Human oversight and ethical guidelines:Human oversight is crucial to ensure responsible and ethical use of LLMs. Establishing clear ethical guidelines for LLM deployment and ensuring human review of critical decisions can help mitigate bias and ensure fairness.

Impact on Finance Professionals

The introduction of LLMs in pharma finance has the potential to significantly impact the role of finance professionals. While LLMs can automate routine tasks, they can also enhance decision-making by providing valuable insights and analysis.

- Upskilling and reskilling:Finance professionals will need to adapt to the evolving landscape by acquiring new skills in data analysis, machine learning, and ethical AI principles. This will involve upskilling and reskilling initiatives to ensure they can effectively work alongside LLMs.

- Shift in focus:The role of finance professionals will likely shift towards higher-level tasks such as strategic planning, risk management, and ethical considerations. LLMs can handle routine tasks, allowing professionals to focus on more complex and value-adding activities.

- Collaboration and augmentation:LLMs can act as powerful tools to augment the capabilities of finance professionals. By collaborating with LLMs, professionals can leverage their expertise and gain access to advanced analytical capabilities.

Impact on the Pharmaceutical Industry

The widespread adoption of LLMs in pharma finance could significantly impact the pharmaceutical industry. LLMs can optimize financial processes, improve decision-making, and enhance efficiency.

- Improved financial forecasting and risk management:LLMs can analyze large datasets to generate accurate financial forecasts and identify potential risks. This can enable better resource allocation, investment decisions, and risk mitigation strategies.

- Enhanced drug development and commercialization:LLMs can assist in identifying promising drug candidates, optimizing clinical trial designs, and predicting market success. This can accelerate drug development and bring life-saving treatments to patients faster.

- Increased transparency and accountability:LLMs can enhance transparency and accountability by providing auditable trails of financial decisions and processes. This can foster trust and build confidence among stakeholders.

Guidelines for Responsible and Ethical Implementation, Large language models like gpt 3 arent good enough for pharma finance

To ensure responsible and ethical implementation of LLMs in pharma finance, organizations should consider the following guidelines:

- Establish clear ethical principles:Develop a comprehensive set of ethical principles that guide the use of LLMs in financial decision-making. These principles should address data privacy, security, bias, transparency, and accountability.

- Implement robust data governance:Establish strong data governance practices to ensure responsible data collection, storage, and use. This includes implementing data anonymization, encryption, and access control measures.

- Foster collaboration and communication:Encourage open communication and collaboration among finance professionals, data scientists, and ethics experts to ensure responsible LLM development and deployment.

- Conduct regular audits and assessments:Regularly audit and assess LLM performance to identify and mitigate potential biases, security vulnerabilities, and ethical concerns.

- Promote transparency and accountability:Provide clear explanations of how LLMs are used in financial decision-making and ensure accountability for the outcomes generated by these models.

Future Directions and Innovations

The potential of LLMs in pharma finance is immense, but realizing this potential requires addressing current limitations and embracing future innovations. Ongoing research and development are paving the way for LLMs that are more sophisticated, adaptable, and capable of handling the nuances of financial data and industry-specific knowledge.

Enhanced Data Handling and Industry-Specific Knowledge

LLMs need to be equipped with the ability to handle the complex and specialized nature of pharma finance data. This involves:

- Improved Data Integration and Processing:Integrating diverse data sources, including financial statements, clinical trial data, regulatory filings, and market research, will enable LLMs to provide a holistic financial picture. This requires advancements in data integration techniques and the ability to process unstructured data like clinical trial reports and regulatory documents.

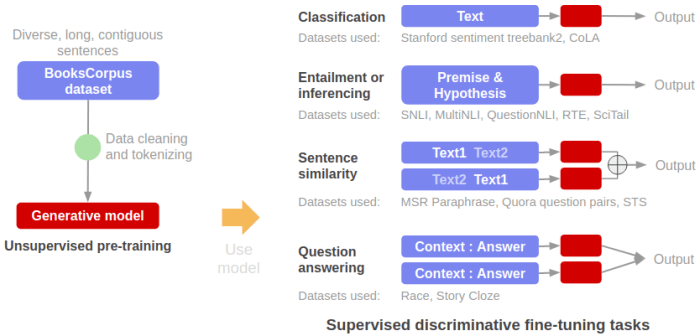

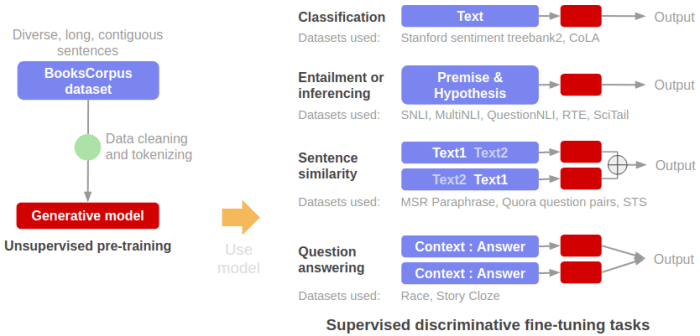

- Domain-Specific Knowledge Representation:LLMs need to be trained on pharma-specific data and knowledge to understand the unique terminology, regulations, and financial models prevalent in the industry. This can be achieved through specialized datasets and fine-tuning techniques tailored to the pharmaceutical domain.

- Enhanced Data Security and Privacy:As LLMs handle sensitive financial data, robust security measures are paramount. This includes data encryption, access control, and adherence to relevant privacy regulations like HIPAA.

Emerging Technologies for LLM Enhancement

The integration of emerging technologies can significantly enhance the capabilities of LLMs in pharma finance:

- Federated Learning:This allows LLMs to learn from decentralized data sources without compromising data privacy. This is crucial for pharma finance, where data is often siloed across different departments and organizations.

- Graph Neural Networks:These networks excel at analyzing complex relationships within data, making them ideal for understanding the intricate network of financial transactions and interactions in the pharma industry.

- Explainable AI (XAI):This technology aims to make LLM decisions transparent and understandable, building trust and accountability in their use for financial analysis and risk assessment.

Future Applications of LLMs in Pharma Finance

LLMs have the potential to revolutionize various aspects of pharma finance:

- Predictive Analytics:LLMs can analyze historical data and market trends to predict future financial performance, identify potential risks, and optimize investment strategies.

- Fraud Detection:By identifying patterns and anomalies in financial data, LLMs can help detect and prevent fraud, ensuring the integrity of financial transactions and protecting the company from financial losses.

- Personalized Financial Planning:LLMs can analyze individual financial needs and goals, providing personalized financial plans for employees, investors, and stakeholders within the pharmaceutical industry.