Google pay yearly fee german news publishers – Google Pay Yearly Fee: German News Publishers’ Perspective delves into the evolving landscape of digital payments in Germany, exploring the potential impact of Google Pay on the news industry. We’ll analyze the fees associated with Google Pay, examine its adoption rate, and discuss how German news publishers are navigating this new payment ecosystem.

While Google Pay offers convenience and accessibility, its fees and potential impact on news publishers remain a point of discussion. This blog post will explore the current state of Google Pay in Germany, highlighting its features, fees, and the potential challenges and opportunities it presents for German news publishers.

Google Pay in Germany

Google Pay has been making inroads into the German market, but it faces stiff competition from established payment methods and a cautious consumer base.

Adoption and Market Share

Despite its global popularity, Google Pay has not yet achieved widespread adoption in Germany. The country has a strong preference for traditional banking methods and debit cards, and many consumers are hesitant to embrace new payment technologies. While Google Pay’s market share remains relatively small compared to other payment methods, it is gradually gaining traction.

Key Features and Functionalities

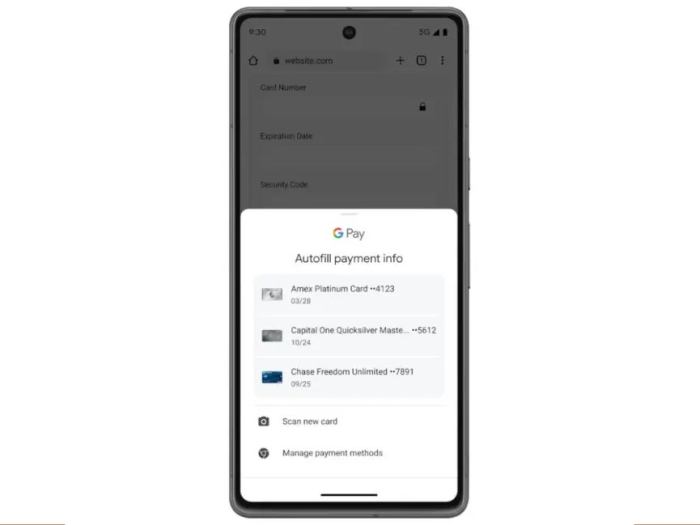

Google Pay offers several features tailored to the German market:

- Contactless Payments:Users can make payments with their smartphones or smartwatches at contactless terminals, which are becoming increasingly common in Germany.

- Online Payments:Google Pay can be used for online purchases at participating merchants, offering a convenient and secure alternative to traditional credit card payments.

- Integration with Banking Apps:Google Pay integrates with several German banks, allowing users to link their bank accounts and make payments directly from their Google Pay app.

- Loyalty Programs:Some German retailers offer loyalty programs integrated with Google Pay, allowing users to earn points and redeem rewards.

The Payment Landscape in Germany

Germany has a diverse payment landscape, with traditional banking methods still dominating.

- Debit Cards:Debit cards, known as “EC-Karten,” are widely accepted and remain the most common payment method in Germany.

- Credit Cards:Credit cards are less prevalent in Germany compared to other European countries, with debit cards preferred for everyday transactions.

- Cash:Cash remains a significant payment method in Germany, particularly for smaller transactions.

- Alternative Payment Methods:Mobile payment solutions like PayPal and Apple Pay are gaining popularity, offering alternative options for online and in-store purchases.

“Germany is a complex market for mobile payments, with strong traditional payment habits and a preference for security and privacy.”

[Source

Payment industry expert]

Fees Associated with Google Pay in Germany

Google Pay, a popular mobile payment platform, is gaining traction in Germany. While it offers convenience and ease of use, understanding the associated fees is crucial for both users and merchants. This blog post explores the potential fees charged by Google Pay in Germany, compares them to other payment providers, and examines their impact on the overall cost of using the platform.

Fees for Users

Users of Google Pay generally do not face direct fees for making payments. Google Pay operates on a transaction-based model, where merchants are charged a fee for processing payments. However, users might indirectly incur fees associated with their bank accounts or card issuers.

For example, some banks might charge a transaction fee for using Google Pay, particularly for international transactions. Additionally, card issuers might impose fees based on the type of card used or the specific transaction category.

Fees for Merchants

Merchants using Google Pay are charged a transaction fee for each successful payment processed. This fee is typically a percentage of the transaction amount, plus a fixed fee per transaction. The specific fee structure can vary depending on factors such as:

- The merchant’s industry

- The transaction volume

- The payment method used (e.g., credit card, debit card)

Google Pay’s fee structure is generally competitive compared to other payment providers in Germany. For example, traditional payment processors like PayPal or Stripe also charge transaction fees, which can be similar to Google Pay’s rates.

Impact of Fees on the Overall Cost of Using Google Pay

The fees associated with Google Pay can impact the overall cost of using the platform for both users and merchants. For users, the indirect fees charged by banks or card issuers can add up, especially for frequent users or those making international transactions.For merchants, the transaction fees can affect their profit margins, particularly for businesses with low profit margins or high transaction volumes.

However, the convenience and security offered by Google Pay can offset these costs, attracting more customers and potentially increasing sales.

Comparison with Other Payment Providers

Google Pay’s fees are generally competitive with other payment providers in Germany.

- PayPal:PayPal charges a transaction fee for merchants, typically ranging from 1.9% to 3.4% of the transaction amount, plus a fixed fee per transaction.

- Stripe:Stripe also charges transaction fees for merchants, with rates ranging from 1.4% to 2.9% of the transaction amount, plus a fixed fee per transaction.

- Visa and Mastercard:Visa and Mastercard charge merchants interchange fees for processing card payments. These fees are typically a percentage of the transaction amount and vary based on factors like the card type and the merchant’s industry.

It’s important to note that the specific fees charged by each provider can vary depending on the individual merchant’s account and transaction volume.

Discover how biohacker teemu arinas will speak at tnw conference has transformed methods in this topic.

German News Publishers’ Perspective on Google Pay

German news publishers are increasingly recognizing the potential of Google Pay to enhance their business operations and reach a wider audience. As a mobile payment solution gaining traction in Germany, Google Pay presents both opportunities and challenges for news publishers in the country.

Opportunities Presented by Google Pay

Google Pay offers several opportunities for German news publishers to expand their reach and generate revenue.

- Enhanced User Experience:Google Pay simplifies the payment process for users, making it easier for them to subscribe to digital news content. This can lead to increased subscription rates and user engagement.

- Micropayments and Digital Kiosks:Google Pay enables publishers to implement micropayment systems for digital content, allowing users to purchase individual articles or access premium features through a convenient and secure platform. This can also be utilized for digital news kiosks, providing users with an alternative to traditional newsstands.

- Targeted Advertising and Promotions:By integrating Google Pay with their platforms, news publishers can leverage user data to personalize advertising and promotions, potentially increasing advertising revenue.

- Partnerships with Google:Google Pay offers opportunities for collaboration with Google, potentially leading to access to new features and resources for news publishers.

Future of Google Pay in Germany: Google Pay Yearly Fee German News Publishers

The future of Google Pay in Germany is brimming with potential. With its user-friendly interface, secure payment system, and growing adoption across the country, Google Pay is poised to become a dominant force in the German digital payment landscape. However, several factors will shape its trajectory, including regulatory changes, consumer trends, and competitive pressures.

Factors Influencing Google Pay’s Future in Germany, Google pay yearly fee german news publishers

Several key factors will influence the future of Google Pay in Germany. These include:

- Regulatory Changes:Germany’s regulatory landscape is evolving, with a focus on data privacy and security. Google Pay will need to adapt to these regulations to ensure compliance and maintain consumer trust. The introduction of PSD2 (Payment Services Directive 2) in 2018 has already spurred significant changes in the German payment market, opening the door for new entrants like Google Pay.

Continued regulatory scrutiny and updates will play a significant role in shaping the competitive landscape.

- Consumer Trends:German consumers are increasingly embracing digital payment solutions. The rise of e-commerce and mobile payments has created a fertile ground for Google Pay’s growth. Consumer preference for contactless payments, fueled by the COVID-19 pandemic, is expected to continue driving adoption of Google Pay.

- Competition:The German digital payment market is fiercely competitive, with established players like PayPal, Apple Pay, and local payment systems like Giropay and Sofort. Google Pay will need to differentiate itself by offering unique features, competitive pricing, and a seamless user experience to attract and retain customers.

Potential Innovations and Enhancements

To solidify its position in the German market, Google Pay could introduce several innovations and enhancements:

- Enhanced Integration with Banking Apps:Google Pay could strengthen its integration with German banking apps, allowing users to manage their accounts and make payments directly within the app. This would simplify the user experience and make Google Pay more accessible to a wider audience.

- Expansion of Payment Options:Google Pay could expand its payment options to include features like loyalty programs, reward systems, and personalized offers, enhancing the overall user experience. This could be achieved through strategic partnerships with retailers and businesses in Germany.

- Increased Focus on Security:Google Pay can further strengthen its security features by implementing advanced fraud detection mechanisms and providing enhanced user authentication options. This will build consumer confidence and encourage wider adoption.