Europes vc funding landscape will look * – Europe’s VC funding landscape will look different in the coming years, driven by a confluence of factors including technological advancements, evolving investment strategies, and growing government support. The continent’s startup ecosystem is witnessing a surge in activity, attracting significant capital from both domestic and international investors.

This shift is creating new opportunities for entrepreneurs and investors alike, while also presenting unique challenges and risks.

The European VC market is expanding rapidly, with a growing number of startups seeking funding across various sectors. From artificial intelligence and fintech to healthcare and sustainability, the continent is home to a diverse range of innovative companies. This growth is fueled by several key factors, including a strong talent pool, a supportive regulatory environment, and increasing access to capital.

Current State of Europe’s VC Funding Landscape

Europe’s venture capital (VC) market has experienced significant growth in recent years, attracting a substantial amount of investment and fostering a vibrant ecosystem of startups and innovative companies. The continent has emerged as a major player in the global VC landscape, with several factors contributing to its rapid rise.

You also can investigate more thoroughly about intel germany strike record e30b deal for chip mega factory to enhance your awareness in the field of intel germany strike record e30b deal for chip mega factory.

Overall Size and Growth Trajectory of the European VC Market

The European VC market has grown considerably in recent years, fueled by a combination of factors such as increased investor interest, a surge in the number of high-growth startups, and supportive government initiatives. The total amount of VC funding raised by European startups reached a record high in 2021, surpassing €100 billion.

This surge in investment reflects the increasing confidence of investors in the potential of European startups to deliver strong returns.

Key Sectors and Industries Receiving the Most VC Investment

The European VC market is characterized by a diverse range of sectors attracting significant investment. The most prominent sectors include:

- Fintech:Europe has a strong fintech ecosystem, with startups developing innovative solutions in areas such as payments, lending, and insurance.

- Software:The software sector remains a major recipient of VC funding, with startups developing cutting-edge applications across various industries.

- Healthcare:The healthcare sector is witnessing a surge in VC investment, driven by the rise of digital health and personalized medicine startups.

- E-commerce:The growth of online retail has led to a significant increase in VC investment in e-commerce startups.

- Cleantech:Europe’s commitment to sustainability has spurred investment in cleantech startups developing solutions for renewable energy, energy efficiency, and environmental protection.

Comparison of the Funding Landscape Across Major European Countries, Europes vc funding landscape will look *

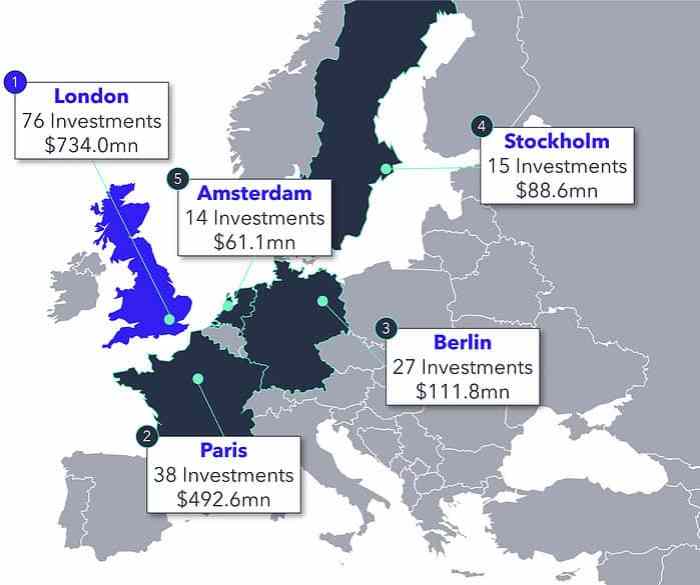

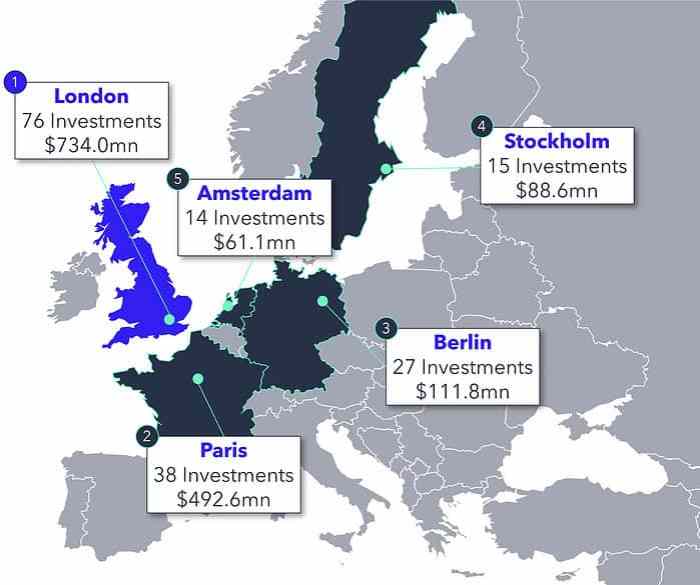

The VC funding landscape varies across different European countries, with certain countries emerging as hubs for VC activity.

- United Kingdom:The UK has long been a major VC hub, attracting significant investment and boasting a thriving startup ecosystem.

- Germany:Germany is another leading VC destination, with a strong focus on industrial technology and deep tech startups.

- France:France has witnessed a surge in VC activity in recent years, with a particular focus on artificial intelligence and digital transformation.

- Nordic Countries:The Nordic countries have a reputation for innovation and entrepreneurship, with a growing number of startups attracting VC funding.

- Netherlands:The Netherlands is a hub for fintech and e-commerce startups, attracting significant VC investment.

Role of Government Initiatives and Policies in Shaping the VC Ecosystem

Government initiatives and policies play a crucial role in shaping the European VC ecosystem. Governments across Europe have implemented various programs and initiatives to foster innovation and entrepreneurship, including:

- Tax incentives:Many European countries offer tax breaks and incentives to encourage VC investment in startups.

- Public funding programs:Governments provide grants and subsidies to support early-stage startups and VC funds.

- Regulatory frameworks:Governments are working to create a favorable regulatory environment for startups and VC firms.

- Public-private partnerships:Governments are collaborating with private sector partners to create innovation hubs and incubators.

Challenges and Risks

While Europe’s VC funding landscape is experiencing growth, it’s not without its challenges and risks. These factors can influence the investment climate and impact the success of startups seeking funding.

Geopolitical Uncertainty and Economic Volatility

Geopolitical uncertainty and economic volatility pose significant challenges to VC investment. These factors can create market instability and make investors hesitant to commit capital. For example, the ongoing conflict in Ukraine, coupled with rising inflation and energy prices, has created a complex economic environment, potentially leading to reduced VC activity.

Impact of Emerging Technologies and Disruptive Innovation

The rapid evolution of emerging technologies like artificial intelligence (AI), blockchain, and quantum computing presents both opportunities and risks for VCs. While these technologies hold immense potential for innovation, they also require careful assessment and management.

- Valuation Challenges:Assessing the value of startups utilizing emerging technologies can be difficult due to the rapid pace of innovation and the lack of established benchmarks.

- Regulatory Uncertainty:Emerging technologies often operate in regulatory grey areas, which can create uncertainty for investors.

- Talent Acquisition:Securing skilled talent to develop and implement these technologies is a major challenge for startups.

Role of Regulation and Compliance

Regulation and compliance play a crucial role in shaping the VC ecosystem. While regulations aim to protect investors and consumers, they can also create hurdles for startups seeking funding.

- Data Protection Regulations:Regulations like the General Data Protection Regulation (GDPR) can impact how startups collect and use data, potentially increasing compliance costs.

- Antitrust Regulations:Antitrust regulations can affect how startups operate and compete in the market, potentially limiting their growth.

- Tax Regulations:Tax regulations can impact the attractiveness of investments for both VCs and startups.

Future Outlook and Predictions: Europes Vc Funding Landscape Will Look *

The European VC market is poised for continued growth, driven by a confluence of factors, including a robust startup ecosystem, increasing government support, and the rise of emerging technologies. This section will delve into the future trajectory of the European VC landscape, exploring key drivers, emerging trends, and the evolving role of VC firms.

Key Drivers of Future Growth

The European VC market is expected to experience significant growth in the coming years, fueled by several key drivers:

- Increased Funding Availability:Venture capital funds are increasingly allocating capital to European startups, attracted by the region’s growing pool of talented entrepreneurs and innovative companies. For example, in 2022, European VC funding reached a record high of €110 billion, indicating a strong appetite for investment in the region.

- Government Support:Governments across Europe are actively promoting innovation and entrepreneurship, providing funding and resources to support startups and VC firms. Initiatives such as the European Innovation Council (EIC) and the European Investment Fund (EIF) are playing a crucial role in fostering a thriving VC ecosystem.

- Growth of Emerging Technologies:The rapid advancement of technologies such as artificial intelligence (AI), blockchain, and biotechnology is creating new opportunities for startups and attracting significant VC investment. European companies are increasingly becoming leaders in these fields, attracting global attention and investment.

Impact of Emerging Trends and Technologies

Emerging trends and technologies will significantly impact the VC investment landscape in Europe:

- Artificial Intelligence (AI):AI is transforming various industries, creating new opportunities for startups developing AI-powered solutions. VC firms are actively investing in AI startups, recognizing their potential to disrupt traditional business models and create significant value.

- Blockchain Technology:Blockchain technology is revolutionizing industries such as finance, supply chain management, and healthcare. VC firms are investing in blockchain startups developing innovative solutions that leverage the decentralized and transparent nature of blockchain.

- Sustainability and Impact Investing:Investors are increasingly seeking investments that align with environmental, social, and governance (ESG) principles. VC firms are focusing on startups developing solutions that address sustainability challenges, contributing to a positive social impact.

Role of Innovation and Entrepreneurship in Economic Growth

Innovation and entrepreneurship are critical drivers of economic growth. Startups play a crucial role in creating new jobs, developing innovative products and services, and fostering competition in the marketplace. VC firms play a vital role in supporting these startups, providing them with the capital and expertise they need to succeed.

Evolving Role of VC Firms and Investment Strategies

VC firms are adapting their investment strategies to keep pace with the evolving landscape:

- Increased Focus on Later-Stage Investments:VC firms are increasingly investing in later-stage companies, providing growth capital to companies that have already demonstrated traction and market potential.

- Specialization and Industry Expertise:VC firms are specializing in specific sectors, such as fintech, healthcare, or cleantech, leveraging their industry expertise to identify and invest in promising startups.

- Cross-Border Investments:VC firms are increasingly making cross-border investments, leveraging their global networks to identify and invest in startups across Europe and beyond.