Europes homegrown battery cells could end reliance on china by * – Europe’s Homegrown Battery Cells Could End Reliance on China by 2030. This is a bold claim, but it’s one that’s gaining traction as European nations race to secure their energy independence and reduce their reliance on Chinese battery manufacturers.

The electric vehicle revolution is driving a surge in demand for lithium-ion batteries, and Europe is determined to become a major player in this burgeoning market. But with China currently dominating the global battery cell market, can Europe truly compete and create a sustainable homegrown industry?

The European Union has ambitious plans to achieve climate neutrality by 2050, and this requires a massive shift towards electric vehicles and renewable energy sources. This shift, however, is heavily dependent on access to reliable and affordable battery cells.

Currently, Europe imports a significant portion of its battery cells from China, creating a dangerous vulnerability in its supply chain. To address this, European governments and companies are investing heavily in research and development, and building new battery cell manufacturing facilities across the continent.

The goal is to create a robust domestic battery cell industry that can not only meet the growing demand but also challenge China’s dominance in the global market.

The Growing Demand for Battery Cells in Europe: Europes Homegrown Battery Cells Could End Reliance On China By *

The demand for battery cells in Europe is skyrocketing, driven by the continent’s ambitious goals for electrifying transportation and achieving energy independence. This surge in demand presents both opportunities and challenges for Europe’s future.

The Factors Driving Demand for Battery Cells

The demand for battery cells in Europe is driven by several key factors:

- The European Union’s (EU) ambitious climate goals, including the target of achieving climate neutrality by 2050, are leading to a rapid shift towards electric vehicles (EVs) and renewable energy sources. This transition requires a significant increase in battery cell production to power these technologies.

- The EU’s dependence on imported battery cells, primarily from China, poses a strategic risk to its energy security and economic competitiveness. To address this vulnerability, the EU is actively promoting the development of a domestic battery cell industry.

- The increasing adoption of EVs in Europe is a major driver of demand for battery cells. The EU’s ambitious targets for EV sales, including a goal of 100% new car sales being zero-emission by 2035, will significantly increase the demand for battery cells.

- The growing use of battery storage for renewable energy sources, such as solar and wind power, is another significant driver of demand. Battery storage systems play a crucial role in stabilizing the grid and ensuring the reliable supply of renewable energy.

The Projected Growth of the Battery Cell Market in Europe

The European battery cell market is expected to experience significant growth in the coming years. According to a report by the European Battery Alliance, the market is projected to reach a value of €250 billion by 2030. This growth will be driven by the factors mentioned above, including the increasing demand for EVs and renewable energy storage.

The Implications of Growing Demand for European Reliance on Imported Battery Cells

The growing demand for battery cells in Europe has significant implications for the continent’s reliance on imported battery cells. As the demand for battery cells continues to rise, Europe’s dependence on imports from China could become even more pronounced. This reliance raises concerns about:

- Energy Security:Europe’s dependence on imported battery cells creates a vulnerability to supply chain disruptions, which could impact the availability of battery cells for EVs and renewable energy storage. This vulnerability is particularly concerning given the geopolitical tensions between Europe and China.

- Economic Competitiveness:The dominance of Chinese battery cell manufacturers could limit Europe’s ability to develop its own battery cell industry and compete in the global market. This could have a negative impact on European jobs and economic growth.

- Environmental Sustainability:The production of battery cells is a resource-intensive process, and reliance on imported battery cells could increase Europe’s carbon footprint. To mitigate this risk, Europe needs to ensure that its battery cell production is sustainable and environmentally friendly.

Europe’s Dependence on China for Battery Cells

The European Union’s ambition to become a leader in the electric vehicle market is heavily reliant on securing a stable and reliable supply of battery cells. However, Europe currently faces a significant challenge: a heavy dependence on China for these crucial components.

China’s Dominance in the Battery Cell Market

China holds a commanding position in the global battery cell market, accounting for a staggering 75% of global production capacity in 2022. This dominance is a result of several factors, including substantial government investment, a well-developed supply chain, and a strong domestic market for electric vehicles.

Reasons for Europe’s Dependence on China

Europe’s reliance on China for battery cells stems from several key factors:

- Lack of Domestic Production Capacity:Europe has lagged behind in developing its own battery cell production capacity. While several battery cell manufacturing plants are under construction, they are not yet operational and will take time to reach full production.

- Higher Production Costs:Establishing battery cell manufacturing facilities in Europe requires significant capital investment, and the cost of labor and energy is generally higher compared to China.

- Well-Established Chinese Supply Chain:China boasts a mature and integrated supply chain for battery cell production, with readily available materials, components, and manufacturing expertise. This gives Chinese companies a significant cost advantage.

Potential Risks Associated with Dependence

Europe’s dependence on China for battery cells poses several risks:

- Supply Chain Disruptions:Any disruptions to the Chinese supply chain, such as natural disasters, political instability, or trade disputes, could severely impact Europe’s access to battery cells.

- Geopolitical Tensions:The ongoing geopolitical tensions between China and the West could lead to export restrictions or other measures that could disrupt the flow of battery cells to Europe.

- Price Volatility:China’s dominant market position gives it significant pricing power, potentially leading to price fluctuations that could impact the competitiveness of European electric vehicle manufacturers.

The Rise of Homegrown Battery Cell Production in Europe

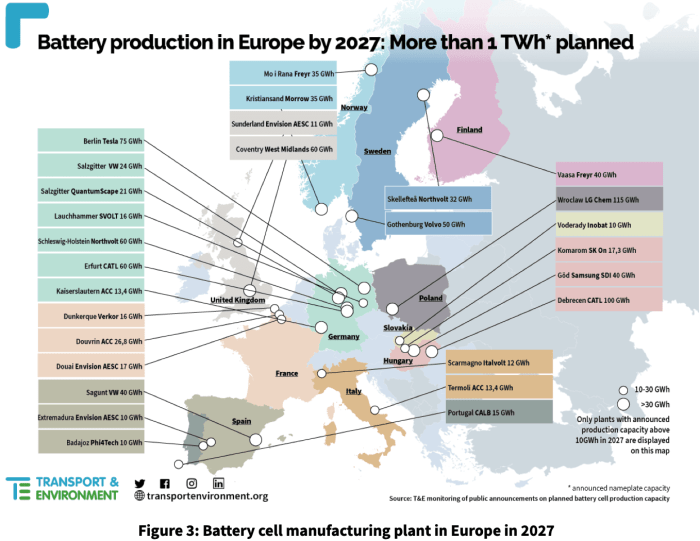

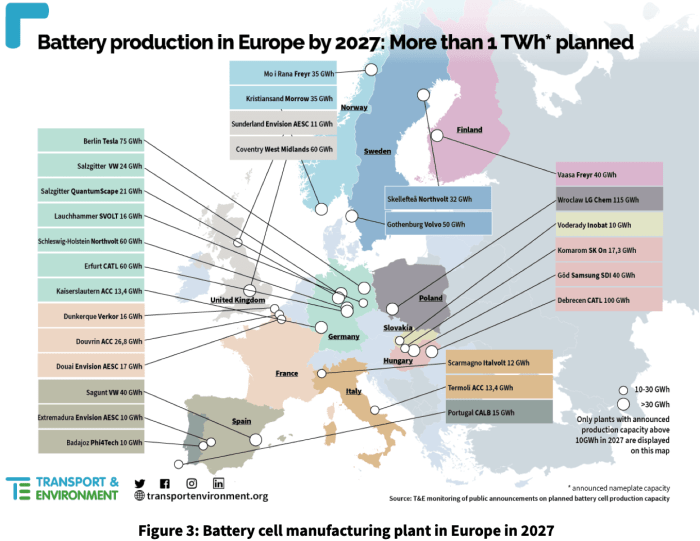

Europe’s dependence on China for battery cells has become a major concern, driving a push for the development of a robust domestic battery cell industry. Recognizing the strategic importance of battery cells in the transition to a green economy, European governments and companies have launched initiatives to boost homegrown production.

These efforts aim to secure the supply chain, reduce reliance on foreign imports, and create new economic opportunities.

Government Initiatives and Investments

The European Union has implemented several policies and programs to support the development of a homegrown battery cell industry. These initiatives include:

- The European Battery Alliance (EBA), a platform for collaboration between industry, research institutions, and governments, aims to foster innovation and create a competitive battery ecosystem in Europe.

- The EU’s “Important Projects of Common European Interest” (IPCEI) program provides financial support to projects in strategic sectors, including battery production. Several battery cell projects have received funding through this program.

- The European Green Deal, a comprehensive plan to make Europe climate-neutral by 2050, includes investments in renewable energy and electric vehicles, which will drive demand for battery cells.

In addition to EU-level initiatives, individual European countries have also launched their own programs to support battery cell production. For example, Germany has established the “Battery Alliance” and has provided significant financial support to battery cell manufacturers. France has launched its “France 2030” plan, which includes investments in battery production and electric vehicle infrastructure.

Progress Made by European Battery Cell Manufacturers

Despite the challenges, European battery cell manufacturers have made significant progress in recent years. The following are some notable examples:

- Northvolt, a Swedish company, is currently Europe’s largest battery cell manufacturer. It has secured significant investments from governments and private companies and is building a gigafactory in northern Sweden, which is expected to have an annual production capacity of 60 GWh by 2025.

- Other European battery cell manufacturers, such as the German company ACC and the French company Verkor, are also expanding their production capacity and developing new technologies.

- In 2022, the total production capacity of European battery cell manufacturers reached approximately 100 GWh. This is still significantly lower than China’s production capacity, which is estimated to be over 500 GWh. However, European manufacturers are rapidly scaling up their production, and experts predict that Europe will have a significant battery cell manufacturing capacity by 2030.

Challenges Faced by European Battery Cell Manufacturers, Europes homegrown battery cells could end reliance on china by *

While European battery cell manufacturers have made significant progress, they still face several challenges in competing with their Chinese counterparts. These challenges include:

- Cost Competitiveness:Chinese battery cell manufacturers benefit from lower labor costs, access to cheaper raw materials, and government subsidies, making them more cost-competitive. European manufacturers need to find ways to reduce their production costs to compete.

- Scale and Experience:Chinese battery cell manufacturers have a larger scale of production and more experience in the industry. This gives them a competitive advantage in terms of cost efficiency and technological development.

- Supply Chain:China dominates the supply chain for battery cell materials, such as lithium, cobalt, and nickel. European manufacturers need to secure reliable and sustainable sources of these materials to ensure their long-term competitiveness.

- Technological Innovation:China is investing heavily in research and development in battery technology. European manufacturers need to keep pace with technological advancements to remain competitive.

Key Factors for European Battery Cell Success

Europe’s ambition to establish a thriving homegrown battery cell industry is a complex undertaking, requiring a multifaceted approach to ensure success. A confluence of factors will determine the ultimate outcome, ranging from strategic government initiatives to technological advancements.

Government Policies and Incentives

Government policies play a crucial role in fostering a competitive battery cell sector. Effective policies create a favorable environment for investment, innovation, and growth.

Expand your understanding about vivaldi browser integrates mastodon social network in alliance against musk twitter with the sources we offer.

- Financial Support:Governments can provide direct financial support through grants, subsidies, and tax incentives to encourage investment in battery cell production facilities. This can help offset the high initial capital costs associated with building new factories. For instance, the European Union’s “Important Projects of Common European Interest” (IPCEI) program has allocated significant funding for battery projects across member states.

- Research and Development Funding:Investing in research and development (R&D) is essential to drive technological advancements and enhance the competitiveness of European battery cells. Governments can provide grants and funding to support collaborative research projects between universities, research institutions, and industry partners.

- Regulatory Framework:A clear and supportive regulatory framework is vital for attracting investment and fostering innovation. This includes streamlining permitting processes for battery cell factories, setting environmental standards, and establishing safety regulations.

Technological Innovation and Research and Development

Technological innovation is the cornerstone of a successful battery cell industry. Continuous advancements in battery chemistry, materials science, and manufacturing processes are essential to enhance performance, reduce costs, and improve sustainability.

- Next-Generation Battery Technologies:Research and development efforts should focus on developing next-generation battery technologies, such as solid-state batteries, which offer higher energy density, faster charging times, and improved safety compared to conventional lithium-ion batteries. The European Battery Alliance (EBA) has established a research and innovation roadmap that Artikels key areas for technological development.

- Recycling and Sustainability:Sustainable battery production is crucial for environmental responsibility and long-term viability. Research and development efforts should focus on developing efficient and cost-effective recycling processes for end-of-life batteries. This will help reduce reliance on critical raw materials and minimize environmental impact.

- Digitalization and Automation:Leveraging digital technologies and automation in battery cell manufacturing can improve efficiency, reduce costs, and enhance quality control. This includes implementing Industry 4.0 concepts such as data analytics, predictive maintenance, and robotics.

The Impact of Homegrown Battery Cells on European Industries

The rise of homegrown battery cell production in Europe holds immense potential to transform various industries, driving economic growth, creating jobs, and strengthening European supply chains. This shift away from dependence on foreign suppliers, particularly China, has the power to reshape the European economic landscape, fostering innovation and competitiveness.

Impact on the Automotive Industry

The automotive industry stands to benefit significantly from the growth of European battery cell production. As electric vehicles (EVs) continue to gain popularity, a reliable and readily available supply of battery cells is crucial. The development of a robust domestic battery cell industry in Europe will:

- Reduce reliance on imported components:This will ensure a more stable and predictable supply of batteries for EV manufacturers, mitigating the risk of supply chain disruptions.

- Drive innovation and competitiveness:A thriving battery cell industry will encourage research and development in battery technology, leading to the creation of more efficient and cost-effective batteries. This will make European EVs more competitive in the global market.

- Create new jobs:The expansion of battery cell production will generate a significant number of jobs in manufacturing, engineering, research, and related fields, contributing to economic growth in Europe.

For example, the Volkswagen Group has invested heavily in battery cell production in Europe, establishing a joint venture with Northvolt to build a gigafactory in Germany. This investment is expected to create thousands of jobs and strengthen Volkswagen’s position in the EV market.

Impact on the Electronics Industry

The electronics industry, encompassing consumer electronics, laptops, and mobile devices, will also benefit from the increased availability of battery cells produced in Europe. This will:

- Secure supply chains:A domestic battery cell industry will reduce reliance on imports, ensuring a consistent supply of high-quality batteries for electronic devices.

- Boost innovation and competitiveness:The proximity of battery cell manufacturers to electronics companies will facilitate collaboration and innovation, leading to the development of more advanced and efficient batteries.

- Promote sustainable manufacturing:European battery cell production can be aligned with environmental standards, promoting the use of recycled materials and reducing the carbon footprint of the electronics industry.

For instance, the French electronics company Schneider Electric has partnered with the Swedish battery company Northvolt to develop battery storage solutions for its products, demonstrating the potential for collaboration within the European electronics sector.

Impact on the Renewable Energy Sector

The renewable energy sector, including solar and wind power, will experience a significant boost from the development of a homegrown battery cell industry in Europe. Battery storage is essential for stabilizing the intermittent nature of renewable energy sources, enabling a more reliable and efficient energy grid.

- Enhance grid stability:Battery storage systems powered by European-made cells will play a critical role in balancing supply and demand in the electricity grid, improving its reliability and resilience.

- Promote energy independence:A domestic battery cell industry will reduce reliance on imported energy storage solutions, contributing to Europe’s energy independence and security.

- Accelerate the transition to clean energy:The availability of cost-effective battery storage solutions will make renewable energy more viable, accelerating the transition to a low-carbon economy.

The German energy company RWE, for example, has invested in battery storage projects using European-made battery cells to enhance the integration of renewable energy sources into its electricity grid.

Challenges and Opportunities for European Battery Cell Production

Europe’s ambition to become a leading player in the battery cell industry faces numerous challenges, but also presents significant opportunities for growth and innovation.

Challenges Faced by European Battery Cell Manufacturers, Europes homegrown battery cells could end reliance on china by *

The European battery cell industry is facing a number of challenges in its quest for self-sufficiency. These include:

- High Production Costs:European manufacturers often face higher production costs compared to their Asian counterparts, particularly in China. This is due to factors such as higher labor costs, stricter environmental regulations, and a less mature supply chain.

- Limited Scale and Experience:European battery cell production is currently operating at a smaller scale than its Asian counterparts, leading to higher unit costs and a lack of economies of scale. This also translates to less experience in large-scale production and process optimization.

- Access to Raw Materials:Europe has limited access to key battery raw materials such as lithium, cobalt, and nickel, which are largely sourced from countries like Australia, Chile, and the Democratic Republic of Congo. This reliance on external suppliers creates vulnerabilities in the supply chain and exposes European manufacturers to price fluctuations and potential disruptions.

- Technological Gap:European manufacturers may lag behind in some key battery technologies, particularly in areas like advanced cell chemistries and manufacturing processes. This technological gap can hinder their ability to compete effectively in the global market.