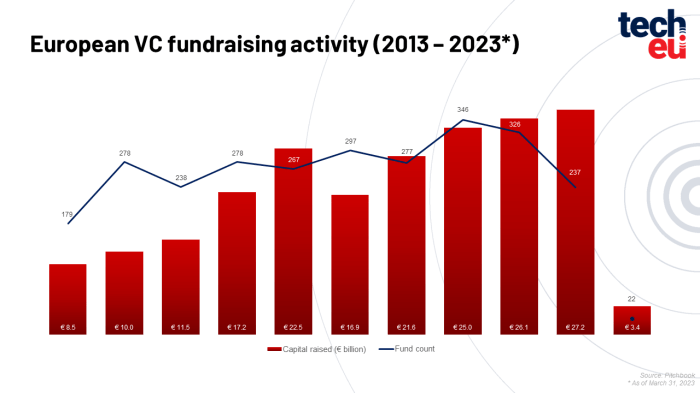

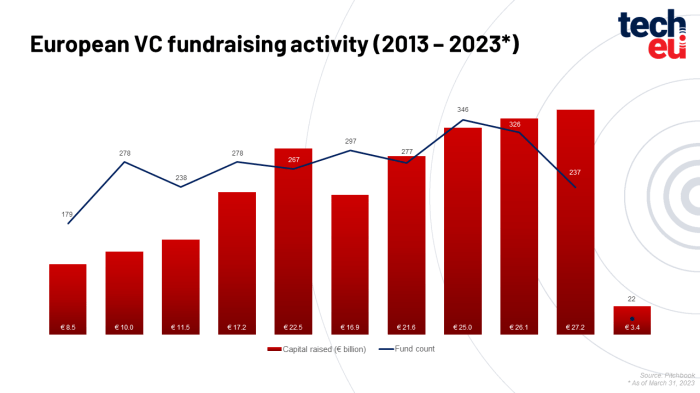

European vc fundraising lowest since * pitchbook – European VC fundraising has hit its lowest point since PitchBook began tracking data, raising concerns about the health of the startup ecosystem. This downturn comes amidst a global economic slowdown, rising inflation, and increased investor caution. While the recent past saw a surge in VC activity across Europe, the current landscape presents a stark contrast, with investors becoming more selective and startups facing a tougher funding environment.

The decline in VC funding has had a significant impact on European startups, particularly those in early stages. Funding rounds are taking longer, valuations are decreasing, and growth prospects are becoming more challenging. Startups are adapting by extending their runway, focusing on profitability, and exploring alternative funding sources.

This shift in the funding landscape has also prompted investors to adjust their strategies, prioritizing proven business models, strong teams, and sustainable growth.

European VC Funding Landscape: European Vc Fundraising Lowest Since * Pitchbook

The European venture capital (VC) funding landscape is currently experiencing a significant downturn, with the total amount of capital raised hitting its lowest point since PitchBook began tracking the data. This decline is a stark contrast to the robust growth seen in recent years, prompting concerns about the future of the European startup ecosystem.

Comparison to Previous Years

The current VC funding environment in Europe is a far cry from the record-breaking years of 2021 and 2022. In 2021, European VC funding reached a record high of €111 billion, fueled by a surge in investor appetite for high-growth technology companies.

However, the landscape has shifted dramatically since then, with 2023 seeing a significant decrease in both the number and size of VC deals.

In this topic, you find that if european smes are going to survive they need tech more than ever is very useful.

Factors Contributing to the Decline

Several factors have contributed to the decline in European VC funding.

- Macroeconomic Conditions:The global economic slowdown, rising inflation, and increasing interest rates have created a challenging environment for investors, making them more cautious about deploying capital.

- Investor Sentiment:The recent market volatility and the potential for a recession have led to a decrease in investor confidence, making them more selective in their investments.

- Market Dynamics:The valuations of tech companies have come down significantly from their peak in 2021, making investors less willing to pay high prices for early-stage startups.

Impact on Startups

The downturn in European VC funding has significant implications for startups, impacting their ability to secure funding, scale their operations, and ultimately, achieve their growth goals. The decreased availability of capital forces startups to adapt their strategies and prioritize their resource allocation to navigate the challenging funding environment.

Funding Rounds and Valuations

The reduced VC funding has directly impacted the funding rounds and valuations of European startups. Startups are finding it more challenging to secure funding, particularly in later stages, as investors become more cautious with their investments. This trend has led to a slowdown in funding rounds and a decrease in valuations for many startups.

A recent report by PitchBook revealed that the average seed round size in Europe declined by 15% in the first quarter of 2023 compared to the same period in 2022.

This trend is particularly noticeable in the later stages of funding, where investors are looking for strong traction and proven business models before committing significant capital. Startups that are unable to secure funding at the desired valuation may have to adjust their growth plans or consider alternative funding options.

Growth Prospects

The funding crunch can hinder the growth prospects of European startups. Limited access to capital can make it difficult for startups to scale their operations, hire new talent, and invest in marketing and product development. This can result in slower growth rates and potentially limit their ability to compete effectively in the market.

For example, the London-based fintech startup, GoCardless, recently announced a layoff of 10% of its workforce citing the challenging economic environment and the need to prioritize profitability over growth.

Strategies for Startups

In this challenging funding environment, startups need to adopt strategies that focus on efficiency, profitability, and sustainable growth. Here are some key strategies:

- Prioritize Profitability:Startups need to demonstrate strong unit economics and focus on generating revenue. Investors are looking for companies with a clear path to profitability, even if it means sacrificing some growth in the short term.

- Extend Runway:Startups should carefully manage their cash flow and extend their runway by minimizing expenses and maximizing revenue. This will allow them to weather the funding crunch and remain operational until the market improves.

- Explore Alternative Funding Sources:Startups should consider alternative funding sources such as debt financing, government grants, and angel investors. These sources can provide additional capital without the need for equity dilution.

- Focus on Value Creation:Startups should focus on delivering value to their customers and building a strong brand. This will help them attract investors and secure future funding rounds.

Investor Perspectives

The decline in European VC funding has prompted a shift in investor sentiment. Investors are now adopting a more cautious approach, carefully evaluating opportunities and prioritizing investments with a higher likelihood of success. This cautious approach reflects the economic uncertainty and the need to ensure strong returns in a challenging market.

Investment Criteria and Priorities

VCs are increasingly emphasizing key investment criteria and priorities in the current market. They are focusing on companies with strong fundamentals, a clear path to profitability, and a proven ability to navigate economic headwinds.

- Strong Unit Economics:VCs are looking for companies with sustainable and scalable business models, demonstrating strong unit economics. This involves analyzing metrics such as customer acquisition cost (CAC), customer lifetime value (CLTV), and gross margins. For example, a SaaS company with a high CAC and low CLTV would be a red flag for investors.

- Proven Traction:VCs are prioritizing companies with demonstrable market traction, indicating product-market fit and strong customer demand. This includes metrics such as revenue growth, customer acquisition rate, and user engagement. For example, a company with a rapidly growing user base and increasing revenue would be more attractive to investors.

- Experienced Management Team:VCs are seeking companies led by experienced and capable management teams with a proven track record of success. This includes expertise in the relevant industry, strong leadership qualities, and a clear vision for the company’s future.

- Market Size and Growth Potential:VCs are focusing on companies operating in large and growing markets with significant potential for expansion. This involves analyzing the overall market size, growth rate, and competitive landscape. For example, a company operating in a niche market with limited growth potential would be less attractive to investors.

Strategies for Navigating the Funding Landscape

VCs are employing various strategies to navigate the current funding landscape, including:

- Increased Due Diligence:VCs are conducting more thorough due diligence, scrutinizing financial statements, market analysis, and management teams. This involves examining the company’s historical performance, future projections, and competitive landscape.

- Focus on Later-Stage Investments:VCs are increasingly investing in later-stage companies with established revenue streams and strong market positions. This approach reduces risk and provides a faster path to liquidity. For example, a Series B or C funding round would be more attractive than a seed round in the current market.

- Seeking Co-Investment Opportunities:VCs are collaborating with other investors to share risk and increase investment size. This approach allows them to invest in larger and more promising companies.

- Prioritizing Portfolio Optimization:VCs are actively managing their portfolios, focusing on companies with the highest potential for growth and profitability. This involves identifying underperforming companies and potentially divesting from them.

Future Outlook

While the current downturn in European VC funding presents challenges, it’s crucial to remember that the long-term outlook for the European startup ecosystem remains positive. Several factors suggest that the VC landscape will recover and continue to grow, albeit with a more cautious approach.

Potential Trends and Predictions

The current funding environment will likely influence future VC activity in Europe, leading to several potential trends:

- Increased Focus on Profitability:Investors will prioritize startups with strong unit economics and clear paths to profitability. This shift reflects the current economic climate and the need for sustainable business models.

- Emphasis on Later-Stage Funding:Seed and early-stage funding rounds might become more selective, with a greater focus on later-stage companies that have proven traction and are closer to achieving profitability.

- Rise of Alternative Funding Sources:Startups may explore alternative funding options, such as revenue-based financing, crowdfunding, or government grants, to reduce their reliance on traditional VC funding.

- Regional Diversification:While major hubs like London and Berlin will remain important, VC activity is expected to diversify across Europe, with emerging ecosystems in countries like Spain, Portugal, and Eastern Europe gaining momentum.

Factors Influencing Future VC Funding

Several factors will shape the future of VC funding in Europe, including:

- Regulatory Changes:The European Union’s regulatory framework for startups and technology companies, such as the proposed AI Act, will influence VC investment strategies and the types of startups attracting funding.

- Technological Advancements:Emerging technologies like artificial intelligence, blockchain, and quantum computing will continue to drive innovation and attract VC investment, creating opportunities for startups in these fields.

- Economic Recovery:The pace and strength of economic recovery in Europe will significantly impact VC activity. A robust economic environment will foster investor confidence and encourage increased investment in startups.

Long-Term Implications for the European Startup Ecosystem

The current funding environment presents both challenges and opportunities for the European startup ecosystem:

- Increased Competition:The more selective funding environment will lead to increased competition among startups for limited capital, requiring them to differentiate themselves and demonstrate strong value propositions.

- Focus on Sustainability:The emphasis on profitability will encourage startups to develop sustainable business models and focus on long-term growth, fostering a more mature and resilient startup ecosystem.

- Potential for Innovation:The need to find alternative funding sources and adapt to changing market conditions could stimulate innovation and creativity within the European startup ecosystem.

Key Statistics and Data

Understanding the European VC funding landscape requires examining key statistics and data to gain insights into the current trends and future outlook. This section delves into the data to provide a comprehensive picture of the European VC funding ecosystem.

Total Funding Raised

The total funding raised by European VC-backed companies has been declining in recent years. According to PitchBook data, total funding raised in 2022 was $105 billion, down from $118 billion in 2021 and $120 billion in 2020.

Average Deal Size

The average deal size has also been decreasing, indicating a shift towards smaller investments. In 2022, the average deal size was $11 million, down from $12 million in 2021 and $13 million in 2020.

Number of Deals, European vc fundraising lowest since * pitchbook

Despite the decrease in total funding and average deal size, the number of deals has remained relatively stable. In 2022, there were 9,500 VC deals, compared to 9,800 in 2021 and 9,600 in 2020.

Sector-Specific Data

The European VC landscape is diverse, with investments spread across various sectors. Here is a breakdown of total funding raised by sector in 2022:

| Sector | Total Funding Raised (in billions) |

|---|---|

| Fintech | $20 |

| Software | $18 |

| E-commerce | $15 |

| Healthcare | $12 |

| Other | $40 |

Country-Specific Data

Investment activity varies across European countries. The UK, Germany, and France are the leading countries for VC funding. Here is a breakdown of total funding raised by country in 2022:

| Country | Total Funding Raised (in billions) |

|---|---|

| United Kingdom | $35 |

| Germany | $20 |

| France | $15 |

| Other | $35 |

Stage of Investment

VC investments are typically made at different stages of a company’s lifecycle. Here is a breakdown of total funding raised by stage of investment in 2022: