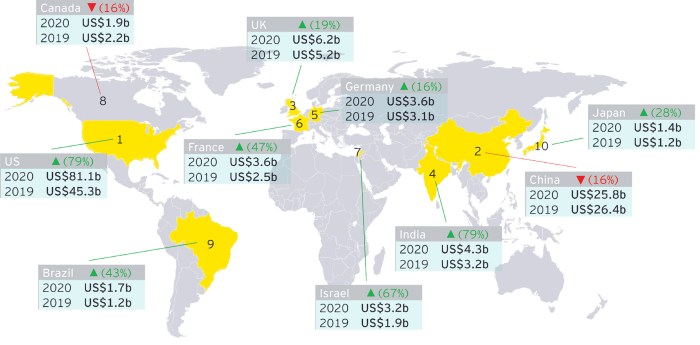

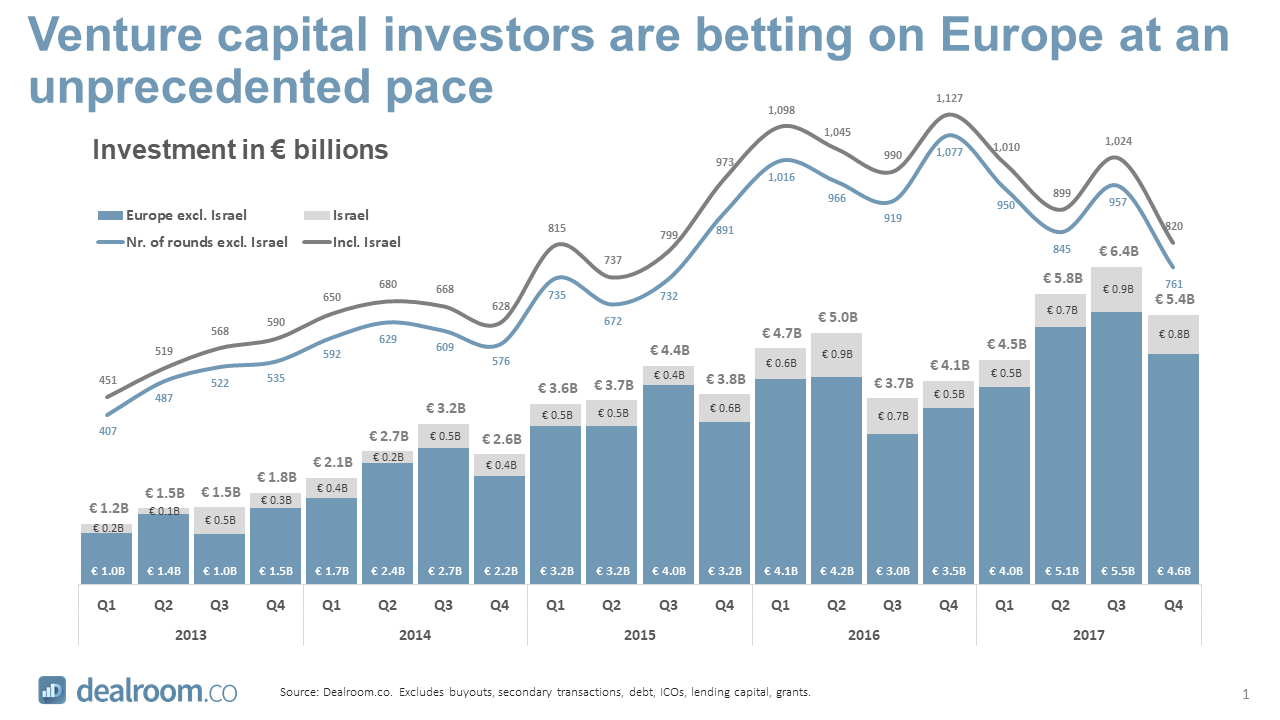

European VC funding increasing is a powerful trend, signaling a shift in the global startup landscape. The continent is experiencing a surge in investment, fueling innovation and attracting top talent. This surge is driven by several factors, including a growing number of promising startups, a favorable regulatory environment, and the increasing availability of capital from both domestic and international investors.

This influx of funding is transforming the European startup scene, empowering entrepreneurs to develop cutting-edge technologies and solutions across various industries. From fintech and AI to healthcare and sustainability, European startups are making their mark on the world stage.

Key Sectors Attracting VC Investment

The European venture capital landscape is experiencing a surge in investment, with certain sectors emerging as frontrunners in attracting capital. These sectors are characterized by high growth potential, innovative technologies, and the ability to address pressing societal challenges.

FinTech

FinTech, or financial technology, is a leading sector attracting significant VC investment in Europe. This sector encompasses companies developing innovative solutions for financial services, such as payments, lending, and investment management. The rise of FinTech is driven by several factors, including:* Technological advancements:The development of new technologies, such as blockchain and artificial intelligence (AI), has enabled the creation of more efficient and user-friendly financial services.

Increased demand for digital solutions

Consumers are increasingly seeking convenient and accessible financial services, driving demand for digital solutions.

Regulatory changes

Regulatory changes, such as the introduction of Open Banking, have created new opportunities for FinTech companies to innovate and disrupt traditional financial institutions.Examples of successful European FinTech startups include:* Wise (formerly TransferWise):A global money transfer platform that offers low-cost international payments.

GoCardless

A leading direct debit provider that simplifies recurring payments for businesses.

Xentral

A cloud-based ERP system designed specifically for small and medium-sized enterprises (SMEs).

E-commerce

E-commerce is another sector attracting substantial VC investment in Europe. The rise of online shopping, fueled by the COVID-19 pandemic and the increasing adoption of digital technologies, has created significant opportunities for e-commerce businesses. Key factors driving VC interest in this sector include:* Growing online retail market:The European online retail market is expected to continue growing in the coming years, offering significant potential for e-commerce companies.

Do not overlook explore the latest data about eu consortium edge ai design proposals.

Shifting consumer preferences

Consumers are increasingly comfortable shopping online, driving demand for innovative e-commerce solutions.

Technological advancements

The development of new technologies, such as artificial intelligence (AI) and machine learning, is enabling e-commerce companies to personalize customer experiences and optimize operations.Examples of successful European e-commerce startups include:* Zalando:A leading online fashion retailer that offers a wide range of clothing and accessories.

The Hut Group

A global online retailer that operates a portfolio of e-commerce brands across various sectors.

Bolt

A ride-hailing and food delivery platform that operates in several European countries.

HealthTech

HealthTech, or health technology, is a rapidly growing sector that is attracting significant VC investment in Europe. This sector encompasses companies developing innovative solutions for healthcare, such as telemedicine, diagnostics, and personalized medicine. The rise of HealthTech is driven by several factors, including:* Aging population:Europe’s aging population is creating an increasing demand for healthcare services, driving the need for innovative solutions.

Technological advancements

The development of new technologies, such as artificial intelligence (AI) and big data analytics, is enabling the development of more efficient and personalized healthcare solutions.

Shifting consumer preferences

Consumers are increasingly seeking convenient and accessible healthcare solutions, driving demand for digital healthcare services.Examples of successful European HealthTech startups include:* Babylon Health:A digital healthcare platform that provides online consultations and medical services.

Kry (formerly Livi)

A telemedicine platform that offers virtual consultations with doctors and therapists.

Doctolib

A platform that allows patients to book appointments with doctors and other healthcare professionals online.

Impact of European VC Funding: European Vc Funding Increasing

The surge in European VC funding is not merely a financial phenomenon; it’s a transformative force shaping the continent’s economic landscape. This influx of capital is fueling innovation, creating jobs, and attracting talent, ultimately positioning Europe as a global leader in the technology and startup ecosystem.

Impact on Innovation, European vc funding increasing

Increased VC funding is directly impacting the European startup ecosystem by providing the necessary resources for companies to develop and scale their innovative ideas. This funding allows startups to invest in research and development, hire top talent, and build robust infrastructure, ultimately accelerating the pace of innovation.

For instance, the rise of European deep tech startups, focused on areas like artificial intelligence, biotechnology, and quantum computing, is a direct result of increased VC funding.

Impact on Job Creation

The growth of the European startup ecosystem, driven by VC funding, is creating a significant number of new jobs. Startups are hiring across various roles, from software engineers and product managers to marketing specialists and data analysts. This job creation not only benefits individual entrepreneurs and employees but also contributes to overall economic growth and development.

The European Commission estimates that startups and scale-ups are responsible for creating over 10 million jobs in Europe.

Impact on Talent Attraction

The influx of VC funding is making Europe a more attractive destination for talented entrepreneurs and professionals from around the world. The availability of funding, coupled with the growth of the startup ecosystem, is creating a vibrant and dynamic environment for ambitious individuals seeking to make a mark.

For example, the rise of tech hubs like Berlin, London, and Amsterdam is attracting a global pool of talent, further strengthening the European startup ecosystem.

Challenges and Opportunities

While European VC funding is on the rise, several challenges remain for startups seeking to access this capital. These challenges are often linked to the unique characteristics of the European startup ecosystem. However, the potential for further growth in European VC funding is significant, presenting exciting opportunities for startups and investors alike.

Challenges Faced by European Startups

- Limited Access to Funding:European startups often face difficulties in securing funding compared to their counterparts in the US. This is due to several factors, including a smaller pool of venture capital, a more risk-averse investment culture, and a lack of established exit routes.

This can make it challenging for startups to scale and achieve significant growth.

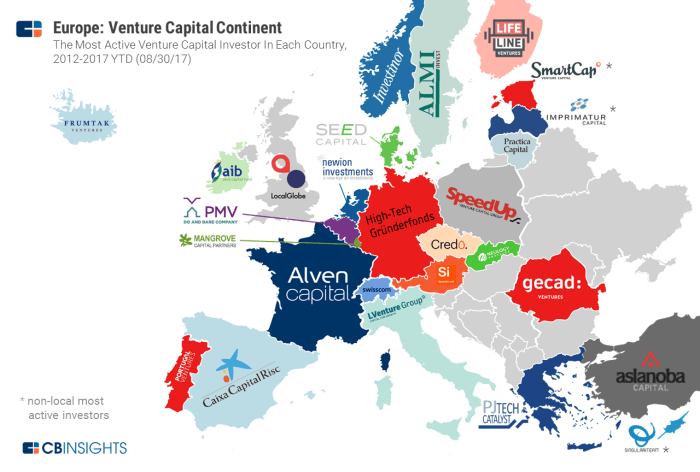

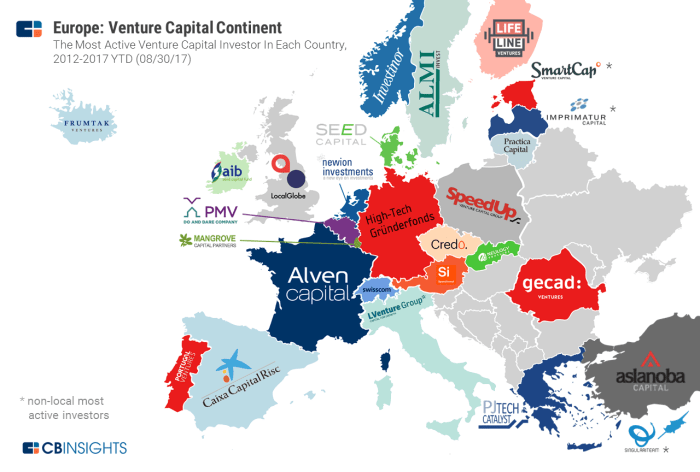

- Fragmentation of the Market:The European VC market is fragmented across different countries, with varying levels of investment activity. This can make it difficult for startups to navigate the different funding landscapes and find the right investors.

- Lack of Experienced Investors:While the number of VC funds in Europe is increasing, there is still a shortage of experienced investors with a deep understanding of the startup ecosystem. This can make it challenging for startups to secure funding from investors who can provide valuable guidance and support.

Potential for Growth in European VC Funding

- Increasing Investment Activity:The European VC market is experiencing a significant surge in investment activity, fueled by a growing number of successful startups and a greater awareness of the potential for high returns.

- Government Initiatives:Governments across Europe are implementing policies to encourage VC investment, including tax breaks, grants, and programs to support early-stage startups.

- Rise of New Technologies:The emergence of new technologies, such as artificial intelligence, blockchain, and biotechnology, is creating new opportunities for innovation and attracting significant VC investment.

Overcoming Challenges and Capitalizing on Opportunities

- Focus on Scalability:European startups need to demonstrate strong potential for scalability to attract VC funding. This means developing a business model that can be replicated across different markets and achieve significant growth.

- Build Strong Networks:Startups should actively build relationships with investors, mentors, and other key stakeholders in the European startup ecosystem.

This can be achieved through attending industry events, joining startup accelerators, and participating in online communities.

- Embrace the Digital Landscape:The digital landscape is transforming the way startups access funding. Startups should leverage online platforms, crowdfunding, and other digital tools to connect with investors and raise capital.

- Focus on Global Markets:European startups should consider targeting global markets from the outset. This can help them attract investors who are looking for companies with international growth potential.

Notable European VC Funds

The European venture capital (VC) ecosystem is thriving, attracting a diverse range of investors and nurturing innovative startups across various sectors. Several prominent VC funds play a crucial role in driving this growth, providing capital and expertise to promising companies.

Prominent European VC Funds

These funds have a proven track record of backing successful startups and contributing to the European tech landscape: