European startups funding down exits muted valuations flat – European Startups: Funding Down, Exits Muted, Valuations Flat – this title succinctly captures the current state of the European startup ecosystem. While the region has seen tremendous growth in recent years, the landscape is now facing headwinds, with funding rounds becoming less frequent, exits becoming more muted, and valuations stagnating.

This trend raises questions about the future of European startups and their ability to compete on a global scale.

The decrease in funding is a direct result of global economic uncertainty and a shift in investor sentiment. Venture capitalists are becoming more cautious with their investments, leading to a decrease in the number and size of funding rounds. This trend is particularly noticeable in Europe, where startups are often reliant on external funding to scale their operations.

European Startup Funding Landscape

The European startup ecosystem has experienced significant growth in recent years, attracting substantial investment from venture capitalists and other investors. However, the funding landscape has shifted in 2023, with a noticeable slowdown in deal activity and valuations. This change reflects broader macroeconomic trends, including rising interest rates and concerns about economic growth.

Remember to click wonder brings chefs on wheels to home delivery and gas emissions to understand more comprehensive aspects of the wonder brings chefs on wheels to home delivery and gas emissions topic.

Funding Trends in Europe

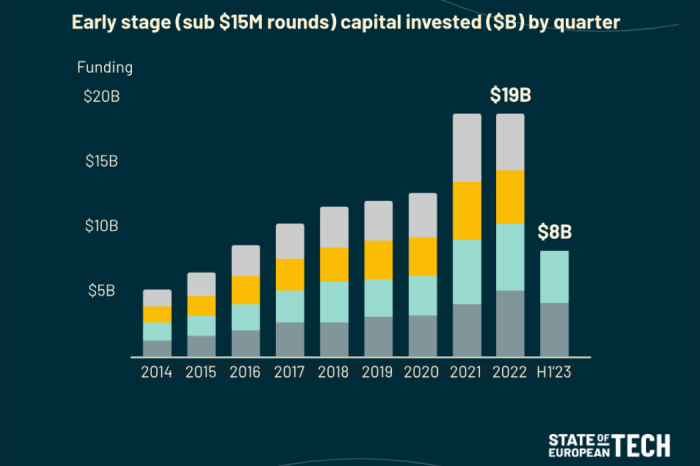

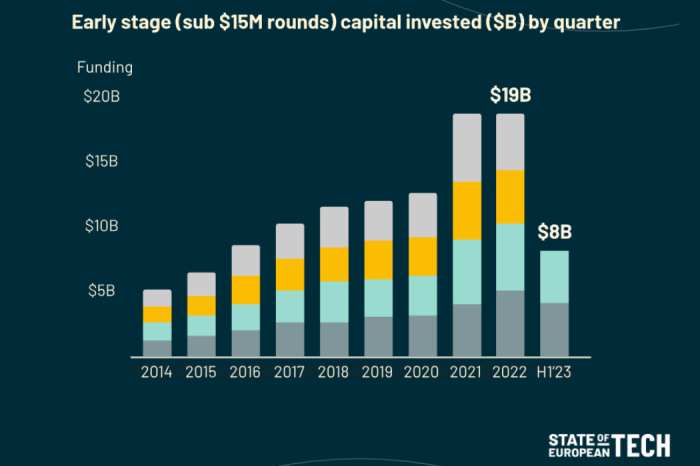

The European startup funding landscape has witnessed a notable decline in 2023 compared to the previous year. According to data from Dealroom, total venture capital investment in European startups decreased by 30% in the first half of 2023, reaching €23 billion.

The average deal size also shrunk, with fewer large rounds being raised. This slowdown can be attributed to various factors, including:

- Rising Interest Rates:Increased interest rates have made it more expensive for startups to borrow money, making investors more cautious about their investments.

- Economic Uncertainty:The global economic outlook has become more uncertain, leading to a decline in investor confidence and a preference for more mature businesses.

- Valuation Corrections:The valuations of many startups had reached unsustainable levels in the previous years, leading to a correction in 2023 as investors became more realistic about their expectations.

Comparison with Other Regions

While Europe has experienced a slowdown in startup funding, the trend is not unique to the region. The US and Asia have also seen a decrease in venture capital investment, although the decline has been less pronounced in some parts of Asia.

However, the overall trend of a funding slowdown suggests a global shift in investor sentiment.

Notable Funding Rounds and Investments

Despite the challenging market conditions, several notable funding rounds and investments have taken place in European startups. These include:

- GoCardless:The UK-based fintech company raised €100 million in Series F funding led by General Atlantic and Salesforce Ventures. This funding will support GoCardless’s global expansion and product development.

- Xentral:The German e-commerce platform raised €70 million in Series C funding led by Insight Partners. The investment will be used to accelerate Xentral’s growth in Europe and beyond.

- Stash:The French fintech startup raised €40 million in Series B funding led by Insight Partners and Eurazeo. Stash aims to revolutionize personal finance management through its innovative app.

Exit Activity and Valuations

The European startup ecosystem has experienced a notable shift in exit activity and valuations in recent years. While the number of startups has grown considerably, the number of successful exits has remained relatively muted, leading to concerns about the overall health of the ecosystem.

Exit Activity

Exit activity, which refers to the process of a startup becoming liquid through means like acquisitions, IPOs, or other forms of monetization, is crucial for investors to realize returns and for founders to cash out on their efforts. The number of exits in Europe has remained relatively low compared to other regions, particularly the US, which has witnessed a more robust exit market.

- Acquisitions:Acquisitions remain the most common form of exit for European startups. Large technology companies, including Google, Amazon, and Microsoft, have actively acquired European startups in various sectors, such as artificial intelligence, fintech, and e-commerce.

- IPOs:Initial Public Offerings (IPOs) have been less frequent in Europe compared to the US. The IPO market has been impacted by factors such as economic uncertainty and investor sentiment, leading to a decline in the number of European startups going public.

- Other forms of liquidity:Other forms of liquidity, such as secondary market transactions or buyouts, have also been less prominent in Europe. These alternative exit routes often involve private equity firms or venture capital funds taking over ownership of the startup.

Reasons for Muted Exit Activity

Several factors contribute to the muted exit activity in the European startup ecosystem:

- Market conditions:The global economic climate, characterized by rising inflation and interest rates, has made investors more cautious, impacting funding rounds and exit valuations.

- Investor sentiment:Investor sentiment towards European startups has become more conservative, leading to a decline in the number of investment deals and a preference for more mature companies with established revenue streams.

- Competition:The intense competition from established players and other startups, particularly in the US, has made it challenging for European startups to gain market share and attract potential acquirers.

Valuations

Valuations of European startups have generally been lower than their counterparts in the US. This discrepancy can be attributed to several factors:

- Economic uncertainty:The ongoing economic uncertainty has led to a more risk-averse approach among investors, resulting in lower valuations for European startups.

- Limited market size:The European market, while large, is fragmented, which can limit the potential growth and scalability of startups compared to the US market.

- Competition:The fierce competition from established players and other startups has put downward pressure on valuations, as investors are more cautious about investing in companies with limited market share.

Impact on Startup Growth

The recent slowdown in European startup funding and muted exit activity has had a significant impact on the growth trajectory of startups across the continent. The decrease in available capital, coupled with lower valuations, has created a challenging environment for startups seeking to scale their operations and achieve profitability.

Challenges Faced by Startups in Securing Funding and Scaling Operations, European startups funding down exits muted valuations flat

The current market conditions have made it more difficult for startups to secure funding. Investors are becoming more cautious and selective in their investments, demanding stronger business models, proven traction, and a clear path to profitability. This increased scrutiny has resulted in longer fundraising cycles and higher hurdles for startups to overcome.

- Reduced Funding Availability:The decline in venture capital investment has limited the amount of capital available for startups. This has made it more difficult for startups to secure the funding they need to grow their businesses.

- Increased Investor Scrutiny:Investors are now demanding more from startups, including a proven track record, a clear path to profitability, and a strong team. This has made it more difficult for startups to secure funding, especially for those in early stages.

- Lower Valuations:The decline in funding has also led to lower valuations for startups. This can make it more difficult for startups to attract talent and raise subsequent rounds of funding.

Examples of Startups Affected by the Current Market Conditions

Several European startups have been impacted by the current market conditions. Some have faced challenges in securing funding, while others have had to adjust their growth plans or even downsize their operations.

- GoCardless:The UK-based fintech company, which helps businesses collect recurring payments, laid off 10% of its workforce in 2023 due to the challenging economic environment.

- Deliveroo:The food delivery platform, which operates in several European countries, saw its share price decline significantly in 2023 after investors expressed concerns about its profitability.

Adaptation Strategies and Alternative Funding Sources

Despite the challenges, many European startups are adapting to the changing landscape and seeking alternative funding sources.

- Bootstrapping:Startups are increasingly relying on bootstrapping, which involves using their own resources to fund their operations. This can help them to reduce their dependence on external funding and maintain control over their businesses.

- Debt Financing:Startups are also exploring debt financing options, such as bank loans and venture debt, as a way to supplement their equity funding.

- Crowdfunding:Crowdfunding platforms have become increasingly popular for startups seeking to raise capital from a large number of individuals.

Future Outlook for European Startups: European Startups Funding Down Exits Muted Valuations Flat

The European startup ecosystem, despite recent challenges, remains a vibrant and promising landscape. While funding and exit activity may have cooled, the underlying fundamentals of innovation and entrepreneurial spirit remain strong. Looking ahead, several factors will shape the future of European startups, presenting both opportunities and challenges.

Factors Influencing Funding and Exit Activity

The current market conditions are influencing funding and exit activity for European startups. However, the future outlook is not solely determined by these current trends. Several factors will play a significant role in shaping the future landscape:

- Macroeconomic Conditions:Global economic uncertainty, inflation, and potential recessions will continue to impact investor sentiment and risk appetite. Startups may face challenges in securing funding, especially during periods of economic downturn.

- Interest Rates and Venture Capital Availability:Rising interest rates and tightening monetary policies can make venture capital less readily available, potentially leading to a decrease in funding rounds and valuations.

- Technological Advancements:Emerging technologies like artificial intelligence, blockchain, and quantum computing will continue to drive innovation and create new opportunities for startups.

- Regulatory Landscape:Government policies and regulations, such as those related to data privacy, competition, and sustainability, will influence the growth and development of startups.

Role of Government Policies and Initiatives

Government policies and initiatives play a crucial role in fostering a supportive environment for startup growth. Governments across Europe are implementing various programs to encourage innovation and entrepreneurship:

- Tax Incentives:Governments are offering tax breaks and incentives to encourage investment in startups, making it more attractive for investors to support early-stage companies.

- Research and Development Grants:Funding for research and development activities helps startups develop innovative technologies and products, leading to stronger competitive advantages.

- Incubator and Accelerator Programs:Government-supported programs provide mentorship, networking opportunities, and access to resources for startups, accelerating their growth and development.

- Public Procurement Opportunities:Governments are increasingly utilizing public procurement to support innovative startups by providing them with opportunities to showcase their solutions and secure contracts.

Emerging Trends and Opportunities

The European startup ecosystem is constantly evolving, presenting new opportunities for entrepreneurs:

- Sustainability and Green Tech:Growing concerns about climate change and environmental sustainability are driving investments in green technologies and sustainable business models.

- HealthTech and Digital Health:Advancements in healthcare technology and increasing demand for personalized healthcare solutions are creating opportunities for startups in the healthtech sector.

- FinTech and Digital Finance:Innovations in financial technology are disrupting traditional financial services, creating opportunities for startups to offer innovative solutions for payments, lending, and investment.

- Cross-Border Collaboration:Increased collaboration between startups across European borders is fostering innovation and creating new markets for growth.