European fintech funding drops first half * – European Fintech Funding Drops in First Half of 2023: The first half of 2023 saw a significant downturn in fintech funding across Europe, marking a departure from the robust growth witnessed in previous years. This decline can be attributed to a confluence of factors, including the global economic slowdown, rising interest rates, and increased investor caution.

The impact of this funding crunch is being felt across various fintech sectors, with payments, lending, and investment management experiencing the most noticeable effects.

Despite the challenges, the European fintech landscape remains dynamic, with innovative startups and established players continuing to push boundaries. However, the current funding environment necessitates a more strategic approach to growth, with companies seeking to optimize their operations, secure alternative funding sources, and prioritize profitability.

This period of adjustment presents both opportunities and hurdles for fintech companies, demanding adaptability and resilience in navigating the evolving funding landscape.

Fintech Funding Landscape in Europe

The first half of 2023 saw a notable decline in fintech funding in Europe, marking a shift from the robust growth witnessed in previous years. This downturn reflects a confluence of factors, including a challenging economic environment, a cautious investor sentiment, and intensified competition within the sector.

Fintech Funding Trends in Europe

The overall fintech funding in Europe during the first half of 2023 experienced a significant decrease compared to the previous year. This decline can be attributed to a combination of factors, including:

- Economic Headwinds:The global economic slowdown, coupled with rising inflation and interest rates, has created a more risk-averse environment for investors, leading to a reduction in capital available for fintech startups.

- Investor Sentiment:The tech sector, including fintech, has faced a correction in valuations, prompting investors to become more selective and demanding in their investment decisions. This has resulted in a decline in the number and size of funding rounds.

- Increased Competition:The fintech landscape in Europe has become increasingly crowded, with numerous startups vying for a limited pool of investors and customers. This intensified competition has made it more challenging for new entrants to secure funding.

Comparison to Previous Years

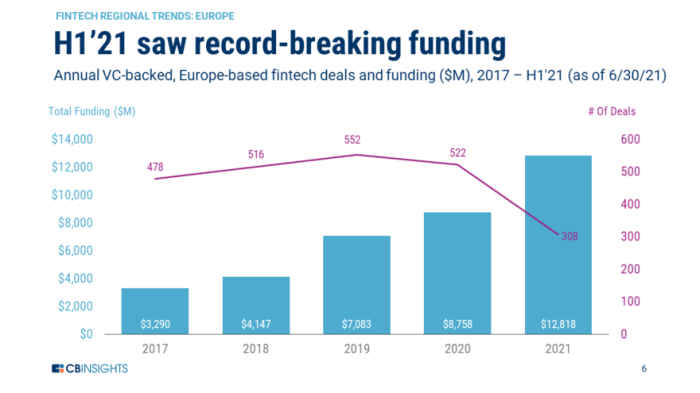

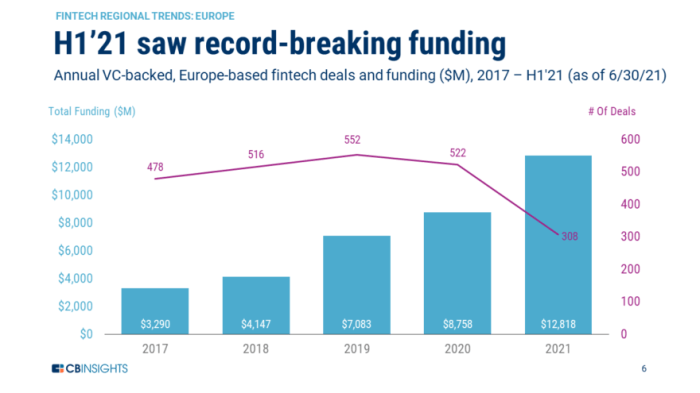

Compared to the previous years, the first half of 2023 witnessed a sharp decline in fintech funding activity in Europe. In 2021 and 2022, the region saw record levels of investment, fueled by a surge in venture capital activity and a favorable regulatory environment.

However, the current economic climate has dampened investor enthusiasm, resulting in a significant reduction in funding rounds and deal sizes.

Key Factors Influencing the Decline

Several factors have contributed to the decline in fintech funding in Europe during the first half of 2023:

- Macroeconomic Conditions:The global economic slowdown, driven by factors such as rising inflation, interest rate hikes, and geopolitical uncertainties, has made investors more cautious about deploying capital, particularly in high-growth sectors like fintech.

- Investor Sentiment:The tech sector, including fintech, has experienced a correction in valuations, leading investors to become more discerning in their investment decisions. This has resulted in a shift towards later-stage companies with proven business models and a stronger track record.

- Market Competition:The European fintech landscape has become increasingly competitive, with numerous startups vying for a limited pool of investors and customers. This intense competition has made it more challenging for new entrants to secure funding and gain market share.

Impact on Different Fintech Sectors

The decline in fintech funding in Europe has had a significant impact on various sectors, forcing companies to adapt their strategies and operations. This section will analyze the impact on specific fintech sectors, such as payments, lending, and investment management, discussing the challenges they face and how they are adapting to the changing funding environment.

Payments

The payments sector has seen a slowdown in funding, reflecting the maturing nature of the industry and the increasing competition from established players. The challenges faced by payments companies include:* Increased competition:The market is becoming increasingly crowded, with traditional financial institutions and large technology companies entering the space.

Do not overlook explore the latest data about why russia cyber army has struggled to impact ukraine war.

Regulatory hurdles

The payments industry is subject to strict regulations, which can make it difficult for startups to scale.

Profitability concerns

Many payments companies are still struggling to achieve profitability, which can make them less attractive to investors.Despite these challenges, the payments sector remains a promising area for fintech innovation. Companies are adapting to the changing funding environment by:* Focusing on niche markets:Some companies are focusing on specific market segments, such as cross-border payments or payments for specific industries.

Developing new technologies

Companies are investing in innovative technologies, such as blockchain and artificial intelligence, to improve efficiency and reduce costs.

Partnering with established players

Many startups are partnering with traditional financial institutions to gain access to their customer base and infrastructure.Examples of payments companies that have been affected by the funding decline include:* GoCardless:This UK-based company provides direct debit services. In 2023, GoCardless raised $95 million in funding, but it was a smaller round than previous years.

Wise

This global payments company, formerly known as TransferWise, saw a significant drop in its valuation in 2023, highlighting the impact of the funding environment on even established players.

Investor Perspective: European Fintech Funding Drops First Half *

The first half of 2023 saw a significant drop in fintech funding in Europe, prompting investors to adopt a more cautious approach. This shift in sentiment is driven by a confluence of factors, including macroeconomic uncertainties, rising interest rates, and a more competitive landscape.

Investor Concerns, European fintech funding drops first half *

Investors are grappling with a number of concerns that are influencing their investment decisions in the European fintech sector.

- Economic Uncertainty:The global economic outlook remains uncertain, with inflation, rising interest rates, and potential recessionary pressures weighing on investor sentiment. This uncertainty makes investors more risk-averse, leading them to prioritize investments with a clear path to profitability and a strong track record.

- Valuation Concerns:The high valuations seen in the fintech sector during the boom years are now being scrutinized, with investors demanding more evidence of sustainable growth and profitability before committing capital. This shift in focus has led to a decline in funding for early-stage companies that are still developing their business models.

- Regulatory Landscape:The regulatory landscape for fintech is evolving rapidly, with new rules and regulations being introduced across Europe. This regulatory uncertainty can make it difficult for investors to assess the long-term viability of fintech businesses, particularly those operating in areas such as payments, lending, and data privacy.

Investment Criteria

In light of these concerns, investors are now prioritizing specific criteria in their decision-making process:

- Strong Unit Economics:Investors are demanding a clear understanding of a company’s unit economics, including its cost of customer acquisition, customer lifetime value, and profitability metrics. This focus on profitability is a departure from the previous emphasis on growth at any cost.

- Proven Business Model:Investors are seeking companies with proven business models that have demonstrated traction in the market. This means prioritizing companies that have achieved product-market fit and have a clear path to scale.

- Experienced Management Team:Investors are placing a premium on experienced management teams with a track record of success in the fintech industry. This focus on expertise is driven by the need for companies to navigate the complex regulatory landscape and manage the challenges of scaling a business.

- Sustainable Growth Strategy:Investors are looking for companies with sustainable growth strategies that are not reliant on external factors such as market bubbles or government subsidies. This focus on long-term sustainability is essential for ensuring that investments deliver returns over the long term.

Future Outlook

While the first half of 2023 saw a dip in fintech funding in Europe, the long-term outlook remains optimistic. The fintech sector continues to be a key driver of innovation and growth in the European economy, and investors are still eager to capitalize on the opportunities presented by this dynamic industry.

Factors Influencing Future Funding

Several factors will influence the future of fintech funding in Europe, including:

- Regulatory Landscape: The regulatory landscape for fintech is evolving rapidly. New regulations, such as the European Union’s Digital Finance Package, are being introduced to address emerging risks and foster innovation. These regulations will have a significant impact on how fintech companies operate and raise capital.

For example, the Digital Finance Package aims to create a more level playing field for fintech companies by harmonizing regulatory requirements across the EU. This could make it easier for fintech companies to scale their operations and attract investors.

- Technological Advancements: The rapid pace of technological advancements, such as artificial intelligence, blockchain, and cloud computing, is creating new opportunities for fintech companies. These technologies are enabling the development of innovative financial products and services that are transforming the way people manage their money.

As these technologies continue to mature, we can expect to see even more disruptive fintech solutions emerge, attracting further investment.

- Macroeconomic Conditions: The global macroeconomic environment is also a key factor influencing fintech funding. Rising inflation, interest rate hikes, and geopolitical uncertainty are creating a challenging environment for businesses. These factors could lead to a slowdown in fintech funding, as investors become more cautious and prioritize investments in more established companies.

However, the fintech sector’s resilience and ability to adapt to changing conditions could make it a more attractive investment option compared to other sectors during periods of economic instability.

Navigating the Funding Landscape

Fintech companies can navigate the current funding landscape and position themselves for future success by:

- Focusing on Profitability: Investors are increasingly looking for fintech companies that can demonstrate a clear path to profitability. This means that fintech companies need to focus on building sustainable business models and generating revenue. Investors are looking for strong unit economics and a clear understanding of how the company will achieve profitability.

This can be achieved by demonstrating strong customer acquisition and retention strategies, efficient cost management, and a robust revenue model.

- Building a Strong Team: Investors are looking for fintech companies with strong leadership teams that have a deep understanding of the financial industry and a proven track record of success. Building a team with diverse skills and experience, including technology, finance, and business development, is crucial.

This will ensure that the company has the necessary expertise to navigate the complex and competitive fintech landscape.

- Demonstrating Value Proposition: Fintech companies need to clearly articulate their value proposition and demonstrate how they are solving a real problem for customers. Investors are looking for companies that have a clear understanding of their target market and a compelling solution that addresses a specific need.

This can be achieved through market research, customer feedback, and a well-defined value proposition that highlights the unique benefits of the company’s products or services.