Eu australia deal critical minerals supply tensions china – EU-Australia deal critical minerals supply tensions china – this is a story about a global scramble for resources, strategic alliances, and the potential for geopolitical shifts. The European Union and Australia have joined forces in a bid to secure critical minerals, essential components for modern technologies, amidst growing concerns over China’s dominance in the supply chain.

This partnership seeks to diversify sourcing and reduce reliance on a single nation, adding a new layer of complexity to the already intricate global landscape of mineral trade.

The EU-Australia deal, while aiming to bolster the supply of critical minerals for both parties, also carries significant implications for the global economy, environment, and international relations. It raises questions about the future of resource diplomacy, the potential for trade disputes, and the role of technological innovation in shaping the future of critical mineral production and consumption.

The EU-Australia Critical Minerals Deal

The EU-Australia Critical Minerals Deal, formally known as the Joint Declaration on Strategic Minerals Cooperation, marks a significant step in bolstering global supply chains for critical minerals. This partnership aims to address growing concerns about the reliance on China for these vital materials, which are essential for manufacturing electric vehicles, renewable energy technologies, and other advanced industries.

Key Objectives of the EU-Australia Deal

The EU-Australia Critical Minerals Deal focuses on securing a stable and reliable supply of critical minerals for both parties. The agreement emphasizes collaboration on several key areas:

- Supply Chain Diversification:The partnership seeks to reduce dependence on single-source suppliers, particularly China, which currently dominates the global market for many critical minerals. This will enhance the resilience of supply chains and mitigate potential disruptions.

- Investment and Development:The agreement encourages investment in exploration, mining, and processing activities in both the EU and Australia, promoting the development of new and sustainable sources of critical minerals.

- Technology and Innovation:The deal emphasizes the need for collaborative research and development in areas such as sustainable mining practices, resource efficiency, and advanced recycling technologies.

- Trade and Market Access:The partnership aims to facilitate trade and market access for critical minerals between the EU and Australia, reducing barriers and promoting a more integrated global market.

Specific Minerals Covered by the Agreement

The EU-Australia Critical Minerals Deal encompasses a wide range of minerals crucial for modern technologies, including:

- Lithium:A key component in electric vehicle batteries and energy storage systems.

- Cobalt:Used in lithium-ion batteries and other electronic devices.

- Nickel:Essential for stainless steel production and electric vehicle batteries.

- Rare Earth Elements (REE):Vital for high-tech applications such as smartphones, wind turbines, and electric motors.

- Graphite:Used in electric vehicle batteries, nuclear reactors, and other industrial applications.

Anticipated Benefits for the EU and Australia

The EU-Australia Critical Minerals Deal is expected to yield significant benefits for both parties:

- EU:The deal provides the EU with access to a secure and reliable supply of critical minerals, reducing its reliance on China and bolstering its industrial competitiveness in sectors like renewable energy and electric vehicles.

- Australia:The partnership offers Australia a strong and stable market for its critical minerals, boosting its economy and creating new jobs in the mining and related industries.

Critical Minerals and Global Supply Chains

The global demand for critical minerals is rapidly increasing, driven by the transition to clean energy technologies, electrification, and digitalization. These minerals are essential components of batteries, solar panels, wind turbines, electric vehicles, and other technologies that are crucial for achieving a sustainable future.

However, the supply of these minerals is concentrated in a few countries, raising concerns about potential disruptions to global supply chains.

Global Demand and Supply Dynamics

The demand for critical minerals is expected to grow significantly in the coming years. The International Energy Agency (IEA) estimates that the demand for lithium, cobalt, nickel, and manganese will increase by five to ten times by 2040 to meet the needs of the global energy transition.

The rising demand for these minerals is driven by the rapid adoption of electric vehicles, renewable energy technologies, and other technologies that rely on these minerals.However, the supply of these minerals is geographically concentrated. The majority of the world’s lithium reserves are located in Australia, Chile, and Argentina.

Cobalt production is dominated by the Democratic Republic of Congo, which accounts for over 70% of global production. Nickel is mainly produced in Indonesia, the Philippines, and Australia. Manganese is extracted in South Africa, Australia, and Gabon.

Major Producers and Consumers of Critical Minerals

The global supply of critical minerals is dominated by a few major producers. China is a significant producer and consumer of critical minerals, accounting for a large share of global production and consumption of lithium, cobalt, nickel, and manganese. Other major producers include Australia, Chile, Indonesia, the Democratic Republic of Congo, and South Africa.The major consumers of critical minerals are primarily located in developed countries, including China, the United States, Europe, and Japan.

These countries are heavily reliant on imports for their critical mineral needs, making them vulnerable to supply disruptions.

Potential Risks and Vulnerabilities in Global Supply Chains

The global supply chains for critical minerals are vulnerable to a range of risks and disruptions. These risks include:

- Geopolitical instability: Conflicts and political instability in key producing countries can disrupt supply chains and increase prices.

- Environmental concerns: Mining operations can have significant environmental impacts, leading to regulations and protests that can disrupt production.

- Market volatility: The prices of critical minerals can fluctuate significantly due to supply and demand imbalances, creating uncertainty for manufacturers and consumers.

- Concentration of supply: The concentration of supply in a few countries makes global supply chains vulnerable to disruptions caused by natural disasters, political instability, or other unforeseen events.

- Technological advancements: New technologies and recycling processes can reduce the demand for certain critical minerals, leading to market disruptions.

The risks and vulnerabilities in global supply chains for critical minerals highlight the need for a more diversified and resilient supply chain. This can be achieved through a combination of strategies, including:

- Developing new sources of supply: Exploring and developing new deposits of critical minerals in different regions can reduce dependence on a few key producers.

- Promoting recycling and reuse: Recycling and reuse of critical minerals can reduce the need for new mining operations and create a more sustainable supply chain.

- Improving transparency and traceability: Ensuring transparency and traceability in supply chains can help identify and mitigate risks related to human rights, environmental impacts, and ethical sourcing.

- Strengthening international cooperation: Collaborative efforts among countries to develop sustainable mining practices, promote responsible sourcing, and share information can improve the resilience of global supply chains.

The global demand for critical minerals is expected to continue growing in the coming years. To ensure a secure and sustainable supply of these essential resources, it is crucial to address the risks and vulnerabilities in global supply chains. This requires a multi-faceted approach that includes diversifying supply, promoting recycling, improving transparency, and strengthening international cooperation.

China’s Role in Critical Minerals

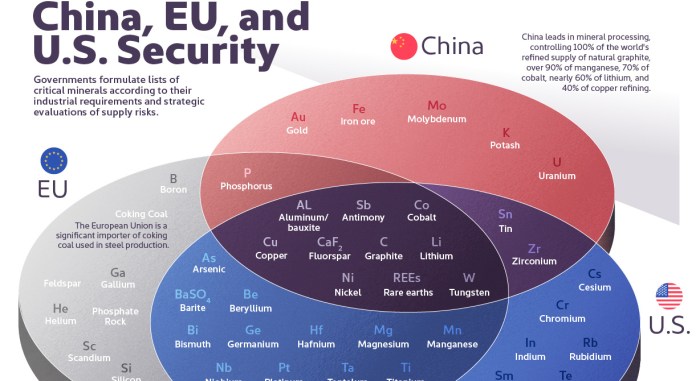

China’s dominance in the critical minerals sector is a significant factor shaping global supply chains and geopolitical dynamics. The country holds a substantial position as a major producer and processor of these essential materials, wielding significant influence over their availability and pricing.

This dominance stems from China’s strategic investments and initiatives in the critical minerals sector, aiming to secure its own supply chain and solidify its global economic standing.

China’s Position as a Major Producer and Processor

China’s role in the critical minerals sector is multifaceted, encompassing both production and processing. The country is a leading producer of several critical minerals, including rare earth elements, lithium, cobalt, and graphite. For example, China accounts for approximately 90% of global rare earth element production, a critical component for various high-tech applications.

This dominance extends to processing, with China refining a substantial proportion of the world’s critical minerals, including lithium, cobalt, and nickel. This processing capacity allows China to exert significant influence over the supply chain, as it can control the quality and availability of refined minerals essential for manufacturing.

China’s Strategic Investments and Initiatives

Recognizing the strategic importance of critical minerals, China has embarked on ambitious initiatives to secure its own supply chain and bolster its global influence. These initiatives include:

- Investments in Mining and Processing:China has actively invested in mining and processing facilities both domestically and internationally, securing access to key resources. For instance, China has invested heavily in lithium mines in Australia and Chile, solidifying its control over the supply chain for electric vehicle batteries.

Check what professionals state about defying gravity this uk based startup is unlocking the potential of space economy and its benefits for the industry.

- Strategic Partnerships:China has forged strategic partnerships with resource-rich countries to secure long-term access to critical minerals. These partnerships often involve joint ventures, infrastructure development, and technology transfer, allowing China to gain a foothold in critical mineral production.

- Research and Development:China has prioritized research and development in the critical minerals sector, focusing on technologies for extraction, processing, and recycling. This emphasis on innovation aims to enhance efficiency, reduce environmental impact, and maintain China’s technological edge in the sector.

Potential Impact of China’s Dominance

China’s dominance in the critical minerals sector presents both opportunities and challenges for the global economy.

- Supply Chain Security:China’s control over critical minerals raises concerns about supply chain security for countries reliant on these materials. Any disruptions to China’s production or processing could have significant implications for global manufacturing and technological development.

- Geopolitical Tensions:China’s dominance has fueled geopolitical tensions, as countries seek to diversify their supply chains and reduce their dependence on China. This has led to increased competition for access to critical minerals and the development of alternative supply chains.

- Price Volatility:China’s control over the market can lead to price volatility, as the country can influence the supply and demand of critical minerals. This can create uncertainty for manufacturers and hinder economic growth.

Strategic Partnerships and Diversification: Eu Australia Deal Critical Minerals Supply Tensions China

The EU-Australia deal is a significant step in the global effort to secure critical mineral supply chains. It highlights the growing importance of strategic partnerships and diversification to reduce reliance on single suppliers, particularly China, which currently dominates the global market for many critical minerals.

This section will examine the EU-Australia deal in the context of other strategic partnerships and explore the challenges and opportunities associated with diversifying critical mineral supply chains.

Comparison with Other Strategic Partnerships

The EU-Australia deal is not the only initiative aimed at securing critical mineral supply chains. Several other strategic partnerships have emerged in recent years, driven by concerns over supply chain vulnerabilities and geopolitical tensions. The EU has also established similar partnerships with other countries, including Canada, Chile, and South Africa.

These partnerships aim to secure access to critical minerals for the EU’s green transition and technological development. The US has also been actively pursuing strategic partnerships for critical minerals. The US-Australia Minerals Dialogue, launched in 2021, aims to strengthen cooperation in critical mineral supply chains.

The US has also signed agreements with other countries, including Canada, Japan, and South Korea, to secure critical mineral supplies.

Potential for Diversifying Critical Mineral Supply Chains

Diversifying critical mineral supply chains is essential for reducing reliance on China and mitigating risks associated with geopolitical tensions. The EU-Australia deal is a step in this direction, but much more needs to be done to create a truly diversified and resilient global supply chain for critical minerals.The potential for diversifying critical mineral supply chains is significant.

Several countries outside China have substantial reserves of critical minerals, including Australia, Canada, Chile, and South Africa. However, diversifying supply chains is not simply a matter of identifying new sources of minerals. It also requires addressing several challenges, including:* Developing new mining and processing capacity:Increasing production of critical minerals requires significant investment in new mining and processing facilities.

Building infrastructure

Transporting minerals from mines to processing facilities and then to end users requires robust infrastructure, including roads, railways, and ports.

Addressing environmental and social concerns

Mining and processing critical minerals can have significant environmental and social impacts, which must be addressed through responsible sourcing and sustainable practices.

Developing new technologies

Advancements in technology, such as improved mining techniques and recycling processes, can help increase the efficiency and sustainability of critical mineral production.

Promoting international cooperation

Effective diversification requires collaboration between governments, industry, and research institutions to address the challenges and opportunities associated with building new supply chains.

Challenges and Opportunities Associated with Establishing New Supply Chains

Establishing new supply chains for critical minerals presents both challenges and opportunities. Challenges:* High investment costs:Developing new mining and processing facilities requires significant capital investment.

Long lead times

Building new infrastructure and establishing new supply chains takes time.

Environmental and social impacts

Mining and processing critical minerals can have negative environmental and social impacts.

Geopolitical risks

Political instability and trade tensions can disrupt supply chains. Opportunities:* New economic opportunities:Developing new critical mineral supply chains can create jobs and economic growth in countries with mineral resources.

Technological innovation

Building new supply chains can drive innovation in mining, processing, and recycling technologies.

Strengthening international partnerships

Collaboration on critical mineral supply chains can foster stronger diplomatic and economic ties between countries.

Addressing climate change

Secure and sustainable supply chains for critical minerals are essential for the transition to a low-carbon economy.

Technological Advancements and Innovation

The race for critical minerals is not just about securing supply chains; it’s also about embracing technological advancements that can reshape the industry. Emerging technologies and innovative approaches are critical to maximizing resource efficiency, reducing environmental impact, and ensuring a sustainable future for critical mineral production.

Emerging Technologies and Innovations

Emerging technologies and innovations hold the potential to revolutionize the production and use of critical minerals. These advancements offer new avenues for resource extraction, processing, and utilization, while simultaneously mitigating environmental concerns.

- Advanced Mining Techniques:Innovations in mining technologies, such as robotic mining, autonomous vehicles, and precision drilling, can improve safety, efficiency, and resource recovery rates. These technologies enable targeted extraction, reducing waste and minimizing environmental disruption.

- Bioleaching and Biomining:Bioleaching and biomining utilize microorganisms to extract minerals from ores, offering a more environmentally friendly alternative to traditional methods. These biological processes can extract minerals from low-grade ores or complex geological formations, expanding resource availability.

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML algorithms can optimize mineral exploration, resource management, and processing operations. By analyzing vast datasets and identifying patterns, these technologies can enhance resource discovery, predict ore grades, and optimize production processes.

Recycling and Resource Recovery

Recycling and resource recovery play a crucial role in reducing reliance on virgin materials, minimizing environmental impact, and securing a sustainable supply of critical minerals. Advancements in recycling technologies and innovative approaches are essential to maximizing resource recovery and promoting a circular economy.

- Hydrometallurgical Recycling:This process uses chemical solutions to separate and recover valuable metals from electronic waste and other sources. Hydrometallurgical recycling can effectively recover critical minerals like lithium, cobalt, and nickel, reducing the need for new mining operations.

- Pyrometallurgical Recycling:Pyrometallurgical recycling involves high-temperature processes to extract metals from scrap materials. This method is particularly suitable for recovering metals like copper, aluminum, and platinum group metals from end-of-life products.

- Urban Mining:This emerging field focuses on extracting valuable materials from urban waste streams, such as construction debris, electronic waste, and municipal solid waste. Urban mining offers a sustainable and environmentally responsible way to recover critical minerals while reducing landfill waste.

Research and Development

Research and development (R&D) is crucial for securing a sustainable supply of critical minerals. Continued investment in R&D is essential to develop new technologies, optimize existing processes, and explore alternative resources.

- Developing New Extraction and Processing Methods:R&D efforts are focused on developing innovative extraction and processing methods that are more efficient, environmentally friendly, and cost-effective. This includes exploring alternative solvents, bio-based reagents, and low-energy processes.

- Exploring New Resources:Researchers are investigating new sources of critical minerals, including deep-sea minerals, geothermal resources, and unconventional deposits. These efforts aim to diversify supply chains and reduce reliance on traditional mining sources.

- Developing Substitutes and Alternatives:R&D plays a crucial role in finding substitutes and alternatives for critical minerals, particularly those with limited availability or high environmental impact. This includes exploring new materials, advanced alloys, and innovative designs.

Geopolitical Implications

The EU-Australia critical minerals deal carries significant geopolitical implications, potentially reshaping global power dynamics and trade relations. It signals a shift in the global supply chain for critical minerals, impacting trade relations between the EU, Australia, and China. The deal also presents opportunities for cooperation and competition between these major players in the critical minerals sector.

Impact on Global Relations

The EU-Australia deal underscores the growing importance of strategic partnerships in securing critical minerals. It reflects a desire to reduce reliance on China, which currently dominates the global supply chain for many critical minerals. This move could lead to:* Increased tensions with China:China may view the deal as a direct challenge to its economic and geopolitical influence.

This could lead to retaliatory measures, such as trade restrictions or diplomatic pressure.

Strengthened alliances

The deal could strengthen the strategic partnership between the EU and Australia, potentially leading to closer cooperation in other areas such as defense and security.

New geopolitical alignments

The deal could encourage other countries to seek similar partnerships, potentially leading to new geopolitical alignments based on shared interests in critical minerals.

Trade Relations, Eu australia deal critical minerals supply tensions china

The EU-Australia deal is likely to have a significant impact on trade relations between the three major players:* Increased trade between the EU and Australia:The deal is expected to boost trade in critical minerals between the two regions, as they seek to establish a more secure and reliable supply chain.

Potential for trade friction with China

China may respond to the deal by imposing trade barriers on Australian or European goods, potentially leading to trade friction between the three parties.

Diversification of trade partners

The deal could encourage the EU and Australia to diversify their trade partners beyond China, seeking alternative sources of critical minerals.

Cooperation and Competition

The EU-Australia deal creates both opportunities for cooperation and potential for competition between the three major players:* Cooperation on technology and innovation:The EU, Australia, and China could cooperate on research and development of new technologies for extracting, processing, and recycling critical minerals.

Competition for market share

The deal could lead to increased competition for market share in the global critical minerals market, as each player seeks to secure a dominant position.

Competition for resources

The three players may compete for access to critical mineral resources, potentially leading to conflicts over resource rights and exploitation.

Economic and Environmental Considerations

The EU-Australia critical minerals deal, while promising for both economies, presents a complex landscape of economic benefits and challenges, alongside significant environmental considerations. Understanding these aspects is crucial for navigating the potential impact of this partnership on both global supply chains and the planet.

Economic Benefits and Challenges

The deal holds the potential for substantial economic benefits for both the EU and Australia. For Australia, it offers a significant market for its critical minerals, boosting its mining sector and generating substantial revenue. For the EU, it provides a secure and reliable source of critical minerals, reducing its dependence on China and other potential suppliers.

However, there are also challenges. The development of mining projects can be expensive and time-consuming, requiring significant investment and regulatory approvals. Additionally, fluctuations in global demand and prices can impact the profitability of mining operations.

Environmental Impact of Critical Minerals

Mining and processing critical minerals can have significant environmental impacts. These include:

- Land degradation:Mining activities can lead to deforestation, habitat loss, and soil erosion.

- Water pollution:Mining operations can release pollutants into water bodies, affecting aquatic ecosystems and human health.

- Air pollution:Mining and processing activities can release dust and other pollutants into the air, contributing to respiratory problems and climate change.

- Climate change:The extraction and processing of critical minerals contribute to greenhouse gas emissions, exacerbating climate change.

Sustainable and Responsible Sourcing

To mitigate the environmental impact of critical mineral extraction, sustainable and responsible sourcing strategies are crucial. These strategies aim to minimize environmental damage while ensuring ethical and socially responsible practices throughout the supply chain. Some key strategies include:

- Adopting sustainable mining practices:This includes minimizing land disturbance, optimizing resource recovery, and implementing environmental monitoring and remediation programs.

- Promoting responsible sourcing:This involves verifying the origin of minerals and ensuring compliance with ethical and environmental standards.

- Developing circular economy models:This involves reusing and recycling critical minerals to reduce the need for primary extraction.

- Investing in technological innovation:This includes developing new technologies for efficient and environmentally friendly extraction, processing, and recycling of critical minerals.