Eu apple ireland tax dispute retrial * – EU Apple Ireland Tax Dispute Retrial: A Second Look – The battle over Apple’s tax arrangements in Ireland is back in the spotlight. The European Commission, having initially ruled that Apple received illegal state aid, is now re-examining the case.

This retrial has sparked a wave of debate, raising questions about international tax practices, corporate responsibility, and the role of the EU in regulating global giants.

The dispute centers on Apple’s complex tax structure in Ireland, which allowed the tech giant to pay minimal taxes on its European profits. The Commission’s initial ruling in 2016 triggered a fierce legal battle, with Apple and Ireland both appealing the decision.

This retrial offers a chance to revisit the arguments, analyze the potential legal and economic implications, and understand the public and political context surrounding this high-stakes case.

Background of the Dispute

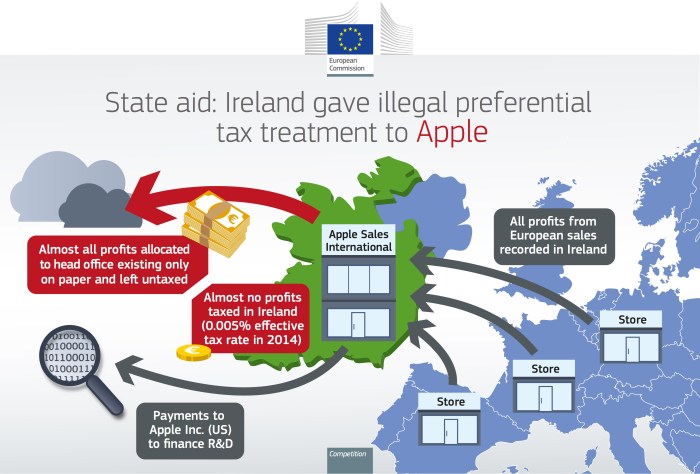

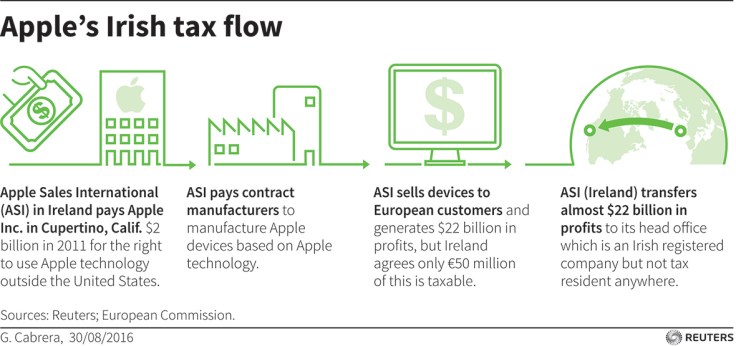

The EU’s investigation into Apple’s tax arrangements in Ireland began in 2014, stemming from concerns about the company’s preferential tax treatment in the country. The European Commission, the EU’s executive body, suspected that Apple’s tax structure allowed it to avoid paying a significant amount of taxes in Europe.The Commission’s investigation focused on two key aspects: the “Double Irish” and “Dutch Sandwich” tax structures used by Apple, which allowed the company to shift profits to low-tax jurisdictions, and the tax rulings issued by the Irish government, which the Commission alleged provided illegal state aid to Apple.

Initial Findings and Decision

The Commission’s investigation found that Apple had received significant tax advantages from Ireland, allowing it to pay an effective corporate tax rate of just 1% on its European profits between 2003 and 2014. This was significantly lower than the standard corporate tax rate in Ireland, which was around 12.5% during that period.In August 2016, the Commission concluded that Ireland had granted illegal state aid to Apple by allowing it to pay an artificially low amount of tax.

The Commission ordered Ireland to recover €13 billion ($14.5 billion) in unpaid taxes from Apple, plus interest.

Apple’s Response and Appeals

Apple strongly disputed the Commission’s findings, arguing that it had acted in accordance with Irish law and that its tax arrangements were not illegal state aid. The company also claimed that the Commission’s decision was based on a flawed understanding of its tax structure and that the €13 billion figure was a miscalculation.Apple appealed the Commission’s decision to the General Court of the European Union, which is the EU’s second-highest court.

The General Court upheld the Commission’s decision in 2020, ruling that Ireland had granted illegal state aid to Apple. Apple then appealed the General Court’s ruling to the European Court of Justice (ECJ), the EU’s highest court.

Discover how attracting talent breaking down silos challenges scaleups face has transformed methods in this topic.

Key Arguments in the Retrial

The retrial of the European Commission’s (EC) case against Apple and Ireland focused on the tax arrangements that allowed Apple to pay significantly lower taxes in Ireland than in other countries. Both sides presented compelling arguments, highlighting the complexities of international tax law and the potential for tax avoidance through aggressive tax planning.

The European Commission’s Arguments

The EC argued that the tax rulings granted to Apple by Ireland constituted illegal state aid, giving Apple an unfair advantage over its competitors. They claimed that Apple’s tax arrangements, based on a “double Irish” structure, artificially shifted profits to low-tax jurisdictions, allowing Apple to avoid paying taxes on billions of euros in profits generated in Europe.

The EC argued that this structure allowed Apple to avoid paying taxes on profits generated in Europe, which should have been taxed in the countries where those profits were generated. They also argued that Ireland’s tax rulings allowed Apple to artificially shift profits to low-tax jurisdictions, giving it an unfair advantage over its competitors.

Apple’s Defense

Apple countered by arguing that its tax arrangements were entirely legal and that the EC was attempting to rewrite international tax rules. They claimed that the Irish tax rulings were based on a legitimate interpretation of Irish law and that Apple had not received any preferential treatment.

Apple also argued that its tax arrangements were a common practice in the tech industry and that the EC’s case was based on a flawed understanding of how multinational corporations operate. They claimed that the EC’s arguments were based on a flawed understanding of how multinational corporations operate and that the EC was trying to impose a new set of rules that would unfairly target American companies.

Comparing the Perspectives

The key issue in the dispute was whether the Irish tax rulings granted to Apple constituted illegal state aid. The EC argued that the rulings gave Apple an unfair advantage over its competitors, while Apple claimed that the rulings were based on a legitimate interpretation of Irish law.

This disagreement highlighted the complexities of international tax law and the difficulty of defining what constitutes state aid. The EC argued that Apple had received an unfair advantage, while Apple maintained that it had simply followed the rules. The retrial also highlighted the potential for tax avoidance through aggressive tax planning.

The EC argued that Apple’s tax arrangements allowed it to avoid paying taxes on billions of euros in profits generated in Europe, while Apple claimed that its arrangements were legal and common practice. The EC sought to challenge the use of aggressive tax planning by multinational corporations, while Apple defended its right to minimize its tax liability.

Legal and Economic Implications

The retrial of the EU’s tax dispute with Apple and Ireland holds significant legal and economic implications, potentially impacting the future of international tax practices and the way multinational corporations operate. The case could set a precedent for how governments assess and collect taxes from multinational corporations, particularly in the digital economy.

Impact on Apple and Ireland

The outcome of the retrial could have far-reaching consequences for both Apple and Ireland. If the European Commission’s decision is upheld, Apple could be forced to pay back billions of euros in unpaid taxes, potentially impacting its profitability and shareholder value.

Additionally, the case could set a precedent for future tax disputes, potentially leading to increased scrutiny of Apple’s tax practices in other countries.Ireland, on the other hand, could face reputational damage and economic losses if it is found to have granted Apple preferential tax treatment.

This could deter future foreign investment and potentially affect the country’s economic growth.

Impact on International Tax Practices

The EU’s case against Apple highlights the challenges of taxing multinational corporations in the digital economy. These companies often operate across multiple jurisdictions, making it difficult to determine where their profits are generated and, therefore, where they should be taxed.

The case could lead to a reevaluation of existing international tax rules and potentially spark discussions about reforming the current system.

Impact on Other Multinational Corporations

The EU’s case against Apple serves as a warning to other multinational corporations operating in Europe. It underscores the increasing scrutiny of tax practices and the potential for legal action if companies are found to be engaging in tax avoidance.

The case could encourage companies to review their tax strategies and ensure they are compliant with international tax laws.

The EU’s case against Apple could be a game-changer for international tax practices. It could set a precedent for how governments assess and collect taxes from multinational corporations, particularly in the digital economy.

Public Opinion and Political Context: Eu Apple Ireland Tax Dispute Retrial *

The EU Apple Ireland tax dispute retrial has attracted significant public attention, sparking debates about corporate tax avoidance and the role of governments in regulating multinational corporations. Public opinion on the case has been divided, with some supporting Apple and others siding with the European Commission.

The political landscape in Ireland and across Europe has also been influenced by the case, as governments and policymakers grapple with the implications of the ruling for their tax systems and economic competitiveness.

Public Opinion on the Case, Eu apple ireland tax dispute retrial *

Public opinion on the EU Apple Ireland tax dispute has been divided, with varying levels of support for Apple and the European Commission.

| Region | Public Opinion | Source |

|---|---|---|

| Ireland | A 2016 poll by Ipsos MRBI found that 63% of Irish people believed that Apple had paid enough tax in Ireland, while 29% believed that they had not paid enough. | The Irish Times |

| Europe | A 2016 poll by YouGov found that 58% of Europeans believed that multinational companies should pay more tax, while 24% believed that they should pay less tax. | YouGov |

Political Stances on the Case

The EU Apple Ireland tax dispute has also sparked debate among policymakers and political parties across Europe. Different stakeholders have taken varying stances on the case, reflecting their own political agendas and priorities.

| Stakeholder | Political Stance |

|---|---|

| Irish Government | The Irish government has consistently defended Apple’s tax arrangements, arguing that they were in line with Irish law. They have also expressed concerns about the potential impact of the ruling on Ireland’s attractiveness as a location for foreign investment. |

| European Commission | The European Commission has maintained that Apple’s tax arrangements in Ireland constituted illegal state aid, giving Apple an unfair advantage over its competitors. They have argued that the ruling is necessary to ensure a level playing field for all businesses operating in the EU. |

| Apple | Apple has argued that its tax arrangements in Ireland were legal and that it has always complied with Irish tax law. They have also criticized the European Commission’s ruling as being politically motivated and unfair. |

| Tax Justice Advocates | Tax justice advocates have supported the European Commission’s ruling, arguing that it is a step towards closing loopholes that allow multinational corporations to avoid paying their fair share of taxes. They have called for greater transparency and accountability in corporate tax practices. |

Potential Impact of the Retrial on the Political Landscape

The retrial of the EU Apple Ireland tax dispute could have significant implications for the political landscape in Ireland and across Europe.

“The outcome of the retrial could have a major impact on the future of corporate taxation in the EU. If the court upholds the European Commission’s ruling, it could lead to a significant increase in tax revenue for EU member states. However, it could also lead to a backlash from multinational corporations, who may be less willing to invest in the EU if they believe that they will be subject to higher taxes.”

The retrial could also influence the political debate on tax avoidance and the role of governments in regulating multinational corporations. If the court rules in favor of the European Commission, it could strengthen the hand of those who are calling for greater transparency and accountability in corporate tax practices.

However, it could also lead to increased tensions between EU member states, as some governments may be reluctant to implement stricter tax rules for fear of deterring foreign investment.

Future Prospects and Potential Outcomes

The retrial of the EU Apple Ireland tax dispute is a landmark case with far-reaching implications for international tax law, corporate practices, and the relationship between governments and multinational corporations. The outcome of the retrial will have a significant impact on the future of tax avoidance strategies employed by multinational companies and the ability of governments to collect revenue from these entities.

Potential Timeline of Future Developments

The retrial is expected to take several months, with a verdict likely to be reached sometime in

2024. Here’s a possible timeline of events

- 2023:The retrial commences, with both sides presenting their arguments and evidence. Expert witnesses will be called to testify, and the court will hear arguments from both sides.

- Early 2024:The trial concludes, and the court begins deliberations.

- Mid-2024:The court issues its judgment, potentially upholding the original ruling, reversing it, or reaching a new compromise.

Possible Outcomes of the Retrial

The retrial could result in several different outcomes, each with its own set of implications:

- Upholding the Original Ruling:If the court upholds the original ruling, Apple will be required to pay back taxes and penalties, setting a precedent for other multinational corporations that may have used similar tax avoidance strategies. This would strengthen the EU’s position in its efforts to combat tax avoidance and could encourage other countries to adopt similar measures.

- Reversing the Original Ruling:If the court reverses the original ruling, it would be a major victory for Apple and could embolden other multinational corporations to challenge similar tax rulings. This could weaken the EU’s ability to collect taxes from multinational corporations and create a more favorable environment for tax avoidance.

- Reaching a New Compromise:The court could also reach a new compromise, where Apple agrees to pay a smaller amount of back taxes or penalties. This would represent a partial victory for both sides and could set a new precedent for resolving tax disputes between governments and multinational corporations.

Long-Term Impact on Tax Law and Corporate Practices

The outcome of the retrial will have significant long-term implications for tax law and corporate practices. Here are some potential impacts:

- Increased Scrutiny of Corporate Tax Practices:The retrial is likely to increase scrutiny of corporate tax practices, both in Europe and around the world. This could lead to more aggressive enforcement of tax laws and a greater focus on preventing tax avoidance.

- Changes to Tax Laws:The outcome of the retrial could also lead to changes in tax laws, both in Europe and internationally.

This could include new rules on transfer pricing, which is the way that multinational corporations price transactions between their subsidiaries in different countries.

- Shift in Corporate Behavior:The retrial could also lead to a shift in corporate behavior, with multinational corporations becoming more cautious about their tax practices and more likely to comply with tax laws.