Eu apple google fines back taxes ireland * – EU Fines Apple & Google for Back Taxes in Ireland has sparked intense debate about corporate tax avoidance and the role of governments in facilitating it. This case, which involves billions of euros in back taxes, has brought to the forefront the complex interplay between multinational corporations, national tax systems, and international regulations.

The EU’s actions have sent shockwaves through the business world, prompting discussions about the future of corporate taxation and the implications for global trade.

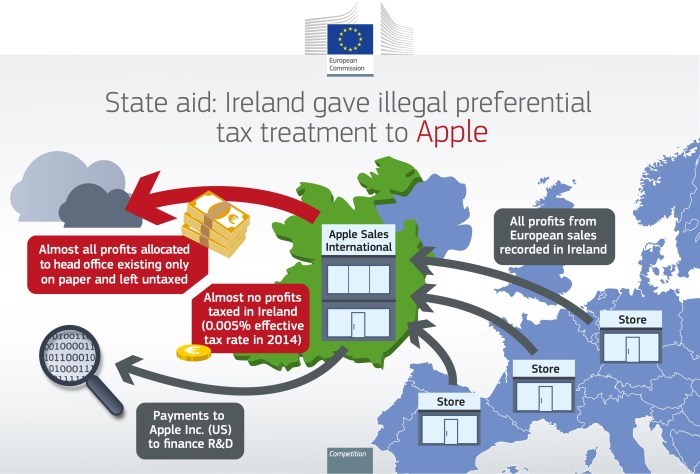

The controversy centers around the tax arrangements of Apple and Google in Ireland, where both companies have established European headquarters. The EU alleges that these companies benefited from sweetheart deals with the Irish government, which allowed them to pay significantly lower taxes than other businesses operating in the region.

These deals, the EU argues, violate EU state aid rules, which prohibit member states from providing unfair advantages to certain companies. The case has ignited a firestorm of criticism, with many accusing Apple and Google of exploiting loopholes in the tax system to avoid paying their fair share.

Meanwhile, Ireland has defended its tax policies, arguing that they are designed to attract foreign investment and boost economic growth. The EU’s decision to fine Apple and Google has raised significant questions about the future of corporate tax avoidance and the role of governments in shaping the global economy.

The EU’s Antitrust Investigations

The European Union (EU) has been actively investigating the tax practices of tech giants like Apple and Google, raising concerns about potential antitrust violations. These investigations are based on the EU’s commitment to ensuring fair competition and preventing companies from gaining an unfair advantage through tax avoidance strategies.

The Rationale Behind the EU’s Antitrust Investigations

The EU’s antitrust investigations target Apple and Google due to concerns about their tax practices in Ireland, which allegedly allowed them to minimize their tax liabilities in the EU. The EU’s rationale stems from the belief that these practices could distort competition by giving these companies an unfair advantage over their rivals.

Allegations Against Apple and Google

The EU’s investigations against Apple and Google center around allegations of illegal state aid. In Apple’s case, the EU alleged that Ireland granted Apple illegal tax benefits by allowing the company to artificially reduce its taxable profits. The EU argued that these benefits gave Apple an unfair advantage over its competitors, distorting the market.Similarly, the EU investigated Google’s tax practices in Ireland, alleging that the company used a complex structure of subsidiaries to shift profits to low-tax jurisdictions.

The EU claimed that these arrangements allowed Google to avoid paying taxes on a significant portion of its revenue, giving it an unfair advantage in the market.

The Legal Framework and Regulations

The EU’s antitrust investigations are based on the EU’s competition law, which aims to prevent anti-competitive practices that harm consumers and businesses. The EU’s competition law prohibits state aid, which refers to financial assistance provided by governments to companies that distorts competition.The EU also relies on the principle of “effective taxation,” which requires companies to pay taxes in the jurisdictions where they generate their profits.

The EU argues that Apple and Google’s tax practices violated this principle by allowing them to artificially reduce their taxable profits and avoid paying taxes on a significant portion of their revenue.

Previous EU Antitrust Cases

The EU has a history of pursuing antitrust cases against tech giants, including:

- Microsoft:In 2004, the EU fined Microsoft €497 million for bundling its media player with its Windows operating system, arguing that this practice gave Microsoft an unfair advantage in the market.

- Intel:In 2009, the EU fined Intel €1.06 billion for offering rebates to computer manufacturers who exclusively used Intel processors, arguing that this practice harmed competition.

- Google:In 2017, the EU fined Google €2.42 billion for abusing its dominant position in the online advertising market, arguing that Google favored its own services in search results.

These cases demonstrate the EU’s commitment to ensuring fair competition in the digital market and preventing tech giants from abusing their dominant positions. The EU’s investigations into Apple and Google’s tax practices are part of this ongoing effort to promote a level playing field for all businesses.

Apple and Google’s Tax Practices in Ireland: Eu Apple Google Fines Back Taxes Ireland *

The European Union (EU) has been investigating the tax practices of several multinational corporations, including Apple and Google, in Ireland. These investigations have led to significant fines levied against these companies, raising concerns about the fairness and transparency of their tax arrangements.

Tax Structures Employed by Apple and Google in Ireland

Apple and Google have employed complex tax structures in Ireland to minimize their tax liabilities. Both companies have established subsidiaries in Ireland, which act as their European headquarters. These subsidiaries are responsible for generating significant revenue from sales in other European countries.

- Apple’s Tax Structure:Apple’s Irish subsidiary, Apple Sales International, has been accused of using a “double Irish” tax structure, which involves routing profits through a series of Irish subsidiaries to minimize its tax liability. This structure allows Apple to shift profits to low-tax jurisdictions, such as Bermuda, where it pays a negligible amount of corporate tax.

- Google’s Tax Structure:Google’s Irish subsidiary, Google Ireland, has been accused of using a “single Irish” tax structure, which involves routing profits through a single Irish subsidiary to minimize its tax liability. This structure allows Google to reduce its tax bill by shifting profits to low-tax jurisdictions, such as the Netherlands, where it pays a lower corporate tax rate.

Comparison of Tax Rates

The tax rates applied to Apple and Google in Ireland have been significantly lower than those applied in other countries.

You also can understand valuable knowledge by exploring podcast ikea parag parekh digital ethics.

- Apple’s Tax Rate:Apple has been accused of paying an effective tax rate of less than 1% on its European profits, significantly lower than the standard corporate tax rate of 12.5% in Ireland. This discrepancy has been attributed to the complex tax structures employed by Apple, which allow it to shift profits to low-tax jurisdictions.

- Google’s Tax Rate:Google has also been accused of paying an effective tax rate significantly lower than the standard corporate tax rate in Ireland. The company has been criticized for using its Irish subsidiary to minimize its tax liability by shifting profits to low-tax jurisdictions.

Key Elements of Tax Arrangements Deemed Unfair

The EU’s investigations have highlighted several key elements of Apple and Google’s tax arrangements that were deemed unfair:

- Artificial Transfer Pricing:The EU found that Apple and Google had artificially inflated the prices of intellectual property transferred to their Irish subsidiaries, leading to lower taxable profits in Ireland. This practice allowed the companies to shift profits to low-tax jurisdictions, where they were subject to lower corporate tax rates.

- Lack of Economic Substance:The EU found that Apple and Google’s Irish subsidiaries lacked economic substance, meaning that they did not perform significant economic activities in Ireland. This raised concerns that the companies were using Ireland as a tax haven to avoid paying taxes in other countries.

- State Aid:The EU found that Ireland had granted illegal state aid to Apple by allowing it to pay a significantly lower tax rate than other companies. This finding was based on the EU’s view that Ireland’s tax arrangements with Apple provided an unfair advantage over other companies operating in the European market.

Potential Impact on Ireland’s Economy

The EU’s investigations and subsequent fines against Apple and Google have raised concerns about the potential impact on Ireland’s economy. Some argue that these investigations could deter multinational companies from investing in Ireland, leading to job losses and economic stagnation.

Others argue that the investigations will encourage greater transparency and fairness in the tax system, ultimately benefiting Ireland’s economy.

The EU’s Fines and Their Impact

The European Union’s antitrust investigations into Apple and Google’s tax practices in Ireland resulted in substantial fines, marking a significant moment in the ongoing debate over tax avoidance by multinational corporations. These fines have far-reaching implications, not only for the companies involved but also for the broader landscape of corporate taxation and regulatory oversight within the EU.

The Amount of Fines Imposed

The EU imposed a total of €14.9 billion in fines on Apple and Google, highlighting the seriousness of the alleged tax avoidance practices. Apple was fined €13 billion in 2016 for receiving illegal state aid from Ireland, while Google was fined €2.42 billion in 2017 for favoring its own shopping comparison service in search results.

These fines are among the largest ever imposed by the EU on companies for antitrust violations.

The Potential Consequences of the Fines

The fines imposed on Apple and Google have significant potential consequences for both companies.

- Financial Impact:The fines represent a substantial financial burden for both companies. While Apple and Google have substantial financial resources, these fines could impact their profitability and future investment plans.

- Reputational Damage:The EU’s findings of tax avoidance have damaged the reputations of both companies, potentially affecting consumer trust and brand loyalty.

- Legal Challenges:Both companies have challenged the EU’s rulings in court, seeking to overturn the fines. The outcome of these legal challenges could have a significant impact on the future of EU antitrust investigations.

Implications for Other Multinational Corporations

The EU’s fines against Apple and Google serve as a strong warning to other multinational corporations operating in Europe. The EU has made it clear that it will aggressively pursue companies that engage in tax avoidance practices, and the potential consequences of being found guilty are substantial.

Potential for Future Regulatory Changes

The EU’s investigations into Apple and Google have prompted calls for further regulatory changes to prevent tax avoidance by multinational corporations.

- Tax Harmonization:Some argue that the EU should move towards a more harmonized system of corporate taxation, eliminating loopholes and reducing the incentive for tax avoidance.

- Increased Transparency:Others advocate for increased transparency in corporate tax practices, requiring companies to disclose their tax arrangements and payments in each country where they operate.

- Strengthened Enforcement:The EU may also strengthen its enforcement mechanisms, increasing the likelihood of future investigations and fines against companies that engage in tax avoidance practices.

Ireland’s Role in the Tax Controversy

Ireland has been at the center of the tax controversy surrounding Apple and Google, playing a crucial role in facilitating their tax arrangements. While Ireland’s tax policies have attracted significant foreign investment, they have also drawn criticism for potentially enabling multinational corporations to avoid paying their fair share of taxes.

Ireland’s Tax Policies and Multinational Companies

Ireland’s tax policies have been instrumental in attracting multinational companies like Apple and Google. The country offers a low corporate tax rate of 12.5%, significantly lower than the average rate in the European Union. This low rate has made Ireland an attractive destination for companies seeking to minimize their tax liabilities.

Additionally, Ireland has a favorable tax regime for intellectual property, allowing companies to deduct a significant portion of their profits related to intellectual property rights. This has made Ireland a popular location for multinational companies to register their intellectual property, further reducing their tax burden.

Benefits and Drawbacks of Ireland’s Tax Policies

Ireland’s tax policies have undoubtedly contributed to its economic growth and job creation. The influx of multinational companies has boosted Ireland’s GDP and created numerous employment opportunities. However, the low tax rates have also been criticized for creating a “race to the bottom” among European countries, as they compete to attract foreign investment by offering increasingly lower tax rates.

This can lead to a reduction in government revenue, potentially impacting public services and social welfare programs.

Implications of the EU’s Rulings for Ireland’s Economic Strategy

The EU’s rulings against Apple and Google have raised questions about the sustainability of Ireland’s economic strategy, which heavily relies on attracting multinational companies through tax incentives. The rulings have put pressure on Ireland to reform its tax policies and ensure that multinational companies pay their fair share of taxes.

This could potentially impact Ireland’s attractiveness to foreign investors, potentially leading to a decline in investment and job creation.

Steps Ireland Might Take in Response to the EU’s Findings, Eu apple google fines back taxes ireland *

In response to the EU’s findings, Ireland might take several steps, including:

- Increase its corporate tax rate: Ireland might consider gradually increasing its corporate tax rate to align with the EU average, reducing its reliance on tax incentives to attract foreign investment.

- Reform its tax regime for intellectual property: Ireland might review its tax regime for intellectual property, potentially introducing stricter rules to prevent companies from exploiting loopholes and minimizing their tax liabilities.

- Enhance transparency and cooperation: Ireland might enhance its transparency and cooperation with the EU, sharing more information about its tax arrangements with multinational companies to ensure compliance with EU regulations.

The Broader Implications of the Case

The EU’s landmark rulings against Apple and Google in Ireland, while initially focused on tax avoidance, have far-reaching implications that extend beyond the specific companies involved. These rulings have sparked a global debate about the role of multinational corporations in international tax systems, the balance of power between nations and global tech giants, and the future of the digital economy.

Implications for International Tax Law and Regulations

The EU’s actions have significantly impacted international tax law and regulations. The rulings have highlighted the limitations of existing tax frameworks in addressing the complexities of the digital economy and the strategies employed by multinational corporations to minimize their tax liabilities.

The EU’s aggressive stance on tax avoidance has prompted other countries to consider similar measures, leading to a growing trend of scrutiny and potential revisions of international tax rules.

Potential Impact on the Relationship Between the EU and the US

The EU’s rulings have strained relations between the EU and the US, as they challenge the US’s stance on corporate tax policies and its approach to international tax law. The US has criticized the EU’s actions, arguing that they create uncertainty for businesses and undermine the principle of international tax cooperation.

The ongoing tension between the two blocs highlights the growing divergence in their approaches to taxation in the digital economy, potentially impacting future trade negotiations and international cooperation.

Broader Implications for the Global Digital Economy and the Role of Multinational Corporations

The EU’s rulings have significant implications for the global digital economy and the role of multinational corporations. The rulings have raised concerns about the potential for double taxation and the creation of a fragmented tax landscape, which could hinder innovation and growth in the digital sector.

The rulings have also prompted discussions about the need for greater transparency and accountability from multinational corporations regarding their tax practices.

Key Stakeholders and Their Perspectives

The EU’s rulings have involved a wide range of stakeholders with diverse perspectives. Here’s a table outlining the key stakeholders and their positions: