Eif invests e40m in female founded climate tech growth fund – EIF Invests €40M in Female-Founded Climate Tech Fund – a bold move that signifies a growing commitment to empowering female entrepreneurs in the fight against climate change. This investment not only fuels innovation in the climate tech sector but also underscores the critical role women play in shaping a sustainable future.

The European Investment Fund (EIF) has recognized the immense potential of female-led climate tech startups and is stepping up to provide the necessary financial backing and support for their growth.

This investment strategy aligns with a broader shift in the venture capital landscape, where investors are increasingly recognizing the value of diversity and inclusion. By backing female-led startups, EIF is not only contributing to a more equitable tech ecosystem but also tapping into a pool of talent that is often overlooked.

This move is poised to have a significant impact on the climate tech sector, fostering innovation and driving positive change.

EIF’s Investment Strategy

EIF’s investment in a female-founded climate tech growth fund reflects a strategic approach to address two pressing global challenges: climate change and gender inequality. This investment aligns with EIF’s commitment to promoting sustainable development and fostering a more inclusive and equitable investment landscape.

Rationale for Investment

EIF’s investment in a female-founded climate tech growth fund is driven by a compelling rationale. The fund targets companies led by women who are developing innovative solutions to address climate change. This focus is based on the recognition that women are significantly underrepresented in the climate tech sector, despite their potential to contribute significantly to the development of sustainable solutions.

Potential Benefits and Risks

Investing in female-founded climate tech startups presents both potential benefits and risks.

Potential Benefits

- Enhanced Innovation:Women bring unique perspectives and experiences to the table, which can lead to more innovative and impactful climate tech solutions. Studies have shown that diverse teams tend to be more creative and generate a wider range of ideas.

- Stronger Returns:Research suggests that companies with more diverse leadership teams tend to outperform their peers financially. Investing in female-led climate tech startups could potentially generate higher returns for EIF.

- Positive Social Impact:Supporting female entrepreneurs in the climate tech sector contributes to a more equitable and inclusive economy, empowering women and promoting gender equality.

Potential Risks

- Limited Access to Funding:Female-founded startups often face challenges in securing funding compared to their male-led counterparts. This can make it difficult for them to scale their businesses and achieve their full potential.

- Lack of Role Models:The lack of prominent female role models in the climate tech sector can discourage women from pursuing careers in this field.

- Uncertain Market Conditions:The climate tech sector is still relatively nascent, and the market for climate solutions is evolving rapidly. This uncertainty can pose challenges for investors.

Comparison with Other Venture Capital Firms

EIF’s investment strategy is distinctive in its explicit focus on supporting female-founded climate tech startups. While other venture capital firms are increasingly investing in climate tech, many lack a dedicated focus on gender diversity. Some firms have implemented diversity initiatives, but EIF’s strategy goes beyond general diversity efforts by specifically targeting female-led companies.

“We believe that investing in female-founded climate tech startups is not just the right thing to do, but also a smart business decision. These companies are driving innovation and creating solutions that will help us address climate change. By supporting them, we are not only making a positive impact on the world, but also generating strong returns for our investors.”

[EIF representative]

Climate Tech Landscape and Female Founders: Eif Invests E40m In Female Founded Climate Tech Growth Fund

The climate tech sector is rapidly evolving, attracting significant investments and innovation. This surge in activity is driven by the urgency to address the climate crisis and the increasing awareness of the need for sustainable solutions. However, despite the growing momentum, the sector faces challenges, particularly for female founders navigating this dynamic space.

Discover more by delving into why tensorflow for python is dying a slow death further.

Key Trends and Challenges in the Climate Tech Sector

The climate tech sector is characterized by several key trends:

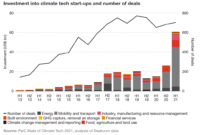

- Growing Investment:Climate tech startups are attracting record investments, with venture capital firms pouring billions into companies developing solutions for clean energy, sustainable agriculture, carbon capture, and other areas.

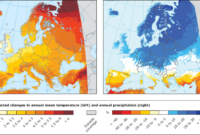

- Technological Advancements:Advancements in artificial intelligence (AI), machine learning, and other technologies are driving innovation in climate tech, enabling more efficient and effective solutions.

- Policy Support:Governments worldwide are implementing policies to encourage the development and adoption of climate-friendly technologies, creating a favorable environment for climate tech startups.

However, the sector also faces significant challenges:

- Scaling Solutions:While many climate tech solutions show promise at the pilot stage, scaling them up to meet global demand remains a significant hurdle.

- Regulation and Policy Uncertainty:The regulatory landscape for climate tech is still evolving, creating uncertainty for startups and investors.

- Market Adoption:Consumers and businesses need to be convinced of the value and affordability of climate tech solutions to drive widespread adoption.

Challenges Faced by Female Founders in Climate Tech

Female founders in the climate tech sector face unique challenges:

- Access to Funding:Female-led startups receive significantly less funding than male-led startups, particularly in the early stages.

- Lack of Representation:Women are underrepresented in leadership positions within climate tech companies and venture capital firms, creating a lack of role models and mentors for aspiring female founders.

- Gender Bias:Female founders often face gender bias, including unconscious bias from investors and potential customers, which can hinder their ability to secure funding and partnerships.

Potential of Female-Led Climate Tech Startups

Despite these challenges, female-led climate tech startups hold immense potential to address global climate change:

- Diverse Perspectives:Female founders bring unique perspectives and experiences to the climate tech sector, leading to innovative solutions that address the needs of diverse communities.

- Focus on Social Impact:Female founders are often driven by a strong desire to create positive social and environmental impact, leading to solutions that benefit both people and the planet.

- Strong Leadership:Female leaders are known for their strong communication, collaboration, and problem-solving skills, which are crucial for navigating the complex challenges of climate change.

Impact of the Investment

EIF’s €40 million investment in a female-founded climate tech growth fund signifies a crucial step towards accelerating the development and deployment of innovative solutions to address climate change. This investment not only directly supports the growth of female-led startups but also catalyzes a broader positive impact on the climate tech sector and the global environment.

Impact on the Climate Tech Sector

This investment is expected to significantly impact the climate tech sector by fueling the growth of promising startups developing innovative solutions to tackle climate change. The fund will provide capital, mentorship, and access to a network of industry experts, enabling these startups to scale their operations and reach wider markets.

This will lead to the accelerated development and deployment of technologies that can reduce greenhouse gas emissions, enhance resource efficiency, and promote sustainable practices across various industries.

Impact on Female-Led Climate Tech Startups, Eif invests e40m in female founded climate tech growth fund

The fund’s focus on female-founded startups is particularly impactful, addressing the persistent gender gap in the technology sector. By providing targeted support and resources, the fund empowers female entrepreneurs to build successful climate tech companies, fostering innovation and diversity within the industry.

This will not only create opportunities for women in the field but also contribute to a more inclusive and equitable climate tech ecosystem.

Impact on Job Creation, Innovation, and Environmental Sustainability

The investment’s potential impact extends beyond financial returns, contributing to broader societal benefits.

| Dimension | Potential Impact | Examples/Real-life Cases |

|---|---|---|

| Job Creation | The fund’s investments will lead to the creation of new jobs in the climate tech sector, boosting economic growth and providing employment opportunities, particularly for women and underrepresented groups. | For instance, a female-founded startup developing sustainable energy solutions could create jobs in engineering, manufacturing, and installation, contributing to local economies and fostering innovation. |

| Innovation | By supporting female-led startups, the fund encourages the development of novel and disruptive climate tech solutions, driving innovation and pushing the boundaries of what’s possible in addressing climate change. | A female-founded startup developing a carbon capture technology could revolutionize the way industries mitigate their emissions, contributing to a cleaner and more sustainable future. |

| Environmental Sustainability | The fund’s investments will accelerate the adoption of climate-friendly technologies, contributing to a significant reduction in greenhouse gas emissions, improved resource efficiency, and a more sustainable future. | For example, a female-founded startup developing a smart grid technology could optimize energy distribution, reduce energy waste, and promote the adoption of renewable energy sources. |

Future of Climate Tech Investment

The climate tech sector is rapidly evolving, driven by increasing awareness of the urgency to address climate change and the emergence of innovative solutions. This has resulted in a surge of investment in climate tech companies, with venture capitalists, corporations, and governments all seeking to capitalize on the potential of this burgeoning industry.

The future of climate tech investment holds significant promise, with several key trends shaping the landscape.

Investment Strategies

Investment strategies in climate tech are becoming increasingly sophisticated as investors seek to maximize returns while contributing to a sustainable future. Here are some key trends to watch:

- Focus on Impact:Investors are increasingly prioritizing companies with a demonstrable positive impact on the environment, going beyond financial returns to consider the social and environmental benefits of their investments.

- Early-Stage Investment:Venture capitalists are actively seeking out early-stage climate tech companies with innovative solutions, recognizing the potential for significant growth and disruption in the sector.

- Sector Diversification:Investment is expanding beyond traditional areas like renewable energy and energy efficiency to include sectors such as sustainable agriculture, carbon capture, and climate-resilient infrastructure.

Funding Sources

The sources of funding for climate tech are diversifying, with traditional venture capital firms joined by a growing number of players:

- Corporate Venture Capital:Large corporations are increasingly investing in climate tech startups, seeking to integrate innovative solutions into their own operations and gain access to new technologies.

- Government Funding:Governments worldwide are allocating significant resources to support climate tech innovation through grants, subsidies, and tax incentives.

- Impact Investors:These investors prioritize social and environmental impact alongside financial returns, contributing to the growth of climate tech companies that address critical sustainability challenges.

Timeline of Key Milestones

The climate tech investment landscape is expected to continue its rapid evolution in the coming years, with several key milestones anticipated:

- 2025:Increased focus on climate-resilient infrastructure and adaptation solutions, driven by the growing impacts of climate change.

- 2030:Maturation of carbon capture and storage technologies, leading to significant investments in this sector.

- 2035:Emergence of new technologies and business models that enable a circular economy and reduce reliance on fossil fuels.