The Allure of Hype

Dont fall for the hype 6 ways to evaluate a crypto project – The crypto space is a breeding ground for hype, with new projects constantly emerging, promising astronomical returns and revolutionary technologies. The allure of hype is undeniable, as it often leads to rapid price increases and significant profits for early adopters.

However, it’s crucial to understand the psychology behind hype and the potential risks associated with investing in hyped projects.

The Psychology of Hype

Hype in the crypto space is often driven by a combination of factors, including:

- FOMO (Fear of Missing Out):The fear of missing out on potential gains can lead investors to jump on the bandwagon without proper due diligence.

- Social Proof:When a project gains popularity and is endorsed by influencers or celebrities, it can create a sense of legitimacy and encourage others to invest.

- Confirmation Bias:Investors may be more likely to seek out information that confirms their existing beliefs about a project, ignoring red flags or negative news.

- Cognitive Biases:The human tendency to overestimate the likelihood of positive outcomes and underestimate the likelihood of negative outcomes can contribute to irrational decision-making.

Examples of Hyped Crypto Projects

Many crypto projects have experienced periods of intense hype, often fueled by aggressive marketing campaigns and promises of groundbreaking innovations. Some notable examples include:

- Dogecoin (DOGE):Initially created as a joke, Dogecoin gained widespread popularity due to social media buzz and support from Elon Musk. It experienced significant price surges, reaching a market capitalization of billions of dollars.

- Shiba Inu (SHIB):Inspired by Dogecoin, Shiba Inu also gained traction through social media marketing and meme culture. Its price skyrocketed, making it one of the top-performing cryptocurrencies in 2021.

- Axie Infinity (AXS):A play-to-earn game that allows users to earn cryptocurrency by playing, Axie Infinity attracted a large user base and saw significant price appreciation during its peak.

Risks of Investing in Hyped Projects

Investing in hyped projects can be extremely risky due to several factors:

- Overvaluation:Hype can drive prices far beyond the project’s intrinsic value, leading to significant losses when the bubble bursts.

- Lack of Fundamental Value:Some hyped projects may lack a solid foundation, relying solely on hype and speculation. This can result in a quick decline in value once the hype fades.

- Scams and Rug Pulls:The anonymity and lack of regulation in the crypto space make it easier for scammers to create and promote fraudulent projects. Rug pulls, where developers abandon a project and abscond with investors’ funds, are a common risk.

- Market Volatility:Cryptocurrencies are highly volatile, and the price of hyped projects can fluctuate dramatically, even in the short term. This volatility can make it difficult to time entry and exit points and increase the risk of losses.

Understanding the Fundamentals: Dont Fall For The Hype 6 Ways To Evaluate A Crypto Project

Beyond the hype, understanding the fundamentals of a crypto project is crucial for making informed investment decisions. This involves examining the project’s core components, its roadmap, and the team behind it.

The Importance of a Strong Whitepaper and Roadmap

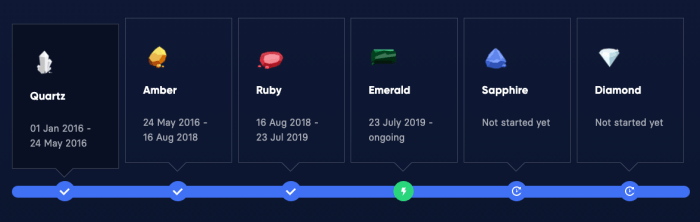

A well-structured whitepaper serves as the foundation of any crypto project. It Artikels the project’s goals, technology, and economic model. A comprehensive roadmap, on the other hand, provides a timeline for the project’s development and implementation. A strong whitepaper should be clear, concise, and well-researched.

It should explain the project’s purpose, its target audience, and how it addresses existing problems. A detailed roadmap should Artikel specific milestones, timelines, and deliverables. It should also be transparent about the project’s funding, team, and community engagement.

Analyzing the Project’s Technology

The technology behind a crypto project is a crucial factor to consider. This involves understanding the project’s core technology, its security, and its scalability.

“The technology behind a crypto project is a crucial factor to consider.”

A thorough analysis of the project’s technology should include:

- Evaluating the project’s core technology: This could involve examining the blockchain platform, the consensus mechanism, and the smart contracts used.

- Assessing the project’s security: This includes evaluating the project’s security protocols, its vulnerability to attacks, and its ability to protect user data.

- Determining the project’s scalability: This involves understanding the project’s ability to handle increasing user traffic and transaction volume.

Assessing the Project’s Team and Community

The team behind a crypto project plays a vital role in its success. A strong team should have a proven track record in the industry, possess relevant skills and expertise, and demonstrate a commitment to the project’s success.The project’s community is another essential factor to consider.

An active and engaged community can provide valuable feedback, support, and advocacy for the project.

“A strong team should have a proven track record in the industry, possess relevant skills and expertise, and demonstrate a commitment to the project’s success.”

When assessing the project’s team and community, consider the following factors:

- Experience and expertise: Evaluate the team’s experience in blockchain development, cryptography, and related fields. Look for individuals with relevant skills and a track record of success in the industry.

- Team dynamics: Analyze the team’s communication, collaboration, and decision-making processes. A cohesive and well-functioning team is crucial for project success.

- Community engagement: Assess the size and activity of the project’s community. Look for signs of active participation, discussion, and support. A thriving community can be a valuable asset for a crypto project.

Scrutinizing the Team

The team behind a crypto project is crucial to its success. A strong team with relevant experience, expertise, and a proven track record can instill confidence in investors. Conversely, a team lacking in these areas can raise red flags. Scrutinizing the team involves investigating their backgrounds, understanding their roles, and assessing their communication and transparency.

Team Experience and Expertise

Understanding the team’s experience and expertise is essential. This involves looking into their professional backgrounds, their prior accomplishments, and their relevant skills.

- Professional Backgrounds:Analyze the team members’ educational qualifications, previous work experience, and any notable achievements in their respective fields. For example, a blockchain developer with experience in building secure and scalable platforms would be a valuable asset to a crypto project.

- Prior Accomplishments:Examine the team’s past projects, especially those related to blockchain technology or cryptocurrency. Look for successful ventures, patents, or publications that demonstrate their capabilities.

- Relevant Skills:Assess the team’s technical skills, such as programming, cryptography, or network security, which are essential for building a robust and secure crypto project.

Track Record, Dont fall for the hype 6 ways to evaluate a crypto project

A team’s track record provides insights into their ability to execute on their promises.

- Past Projects:Investigate the team’s previous projects and their outcomes. Successful projects demonstrate the team’s ability to deliver on their commitments.

- Reputation:Research the team members’ reputation in the industry. Look for any negative feedback or controversies that could raise concerns about their credibility.

- Financial Performance:If the team has been involved in previous projects, analyze their financial performance. A history of profitability or successful fundraising can be a positive indicator.

Communication and Transparency

Open and transparent communication is crucial for building trust with investors.

- Website and Whitepaper:The project’s website and whitepaper should provide comprehensive information about the team, their vision, and their plans. Look for detailed biographies, contact information, and clear explanations of the project’s goals and roadmap.

- Social Media Presence:Analyze the team’s activity on social media platforms. Regular updates, responses to queries, and engagement with the community demonstrate their commitment to transparency.

- Community Engagement:Evaluate the team’s interactions with the community. A responsive and approachable team fosters a sense of trust and confidence.

Examining the Tokenomics

Tokenomics play a crucial role in understanding the economic viability and potential success of a cryptocurrency project. It’s essential to dissect the token’s role, distribution, utility, and growth potential to make an informed investment decision. By analyzing the tokenomics, you can gain insights into the project’s long-term sustainability and its ability to attract and retain value.

Token Distribution

Token distribution refers to how the project’s tokens are initially allocated among different stakeholders. Understanding the distribution helps assess the project’s fairness, transparency, and potential for future token supply changes.

- Initial Coin Offering (ICO):Many crypto projects use ICOs to raise capital. The distribution typically involves allocating tokens to early investors, team members, advisors, and the project treasury.

- Pre-Sale:Projects may conduct pre-sales before the main ICO to raise funds from a smaller group of investors at a discounted price.

- Public Sale:The public sale allows anyone to purchase tokens, usually through exchanges or dedicated platforms.

- Team Allocation:A portion of the tokens is typically reserved for the project team, incentivizing them to build and maintain the project.

- Community Allocation:Some projects allocate tokens to the community through airdrops, bounties, or other initiatives to foster early adoption and engagement.

- Ecosystem Development:Tokens may be allocated to fund future development, marketing, and other initiatives that support the project’s growth.

Token Utility

Token utility refers to the practical uses of the token within the project’s ecosystem. A clear and well-defined utility is essential for a token’s value proposition and its potential for long-term growth.

- Governance:Some tokens allow holders to participate in the project’s governance, such as voting on proposals or electing representatives.

- Payment:Tokens can be used as a means of payment for goods and services within the project’s ecosystem, such as accessing features, buying products, or paying for fees.

- Staking:Tokens can be staked to earn rewards, participate in consensus mechanisms, or support the project’s security.

- Access:Tokens may grant access to exclusive features, content, or services within the project’s platform.

- Utility Token:These tokens are designed to be used exclusively within the project’s ecosystem, offering specific benefits or functionalities.

Token Growth Potential

Assessing a token’s growth potential requires considering factors such as its market demand, adoption rate, and the project’s overall success.

- Market Demand:The demand for a token is driven by factors like its utility, adoption rate, and the overall market sentiment.

- Adoption Rate:A higher adoption rate, indicating more users and transactions, can drive token demand and value.

- Project Success:The project’s success in delivering its value proposition and achieving its goals is crucial for the token’s growth.

- Tokenomics Design:A well-designed tokenomics model, with a clear utility, sustainable distribution, and effective incentives, can contribute to the token’s growth potential.

Token Models

Cryptocurrency projects employ different token models, each with its unique characteristics and implications.

- Utility Token:These tokens are designed for specific use cases within a project’s ecosystem. Their value is derived from their utility and the project’s success.

- Security Token:These tokens represent ownership in a real-world asset or a project. They often offer dividends or other forms of revenue sharing.

- Governance Token:These tokens allow holders to participate in the project’s governance, such as voting on proposals or electing representatives.

- Stablecoin:These tokens are designed to maintain a stable price, typically pegged to a fiat currency or a basket of assets.

Analyzing the Community

A vibrant and engaged community is a strong indicator of a project’s potential success. A healthy community fosters collaboration, innovation, and support, contributing significantly to a project’s long-term viability. Evaluating the community involves assessing its size, engagement levels, and overall sentiment towards the project.

Social Media and Online Forums

Social media platforms and online forums play a crucial role in community building. These platforms provide spaces for users to interact, share information, and discuss the project. Analyzing the activity on these platforms can offer valuable insights into the community’s health.

- Size and Growth:A large and growing community indicates strong interest in the project. Monitor the number of followers, subscribers, and active participants on social media platforms and forums.

- Engagement Levels:High engagement levels, such as frequent posts, comments, and interactions, suggest a passionate and active community. Analyze metrics like post frequency, comment counts, and social media mentions.

- Sentiment Analysis:Gauge the overall sentiment of the community towards the project. Look for positive or negative comments, reviews, and discussions. Tools for sentiment analysis can be helpful in identifying trends and patterns.

Due Diligence and Risk Assessment

While the allure of hype might be tempting, it’s crucial to remember that the crypto world is still relatively nascent and carries inherent risks. Due diligence and risk assessment are essential components of responsible crypto investing. They involve a systematic and comprehensive evaluation of a project’s potential and its associated risks.

The Importance of Independent Research and Verification

Conducting independent research and verifying information is paramount in the crypto space. This involves going beyond the project’s marketing materials and seeking information from diverse sources.

- Scrutinize Whitepapers:Whitepapers serve as the project’s blueprint, outlining its technology, tokenomics, and roadmap. Look for clear explanations, realistic timelines, and evidence of a well-defined team.

- Explore Online Communities:Engage with the project’s community on forums, social media platforms, and Discord channels. Gauge the level of community engagement, the quality of discussions, and any potential red flags.

- Check for Audits and Security Reviews:Reputable projects undergo independent audits to ensure the security of their smart contracts. Look for evidence of such audits and the reputation of the auditing firm.

Types of Risks Associated with Crypto Investments

Crypto investments come with various risks, understanding these risks is essential for making informed decisions.

- Market Volatility:The crypto market is highly volatile, with prices fluctuating significantly in short periods. This volatility can lead to substantial losses.

- Regulatory Uncertainty:Crypto regulations are still evolving globally, and regulatory changes can impact the value of crypto assets.

- Security Risks:Crypto assets are vulnerable to hacking and theft. It’s crucial to store your assets securely and be aware of potential scams.

- Project Failure:Not all crypto projects succeed. Projects may fail due to technical issues, poor management, or lack of market adoption.

- Rug Pulls and Scams:Be wary of projects that promise unrealistic returns or lack transparency. Rug pulls occur when developers abandon a project after raising funds, leaving investors with worthless tokens.