Deeptech vc fund semiconductor startups – Deep tech VC fund semiconductor startups are at the forefront of a revolution in the chip industry. These funds are pouring resources into companies developing groundbreaking technologies like advanced materials, quantum computing, and AI-powered chip design. This investment is driven by the insatiable demand for faster, more efficient, and powerful semiconductors, fueling a race to push the boundaries of what’s possible in the semiconductor landscape.

These deep tech startups are not just creating new chips; they’re reshaping entire industries. From the way we communicate and compute to the development of autonomous vehicles and medical breakthroughs, the impact of these innovations is profound and far-reaching. But navigating this dynamic landscape requires a deep understanding of the challenges and opportunities that lie ahead.

The Rise of Deep Tech in Semiconductors

The semiconductor industry is experiencing a renaissance, driven by the insatiable demand for faster, smaller, and more powerful computing devices. This surge in demand is pushing the boundaries of traditional semiconductor technology, leading to the emergence of deep tech as a vital force in driving innovation.

Deep Tech’s Role in Semiconductor Innovation

Deep tech leverages cutting-edge scientific discoveries and technological advancements to address fundamental challenges in the semiconductor industry. It empowers engineers and researchers to push beyond the limitations of conventional approaches, leading to breakthroughs in areas like materials science, quantum computing, and AI-powered chip design.

Impact of Deep Tech in Key Areas

Deep tech is making a significant impact across various areas of the semiconductor industry.

- Advanced Materials:The pursuit of smaller, more efficient transistors requires innovative materials that can withstand the extreme miniaturization and operate at higher speeds. Deep tech is enabling the development of novel materials like 2D materials (graphene, MoS2) and advanced alloys, offering superior performance and energy efficiency compared to traditional silicon.

For instance, researchers at the University of California, Berkeley, have developed a new type of 2D material called “MXene” that exhibits exceptional electrical conductivity and thermal stability, making it a promising candidate for next-generation transistors.

- Quantum Computing:Quantum computing harnesses the principles of quantum mechanics to perform calculations that are impossible for classical computers. Deep tech is playing a crucial role in developing quantum computing hardware, including superconducting qubits, trapped ions, and photonic chips. Google’s Sycamore processor, for example, achieved quantum supremacy in 2019 by solving a complex problem in 200 seconds that would take a classical supercomputer 10,000 years.

- AI-Powered Chip Design:Deep learning algorithms are being used to optimize chip design, enabling the creation of more efficient and powerful chips. AI-powered design tools can analyze vast amounts of data to identify optimal layouts, reduce power consumption, and improve performance. For example, companies like Cadence Design Systems and Synopsys are incorporating AI into their chip design software, allowing engineers to create chips with higher performance and lower power consumption.

The Role of VC Funds in Deep Tech Semiconductor Startups

Venture capital (VC) funds play a crucial role in nurturing the growth of deep tech semiconductor startups. These startups are at the forefront of innovation, pushing the boundaries of chip design, fabrication, and applications. VC funds provide the essential capital and expertise needed to navigate the complex and capital-intensive semiconductor landscape.

The Investment Landscape for Deep Tech Semiconductor Startups

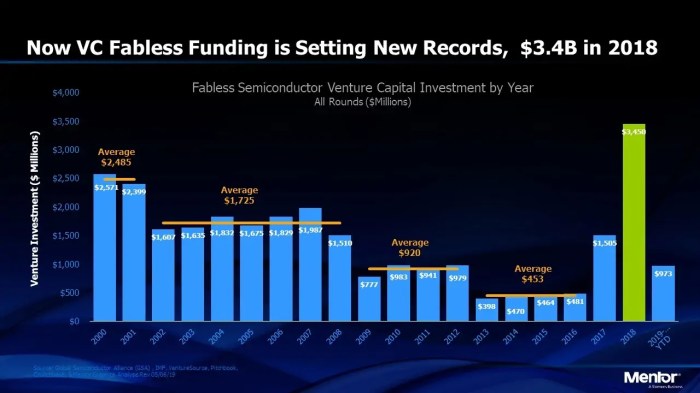

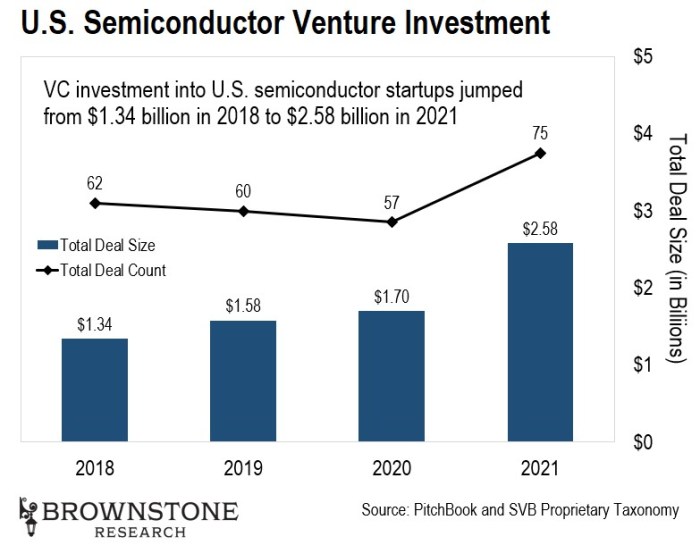

The investment landscape for deep tech semiconductor startups is characterized by significant capital requirements, long development cycles, and high technical barriers to entry. The sector attracts a diverse range of investors, including traditional VC funds, corporate venture capitalists, and government agencies.

- Early-stage investments:Seed and Series A funding rounds are typically led by specialized VC funds focused on deep tech and semiconductors. These funds provide early-stage capital to help startups validate their technology, build prototypes, and secure initial customer traction.

- Growth-stage investments:As startups progress, they often require larger capital injections for scaling production, expanding their team, and securing strategic partnerships. Growth-stage investments are typically led by larger VC funds or corporate venture capitalists with expertise in the semiconductor industry.

- Strategic partnerships:Many deep tech semiconductor startups also seek strategic partnerships with established players in the industry. These partnerships can provide access to manufacturing capabilities, distribution channels, and technical expertise.

Challenges and Opportunities for VC Funds

Investing in deep tech semiconductor startups presents unique challenges and opportunities for VC funds.

Challenges

- High capital requirements:Developing new semiconductor technologies is extremely expensive, requiring significant investments in research and development, fabrication facilities, and equipment. VC funds need to be prepared to commit substantial capital to support these startups.

- Long development cycles:Bringing a new semiconductor product to market can take several years, involving multiple stages of design, prototyping, testing, and manufacturing. VC funds need to have a long-term investment horizon and patience to navigate these extended timelines.

- Technical complexity:The semiconductor industry is highly technical, requiring deep expertise in chip design, fabrication, and applications. VC funds need to have strong technical due diligence capabilities to evaluate the potential of these startups.

- Competitive landscape:The semiconductor industry is highly competitive, with established players and numerous startups vying for market share. VC funds need to carefully assess the competitive landscape and identify startups with a clear differentiation and potential for success.

Opportunities

- Disruptive innovation:Deep tech semiconductor startups are driving disruptive innovation in various industries, from artificial intelligence and autonomous vehicles to healthcare and energy. VC funds have the opportunity to invest in companies that are shaping the future of technology.

- Growing market demand:The global semiconductor market is expected to grow significantly in the coming years, driven by increasing demand for computing power, connectivity, and advanced applications. VC funds can capitalize on this growth by investing in startups addressing key market trends.

- Strategic partnerships:VC funds can leverage their network and expertise to facilitate strategic partnerships between deep tech semiconductor startups and established players in the industry. These partnerships can accelerate the development and adoption of new technologies.

- High returns on investment:Successful deep tech semiconductor startups can generate significant returns on investment for VC funds. These companies have the potential to become industry leaders and disrupt existing markets.

Investment Strategies of VC Funds

VC funds specializing in deep tech semiconductors employ a variety of investment strategies tailored to the specific needs of the sector.

Learn about more about the process of can chatgpt write you the ultimate cover letter in the field.

- Focus on specific technology areas:Some VC funds focus on investing in startups developing specific technologies, such as AI chips, quantum computing, or advanced memory technologies. This specialization allows them to build expertise and networks within a particular area.

- Geographic focus:Some VC funds focus on investing in startups located in specific regions known for their semiconductor expertise, such as Silicon Valley, Israel, or Taiwan. This approach allows them to leverage local networks and resources.

- Stage-specific investments:Some VC funds specialize in investing at specific stages of the startup lifecycle, such as seed, Series A, or growth stage. This focus allows them to develop expertise and networks within a particular stage of development.

- Value creation through active engagement:VC funds actively engage with their portfolio companies, providing mentorship, strategic guidance, and access to their networks. This active approach helps startups navigate the complex challenges of the semiconductor industry.

Key Characteristics of Deep Tech Semiconductor Startups: Deeptech Vc Fund Semiconductor Startups

Deep tech semiconductor startups are a unique breed, operating at the cutting edge of innovation. They push the boundaries of what’s possible with silicon, revolutionizing industries and shaping the future of technology. To understand what makes them successful, we need to delve into their key characteristics.

Strong Technical Expertise

Deep tech semiconductor startups are founded by individuals with deep expertise in semiconductor design, fabrication, and related fields. This expertise is crucial for developing innovative and competitive technologies.

- Founders with Proven Track Records:Successful deep tech semiconductor startups often have founders with proven track records in the semiconductor industry. They may have previously worked at established companies, contributed to significant breakthroughs, or hold relevant patents. For example, the founders of ARM Holdings, a leading semiconductor design company, were veterans of Acorn Computers, a company known for its innovative computer designs.

- Strong Research and Development (R&D) Teams:These startups invest heavily in R&D, assembling teams of highly skilled engineers, scientists, and researchers. They are constantly exploring new materials, processes, and architectures to develop groundbreaking technologies. A notable example is the company Graphcore, which is developing a new type of processor based on graph neural networks, a powerful type of artificial intelligence (AI).

Intellectual Property (IP) Protection

Protecting intellectual property is critical for deep tech semiconductor startups. Their innovations often involve complex technologies that require significant investment and time to develop.

- Patents and Trade Secrets:These startups aggressively pursue patents to protect their inventions. They also rely on trade secrets to safeguard their proprietary know-how. Companies like Qualcomm, known for its mobile chipsets, have a strong portfolio of patents that protect their innovations.

- IP Licensing and Partnerships:Some startups leverage their IP by licensing it to other companies or forming partnerships to bring their technologies to market. For example, ARM Holdings licenses its processor designs to various companies, enabling them to develop their own chips.

Market Validation

Deep tech semiconductor startups need to demonstrate the viability of their technologies in the market. This requires a thorough understanding of customer needs, market trends, and potential applications.

- Early Customer Adoption:Securing early adopters is essential for validating the market potential of a new technology. These customers can provide valuable feedback and help refine the product. A company like NVIDIA, known for its graphics processing units (GPUs), has gained significant market share by focusing on early adopters in the gaming and high-performance computing sectors.

- Market Research and Analysis:Deep tech semiconductor startups conduct extensive market research to identify potential applications for their technologies. This includes analyzing industry trends, competitor landscapes, and customer preferences. For example, the company Analog Devices, a leader in analog and mixed-signal semiconductor technologies, invests heavily in market research to understand the evolving needs of its customers in various industries.

Impact of Deep Tech Semiconductor Startups on the Industry

![]()

Deep tech semiconductor startups are not merely adding to the existing landscape; they are fundamentally reshaping the industry. They are bringing fresh perspectives, innovative technologies, and disruptive business models that are challenging established players and paving the way for a new era of semiconductor innovation.

Disruption and New Markets

Deep tech semiconductor startups are disrupting existing markets by offering solutions that address unmet needs and challenges. They are pushing the boundaries of what’s possible with semiconductors, leading to the creation of entirely new markets. For example, startups developing advanced materials and fabrication processes are enabling the creation of smaller, faster, and more energy-efficient chips, which are driving innovation in fields like artificial intelligence, quantum computing, and the Internet of Things.

Examples of Successful Deep Tech Semiconductor Startups

- Graphcore: This UK-based startup has developed a new type of processor called the Intelligence Processing Unit (IPU) that is specifically designed for AI workloads. Graphcore’s IPUs are significantly faster and more efficient than traditional GPUs, making them ideal for applications like machine learning and deep learning.

- AI21 Labs: This Israeli company focuses on natural language processing (NLP) and has developed a new type of AI model called Jurassic-1 Jumbo. This model boasts 178 billion parameters, making it one of the largest and most powerful language models available.

It can be used for various NLP tasks, including text generation, translation, and question answering.

- PsiQuantum: This US-based startup is developing a photonic quantum computer that leverages the principles of quantum mechanics to perform calculations at unprecedented speeds. PsiQuantum’s technology has the potential to revolutionize fields like drug discovery, materials science, and financial modeling.

Challenges and Opportunities for Deep Tech Semiconductor Startups

Deep tech semiconductor startups, while pioneering cutting-edge advancements, face a unique set of challenges and opportunities. Navigating these complexities is crucial for their success and impact on the industry.

Challenges for Deep Tech Semiconductor Startups

Deep tech semiconductor startups often face significant hurdles in their journey to commercialization. These challenges stem from the inherent complexities of the semiconductor industry and the high capital requirements for developing and manufacturing advanced chips.

- Funding:Semiconductor development is capital-intensive, requiring substantial investments in research, development, and manufacturing. Securing funding, particularly in the early stages, can be a major obstacle for startups. Venture capitalists may be hesitant to invest in deep tech ventures due to the long development cycles and uncertainties associated with emerging technologies.

- Talent Acquisition:Deep tech semiconductor startups require specialized expertise in areas like chip design, fabrication, and advanced materials. Attracting and retaining highly skilled engineers and scientists is a major challenge, especially in a competitive talent market.

- Market Adoption:Deep tech semiconductor startups often develop innovative technologies that may not be readily accepted by the market. Overcoming customer skepticism and demonstrating the value proposition of their solutions can be challenging, especially in established industries where incumbent players have strong market positions.

- Manufacturing:Semiconductor manufacturing is a highly complex and specialized process. Startups may face difficulties accessing fabrication facilities and securing manufacturing partners with the necessary expertise and capacity.

- Regulation and Standards:The semiconductor industry is subject to stringent regulations and industry standards. Startups need to comply with these regulations and ensure their products meet industry standards, which can be a complex and time-consuming process.

Opportunities for Deep Tech Semiconductor Startups, Deeptech vc fund semiconductor startups

Despite the challenges, deep tech semiconductor startups have the potential to disrupt established markets and create significant value. They can leverage emerging technologies and trends to develop innovative solutions that address critical industry needs.

- Partnerships with Established Players:Collaborating with established semiconductor companies can provide startups with access to resources, expertise, and market channels. Partnerships can facilitate faster adoption of new technologies and accelerate the commercialization process.

- Emerging Markets:Deep tech semiconductor startups can target emerging markets with high growth potential, such as the Internet of Things (IoT), artificial intelligence (AI), and quantum computing. These markets are characterized by rapid adoption of new technologies and offer significant opportunities for innovation.

- Government Support:Governments worldwide are increasingly investing in semiconductor research and development, recognizing the strategic importance of the industry. Startups can benefit from government grants, funding programs, and tax incentives to support their growth and innovation.

- Open Source and Community Building:Engaging with open source communities and fostering collaboration can accelerate innovation and reduce development costs. Startups can leverage the collective knowledge and resources of open source communities to develop and refine their technologies.

- Vertical Integration:Deep tech semiconductor startups can pursue vertical integration by developing their own manufacturing capabilities. This can provide greater control over the supply chain and reduce dependence on external partners.