Dear EU policymakers please stop ignoring freelancers – this is a call to action, a plea for recognition, and a spotlight on a growing segment of the European workforce that is often overlooked. The freelance economy is booming, contributing significantly to the EU’s economic engine.

Yet, freelancers face systemic challenges that hinder their potential and create a landscape of insecurity. From a lack of social security and benefits to unfair payment practices, the hurdles they face are numerous and often insurmountable.

This blog post explores the critical issues surrounding freelancers in the EU, delves into the impact of ignoring their needs, and proposes concrete policy recommendations for a more equitable and supportive future. It’s time for the EU to acknowledge the vital role freelancers play and take steps to ensure they have the resources and opportunities to thrive.

The Growing Freelance Workforce: Dear Eu Policymakers Please Stop Ignoring Freelancers

The freelance workforce in the European Union is expanding rapidly, representing a significant and dynamic segment of the EU economy. This growth is driven by various factors, including technological advancements, changing work patterns, and the increasing demand for specialized skills.

The Size and Growth of the Freelance Workforce in the EU

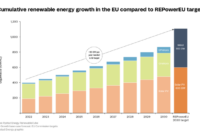

The freelance workforce in the EU is substantial and growing. According to a 2022 report by the European Commission, approximately 17% of the EU workforce is engaged in freelance work. This translates to over 35 million freelancers across the EU, contributing significantly to the overall economic landscape.

Obtain direct knowledge about the efficiency of to detect deepfake video call ask suspect to turn sideways through case studies.

The growth of the freelance workforce is expected to continue in the coming years. The increasing adoption of digital technologies, the rise of the gig economy, and the growing demand for flexible work arrangements are all contributing to this trend.

The Economic Contributions of Freelancers to the EU Economy

Freelancers play a vital role in the EU economy, contributing to economic growth and job creation. They provide a wide range of services, from software development and design to consulting and writing, catering to the needs of both large corporations and small businesses.

The economic contributions of freelancers are substantial. They generate significant revenue, pay taxes, and create employment opportunities. Additionally, they contribute to innovation and entrepreneurship, fostering a dynamic and adaptable economy.

Types of Freelance Work Prevalent in the EU

The types of freelance work prevalent in the EU are diverse, reflecting the changing nature of the labor market. Some of the most common types of freelance work include:

- IT and Software Development:This sector is experiencing significant growth, with freelancers providing a wide range of services, including web development, mobile app development, and data analysis.

- Design and Creative Services:Freelancers in this sector offer services such as graphic design, web design, photography, and video production.

- Writing and Content Creation:This category encompasses freelancers specializing in writing, editing, translation, and content creation for various platforms, including websites, blogs, and social media.

- Consulting and Business Services:Freelancers in this area provide consulting services, business analysis, market research, and project management.

- Teaching and Education:Freelancers in this sector offer online courses, tutoring, and educational services.

Challenges Faced by Freelancers

Freelancing, while offering flexibility and autonomy, presents a unique set of challenges for individuals operating within the European Union. These challenges often stem from the lack of traditional employment structures and the inherent instability associated with freelance work.

Lack of Social Security and Benefits

Freelancers often face significant challenges when it comes to accessing social security and benefits. In contrast to traditional employees, they are typically responsible for securing their own social protection, including pensions, healthcare, and unemployment insurance. This can lead to financial insecurity and a lack of safety net in case of illness, unemployment, or retirement.

- Limited Access to Social Security:EU regulations provide for social security coordination for cross-border workers, but freelancers often struggle to access benefits in their country of residence if they work in another EU country.

- High Costs of Private Insurance:Freelancers may need to purchase private insurance for healthcare, pensions, and unemployment, which can be costly and complex to navigate.

- Varying Social Security Systems Across EU Countries:Social security systems and benefits vary significantly across EU countries, leading to disparities in coverage and access for freelancers.

Difficulty Accessing Financing

Securing financing can be a significant hurdle for freelancers. Banks and financial institutions often perceive freelancers as high-risk borrowers due to the inherent instability of freelance work. This can make it difficult for freelancers to obtain loans, mortgages, or other forms of financial assistance necessary for business growth or personal needs.

- Limited Access to Traditional Loans:Banks often require stable employment history and income streams, which freelancers may not possess.

- High Interest Rates on Microloans:Microloans, a common alternative for freelancers, often come with high interest rates, making them an expensive option.

- Lack of Awareness of Financial Support Programs:Freelancers may be unaware of government grants, subsidies, or other financial support programs available to them.

Unfair Payment Practices

Freelancers often face unfair payment practices, including delayed payments, non-payment, and disputes over invoices. This can lead to financial hardship and instability, particularly for freelancers who rely on timely payments for their livelihood.

- Late Payments from Clients:Clients may delay payments, forcing freelancers to wait for their earnings and potentially impacting their cash flow.

- Non-Payment of Invoices:Some clients may refuse to pay invoices altogether, leaving freelancers with unpaid work and financial losses.

- Lack of Clear Contracts:Unclear contracts or the absence of contracts can lead to disputes over payment terms, scope of work, and deliverables.

Limited Access to Professional Development Opportunities

Freelancers often face challenges accessing professional development opportunities, including training, networking events, and mentorship programs. These limitations can hinder their growth, competitiveness, and ability to stay abreast of industry trends.

- Limited Access to Traditional Training Programs:Traditional training programs may be inaccessible or unaffordable for freelancers due to time constraints or financial limitations.

- Lack of Dedicated Support Networks:Freelancers may struggle to find dedicated support networks, mentorship programs, or industry events tailored to their needs.

- Difficulties in Staying Updated:Keeping up with industry advancements and technological changes can be challenging for freelancers without access to continuous learning opportunities.

Impact of Ignoring Freelancers

Ignoring the needs of freelancers comes with significant consequences for the EU, potentially hindering its economic growth and social well-being. Failing to recognize and support this rapidly growing segment of the workforce could lead to a loss of valuable talent and innovation, exacerbate economic inequality, and ultimately weaken the EU’s competitiveness in the global marketplace.

Loss of Talent and Innovation

The freelance workforce is a hotbed of talent and innovation. Freelancers often bring fresh perspectives, specialized skills, and a high degree of adaptability to projects. By ignoring their needs, the EU risks losing access to this valuable pool of talent, hindering its ability to compete in a rapidly evolving global economy.

For instance, the EU might miss out on opportunities to leverage the expertise of freelancers in emerging fields like artificial intelligence, cybersecurity, and sustainable technologies.

Increased Economic Inequality

Ignoring freelancers can contribute to growing economic inequality within the EU. Freelancers often face challenges accessing benefits and protections available to traditional employees, such as sick leave, pensions, and unemployment insurance. This lack of support can create a two-tier system where freelancers struggle to secure financial stability and face greater risks, widening the gap between them and traditional employees.

This could lead to a situation where the EU’s social safety net fails to adequately support a significant segment of its workforce, exacerbating existing social and economic disparities.

Weakening of the EU’s Competitiveness

Ignoring freelancers weakens the EU’s competitiveness in the global economy. The EU needs to attract and retain talent to maintain its economic strength. By failing to create a supportive environment for freelancers, the EU risks pushing talented individuals to seek opportunities elsewhere, ultimately undermining its ability to compete in the global marketplace.

This is especially important in a world where businesses increasingly rely on flexible and agile workforces, and where attracting and retaining top talent is crucial for success.

Policy Recommendations

The EU policymakers have a critical role to play in shaping a future where freelancers can thrive. To address the unique challenges faced by this growing workforce, a comprehensive set of policy recommendations is necessary. These recommendations aim to create a fairer, more supportive, and sustainable environment for freelancers, ensuring their contributions to the EU economy are fully recognized and valued.

Policy Recommendations for Freelancers, Dear eu policymakers please stop ignoring freelancers

This table Artikels key policy areas and specific recommendations for EU policymakers to address the challenges faced by freelancers:

| Policy Area | Specific Recommendations | Potential Benefits |

|---|---|---|

| Social Protection |

|

|

| Taxation and Administration |

|

|

| Contractual Rights and Protections |

|

|

| Professional Development and Skills |

|

|

| Access to Finance and Investment |

|

|

Policy Initiatives for Freelancer Empowerment

The following list Artikels potential policy initiatives that can support and empower freelancers in the EU:

- Establishment of a dedicated Freelancer Task Force: A task force composed of representatives from government, industry, and freelance organizations can provide a platform for dialogue, collaboration, and the development of targeted policies for freelancers.

- National Freelancer Support Programs: Governments can establish dedicated programs to provide financial assistance, training, and mentoring to freelancers, particularly those facing challenges related to social security, taxation, or access to finance.

- Promotion of Freelance Platforms and Networks: The EU can support the development and growth of online platforms and networks that connect freelancers with clients, facilitate collaboration, and provide access to resources and support services.

- Integration of Freelancing into Education and Training Systems: Educational institutions can incorporate modules on freelancing, entrepreneurship, and digital skills into their curricula, preparing students for a future of work that increasingly embraces independent work.

- Public Procurement Opportunities for Freelancers: Governments can prioritize the inclusion of freelancers in public procurement processes, creating opportunities for them to participate in public projects and contribute to the public sector.

Key Steps for EU Policymakers

EU policymakers can take several key steps to improve the working conditions and economic security of freelancers:

- Recognize and acknowledge the growing importance of the freelance workforce: By recognizing the significant contribution of freelancers to the EU economy, policymakers can prioritize policies that support their needs and empower their growth.

- Engage with freelancer organizations and representatives: By actively engaging with freelancer organizations and representatives, policymakers can gain valuable insights into the challenges and opportunities faced by freelancers, informing the development of effective policies.

- Promote a culture of collaboration and innovation: By fostering a collaborative environment where freelancers, businesses, and policymakers work together, the EU can unlock the full potential of the freelance workforce and drive economic growth.

- Monitor and evaluate the impact of policies on freelancers: Regular monitoring and evaluation of policy initiatives aimed at freelancers are crucial to ensure their effectiveness and make necessary adjustments to address evolving needs and challenges.

The Future of Freelancing

The future of freelancing is bright, with the potential to reshape the way work is done and empower individuals to pursue their passions. As the freelance workforce continues to grow, it’s crucial to look at successful models in other countries and consider how emerging technologies can shape the future of freelancing in the EU.

Successful Freelance Ecosystems

The growth of the freelance workforce is a global phenomenon, with several countries showcasing successful models for supporting and empowering freelancers.

- The Netherlands: The Dutch government has implemented policies that promote freelance work, such as flexible tax systems and access to social security benefits for freelancers. This has fostered a thriving freelance ecosystem with a strong support network.

- Canada: Canada has a robust freelance ecosystem, with strong legal frameworks and access to various government programs designed specifically for freelancers. These programs provide financial assistance, training, and mentorship opportunities.

- Germany: Germany has established a strong freelance infrastructure, with dedicated platforms and organizations providing resources and support to freelancers. This includes access to professional development programs, networking opportunities, and legal advice.

These examples highlight the importance of government support and infrastructure in fostering a thriving freelance ecosystem.

Impact of Emerging Technologies

Emerging technologies are poised to significantly impact the freelance workforce in the EU.

- Artificial Intelligence (AI): AI-powered tools can automate tasks, freeing up freelancers to focus on higher-value work. This can lead to increased efficiency and productivity, allowing freelancers to take on more complex projects.

- Blockchain Technology: Blockchain can facilitate secure and transparent transactions, making it easier for freelancers to get paid and for clients to find and hire them. This can streamline the freelance process and reduce administrative overhead.

- Remote Work Technologies: Technologies like video conferencing and project management tools have made it easier for freelancers to collaborate with clients remotely. This has opened up new opportunities for freelancers to work with clients worldwide.

These technologies can empower freelancers, enabling them to work more efficiently, connect with global clients, and access new markets.

Vision for the Future

The future of freelancing in the EU can be one where freelancers are recognized, supported, and empowered.

“The EU can become a global leader in fostering a thriving freelance ecosystem, where freelancers are empowered to contribute to economic growth and innovation.”

This vision can be achieved through a combination of policy changes, technological advancements, and collaborative efforts.

- Policy Changes: The EU should implement policies that provide freelancers with access to social security benefits, affordable healthcare, and training programs. This will ensure a more equitable and secure environment for freelancers.

- Technological Advancements: The EU should invest in research and development of technologies that support freelancers, such as AI-powered tools, blockchain platforms, and remote work infrastructure.

- Collaborative Efforts: The EU should foster collaboration between governments, businesses, and freelance organizations to develop strategies and resources that empower freelancers.

By taking these steps, the EU can create a future where freelancers are valued and empowered to thrive in a rapidly changing world.