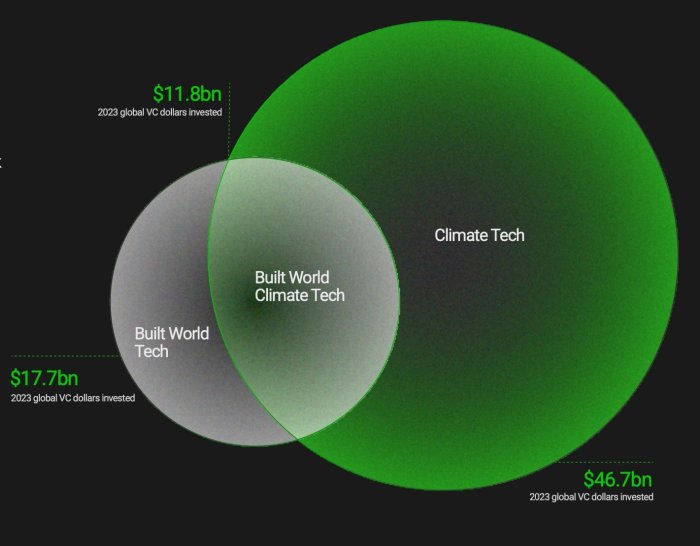

Climate tech built world investment report – The Climate Tech Built World: Investment Report delves into the booming landscape of climate technology, analyzing trends, key players, and the future potential of this rapidly growing sector. This report serves as a guide for investors looking to navigate the complex world of climate tech, highlighting the opportunities and challenges that lie ahead.

From renewable energy and energy storage to carbon capture and sustainable agriculture, the report explores the key sectors driving climate innovation. It examines the role of venture capital and private equity in shaping this ecosystem, while also highlighting the impact of ESG considerations on investment decisions.

Climate Tech Investment Landscape

The global climate tech investment landscape is experiencing rapid growth, driven by increasing awareness of the urgency of climate change and the emergence of innovative solutions. Investors are pouring capital into companies developing technologies that can help mitigate climate change and adapt to its impacts.

Key Trends and Growth Areas

Climate tech investment is characterized by several key trends:

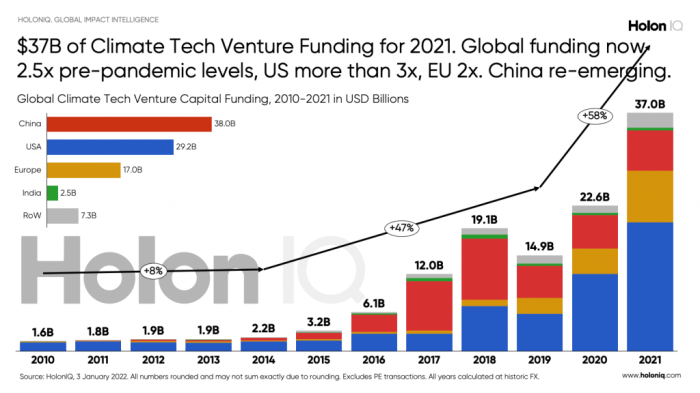

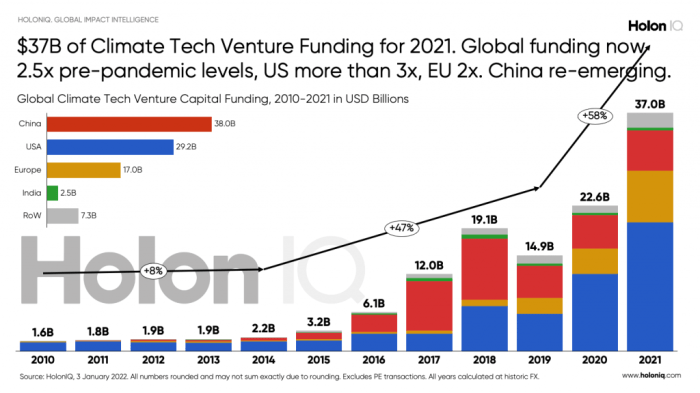

- Growing Investment:Global climate tech investment has surged in recent years, reaching record highs in 2021 and 2022. This trend is expected to continue, fueled by increasing investor interest and the growing scale of the climate crisis.

- Diversification of Investment:Investment is spreading across a wide range of climate tech sectors, including renewable energy, energy storage, carbon capture, electric vehicles, sustainable agriculture, and climate adaptation. This diversification reflects the multifaceted nature of the climate challenge and the need for solutions across multiple areas.

- Focus on Scalability:Investors are increasingly seeking out companies with scalable solutions that can have a significant impact on reducing greenhouse gas emissions or adapting to climate change. This focus on scalability is essential for achieving the ambitious goals of the Paris Agreement.

Leading Investors in Climate Tech

Several leading investors are actively shaping the climate tech landscape:

- Breakthrough Energy Ventures (BEV):Founded by Bill Gates, BEV invests in companies developing technologies that can accelerate the transition to a clean energy future. Its portfolio includes companies like Carbon Engineering, which captures carbon dioxide from the atmosphere, and Heliogen, which uses concentrated solar energy to produce clean fuels.

- Climate Capital:A venture capital firm focused on climate solutions, Climate Capital invests in companies across a range of sectors, including renewable energy, energy efficiency, and sustainable agriculture. Its portfolio includes companies like Redwood Materials, which recycles battery materials, and Pivot Bio, which develops nitrogen-fixing microbes for agriculture.

- Lowercarbon Capital:This venture capital firm invests in companies developing technologies that can reduce greenhouse gas emissions and accelerate the transition to a low-carbon economy. Its portfolio includes companies like Charm Industrial, which removes carbon dioxide from the atmosphere, and Form Energy, which develops long-duration energy storage.

Investment Stages in Climate Tech, Climate tech built world investment report

Climate tech investment spans different stages, from seed funding to late-stage venture capital:

- Seed Funding:Seed funding provides early-stage companies with capital to develop their initial product or service. This stage is often characterized by high risk but also high potential for growth. Seed investors typically focus on the company’s team, technology, and market potential.

- Series A Funding:Series A funding helps companies scale their operations and expand their market reach. Investors at this stage typically look for companies with a proven product-market fit and a strong management team. They also consider the company’s growth potential and its ability to attract further investment.

- Series B and Beyond:Series B and later-stage funding rounds are typically used to fund significant growth initiatives, such as expanding production, launching new products, or entering new markets. Investors at this stage typically seek companies with strong revenue growth and a clear path to profitability.

They also consider the company’s competitive landscape and its ability to execute its growth strategy.

Key Sectors and Technologies

Climate technology, or climate tech, encompasses a wide range of innovative solutions addressing the climate crisis. This sector is experiencing significant growth, attracting substantial investment as investors recognize the urgent need for climate action and the immense potential of these technologies.

This section delves into the key sectors within climate tech, exploring the emerging technologies driving innovation and highlighting successful companies shaping the future of climate solutions.

Renewable Energy

Renewable energy sources, such as solar, wind, hydro, geothermal, and biomass, play a pivotal role in mitigating climate change by reducing reliance on fossil fuels. These technologies are experiencing rapid advancements, leading to increased efficiency, affordability, and scalability.

- Solar Energy:Photovoltaic (PV) solar technology converts sunlight directly into electricity, and advancements in solar cell efficiency and manufacturing have led to significant cost reductions. The emergence of solar farms, rooftop solar installations, and integrated solar solutions is further driving the growth of solar energy.

- Wind Energy:Wind turbines harness the kinetic energy of wind to generate electricity. Technological advancements in turbine design, blade optimization, and offshore wind technology have increased energy generation capacity and reduced costs. The expansion of wind farms, particularly in offshore locations with higher wind speeds, is contributing to a substantial increase in wind energy production.

- Hydropower:Hydroelectric power plants generate electricity from the flow of water. While traditional hydropower plants have been in operation for decades, advancements in pumped hydro storage and small-scale hydropower solutions are enabling the development of more efficient and flexible hydropower systems.

- Geothermal Energy:Geothermal energy harnesses heat from the Earth’s interior to generate electricity. Advancements in geothermal drilling technologies and the development of enhanced geothermal systems (EGS) are expanding the potential of geothermal energy, particularly in areas with high geothermal activity.

- Biomass Energy:Biomass energy utilizes organic matter, such as wood, crops, and waste, to produce electricity and heat.

Advancements in biomass conversion technologies, such as gasification and pyrolysis, are improving the efficiency and sustainability of biomass energy production.

Successful Companies:

- First Solar (FSLR):First Solar is a leading manufacturer of thin-film solar panels, known for their high efficiency and durability. The company’s innovative manufacturing processes and commitment to sustainability have made it a prominent player in the solar energy industry.

- Vestas (VWS):Vestas is a global leader in wind turbine technology, offering a wide range of wind turbine solutions for onshore and offshore applications.

The company’s focus on innovation, technological advancements, and customer service has positioned it as a key player in the wind energy sector.

- Enphase Energy (ENPH):Enphase Energy is a leading provider of microinverters for residential solar systems. The company’s microinverters optimize energy production at the panel level, increasing efficiency and reliability.

Enphase Energy’s innovative technology and focus on customer satisfaction have made it a prominent player in the residential solar market.

Energy Storage

Energy storage is crucial for ensuring grid stability and reliability, especially as the adoption of renewable energy sources increases. Energy storage technologies enable the storage of energy generated from renewable sources, allowing for its use when demand is high or renewable energy production is low.

- Lithium-ion Batteries:Lithium-ion batteries are the dominant energy storage technology, used in electric vehicles, grid-scale storage, and consumer electronics. Advancements in battery chemistry, materials, and manufacturing processes are driving improvements in battery performance, cost, and lifespan.

- Flow Batteries:Flow batteries are a type of energy storage technology that uses electrolytes dissolved in liquids to store energy.

These batteries offer long lifespans, high discharge rates, and scalability, making them suitable for grid-scale energy storage applications.

- Pumped Hydro Storage:Pumped hydro storage uses excess electricity to pump water uphill to a reservoir. When electricity is needed, the water is released downhill through turbines to generate electricity.

Pumped hydro storage is a mature and cost-effective energy storage technology, particularly suitable for large-scale applications.

- Compressed Air Energy Storage (CAES):CAES systems store energy by compressing air into underground caverns or tanks. When electricity is needed, the compressed air is released to drive turbines and generate electricity.

CAES is a mature technology, but advancements in system efficiency and the development of hybrid CAES systems are expanding its potential.

Successful Companies:

- Tesla (TSLA):Tesla is a leading manufacturer of electric vehicles and energy storage systems. The company’s Powerwall home battery and Powerpack grid-scale battery storage systems are widely used for residential and commercial applications. Tesla’s focus on innovation, technology, and sustainability has made it a dominant force in the energy storage market.

- LG Energy Solution (LGES):LG Energy Solution is a leading manufacturer of lithium-ion batteries for electric vehicles, consumer electronics, and grid-scale energy storage. The company’s focus on battery performance, cost reduction, and sustainability has positioned it as a key player in the energy storage industry.

- Fluence Energy (FLNC):Fluence Energy is a leading provider of energy storage solutions for grid-scale applications. The company’s focus on providing flexible and reliable energy storage solutions for utilities and independent power producers has made it a key player in the grid-scale energy storage market.

Carbon Capture

Carbon capture technologies aim to remove carbon dioxide (CO2) from the atmosphere or industrial emissions. These technologies are crucial for mitigating climate change by reducing greenhouse gas concentrations in the atmosphere.

- Direct Air Capture (DAC):DAC technologies directly capture CO2 from the atmosphere. These technologies typically use specialized filters or sorbents to capture CO2, which is then stored or used for other purposes. DAC technologies are still in their early stages of development, but they offer significant potential for removing CO2 from the atmosphere.

- Carbon Capture and Storage (CCS):CCS technologies capture CO2 from industrial emissions, such as power plants and factories, and store it underground in geological formations. CCS is a mature technology, and several large-scale CCS projects are currently in operation or under development.

- Carbon Capture and Utilization (CCU):CCU technologies capture CO2 from industrial emissions and utilize it to produce valuable products, such as fuels, chemicals, and building materials.

CCU technologies offer a pathway to reduce emissions while creating new economic opportunities.

Successful Companies:

- Climeworks (CLWK):Climeworks is a leading provider of direct air capture technologies. The company’s DAC plants capture CO2 directly from the atmosphere and store it underground or utilize it for other purposes. Climeworks’ innovative technology and commitment to sustainability have positioned it as a key player in the carbon capture market.

Explore the different advantages of uk police report epidemic android false emergency calls that can change the way you view this issue.

- Global CCS Institute:The Global CCS Institute is a non-profit organization that promotes the development and deployment of CCS technologies. The institute provides research, analysis, and advocacy to advance the adoption of CCS technologies globally.

- Carbon Engineering (CE):Carbon Engineering is a company developing DAC technologies.

The company’s DAC plants capture CO2 directly from the atmosphere and convert it into synthetic fuels. Carbon Engineering’s innovative technology and focus on climate solutions have positioned it as a key player in the carbon capture market.

Sustainable Agriculture

Sustainable agriculture practices aim to reduce the environmental impact of agriculture while ensuring food security and economic viability. These practices focus on minimizing resource use, reducing greenhouse gas emissions, and promoting biodiversity.

- Precision Agriculture:Precision agriculture uses technology to optimize crop yields and resource use. Techniques include sensor networks, drones, and data analytics to monitor crop health, soil conditions, and irrigation needs. Precision agriculture can reduce fertilizer and pesticide use, improve water efficiency, and increase crop yields.

- Vertical Farming:Vertical farming involves growing crops in stacked layers, often in controlled environments. This method can increase food production density, reduce water consumption, and minimize the use of pesticides. Vertical farming offers a potential solution for urban agriculture and sustainable food production.

- Regenerative Agriculture:Regenerative agriculture practices focus on improving soil health, increasing biodiversity, and sequestering carbon. Techniques include no-till farming, cover cropping, and composting, which promote soil health and resilience. Regenerative agriculture can enhance food security, mitigate climate change, and improve ecosystem services.

Successful Companies:

- FarmLogs:FarmLogs provides a platform for farmers to manage their data, track crop performance, and optimize their operations. The company’s technology helps farmers make data-driven decisions, improving efficiency and sustainability.

- Plenty:Plenty is a vertical farming company that uses technology to grow fresh produce in controlled environments.

The company’s vertical farms are located in urban areas, reducing transportation costs and food waste. Plenty’s innovative technology and commitment to sustainable food production have positioned it as a leader in the vertical farming industry.

- Indigo Agriculture:Indigo Agriculture develops technologies to improve soil health and crop yields.

The company’s products and services help farmers reduce their environmental impact while increasing their profitability. Indigo Agriculture’s focus on sustainable agriculture practices has positioned it as a key player in the agricultural technology sector.

Investment Trends and Drivers

The climate tech sector is experiencing unprecedented investment growth, driven by a confluence of factors. These factors include escalating awareness of climate change, the increasing urgency to transition to a low-carbon economy, and the emergence of innovative technologies offering solutions.

Government Policies and Regulations

Government policies and regulations play a pivotal role in shaping the investment landscape for climate tech. Governments worldwide are enacting policies and regulations to incentivize the development and deployment of climate-friendly technologies. These policies include carbon pricing mechanisms, renewable energy subsidies, and energy efficiency standards.

For example, the European Union’s Emissions Trading System (ETS) has significantly influenced investment in carbon capture and storage technologies. Similarly, the US Inflation Reduction Act, passed in 2022, provides substantial tax credits for renewable energy projects and clean technologies, driving significant investment in the sector.

Market Demand and Consumer Preferences

Growing consumer demand for sustainable products and services is driving investment in climate tech. Consumers are increasingly aware of the environmental impact of their choices and are actively seeking out eco-friendly alternatives. This shift in consumer preferences is creating new market opportunities for climate tech companies.

For example, the surge in demand for electric vehicles (EVs) has led to substantial investments in battery technology, charging infrastructure, and EV manufacturing.

Venture Capital and Private Equity

Venture capital (VC) and private equity (PE) firms are playing a crucial role in funding climate tech startups and scaling up existing companies. These firms are increasingly allocating capital to climate tech, recognizing the potential for high returns and positive societal impact.

The growing number of climate tech-focused VC and PE funds further underscores this trend. For example, Breakthrough Energy Ventures, a VC fund founded by Bill Gates, focuses exclusively on climate-related technologies.

ESG Considerations

Environmental, Social, and Governance (ESG) considerations are becoming increasingly important in investment decisions. Investors are incorporating ESG factors into their investment strategies, prioritizing companies that demonstrate strong environmental performance, social responsibility, and good governance practices. This trend is driving investment towards climate tech companies that are addressing key environmental challenges and contributing to a more sustainable future.

Challenges and Opportunities

While climate tech offers immense potential for a more sustainable future, investors face significant challenges and opportunities that need careful consideration. This section delves into the key hurdles that investors encounter, explores the potential for generating both financial and social returns, and examines how climate tech can contribute to a more resilient world.

Technological Risks

The rapid pace of innovation in climate tech presents both opportunities and risks.

- Unproven Technologies:Many climate tech solutions are still in their early stages of development, with unproven track records and potential for technological failures. For example, carbon capture and storage (CCS) technologies, while promising, have faced challenges in terms of cost, efficiency, and long-term storage.

- Scalability and Deployment:Scaling up climate tech solutions to meet global demand poses a significant challenge. Many technologies may work effectively on a small scale but struggle to be deployed widely and efficiently. This is particularly true for renewable energy technologies, which require extensive infrastructure development and grid integration.

- Rapid Technological Advancements:The rapid pace of innovation in climate tech can lead to obsolescence and technological disruption. Investors need to carefully assess the longevity and future-proofing of their investments in a rapidly evolving landscape. For instance, the emergence of new battery technologies could render existing solar and wind energy storage solutions less competitive.

Future Outlook and Recommendations: Climate Tech Built World Investment Report

The climate tech investment landscape is poised for continued growth, driven by a confluence of factors including increasing regulatory pressure, growing investor awareness of climate risks, and the emergence of innovative technologies. As the urgency to address climate change intensifies, we can expect to see significant advancements in climate tech solutions, leading to a more sustainable future.

The Trajectory of Climate Tech Investment

The future of climate tech investment is bright, with several key trends pointing towards sustained growth. One notable trend is the increasing involvement of institutional investors, including pension funds and sovereign wealth funds, who are seeking to allocate capital towards sustainable investments.

Additionally, the rise of venture capital funds specializing in climate tech is fueling innovation and supporting early-stage companies. This trend is expected to continue as the demand for climate solutions grows.

Recommendations for Investors

For investors seeking to capitalize on the burgeoning climate tech market, several key recommendations can guide their investment decisions.

- Focus on scalable solutions:Investing in companies with technologies that can be scaled to meet the global demand for climate solutions is crucial. Examples include renewable energy technologies like solar and wind power, which have demonstrated their ability to be deployed at scale.

- Consider the long-term impact:Climate tech investments are often long-term propositions, requiring a patient approach. Investors should prioritize companies with a clear vision for achieving positive environmental impact and a sustainable business model.

- Diversify across sectors:The climate tech market encompasses a wide range of sectors, from renewable energy to carbon capture and storage. Diversifying investments across different sectors can mitigate risk and maximize returns.

- Support emerging technologies:Investing in early-stage companies developing innovative technologies can provide significant returns. These technologies have the potential to disrupt existing markets and drive significant progress in climate change mitigation.

Climate Tech’s Role in Achieving Global Climate Goals

Climate tech plays a critical role in achieving global climate goals, such as limiting global warming to 1.5 degrees Celsius. The Paris Agreement, adopted in 2015, sets out a framework for global cooperation on climate change, with countries committing to ambitious emission reduction targets.

Climate tech solutions are essential for achieving these targets, as they offer innovative ways to reduce greenhouse gas emissions, enhance energy efficiency, and adapt to the impacts of climate change.

- Renewable energy:The transition to renewable energy sources, such as solar, wind, and geothermal, is a key pillar of climate change mitigation. Climate tech companies are developing innovative technologies to improve the efficiency and cost-effectiveness of renewable energy generation and storage.

- Carbon capture and storage:Carbon capture and storage (CCS) technologies can capture CO2 emissions from industrial processes and store them underground, preventing them from entering the atmosphere. CCS is particularly important for industries that are difficult to decarbonize, such as cement and steel production.

- Climate adaptation:Climate change is already having a significant impact on communities around the world. Climate tech solutions can help communities adapt to these impacts, such as by developing drought-resistant crops or building resilient infrastructure.