Chip giant infineon lowers * forecast electronics slowdown – Chip giant Infineon lowers – forecast electronics slowdown takes center stage, signaling a potential shift in the global electronics market. This move, driven by a confluence of factors including weakening demand and supply chain disruptions, has sent ripples through the industry, raising concerns about the future trajectory of consumer electronics and the broader technology sector.

Infineon, a leading semiconductor manufacturer known for its expertise in power management and automotive chips, has revised its outlook downward, indicating a dimmer outlook for the coming months. This forecast reflects a broader trend of slowing growth in the electronics industry, driven by factors such as rising inflation, geopolitical uncertainties, and a slowdown in consumer spending.

Infineon’s Lowered Forecast: Chip Giant Infineon Lowers * Forecast Electronics Slowdown

Infineon Technologies, a leading chipmaker, has lowered its forecast for the current fiscal year, reflecting the growing concerns about a slowdown in the global electronics industry. This move has sent ripples through the market, raising questions about the future of the sector and its potential impact on various industries reliant on semiconductors.

Factors Contributing to Infineon’s Lowered Forecast

The decision to lower the forecast was driven by several factors, including:

- Weakening Demand:The global electronics market is facing a slowdown in demand, particularly for consumer electronics like smartphones and PCs. This is attributed to factors such as inflation, rising interest rates, and geopolitical uncertainties.

- Inventory Adjustments:Electronics companies are adjusting their inventory levels to align with the softening demand, leading to a reduction in chip orders.

- Supply Chain Disruptions:The ongoing global supply chain disruptions, exacerbated by the COVID-19 pandemic and geopolitical tensions, continue to impact chip production and delivery timelines.

- Economic Uncertainty:The global economic outlook remains uncertain, with concerns about recessionary pressures and rising inflation weighing on consumer spending and business investment.

Potential Consequences for the Electronics Market, Chip giant infineon lowers * forecast electronics slowdown

Infineon’s lowered forecast has implications for the broader electronics market, including:

- Reduced Chip Production:Semiconductor manufacturers may adjust their production plans to reflect the lowered demand, potentially leading to a decrease in chip supply.

- Price Pressure:The reduced demand could lead to price pressure on chips, as manufacturers compete for market share.

- Delayed Product Launches:The slowdown in chip supply could delay the launch of new products and devices, impacting the innovation cycle in the electronics industry.

- Impact on Related Industries:The slowdown in the electronics market can have ripple effects on industries that rely on semiconductors, such as automotive, industrial automation, and consumer goods.

Infineon’s Business and Market Position

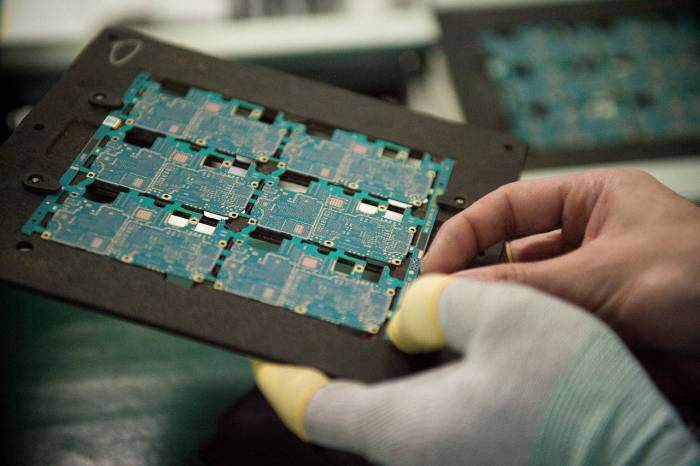

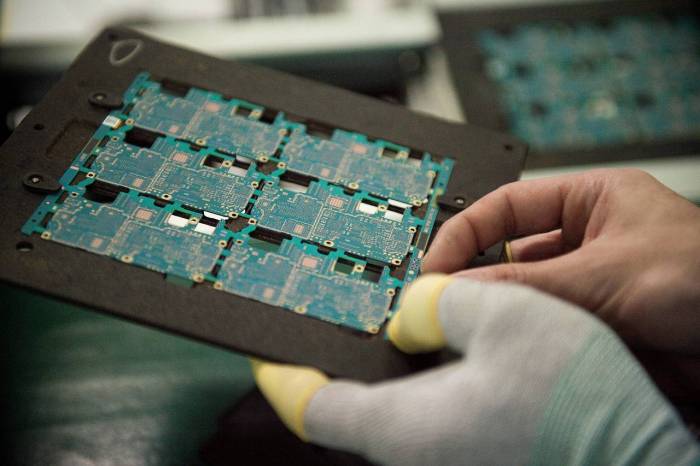

Infineon Technologies AG is a global semiconductor company headquartered in Munich, Germany. The company is a leading provider of semiconductor solutions for a wide range of applications, including automotive, industrial, power management, and communication. Infineon’s core business operations are focused on developing, manufacturing, and selling semiconductor components and systems.

The company’s key product lines include:

Key Product Lines

- Automotive:Infineon is a leading supplier of automotive semiconductors, including microcontrollers, power semiconductors, sensors, and security solutions. The company’s automotive products are used in a wide range of applications, such as engine control, powertrain, safety, and infotainment systems.

- Industrial:Infineon’s industrial products include power semiconductors, microcontrollers, sensors, and wireless connectivity solutions. These products are used in a wide range of industrial applications, such as automation, robotics, energy management, and factory automation.

- Power Management:Infineon’s power management products include power semiconductors, power modules, and power management ICs. These products are used in a wide range of applications, such as power supplies, battery management, and motor control.

- Communication:Infineon’s communication products include RF semiconductors, power amplifiers, and transceivers. These products are used in a wide range of communication applications, such as mobile devices, wireless networks, and data centers.

Major Markets Served

Infineon serves a diverse range of markets, including:

- Automotive:This is Infineon’s largest market, accounting for a significant portion of its revenue. The company is a leading supplier of automotive semiconductors, including microcontrollers, power semiconductors, sensors, and security solutions. Infineon’s automotive products are used in a wide range of applications, such as engine control, powertrain, safety, and infotainment systems.

- Industrial:Infineon’s industrial products include power semiconductors, microcontrollers, sensors, and wireless connectivity solutions. These products are used in a wide range of industrial applications, such as automation, robotics, energy management, and factory automation.

- Power Management:Infineon’s power management products are used in a wide range of applications, such as power supplies, battery management, and motor control. The company’s power management products are used in various industries, including consumer electronics, industrial, automotive, and renewable energy.

- Communication:Infineon’s communication products include RF semiconductors, power amplifiers, and transceivers. These products are used in a wide range of communication applications, such as mobile devices, wireless networks, and data centers. The company’s communication products are used in various industries, including telecommunications, consumer electronics, and industrial.

Obtain direct knowledge about the efficiency of worlds tallest wooden wind turbine through case studies.

Competitive Landscape

Infineon competes with a wide range of companies in the semiconductor industry, including:

- NXP Semiconductors:NXP is a leading supplier of automotive semiconductors and is a major competitor to Infineon in this market.

- STMicroelectronics:STMicroelectronics is another major competitor to Infineon in the automotive, industrial, and power management markets.

- Texas Instruments:Texas Instruments is a leading supplier of analog and embedded semiconductors, and it competes with Infineon in the industrial and automotive markets.

- Broadcom:Broadcom is a leading supplier of communication semiconductors and competes with Infineon in this market.

- Qualcomm:Qualcomm is a leading supplier of mobile processors and wireless communication chips, and it competes with Infineon in the communication market.

Recent Performance and Trends

Infineon has consistently delivered strong financial performance in recent years. The company’s revenue has grown steadily, driven by strong demand for its automotive, industrial, and power management products.

- Revenue Growth:Infineon’s revenue has grown steadily in recent years, driven by strong demand for its automotive, industrial, and power management products. The company’s revenue reached €14.2 billion in fiscal year 2022, an increase of 19% year-over-year.

- Profitability:Infineon has also maintained strong profitability in recent years. The company’s operating margin has remained above 20% in recent years, reflecting its strong pricing power and efficient operations.

- Strategic Acquisitions:Infineon has made several strategic acquisitions in recent years, including Cypress Semiconductor in 2019 and International Rectifier in 2015. These acquisitions have expanded Infineon’s product portfolio and market reach.

- Focus on Emerging Technologies:Infineon is investing heavily in emerging technologies, such as electric vehicles, renewable energy, and artificial intelligence. The company is developing new products and solutions to address these growing markets.

Global Semiconductor Market Trends

The global semiconductor market is experiencing a period of significant change, driven by a confluence of factors, including technological advancements, evolving consumer demand, and geopolitical shifts. While the market has shown resilience in the face of challenges, several key trends and challenges are shaping the future of this critical industry.

Geopolitical Factors and Supply Chain Disruptions

Geopolitical tensions and trade disputes have had a profound impact on the semiconductor industry. The ongoing trade war between the United States and China has led to increased tariffs and export restrictions, disrupting global supply chains and creating uncertainty for businesses.

The conflict in Ukraine has also highlighted the vulnerability of semiconductor supply chains, particularly for critical components used in military and defense applications.

- Increased Regionalization and Reshoring:In response to these disruptions, many governments are implementing policies to promote domestic semiconductor production and reduce reliance on foreign suppliers. This trend is evident in the United States, Europe, and Asia, with countries investing heavily in research and development, infrastructure, and incentives for semiconductor manufacturers.

- Supply Chain Diversification:Semiconductor companies are also actively diversifying their supply chains to mitigate risks. This involves establishing manufacturing facilities in multiple locations and securing alternative sources for key components. For example, Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest semiconductor foundry, is building new fabrication plants in Arizona and Japan, aiming to reduce its reliance on its home market.

- Government Support and Incentives:Governments are playing a crucial role in supporting the semiconductor industry, providing subsidies, tax breaks, and other incentives to encourage investment and innovation. For instance, the U.S. government has passed the CHIPS and Science Act, a $280 billion package aimed at boosting domestic semiconductor production and research.

Growth Prospects for Different Semiconductor Market Segments

Despite the challenges, the semiconductor market is expected to continue growing in the coming years, driven by strong demand from various end markets, including automotive, consumer electronics, data centers, and industrial applications.

- Automotive Semiconductors:The automotive industry is experiencing a rapid shift towards electrification and autonomous driving, driving significant demand for advanced semiconductors. These chips are used in powertrain control, safety systems, infotainment, and other critical functions. For example, electric vehicles (EVs) typically require two to three times more semiconductors than traditional gasoline-powered vehicles.

- Data Center Semiconductors:The increasing adoption of cloud computing, artificial intelligence (AI), and big data analytics is driving demand for high-performance computing (HPC) chips, including CPUs, GPUs, and specialized AI accelerators. Data centers require vast amounts of computing power to process and store massive amounts of data, fueling growth in this segment.

- Internet of Things (IoT) Semiconductors:The proliferation of connected devices in homes, offices, and industrial settings is creating a growing market for low-power, embedded semiconductors. These chips are used in sensors, actuators, and communication modules, enabling the collection and exchange of data across interconnected devices.

Implications for Consumers and Businesses

Infineon’s lowered forecast, a reflection of the softening global semiconductor market, carries significant implications for both consumers and businesses. This downward adjustment signals a potential shift in the availability and pricing of consumer electronics, while businesses reliant on Infineon’s products may face challenges in their operations and supply chains.

Impact on Consumer Electronics

The lowered forecast suggests a potential decrease in the supply of semiconductors, which are crucial components in a wide range of consumer electronics. This could lead to higher prices for devices like smartphones, laptops, and smart home appliances. The availability of these products might also be affected, with potential delays in production and longer wait times for consumers.

For example, the automotive industry, which relies heavily on Infineon’s chips, has already experienced production disruptions due to chip shortages, resulting in higher car prices and longer wait times for new vehicles.

Implications for Businesses

Businesses that depend on Infineon’s products and services, particularly those in the automotive, industrial, and energy sectors, could face several challenges. These include:

- Increased Costs:The reduced supply of semiconductors might drive up component prices, impacting businesses’ production costs and potentially leading to higher prices for their products or services.

- Supply Chain Disruptions:The slowdown in semiconductor production could disrupt supply chains, leading to delays in production schedules and potentially affecting businesses’ ability to meet customer demands.

- Potential for Innovation Delays:The tight semiconductor supply could hinder businesses’ ability to develop and introduce new products or services that rely on advanced semiconductor technology.

Opportunities and Challenges

The evolving semiconductor landscape presents both opportunities and challenges for businesses.

- Increased Focus on Diversification:Businesses may seek to diversify their semiconductor suppliers to mitigate risks associated with reliance on a single source.

- Investments in Automation:The demand for semiconductors is likely to remain strong in the long term, prompting businesses to invest in automation and advanced manufacturing processes to enhance efficiency and reduce reliance on manual labor.

- Emerging Technologies:The semiconductor industry is constantly evolving, with new technologies like artificial intelligence (AI) and quantum computing emerging. Businesses that invest in research and development in these areas could gain a competitive advantage.

Industry Responses and Future Outlook

Infineon’s lowered forecast serves as a stark reminder of the challenges facing the semiconductor industry. As the electronics slowdown ripples through the supply chain, other chipmakers are also feeling the pressure to adjust their strategies. The industry is responding to these headwinds with a combination of cost-cutting measures, diversification efforts, and a focus on long-term growth opportunities.

Strategies for Mitigating the Impact

The electronics slowdown is prompting semiconductor companies to adopt various strategies to mitigate its impact.

- Cost Optimization:Many companies are implementing cost-cutting measures to improve profitability. This includes streamlining operations, reducing workforce, and renegotiating supply contracts. For example, Intel recently announced plans to cut its workforce by 10% and reduce capital expenditures in response to declining PC demand.

- Diversification:Companies are diversifying their product portfolios and customer bases to reduce reliance on any single market segment. This includes expanding into new growth areas such as automotive, industrial automation, and artificial intelligence.

- Strategic Partnerships:Collaboration and partnerships are becoming increasingly important in the semiconductor industry. Companies are joining forces to develop new technologies, share resources, and access new markets. For example, Samsung and TSMC have announced plans to collaborate on the development of next-generation memory technologies.

Long-Term Outlook for the Semiconductor Industry

Despite the current slowdown, the long-term outlook for the semiconductor industry remains positive. The industry is driven by several fundamental trends, including:

- Digital Transformation:The ongoing digital transformation across various industries is driving demand for semiconductors. From cloud computing and data centers to the Internet of Things (IoT) and artificial intelligence, the need for advanced chips continues to grow.

- Emerging Technologies:The development of new technologies such as 5G, autonomous vehicles, and quantum computing will require sophisticated semiconductors. These emerging applications will drive significant growth in the industry.

- Government Support:Governments around the world are investing heavily in semiconductor research and manufacturing to bolster domestic production and secure critical technologies. This support will help to stimulate innovation and drive industry growth.