Digital bank monzo raises 340m uk fintech leadership – Digital bank Monzo raising £340 million, solidifying its position as a leader in the UK fintech landscape, is a major development. This funding round signifies Monzo’s ambition to scale its operations, expand its product offerings, and potentially enter new markets.

The move also underscores the vibrant and competitive nature of the UK fintech scene, where innovative players are challenging traditional banking norms.

Monzo’s success is a testament to its commitment to providing a user-friendly and transparent banking experience. Its focus on mobile-first technology, coupled with its transparent pricing and customer-centric approach, has resonated with a large audience, particularly among younger generations. This funding will enable Monzo to further invest in its technology, expand its team, and accelerate its growth trajectory.

Monzo’s Funding Round and its Significance

Monzo, the UK-based digital bank, has secured a massive £340 million funding round, solidifying its position as a leading player in the UK fintech landscape. This significant investment underscores the confidence investors have in Monzo’s growth trajectory and its potential to disrupt the traditional banking sector.

Impact on the UK Fintech Landscape

This funding round represents a major boost for the UK fintech sector, highlighting its continued growth and attractiveness to investors. Monzo’s success attracts further investment and encourages innovation within the UK’s thriving fintech ecosystem. This funding round sends a strong signal to the market that fintech companies in the UK are attracting substantial capital, creating a ripple effect across the industry.

Monzo’s Business Model and Competitive Advantage

Monzo, a leading digital bank in the UK, has carved a unique niche in the financial landscape with its innovative business model and customer-centric approach. This model has propelled Monzo to the forefront of the UK’s fintech scene, attracting significant funding and garnering a loyal customer base.

Monzo’s Core Business Model, Digital bank monzo raises 340m uk fintech leadership

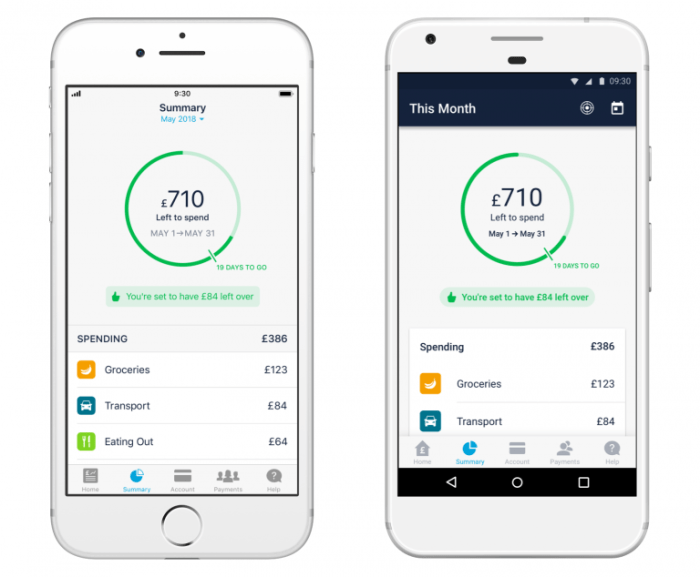

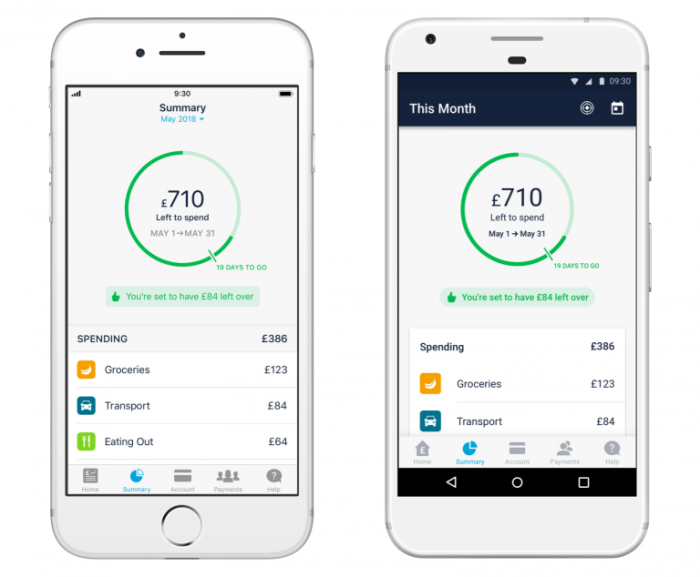

Monzo’s business model revolves around providing a fully digital banking experience, eliminating the need for physical branches and traditional banking processes. The bank leverages technology to offer a range of financial services, including current accounts, savings accounts, debit cards, and money transfers, all accessible through its mobile app.

This digital-first approach allows Monzo to operate with lower overhead costs compared to traditional banks, enabling it to offer competitive pricing and innovative features.

Monzo’s Value Proposition

Monzo’s value proposition centers around convenience, transparency, and customer-centricity. The bank’s mobile app provides a seamless and intuitive user experience, allowing customers to manage their finances on the go. Monzo also prioritizes transparency, providing clear and concise information about fees and charges.

Additionally, the bank emphasizes customer service, offering 24/7 support through in-app chat and other channels. This commitment to customer satisfaction has been a key driver of Monzo’s success.

Obtain a comprehensive document about the application of intel unveils neuromorphic approach to interactive continual learning robots that is effective.

Comparison with Traditional Banks and Other Fintech Players

Monzo’s approach to banking stands in stark contrast to traditional banks, which often struggle to adapt to the changing needs of modern consumers. While traditional banks are often characterized by complex processes, high fees, and limited digital capabilities, Monzo offers a simplified, transparent, and tech-driven banking experience.

Compared to other fintech players in the UK, Monzo distinguishes itself through its comprehensive range of banking services, its strong focus on customer experience, and its commitment to responsible banking practices.

Key Factors Contributing to Monzo’s Competitive Advantage

Monzo’s competitive advantage stems from a combination of factors:

- Digital-first approach:Monzo’s fully digital model allows it to operate with lower costs and offer competitive pricing.

- Customer-centricity:Monzo prioritizes customer experience, offering a seamless and intuitive mobile app, transparent pricing, and excellent customer support.

- Innovation and technology:Monzo continuously invests in technology to enhance its services and develop innovative features, such as budgeting tools and spending insights.

- Strong brand reputation:Monzo has built a strong brand reputation for its transparency, customer focus, and commitment to responsible banking.

Monzo’s Growth Strategy and Future Prospects: Digital Bank Monzo Raises 340m Uk Fintech Leadership

Monzo, the UK-based digital bank, has set its sights on becoming a global fintech leader. With its recent $340 million funding round, the company is well-positioned to execute its ambitious growth strategy and expand its reach to new markets and product offerings.

This section will delve into Monzo’s future plans, the challenges it faces, and its potential for long-term success in the ever-evolving digital banking landscape.

Monzo’s Expansion Plans

Monzo’s expansion strategy revolves around expanding its geographic reach and diversifying its product offerings. The company has already made significant strides in this direction, launching operations in the United States and aiming to enter new markets in Europe and Asia.

Geographic Expansion

- United States:Monzo launched its US operations in 2019, targeting the large and lucrative American market. The company has since secured a banking license in the US and is actively growing its customer base.

- Europe:Monzo has expressed interest in expanding to other European countries, leveraging its existing regulatory framework and brand recognition. The company is likely to focus on countries with large, digitally-savvy populations and favorable regulatory environments.

- Asia:Monzo has also hinted at potential expansion into Asia, a region with a rapidly growing digital banking market. The company would need to navigate the complexities of local regulations and cultural nuances in order to succeed in this region.

Product Diversification

- Business Banking:Monzo has already begun offering business banking services in the UK, and plans to expand this offering to other markets. This move is aimed at capturing a larger share of the SME market and providing a comprehensive suite of financial products to its customers.

- Investment Products:Monzo is also exploring the possibility of offering investment products, such as robo-advisory services, to its customers. This would allow the company to cater to a wider range of financial needs and compete with established players in the investment space.

- Insurance Products:Monzo is looking to offer insurance products, such as travel insurance and home insurance, to its customer base. This would further diversify its revenue streams and provide a more comprehensive financial ecosystem for its users.

Implications of Monzo’s Success for the Banking Industry

Monzo’s success has sent ripples through the traditional banking industry, forcing established players to re-evaluate their strategies and adapt to the changing landscape. The rise of fintech companies like Monzo has presented both challenges and opportunities for traditional banks, forcing them to innovate and offer more customer-centric services.

Impact on Traditional Banking

Monzo’s success has demonstrated the potential for digital-first banking models to disrupt the traditional banking sector. Traditional banks face several challenges due to the emergence of fintech players like Monzo:

- Increased Competition:Fintech companies like Monzo are attracting customers with their user-friendly interfaces, innovative features, and lower fees, putting pressure on traditional banks to compete on these fronts.

- Erosion of Market Share:As more customers switch to digital banks, traditional banks risk losing market share and revenue.

- Customer Expectations:Fintech companies have set a new standard for customer experience, forcing traditional banks to improve their digital offerings and customer service.

Opportunities for Traditional Banks

While Monzo’s success presents challenges, it also offers opportunities for traditional banks to adapt and thrive in the evolving banking landscape:

- Innovation and Digital Transformation:Traditional banks can leverage their existing infrastructure and resources to develop innovative digital products and services, such as mobile banking apps, personalized financial advice, and open banking solutions.

- Partnerships with Fintech Companies:Collaborating with fintech companies can provide access to cutting-edge technologies and innovative solutions, enabling traditional banks to offer more competitive products and services.

- Focus on Customer Experience:Traditional banks can learn from fintech companies’ focus on customer experience and prioritize user-friendly interfaces, personalized services, and responsive customer support.

Traditional Banks’ Adaption Strategies

Traditional banks are responding to the competition from fintech players like Monzo by adopting various strategies:

- Investing in Digital Capabilities:Banks are investing heavily in technology to enhance their digital offerings, including mobile banking apps, online platforms, and data analytics capabilities.

- Developing Innovative Products and Services:Banks are introducing new products and services, such as mobile payments, personal finance management tools, and open banking solutions, to cater to evolving customer needs.

- Improving Customer Experience:Banks are focusing on enhancing customer experience through personalized services, responsive customer support, and seamless digital interactions.

- Acquiring or Partnering with Fintech Companies:Banks are acquiring or partnering with fintech companies to gain access to innovative technologies and talent, and to accelerate their digital transformation.