European fintech * – European Fintech, a dynamic force reshaping the financial landscape, is rapidly gaining momentum. From innovative payment solutions to disruptive insurance models, the continent is witnessing a surge in tech-driven financial services that are challenging traditional institutions and transforming the way people manage their money.

The European Fintech sector is characterized by a thriving ecosystem of startups, established players, and supportive government initiatives. This dynamic environment has led to the emergence of leading Fintech hubs across Europe, each with its own unique strengths and focus areas.

European Fintech Landscape

The European Fintech landscape is dynamic and rapidly evolving, driven by a confluence of factors, including technological advancements, changing consumer preferences, and supportive regulatory environments. This has led to the emergence of numerous innovative Fintech companies across the continent, disrupting traditional financial services and offering new solutions to consumers and businesses alike.

Check european startup funding to drop but theres cause for hope to inspect complete evaluations and testimonials from users.

Key Drivers of Fintech Growth in Europe, European fintech *

The growth of Fintech in Europe is driven by several key factors:

- Technological Advancements:The rapid development of technologies such as artificial intelligence, blockchain, and cloud computing has created new opportunities for Fintech companies to develop innovative products and services. These technologies enable faster, more efficient, and more cost-effective financial services, attracting both consumers and businesses.

- Changing Consumer Preferences:Consumers are increasingly demanding more convenient, transparent, and personalized financial services. Fintech companies are well-positioned to meet these demands by offering digital-first solutions that are accessible and user-friendly.

- Supportive Regulatory Environment:Many European countries have implemented policies and regulations that encourage innovation and competition in the financial services sector. This has created a more favorable environment for Fintech companies to operate and grow.

- Access to Funding:Venture capital and private equity investments in European Fintech companies have increased significantly in recent years. This influx of funding has provided Fintech companies with the resources they need to scale their operations and expand into new markets.

Regulatory Landscape for Fintech in Europe

The regulatory landscape for Fintech in Europe varies across different countries, with some countries having more progressive regulations than others. For example, the UK has been a leader in Fintech regulation, with initiatives such as the Financial Conduct Authority’s (FCA) regulatory sandbox, which allows Fintech companies to test new products and services in a controlled environment.

Other countries, such as France and Germany, have also implemented measures to foster Fintech innovation, but their regulatory frameworks may differ in terms of scope and stringency.

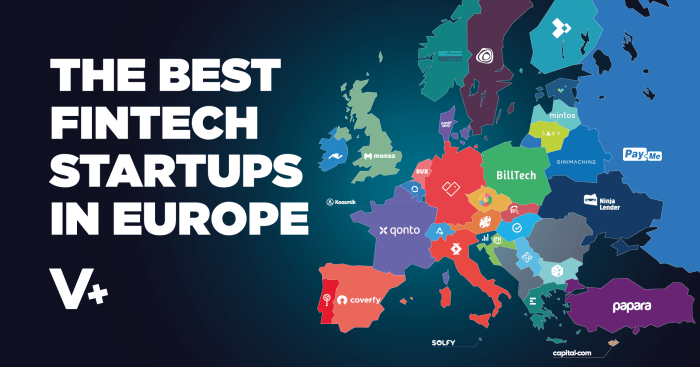

Major European Fintech Hubs

Several European cities have emerged as major Fintech hubs, attracting a significant concentration of Fintech companies and talent. These hubs benefit from a combination of factors, including supportive government policies, access to talent, and a vibrant startup ecosystem. Some of the most prominent European Fintech hubs include:

- London, UK:London has long been a global financial center and has emerged as a leading Fintech hub in Europe. The city boasts a strong financial infrastructure, a large pool of talent, and a supportive regulatory environment. London is home to numerous Fintech companies, including TransferWise, Monzo, and GoCardless.

- Berlin, Germany:Berlin has become a thriving hub for Fintech startups, attracting entrepreneurs and investors from around the world. The city’s strong technology sector, affordable living costs, and a culture of innovation have contributed to its growth as a Fintech center. Berlin is home to Fintech companies such as N26, Xentral, and Solarisbank.

- Paris, France:Paris is another major European Fintech hub, benefiting from a strong financial industry, a growing technology sector, and government initiatives to support Fintech innovation. The city is home to Fintech companies such as Qonto, Alan, and Lydia.

- Amsterdam, Netherlands:Amsterdam has emerged as a significant Fintech hub, attracting companies focused on payments, lending, and investment technology. The city’s central location in Europe, its strong financial infrastructure, and its supportive regulatory environment have contributed to its growth as a Fintech center.

Amsterdam is home to Fintech companies such as Adyen, Bunq, and Mollie.

Impact of Brexit on the European Fintech Sector

Brexit has had a significant impact on the European Fintech sector, particularly in the UK. The uncertainty surrounding the UK’s future relationship with the EU has led to some Fintech companies relocating their operations to other European countries. The UK government has taken steps to mitigate the impact of Brexit on the Fintech sector, including launching a new Fintech strategy and creating a new regulatory regime for financial services.

However, the long-term impact of Brexit on the UK Fintech sector remains to be seen.

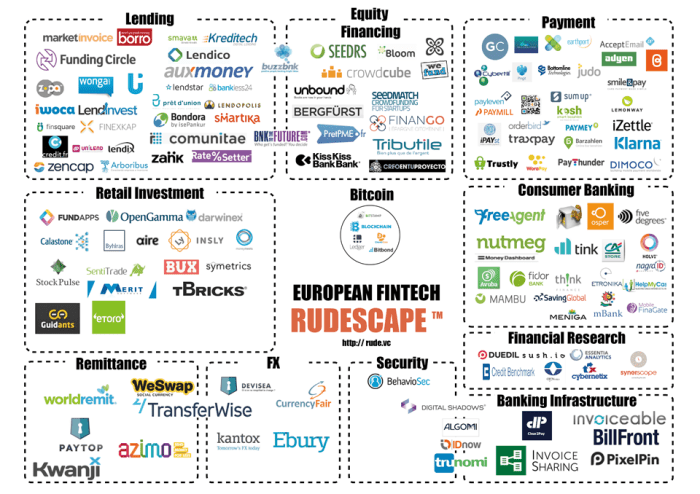

Key European Fintech Sectors

The European fintech landscape is a vibrant and rapidly evolving ecosystem, characterized by innovation and a focus on addressing specific needs of consumers and businesses. Several key sectors within European fintech are experiencing significant growth and reshaping the financial services industry.

Payments and Digital Banking

The European payments sector has witnessed substantial growth, driven by the increasing adoption of digital payment methods. The rise of mobile payments, online banking, and alternative payment solutions has significantly transformed how consumers and businesses conduct transactions.

- Mobile Payments:Mobile payment solutions like Apple Pay, Google Pay, and Samsung Pay have gained significant traction in Europe, enabling contactless payments and seamless transactions.

- Open Banking:The implementation of open banking regulations has opened up new possibilities for innovation in digital banking. This allows third-party providers to access customer financial data with their consent, leading to the development of personalized financial services and enhanced competition.

- Neobanks:Neobanks, like Monzo, Revolut, and N26, have disrupted the traditional banking landscape by offering mobile-first, user-friendly, and often fee-free banking services.

InsurTech

InsurTech, the intersection of insurance and technology, has emerged as a significant force in the European insurance industry. InsurTech companies are leveraging technology to improve customer experience, streamline processes, and develop innovative insurance products.

- Digital Insurance Platforms:InsurTech platforms like Lemonade and GoCardless offer online insurance products and services, simplifying the buying and claiming process.

- Data Analytics and AI:InsurTech companies are using data analytics and artificial intelligence to assess risk, personalize pricing, and improve fraud detection.

- InsurTech Investments:The European InsurTech sector has attracted significant investments, with venture capital firms and traditional insurers actively seeking opportunities in this space.

Blockchain Technology in Finance

Blockchain technology, known for its decentralized and secure nature, holds immense potential for revolutionizing European finance. It offers a range of applications, including cross-border payments, trade finance, and asset management.

- Cross-Border Payments:Blockchain-based platforms can facilitate faster and cheaper cross-border payments, eliminating the need for intermediaries.

- Securities Trading:Blockchain can streamline securities trading by providing a secure and transparent platform for transactions.

- Digital Assets:Blockchain technology enables the creation and management of digital assets, including cryptocurrencies and tokenized securities.

Crowdfunding and Peer-to-Peer Lending

Crowdfunding and peer-to-peer (P2P) lending platforms have gained popularity in Europe, providing alternative sources of financing for businesses and individuals.

- Crowdfunding:Crowdfunding platforms like Kickstarter and Indiegogo allow individuals and businesses to raise capital from a large number of investors.

- Peer-to-Peer Lending:P2P lending platforms like Funding Circle and Zopa connect borrowers directly with lenders, bypassing traditional financial institutions.

European Fintech Innovation: European Fintech *

Europe is a hotbed of fintech innovation, with a thriving ecosystem of startups, established companies, and investors. The region is home to a diverse range of innovative fintech solutions, from payments and lending to wealth management and insurance.

Examples of Innovative Fintech Solutions

Europe is home to a plethora of innovative fintech solutions. Here are some examples:

- TransferWise(now Wise) is a UK-based company that offers low-cost international money transfers. The company has revolutionized the way people send money abroad, offering a cheaper and faster alternative to traditional banks.

- Klarnais a Swedish company that provides buy now, pay later (BNPL) services. Klarna has become one of the most popular BNPL providers globally, allowing customers to split their payments into installments.

- N26is a German digital bank that offers a range of banking services, including current accounts, debit cards, and loans. N26 has gained popularity for its user-friendly mobile app and innovative features.

- Xentralis a German company that provides cloud-based ERP software for small and medium-sized enterprises (SMEs). Xentral offers a comprehensive suite of tools for managing finances, inventory, and customer relationships.

The Role of Accelerators and Incubators

Accelerators and incubators play a crucial role in fostering fintech startups in Europe. These programs provide startups with access to funding, mentorship, and networking opportunities. Here are some examples of accelerators and incubators:

- FinTech Innovation Lab Londonis a program run by Accenture and Level39 that provides fintech startups with access to mentorship, workshops, and networking events.

- Startupbootcamp FinTechis a global accelerator program with a presence in several European cities, including London, Berlin, and Amsterdam.

- FinTech Hubis an incubator based in Berlin that supports fintech startups in the early stages of development.

The Impact of Venture Capital and Private Equity Investment

Venture capital (VC) and private equity (PE) investment have been instrumental in driving fintech innovation in Europe. Investors are increasingly attracted to the high growth potential of the fintech sector. Here are some examples of VC and PE firms that are active in the European fintech market:

- Accelis a global VC firm with a strong presence in Europe. Accel has invested in several successful fintech companies, including Wise, GoCardless, and Stash.

- Index Venturesis a European VC firm that has invested in companies such as TransferWise, N26, and Tide.

- Atomicois a VC firm founded by Skype co-founder Niklas Zennström. Atomico has invested in fintech companies such as GoCardless, Taxfix, and Stash.

Challenges and Opportunities for European Fintech Startups

European fintech startups face a number of challenges, including:

- Competition from established players:Traditional banks and financial institutions are increasingly investing in fintech, making it more challenging for startups to compete.

- Regulatory hurdles:The fintech sector is subject to a complex regulatory environment, which can be a barrier to entry for startups.

- Access to funding:While VC and PE investment in fintech is increasing, it can still be difficult for startups to secure funding, especially in the early stages.

Despite these challenges, European fintech startups also have a number of opportunities:

- Growing demand for fintech solutions:Consumers and businesses are increasingly demanding innovative financial products and services.

- Supportive government policies:Many European governments are implementing policies to support the growth of the fintech sector.

- A strong talent pool:Europe has a strong pool of talent in the fintech sector, with many skilled professionals working in the industry.

Future of European Fintech

The European Fintech landscape is evolving rapidly, driven by technological advancements, changing consumer preferences, and a supportive regulatory environment. This dynamic environment presents both opportunities and challenges for Fintech companies and traditional financial institutions alike.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming the Fintech sector, enabling more personalized and efficient services. AI-powered algorithms can analyze vast amounts of data to identify patterns, predict customer behavior, and automate tasks, such as fraud detection, credit scoring, and investment management.

- AI-powered chatbots are being used to provide customer support, answer questions, and resolve issues more efficiently.

- Machine learning algorithms are being used to personalize financial products and services, such as investment recommendations and loan approvals.

- AI is also being used to automate back-office processes, such as risk management and compliance, freeing up employees to focus on more strategic tasks.

Regulation and Responsible Innovation

Regulation plays a crucial role in fostering responsible innovation in Fintech. European regulators are actively working to create a level playing field for Fintech companies while ensuring consumer protection and financial stability.

- The European Union’s Payment Services Directive 2 (PSD2) has opened up the payments market to new entrants, promoting competition and innovation.

- The General Data Protection Regulation (GDPR) has strengthened data privacy rights, encouraging Fintech companies to adopt more responsible data handling practices.

- The European Banking Authority (EBA) has issued guidelines for Fintech companies, providing clarity on regulatory expectations and fostering a more predictable environment for innovation.

Collaboration Between Traditional Institutions and Fintech Startups

Collaboration between traditional financial institutions and Fintech startups is becoming increasingly common. Traditional institutions can benefit from the agility and innovation of Fintech companies, while Fintech companies can leverage the resources and expertise of established players.

- Traditional banks are partnering with Fintech companies to develop new products and services, such as digital banking platforms and mobile payment solutions.

- Fintech startups are using APIs to integrate their services with existing banking systems, offering innovative solutions to traditional institutions.

- Incubators and accelerators are fostering collaboration between traditional institutions and Fintech startups, providing mentorship, funding, and access to networks.