European fintech players bracing market consolidation across the market – it’s a phrase that’s been echoing through the industry for some time now. The European fintech landscape has undergone a dramatic transformation in recent years, fueled by rapid innovation, a surge in investment, and a growing appetite for digital financial services.

But amidst this exciting growth, a new reality is emerging: consolidation is becoming the norm. Mergers and acquisitions are happening at an unprecedented pace, reshaping the competitive landscape and prompting questions about the future of the European fintech sector.

This trend isn’t just a passing fancy. Several factors are driving it, including the need for scale, the desire to access new markets and technologies, and the pressure to achieve profitability in a rapidly evolving environment. But what does this mean for consumers and businesses?

What are the potential benefits and drawbacks of consolidation? And what does the future hold for the European fintech industry?

The Landscape of European Fintech

The European fintech landscape is a dynamic and rapidly evolving ecosystem, characterized by a diverse range of players, innovative solutions, and significant growth potential. This sector has witnessed a surge in activity in recent years, driven by factors such as increased digitalization, regulatory support, and a growing demand for alternative financial services.

Key Players and Sectors

The European fintech market is home to a wide array of players, ranging from established financial institutions to innovative startups. Key players include:

- Traditional Financial Institutions:Many established banks and financial institutions are actively embracing fintech, launching digital banking services, partnering with fintech startups, and investing in fintech innovation.

- Fintech Startups:The European fintech scene is teeming with startups offering innovative solutions across various sectors, including payments, lending, wealth management, and insurance.

- Fintech Incubators and Accelerators:Numerous incubators and accelerators provide support and resources to fintech startups, fostering their growth and development.

The European fintech market is segmented into various sectors, each with its own unique characteristics and growth drivers. Key sectors include:

- Payments:The payments sector is dominated by players like Stripe, Adyen, and Wise, offering innovative payment solutions for businesses and consumers.

- Lending:Fintech companies like Funding Circle, Zopa, and Klarna are disrupting the traditional lending market with alternative lending models and digital platforms.

- Wealth Management:Fintech startups like Nutmeg, Moneyfarm, and Scalable Capital are providing automated investment solutions and robo-advisory services.

- Insurance:Fintech companies like Lemonade, Luko, and Bought By Many are offering digital insurance solutions, leveraging technology to streamline processes and enhance customer experiences.

Factors Driving Growth and Innovation

Several factors are driving the growth and innovation of the European fintech industry:

- Increased Digitalization:The increasing adoption of digital technologies and mobile devices has created a favorable environment for fintech solutions.

- Regulatory Support:The European Union has implemented a series of regulations, such as PSD2 and the General Data Protection Regulation (GDPR), that have created a level playing field for fintech companies and encouraged innovation.

- Growing Demand for Alternative Financial Services:Consumers and businesses are increasingly seeking alternative financial services that are more convenient, transparent, and cost-effective than traditional offerings.

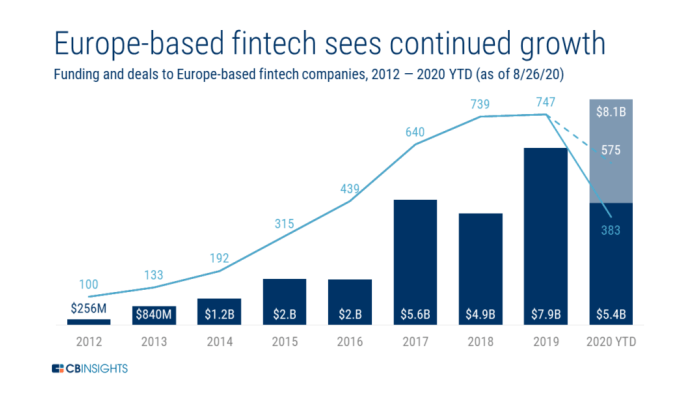

- Availability of Funding:Venture capital investments in European fintech companies have surged in recent years, providing significant funding for growth and expansion.

Challenges Faced by European Fintech Companies

Despite the significant growth and potential of the European fintech market, fintech companies face several challenges:

- Competition from Established Players:Fintech companies often face competition from established financial institutions that are investing heavily in digital transformation.

- Regulatory Complexity:The regulatory landscape for fintech is complex and constantly evolving, requiring companies to navigate a maze of rules and regulations.

- Data Privacy Concerns:Fintech companies must comply with strict data privacy regulations, such as GDPR, which can pose challenges in collecting and utilizing customer data.

- Access to Funding:While venture capital investments in European fintech have increased, access to funding can still be a challenge for some companies.

Market Consolidation

The European fintech landscape is undergoing a period of significant consolidation, driven by a confluence of factors that are reshaping the industry. This trend is not merely a passing phase but rather a fundamental shift in the market dynamics, with far-reaching implications for players across the spectrum.

Reasons for Market Consolidation

The increasing consolidation in the European fintech market is driven by a combination of factors, including:

- Increased Competition:The European fintech sector has witnessed a surge in new entrants and established players expanding their operations, leading to heightened competition for market share and customer acquisition. Consolidation allows companies to gain scale, reduce costs, and enhance their competitive edge.

- Maturity of the Market:As the European fintech market matures, investors are seeking more established and profitable businesses. Consolidation allows companies to demonstrate stronger financial performance and attract larger investments, particularly from venture capitalists and private equity firms.

- Regulatory Landscape:The evolving regulatory landscape, including the introduction of the Payment Services Directive 2 (PSD2), has created a more complex and demanding environment for fintech companies. Consolidation can provide access to greater resources, expertise, and compliance capabilities to navigate these challenges.

- Technological Advancements:The rapid pace of technological innovation in the fintech space necessitates significant investments in research and development. Consolidation allows companies to pool resources and leverage combined expertise to stay ahead of the curve.

Motivations for Mergers and Acquisitions

Fintech companies are engaging in mergers and acquisitions (M&A) driven by a variety of strategic motivations:

- Market Expansion:M&A allows companies to expand their geographical reach, target new customer segments, and enter adjacent markets. This can be achieved by acquiring companies with complementary products, services, or customer bases.

- Product and Service Diversification:By acquiring companies with specialized products or services, fintech companies can expand their offerings and cater to a wider range of customer needs. This diversification can also help mitigate risk and enhance revenue streams.

- Technological Integration:M&A provides an opportunity to acquire innovative technologies, platforms, or intellectual property that can enhance existing products and services or enable the development of new solutions. This can give companies a competitive advantage in a rapidly evolving landscape.

- Talent Acquisition:M&A can provide access to a pool of skilled talent, including engineers, product managers, and data scientists, who can contribute to the acquiring company’s growth and innovation efforts. This is particularly valuable in a tight labor market where skilled talent is in high demand.

Recent M&A Deals in the European Fintech Space

The European fintech market has witnessed a number of significant M&A deals in recent years, highlighting the consolidation trend:

- Klarna’s Acquisition of Top 5% of Italy’s Market Share: In 2022, Swedish fintech giant Klarna acquired a significant portion of the Italian market share, solidifying its position as a major player in the European market.

- GoCardless’s Acquisition of Transpaygo: In 2023, UK-based fintech company GoCardless acquired Transpaygo, a leading provider of recurring payment solutions, expanding its reach into the European market.

- Adyen’s Acquisition of mPOS: In 2022, Dutch payment processing company Adyen acquired mPOS, a provider of mobile point-of-sale solutions, strengthening its position in the mobile payments market.

Impact of Consolidation on the Market

The consolidation of the European fintech market presents a complex picture with both potential benefits and risks. While some see it as a natural progression leading to stronger, more efficient players, others worry about the potential for reduced competition and innovation.

Get the entire information you require about onfido launches industry first biometric id verification system motion on this page.

Understanding the implications of this trend is crucial for all stakeholders, including consumers, businesses, and investors.

Benefits of Market Consolidation

Market consolidation can offer several benefits, both for consumers and businesses.

- Enhanced Efficiency:Larger, consolidated entities can leverage economies of scale, reducing operational costs and potentially leading to lower prices for consumers. This efficiency can also translate into improved service quality and faster product development.

- Increased Innovation:Consolidation can fuel innovation by pooling resources and expertise. Larger fintech companies may have greater capacity for research and development, leading to the creation of more sophisticated and innovative products and services.

- Greater Access to Capital:Consolidated players can access capital more easily, enabling them to invest in growth, expansion, and further innovation. This can benefit consumers by providing access to a wider range of financial products and services.

Potential Drawbacks of Market Consolidation

While consolidation can offer benefits, it also presents potential drawbacks that need to be considered.

- Reduced Competition:Consolidation can lead to a reduction in the number of players in the market, potentially decreasing competition and allowing dominant players to exert more control over pricing and product offerings. This could result in less choice for consumers and a potential increase in fees.

- Less Innovation:While consolidation can potentially fuel innovation, it can also stifle it. A smaller number of players might be less willing to take risks or experiment with new ideas, potentially leading to a less dynamic and innovative market.

- Increased Concentration of Power:Consolidation can lead to a concentration of power in the hands of a few large players, potentially impacting market transparency and accountability. This could raise concerns about data privacy, security, and potential manipulation of the market.

Comparative Competitive Landscape

The competitive landscape of the European fintech market has been significantly impacted by consolidation.

- Before Consolidation:The pre-consolidation market was characterized by a diverse range of startups and established players, each offering unique products and services. This competition fostered innovation and provided consumers with a wide array of choices.

- After Consolidation:The market is now dominated by a smaller number of larger players, many of whom have emerged through mergers and acquisitions. This has led to a more concentrated market with fewer independent players, potentially reducing the level of competition and innovation.

Key Players and Their Strategies

The European fintech landscape is characterized by a diverse range of players, each with their own unique strategies and approaches to market consolidation. These strategies are driven by factors such as market trends, regulatory changes, and the desire to achieve scale and efficiency.

Prominent European Fintech Players and Their M&A Strategies

The consolidation of the European fintech market is driven by a number of prominent players. These players are adopting diverse strategies to gain market share and strengthen their competitive positions. These strategies include:

- Horizontal Acquisitions:Companies like Wise (formerly TransferWise) have pursued horizontal acquisitions to expand their product offerings and reach new customer segments. For instance, Wise acquired CurrencyFair in 2019 to enhance its peer-to-peer foreign exchange capabilities. This strategy allows companies to expand their product portfolios and increase their customer base.

- Vertical Integration:Some players, like Adyen, are focused on vertical integration, acquiring companies that complement their existing offerings. Adyen acquired Mollie in 2022, a leading payment gateway in the Netherlands, to expand its European presence and provide a more comprehensive payment processing solution for merchants.

- Strategic Partnerships:Many fintech players are forming strategic partnerships to gain access to new markets, technologies, or customer segments. For example, Klarna partnered with Amazon in 2021 to offer its “buy now, pay later” (BNPL) services to Amazon customers. This approach allows companies to leverage each other’s strengths and reach a wider audience.

Impact of Consolidation on Key Players

Market consolidation has a significant impact on the competitive positions of key players. Here are some of the key effects:

- Increased Market Share and Dominance:Consolidation leads to the emergence of larger, more dominant players, which can exert greater influence over the market. For example, the acquisition of CurrencyFair by Wise significantly increased Wise’s market share in the international money transfer market. This can lead to increased pricing power and a stronger bargaining position with customers and partners.

- Enhanced Product Offerings and Capabilities:Consolidation allows companies to combine their strengths and create more comprehensive product offerings. The acquisition of Mollie by Adyen resulted in a more robust payment processing platform, providing merchants with a wider range of payment options and functionalities. This can lead to greater customer satisfaction and increased competitiveness.

- Increased Efficiency and Cost Reduction:Consolidation can lead to increased efficiency through economies of scale and the elimination of redundancies. Companies can streamline operations, reduce costs, and improve profitability. For example, the merger of two competing fintech companies could lead to the consolidation of their IT infrastructure and customer support teams, resulting in cost savings.

Future Outlook for European Fintech: European Fintech Players Bracing Market Consolidation Across The Market

The European fintech landscape is poised for continued growth and evolution, with market consolidation playing a significant role in shaping the future. While consolidation has already been a defining trend, it is expected to accelerate further in the coming years.

Impact of Regulatory Changes and Technological Advancements, European fintech players bracing market consolidation across the market

Regulatory changes and technological advancements will significantly influence the trajectory of market consolidation in European fintech. The regulatory environment is constantly evolving, with new rules and regulations being introduced to address issues such as data privacy, financial crime, and consumer protection.

These changes will create new opportunities for fintech companies that can adapt and comply with the evolving regulatory landscape. Technological advancements, such as artificial intelligence (AI), blockchain, and cloud computing, are driving innovation and efficiency in the financial services sector.

Fintech companies that can leverage these technologies will be well-positioned to gain a competitive advantage and drive consolidation.

“The combination of regulatory changes and technological advancements is creating a perfect storm for consolidation in the European fintech market. Companies that can adapt to these changes and leverage new technologies will be the ones that thrive.”

[Source

Industry Expert]

Emerging Trends and Opportunities for Fintech Companies in a Consolidated Market

Fintech companies in a consolidated market will need to focus on emerging trends and opportunities to thrive.

- Specialization:Fintech companies are increasingly specializing in specific niches within the financial services sector. This allows them to develop expertise and build strong relationships with customers in their chosen areas.

- Cross-border Expansion:The European Union’s single market offers significant opportunities for fintech companies to expand across borders. This allows them to reach new customers and markets, increasing their scale and reach.

- Open Banking:Open banking regulations are creating new opportunities for fintech companies to access and utilize customer data. This allows them to develop innovative products and services that meet the evolving needs of customers.

- Embedded Finance:Fintech companies are increasingly integrating financial services into other platforms and applications. This allows them to reach new customers and offer a more seamless experience.