Early stage European SaaS startups funding rebound is a story of resilience and growth, defying the economic headwinds of recent years. This surge in investment reflects a renewed faith in the potential of European tech, driven by a confluence of factors including technological innovation, a booming digital economy, and supportive government policies.

The European SaaS landscape is experiencing a renaissance, attracting global attention with its vibrant ecosystem of innovative startups. This resurgence is fueled by a number of key drivers, including the increasing adoption of cloud-based solutions across industries, the rise of specialized SaaS offerings catering to niche markets, and a growing pool of talented entrepreneurs and developers.

The funding landscape, while facing challenges, has witnessed a significant rebound, demonstrating the resilience and potential of European SaaS startups.

The European SaaS Landscape

The European SaaS market is experiencing a period of rapid growth, driven by several key trends. These include the increasing adoption of cloud computing, the rise of digital transformation initiatives across industries, and the growing demand for software solutions that can help businesses improve efficiency and productivity.

Prominent SaaS Sectors in Europe

The European SaaS landscape is diverse, with a wide range of sectors experiencing significant growth. Some of the most prominent sectors include:

- FinTech:The European FinTech sector is booming, with SaaS solutions playing a crucial role in enabling innovation and disrupting traditional financial services. Examples include online banking platforms, payment processing systems, and investment management tools.

- E-commerce:E-commerce businesses are increasingly relying on SaaS solutions to manage their online operations, from order fulfillment and customer relationship management to marketing and analytics.

- Healthcare:The healthcare sector is embracing SaaS solutions to improve patient care, streamline administrative processes, and enhance data management. Examples include electronic health records (EHR) systems, telemedicine platforms, and patient engagement tools.

- Education:Educational institutions are adopting SaaS solutions to enhance learning experiences, manage student data, and improve administrative efficiency. Examples include learning management systems (LMS), online assessment tools, and student information systems (SIS).

- Manufacturing:The manufacturing sector is leveraging SaaS solutions to optimize production processes, improve supply chain management, and enhance data analytics. Examples include manufacturing execution systems (MES), enterprise resource planning (ERP) systems, and predictive maintenance tools.

Competitive Landscape

The European SaaS market is characterized by a highly competitive landscape, with both established players and emerging startups vying for market share.

- Established Players:Major players in the European SaaS market include companies like SAP, Oracle, Salesforce, and Microsoft. These companies have a strong presence across multiple sectors and offer a wide range of solutions.

- Emerging Startups:The European SaaS ecosystem is also home to a thriving community of emerging startups, many of which are developing innovative solutions that are disrupting traditional industries. These startups are often focused on specific niches and are leveraging the latest technologies to gain a competitive edge.

Early Stage Funding Trends: Early Stage European Saas Startups Funding Rebound

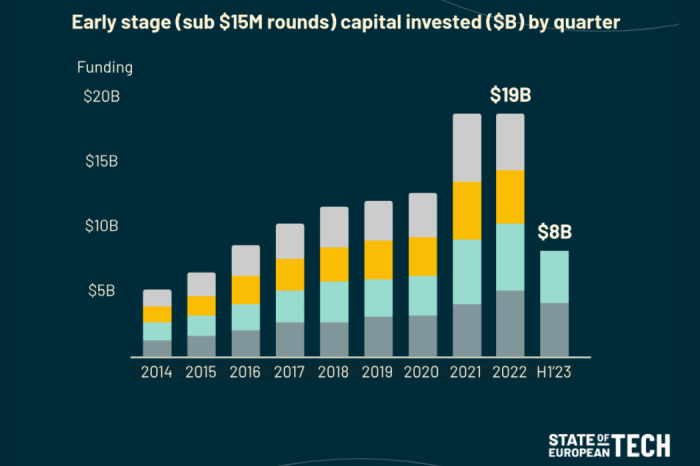

The recent economic headwinds, including rising inflation, interest rate hikes, and geopolitical uncertainty, have significantly impacted early-stage SaaS funding in Europe. While the continent boasts a vibrant SaaS ecosystem, the funding landscape has shifted dramatically compared to pre-pandemic levels.

Impact of Economic Challenges on Early-Stage SaaS Funding

The current economic climate has made investors more cautious, leading to a decrease in funding rounds and a higher bar for startups seeking capital.

- Reduced Investment Activity:Venture capital firms have become more selective, focusing on later-stage companies with proven traction and strong unit economics. This has resulted in a decline in seed and Series A funding rounds for early-stage SaaS startups.

- Higher Valuation Expectations:Investors are demanding higher returns on their investments, leading to increased pressure on startups to demonstrate strong growth and profitability. This has resulted in lower valuations for early-stage companies.

- Increased Focus on Unit Economics:Investors are scrutinizing startups’ unit economics more closely, seeking evidence of sustainable profitability. This has led to a greater emphasis on metrics such as customer acquisition cost (CAC), customer lifetime value (CLTV), and churn rate.

Comparison to Pre-Pandemic Funding Environment

Prior to the pandemic, the European SaaS funding landscape was characterized by abundant capital, high valuations, and a strong appetite for early-stage companies.

- Increased Competition:The influx of capital led to increased competition among startups, making it more challenging to stand out and secure funding. This has become more pronounced in the current environment, as investors are more selective and prioritize companies with a clear path to profitability.

- Shift in Investor Focus:Investors are now more focused on companies with strong unit economics and a clear path to profitability, rather than simply high growth. This shift reflects the current economic climate, where investors are seeking more conservative investments.

- Lower Valuations:The current economic climate has led to lower valuations for early-stage companies, as investors are demanding higher returns on their investments. This is a significant shift from the pre-pandemic era, where valuations were often inflated.

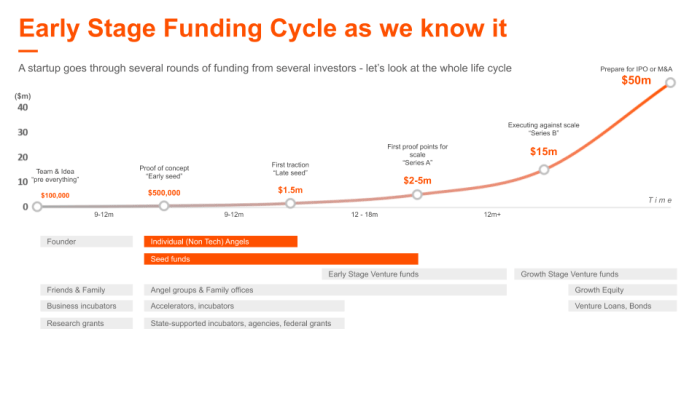

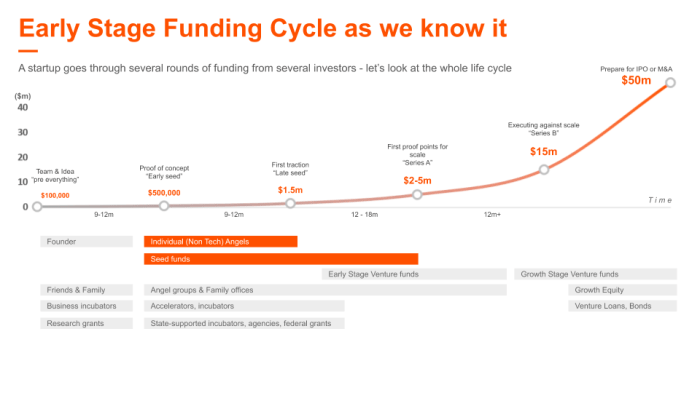

Role of Venture Capital and Other Investment Sources

Despite the challenges, venture capital remains a crucial source of funding for early-stage SaaS startups in Europe. However, the role of other investment sources is becoming increasingly important.

- Venture Capital:While venture capital firms have become more selective, they continue to play a vital role in funding early-stage SaaS companies. They provide not only capital but also mentorship, networks, and expertise.

- Corporate Venture Capital (CVC):CVCs are increasingly active in the European SaaS market, providing capital and strategic partnerships to startups. This trend is driven by the growing need for corporations to innovate and invest in emerging technologies.

- Angel Investors:Angel investors remain an important source of funding for early-stage startups, providing seed capital and valuable insights. They often have industry expertise and can provide mentorship and connections.

- Government Grants:Government grants and subsidies are becoming more available to support early-stage SaaS startups in Europe. These programs provide financial assistance and can help startups overcome early-stage challenges.

Factors Driving the Funding Rebound

The resurgence of funding for early-stage European SaaS startups is a testament to the region’s burgeoning tech ecosystem. Several key factors have converged to create this favorable environment, attracting investors and fueling innovation.

Technological Advancements and Emerging Market Opportunities

The rapid evolution of technology has been a driving force behind the SaaS boom. The emergence of cloud computing, artificial intelligence (AI), and other disruptive technologies has opened up new possibilities for SaaS solutions. These advancements are enabling startups to address a wide range of industry-specific challenges, from automating workflows to enhancing customer experiences.

For instance, the rise of AI-powered chatbots has revolutionized customer service, while data analytics platforms have empowered businesses to make data-driven decisions. These technologies are not only creating new market opportunities but also driving increased demand for SaaS solutions.

Challenges and Opportunities

While the funding rebound is promising for European SaaS startups, it’s essential to acknowledge the challenges they face and the opportunities they can capitalize on. The European landscape presents both hurdles and advantages for these businesses seeking to thrive in the global SaaS market.

Challenges Faced by European SaaS Startups Seeking Funding

The European SaaS funding landscape is characterized by a unique set of challenges. Understanding these obstacles is crucial for startups to navigate the funding process effectively.

- Limited Access to Capital:European SaaS startups often face a more limited pool of capital compared to their counterparts in the US. This can make it difficult to secure large funding rounds, especially in the early stages.

- Shorter Funding Cycles:European venture capitalists tend to have shorter funding cycles than their US counterparts, leading to more frequent fundraising rounds and increased pressure on startups to demonstrate rapid growth.

- Fragmented Market:The European market is fragmented, with different languages, cultures, and regulations across various countries. This can make it challenging for SaaS startups to scale their operations and reach a wider audience.

- Competition from US-Based SaaS Companies:European SaaS startups often face stiff competition from established US-based companies that have already achieved significant market share and brand recognition.

Comparison of the Funding Landscape in Europe to Other Regions

The funding landscape in Europe differs significantly from other regions, particularly the US.

- Smaller Average Deal Size:European SaaS startups typically raise smaller average deal sizes compared to their US counterparts. This is partly due to the limited pool of capital available in Europe.

- Focus on Profitability:European investors often prioritize profitability over rapid growth, emphasizing a more sustainable and long-term approach to building businesses.

- Stronger Regulatory Environment:Europe has a more stringent regulatory environment for data privacy and security, which can create additional challenges for SaaS startups.

Opportunities for European SaaS Startups to Capitalize on the Funding Rebound

Despite the challenges, European SaaS startups have several opportunities to capitalize on the funding rebound.

Do not overlook the opportunity to discover more about the subject of arm targets cars as chip competition grows from open source risc v.

- Focus on Niche Markets:European SaaS startups can target specific niche markets within Europe, leveraging their understanding of local needs and regulations to gain a competitive advantage.

- Leverage European Strengths:European startups can leverage their strengths in areas such as sustainability, data privacy, and innovation to differentiate themselves from US-based competitors.

- Embrace Cross-Border Expansion:European SaaS startups can expand their operations across borders, leveraging the single market to reach a wider audience.

- Partner with European VCs:Startups should seek partnerships with European venture capitalists who have a strong track record of supporting SaaS companies and understand the European market dynamics.

Investor Perspectives

Venture capitalists (VCs) are the driving force behind the funding rebound in the European SaaS landscape. Their investment decisions are crucial in shaping the future of these startups. Understanding their criteria and preferences is essential for aspiring entrepreneurs.

Investment Criteria and Preferences

VCs evaluate European SaaS startups based on several key factors, including:

- Market Size and Growth:VCs prioritize startups targeting large and rapidly growing markets with significant potential for scalability. They assess the market’s overall size, its growth rate, and the startup’s ability to capture a substantial share.

- Product-Market Fit:VCs seek startups with a strong product-market fit, meaning their product solves a real problem for a defined customer segment. They evaluate the product’s features, usability, and its ability to generate value for users.

- Team and Execution:VCs place high value on the founding team’s experience, expertise, and passion for the business. They also assess the team’s ability to execute on its strategy and navigate the challenges of scaling a startup.

- Unit Economics and Scalability:VCs analyze the startup’s unit economics, such as customer acquisition cost (CAC) and customer lifetime value (CLTV). They evaluate the startup’s ability to achieve profitability and scale its operations efficiently.

- Competitive Landscape:VCs assess the competitive landscape to understand the startup’s position within the market. They consider factors such as the number and strength of competitors, the startup’s differentiation, and its ability to gain market share.

Focus on Specific SaaS Sectors

The increased focus on specific SaaS sectors is driven by several factors:

- Emerging Trends:VCs are increasingly interested in startups operating in emerging SaaS sectors, such as artificial intelligence (AI), cybersecurity, and fintech. These sectors are experiencing rapid growth and innovation, presenting significant investment opportunities.

- Market Demand:The growing demand for SaaS solutions across various industries has fueled investment in specific sectors. For example, the rise of remote work and digital transformation has increased the demand for collaboration and productivity tools, attracting investment in these areas.

- Technological Advancements:Advancements in technology, such as cloud computing and mobile devices, have enabled the development of new and innovative SaaS solutions. VCs are keen to invest in startups leveraging these advancements to disrupt existing markets.

Key Investment Trends and Deal Sizes, Early stage european saas startups funding rebound

| Trend | Description | Deal Size (USD) |

|---|---|---|

| Increased Seed Funding | Early-stage SaaS startups are receiving larger seed funding rounds, reflecting investor confidence in the sector. | $1-5 Million |

| Focus on Series A Funding | VCs are increasingly focusing on Series A funding rounds, providing significant capital for growth and expansion. | $5-15 Million |

| Mega-Rounds | A few high-growth SaaS startups are securing mega-rounds of funding, exceeding $100 million. | $100 Million+ |

Success Stories and Case Studies

The recent funding rebound in the European SaaS landscape has seen several startups emerge as success stories, showcasing the resilience and potential of the region’s tech ecosystem. These startups have successfully secured funding despite the challenging economic climate, demonstrating the continued appetite for innovative SaaS solutions.

Examining these success stories provides valuable insights into the strategies and factors that contributed to their success, offering valuable lessons for other aspiring SaaS startups.

Success Stories of European SaaS Startups

Several European SaaS startups have secured significant funding during the recent rebound. These companies represent diverse sectors, including fintech, healthcare, and e-commerce, highlighting the broad appeal of SaaS solutions across various industries.

- GoCardless, a UK-based fintech company, raised $95 million in Series E funding in 2022. The company provides a platform for businesses to collect recurring payments, simplifying the payment process for both businesses and customers. GoCardless’s success can be attributed to its strong market position, robust product offering, and efficient operations.

- Xentral, a German company offering a comprehensive ERP and e-commerce platform, secured €40 million in Series C funding in 2023. Xentral’s success is driven by its comprehensive solution catering to the needs of small and medium-sized enterprises (SMEs).

- Doctorlink, a UK-based healthcare platform, raised £25 million in Series C funding in 2023. The company provides a digital platform for patients to access healthcare services, connecting them with healthcare professionals remotely. Doctorlink’s success is driven by the growing demand for telehealth solutions and its user-friendly platform.

Key Strategies and Factors Contributing to Success

The success of these European SaaS startups can be attributed to a combination of factors, including:

- Strong Product-Market Fit:These startups have identified a clear need in the market and developed solutions that address those needs effectively. They have a deep understanding of their target audience and their pain points, allowing them to tailor their products accordingly.

- Scalable Business Model:These startups have developed scalable business models that allow them to grow rapidly and efficiently. This includes a focus on recurring revenue streams, such as subscriptions, and a strong customer acquisition strategy.

- Experienced Leadership:These startups are led by experienced entrepreneurs and executives with a proven track record of success. They have a clear vision for their companies and the ability to build and manage high-performing teams.

- Favorable Market Conditions:The European SaaS market is experiencing strong growth, driven by factors such as digital transformation, cloud adoption, and the increasing demand for software-based solutions. This favorable market environment has created opportunities for SaaS startups to thrive.

Key Takeaways from Success Stories

The success stories of these European SaaS startups provide valuable insights for other aspiring startups:

| Key Takeaway | Description |

|---|---|

| Focus on Product-Market Fit | Identify a clear need in the market and develop a solution that effectively addresses it. |

| Build a Scalable Business Model | Develop a business model that allows for rapid and efficient growth, focusing on recurring revenue streams and effective customer acquisition. |

| Assemble a Strong Leadership Team | Seek experienced and visionary leaders with a proven track record of success. |

| Leverage Favorable Market Conditions | Capitalize on the growth of the European SaaS market and the increasing demand for software-based solutions. |

Future Outlook

The European SaaS landscape is poised for continued growth, with early-stage funding expected to remain robust in the coming years. Several factors suggest a positive outlook for both investors and entrepreneurs.

Growth Drivers and Trends

Several key trends will shape the future of early-stage funding for European SaaS startups.

- Continued Digital Transformation:The ongoing digital transformation across industries will drive demand for SaaS solutions, creating ample opportunities for startups to address specific needs. For instance, the rise of remote work and hybrid models has spurred demand for collaboration tools and communication platforms, benefitting companies like Slack and Zoom.

- Focus on Innovation:European startups are known for their innovative solutions, particularly in areas like artificial intelligence, cybersecurity, and fintech. This focus on innovation will attract investors seeking high-growth potential. For example, the UK-based AI startup, Graphcore, raised over $200 million in funding to develop its innovative AI chips.

- Favorable Regulatory Environment:The European Union’s focus on fostering innovation through policies like the General Data Protection Regulation (GDPR) creates a more predictable and favorable environment for startups. The GDPR, despite its challenges, has also encouraged the development of privacy-focused SaaS solutions, creating a new market segment.

- Increased Venture Capital Activity:European venture capital firms are increasingly active in the SaaS space, with a growing number of funds dedicated to early-stage startups. This increased investment activity provides a strong pipeline of funding for promising startups. For example, the European Investment Fund (EIF) has launched several initiatives to support early-stage startups, including the “EIF Venture Capital Facility,” which has invested over €1 billion in European startups.

Challenges and Opportunities

While the future looks promising, several challenges could impact the funding landscape.

- Competition:The SaaS market is becoming increasingly competitive, with established players and new entrants vying for market share. Startups will need to differentiate themselves through innovation, strong execution, and effective marketing to secure funding and attract customers.

- Economic Uncertainty:Global economic conditions can impact investor sentiment and funding availability. However, the resilience of the SaaS sector during previous economic downturns suggests that it could be relatively insulated from broader economic fluctuations.

- Talent Acquisition:Attracting and retaining top talent is crucial for startup success. The tight labor market in Europe could pose challenges for startups competing for skilled engineers and other professionals. To address this, startups may need to offer competitive salaries and benefits packages, as well as emphasize company culture and growth opportunities.

Investor Perspectives

Investors are increasingly looking for SaaS startups that demonstrate:

- Strong Unit Economics:Investors seek startups with sustainable business models and the potential for profitability. This includes a clear understanding of customer acquisition costs, customer lifetime value, and the ability to scale efficiently.

- Proven Traction:Early traction, such as a growing customer base, positive customer feedback, and strong revenue growth, is crucial for securing funding. Investors want to see evidence that the startup’s product resonates with the market and has the potential to become a leader in its category.

- Experienced Team:Investors value experienced founders and management teams with a track record of success in building and scaling businesses. This includes expertise in product development, marketing, sales, and operations.