80 percent of fraud scams come from metas platforms uk bank warns – A chilling warning has been issued by a UK bank: a staggering 80% of fraud scams are now originating on Meta platforms like Facebook, Instagram, and WhatsApp. This alarming statistic highlights the growing threat posed by cybercriminals exploiting these platforms to prey on unsuspecting users.

From sophisticated phishing schemes to cleverly crafted fake profiles, fraudsters are employing a range of tactics to deceive and steal from individuals.

The sheer scale of the problem is concerning, with victims suffering not only financial losses but also significant emotional distress. Understanding how these scams work, identifying warning signs, and taking proactive measures to protect ourselves are crucial steps in combating this growing threat.

The Scope of the Problem

A recent warning from a UK bank has highlighted the alarming reality that 80% of fraud scams originate from Meta platforms. This revelation underscores the significant threat these platforms pose to individuals and businesses alike, demanding a heightened awareness of the various scams prevalent on these platforms.

Meta Platforms and Fraud Scams

The UK bank’s warning specifically targeted Meta platforms, including Facebook, Instagram, and WhatsApp. These platforms, with their vast user base and extensive reach, have become fertile ground for fraudsters to exploit.

Common Fraud Scams on Meta Platforms, 80 percent of fraud scams come from metas platforms uk bank warns

Scammers employ a variety of tactics on Meta platforms to deceive unsuspecting users. Some common examples include:

- Romance Scams:Fraudsters create fake profiles on these platforms, often posing as attractive individuals, to build relationships with victims. They then manipulate their emotions to extract money or personal information.

- Investment Scams:Scammers promote fraudulent investment opportunities, promising high returns with minimal risk. They often target individuals seeking quick financial gains, leading them to invest their savings in non-existent schemes.

- Phishing Scams:Scammers create fake websites or messages that mimic legitimate organizations to trick users into providing sensitive information, such as login credentials or bank details. These messages often appear as urgent notifications or promotions, urging immediate action.

- Lottery Scams:Fraudsters claim that users have won a lottery or prize, requiring them to pay a fee or provide personal information to claim their winnings. These scams often involve pressure tactics and promises of large sums of money to entice victims.

Understanding the Methods

The UK bank’s warning highlights the alarming prevalence of fraud scams originating from Meta platforms. Understanding the methods employed by these fraudsters is crucial for safeguarding individuals and businesses from falling victim to their schemes.

Phishing Links

Phishing links are a common tactic used by fraudsters to gain access to sensitive information. These links, often disguised as legitimate messages from trusted sources, redirect users to fraudulent websites designed to mimic authentic login pages. Once users enter their credentials on these fake websites, fraudsters can steal their account information, leading to identity theft and financial losses.

Fake Profiles

Fraudsters create fake profiles on Meta platforms to deceive users into believing they are interacting with genuine individuals. These profiles often use stolen images and fabricated identities to build trust and establish connections with potential victims. Once trust is established, fraudsters may engage in various scams, such as requesting money, selling counterfeit goods, or promoting fraudulent investment opportunities.

Impersonation

Impersonation involves fraudsters posing as legitimate individuals or organizations to trick users into revealing sensitive information or taking actions that benefit the fraudster. For example, fraudsters may impersonate customer support representatives from reputable companies to gain access to account information or persuade users to transfer funds.

Examples of Specific Scams

Romance Scams

Romance scams often target individuals seeking companionship or love online. Fraudsters create fake profiles on dating platforms and social media sites, posing as attractive and charming individuals. They build relationships with victims over time, eventually requesting money or gifts for various fabricated reasons.

Investment Scams

Investment scams involve fraudsters promoting fake investment opportunities, promising high returns with minimal risk. They may use sophisticated websites and marketing materials to appear legitimate, but ultimately, these schemes are designed to defraud investors. Victims are often lured by promises of quick and easy wealth, leading them to invest significant sums of money that they ultimately lose.

Job Scams

Job scams often target individuals seeking employment. Fraudsters create fake job postings, offering attractive salaries and benefits. They may request personal information, such as bank details, as part of the application process. Victims may also be asked to pay for training materials or other expenses, only to discover that the job offer was fraudulent.

Impact on Victims

The consequences of falling victim to fraud scams can be devastating, both financially and emotionally. Victims often experience a sense of betrayal, shame, and vulnerability, leading to a decline in mental well-being. The financial losses can be significant, causing hardship and impacting their ability to meet essential needs.

Check what professionals state about what does europes approach data privacy mean for gpt and dall e and its benefits for the industry.

Financial Consequences

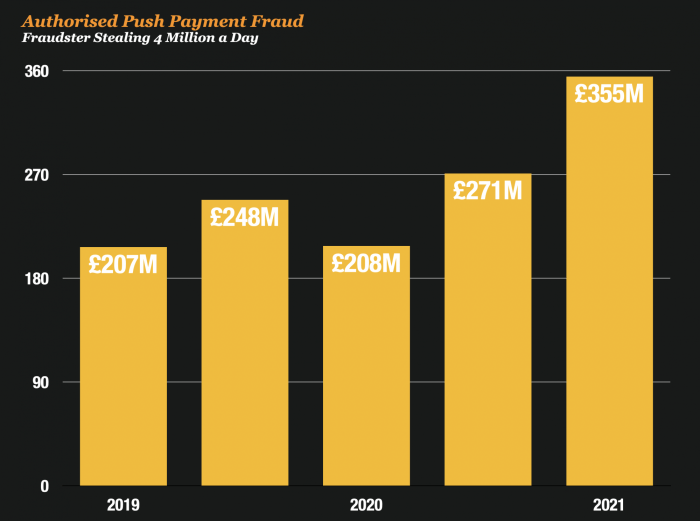

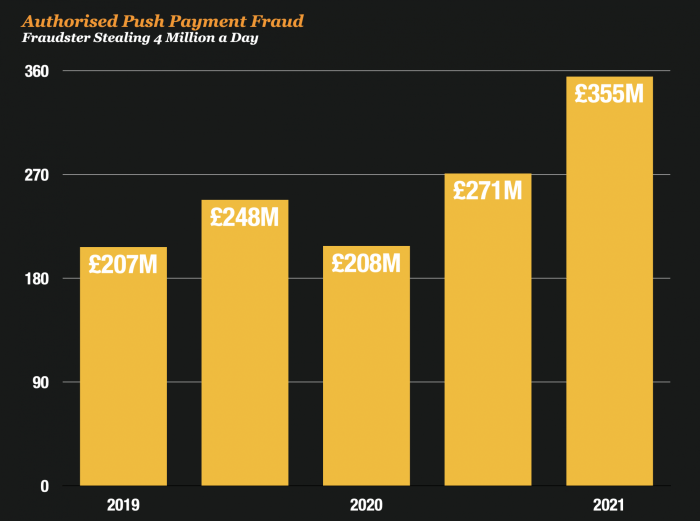

The financial impact of fraud scams can be severe, leading to significant financial losses and hardship for victims. These losses can range from small amounts to substantial sums, depending on the type of scam and the amount of money involved.

- Direct Financial Loss:The most immediate consequence is the direct financial loss incurred by victims. This loss can include the amount of money stolen, the cost of replacing stolen items, and the expenses associated with recovering from the fraud.

- Loss of Savings and Investments:Victims may lose their savings and investments, impacting their long-term financial security. This can be particularly devastating for individuals who have been saving for retirement or other important life goals.

- Credit Damage:Fraudulent activity can negatively impact victims’ credit scores, making it difficult to obtain loans or credit in the future. This can have a ripple effect on their financial well-being, making it harder to access essential financial services.

- Increased Debt:Victims may find themselves burdened with increased debt due to the need to replace stolen items or cover financial losses. This can lead to a cycle of debt and financial instability.

Emotional Consequences

The emotional impact of falling victim to fraud scams can be profound and long-lasting. Victims may experience a range of negative emotions, including:

- Betrayal and Shame:Victims often feel betrayed by the perpetrators and may experience feelings of shame and embarrassment for falling prey to the scam.

- Fear and Anxiety:The experience can leave victims feeling fearful and anxious about their financial security and personal safety. They may be constantly on edge, worried about becoming a victim again.

- Loss of Trust:Victims may lose trust in others, making it difficult to form new relationships or engage in online interactions. This can have a significant impact on their social life and overall well-being.

- Depression and Stress:The emotional turmoil associated with fraud scams can lead to depression, anxiety, and stress. Victims may struggle to cope with the emotional fallout and may require professional support to manage their mental health.

Protective Measures

Meta platforms have become a central hub for communication and information sharing, making them a prime target for scammers. It’s essential to stay vigilant and employ protective measures to safeguard yourself from falling prey to fraudulent activities.

Identifying and Avoiding Fraud Scams

It is crucial to be able to recognize potential scams to avoid falling victim to them. Here are some key indicators to watch out for:

- Unrealistic Offers: Be wary of offers that seem too good to be true, such as winning a large sum of money, receiving free gifts, or getting significant discounts.

- Urgency and Pressure: Scammers often create a sense of urgency, pressuring you to act quickly before the opportunity disappears.

- Suspicious Links: Avoid clicking on links from unknown sources, especially if they are sent via messages or posts that seem suspicious.

- Request for Personal Information: Never provide sensitive personal information like your bank details, passwords, or social security number to unknown individuals or entities.

- Grammar and Spelling Errors: Scammers may use poor grammar and spelling, which can be a red flag indicating a fraudulent attempt.

- Requests for Payment in Unusual Ways: Be cautious of requests for payment through unconventional methods, such as gift cards or cryptocurrency, especially if the transaction seems unusual.

Staying Safe on Meta Platforms

Here are some actionable tips to enhance your safety on Meta platforms:

- Verify Information: Before clicking on links, making a purchase, or providing personal information, double-check the source and legitimacy of the information.

- Be Wary of Suspicious Links: Hover your mouse over links without clicking to see where they redirect. If the link looks suspicious, avoid clicking it.

- Report Suspicious Activity: If you encounter suspicious activity, report it to Meta immediately.

- Enable Two-Factor Authentication: Two-factor authentication adds an extra layer of security by requiring a code sent to your phone or email in addition to your password.

- Use Strong Passwords: Create strong passwords that are unique and difficult to guess.

- Be Cautious of Direct Messages: Be wary of unsolicited direct messages from unknown individuals, especially if they ask for personal information or try to sell you something.

- Review Privacy Settings: Regularly review your privacy settings to control who can see your information and what you share.

Taking Action If You Suspect a Scam

If you suspect you have been a victim of a scam, take the following steps:

- Contact Your Bank or Financial Institution: If you have shared financial information, contact your bank or financial institution immediately to report the incident and take necessary steps to protect your accounts.

- Report the Scam to Meta: Report the scam to Meta through their reporting tools.

- Change Your Passwords: Change your passwords for all accounts that may have been compromised.

- Monitor Your Accounts: Keep a close eye on your accounts for any unusual activity.

- File a Police Report: If you have suffered significant financial loss, file a police report.

Meta’s Role in Combating Fraud: 80 Percent Of Fraud Scams Come From Metas Platforms Uk Bank Warns

Meta, the parent company of Facebook, Instagram, and WhatsApp, has acknowledged the significant problem of fraud scams on its platforms and has implemented various measures to combat them. However, the effectiveness of these measures remains a subject of debate, with some users and experts arguing that more needs to be done.

Meta’s Current Efforts

Meta’s efforts to combat fraud scams on its platforms are multifaceted, including:

- Proactive detection and removal of fraudulent accounts:Meta utilizes automated systems and human reviewers to identify and remove accounts involved in fraudulent activities. These systems analyze account behavior, content, and interactions to flag suspicious accounts for review.

- Investment in artificial intelligence (AI) and machine learning (ML):Meta is actively developing and deploying AI and ML algorithms to detect and prevent fraudulent activities. These technologies can analyze vast amounts of data to identify patterns and anomalies indicative of scams.

- Collaboration with law enforcement agencies:Meta cooperates with law enforcement agencies to investigate and prosecute individuals and organizations involved in fraudulent activities. This collaboration allows for the sharing of information and resources to dismantle fraudulent networks.

- User education and awareness campaigns:Meta conducts campaigns to educate users about common fraud scams and provide tips on how to protect themselves. These campaigns are disseminated through various channels, including social media posts, website articles, and email notifications.

- Reporting mechanisms:Meta provides users with tools to report suspicious activity, including accounts, posts, and messages. These reports are reviewed by Meta’s teams, who take appropriate action to remove fraudulent content or accounts.

Comparison with Other Social Media Companies

Meta’s efforts to combat fraud scams are comparable to those of other major social media companies, such as Google (YouTube), Twitter, and TikTok. These companies also employ automated systems, AI/ML technologies, and user reporting mechanisms to identify and remove fraudulent content and accounts.

However, the effectiveness of these efforts varies depending on the platform and the specific types of scams targeted.

Areas for Improvement

While Meta has made significant strides in combating fraud scams, there are areas where improvements can be made:

- Enhanced detection and prevention of sophisticated scams:Scammers are constantly evolving their tactics, using more sophisticated methods to bypass detection systems. Meta needs to improve its ability to identify and prevent these advanced scams, such as those involving deepfakes or social engineering.

- Increased transparency and accountability:Meta could improve transparency by providing more detailed information about its efforts to combat fraud scams, including the number of fraudulent accounts removed, the types of scams detected, and the effectiveness of its detection systems.

- Strengthening user protection mechanisms:Meta should explore ways to enhance user protection mechanisms, such as implementing stronger authentication requirements, providing more robust fraud prevention tools, and improving the speed and efficiency of responding to user reports.

- Collaboration with financial institutions:Meta could collaborate more closely with financial institutions to share information about fraudulent activities and develop joint strategies to protect users from financial scams.

Government and Regulatory Response

The UK government recognizes the severity of online fraud and has taken various steps to combat it. While there is existing legislation and regulations, there is a continuous need for improvement and adaptation to effectively address the evolving nature of online fraud.

Existing Legislation and Regulations

The UK has a range of laws and regulations in place to combat online fraud. Some key pieces of legislation include:

- The Fraud Act 2006: This act defines various fraud offenses and provides the legal framework for prosecuting individuals involved in fraud activities.

- The Proceeds of Crime Act 2002: This act aims to disrupt and dismantle criminal organizations by seizing their assets and preventing them from profiting from their crimes. This includes money laundering related to fraud.

- The Data Protection Act 2018: This act focuses on protecting personal data and sets out requirements for organizations to handle personal information responsibly. This is crucial for preventing fraud as criminals often rely on stolen personal data to commit their crimes.

- The Payment Services Regulations 2017: These regulations aim to protect consumers when using payment services and introduce measures to combat fraud related to online payments.

In addition to legislation, various regulatory bodies play a role in combating online fraud. The Financial Conduct Authority (FCA) is responsible for regulating financial services and has a specific focus on preventing financial crime, including fraud. The Information Commissioner’s Office (ICO) enforces the Data Protection Act 2018 and investigates data breaches that can be exploited for fraudulent purposes.

Potential Future Measures

While existing legislation and regulations provide a framework, there is a need for ongoing adaptation to address the evolving nature of online fraud. Some potential future measures include:

- Enhanced Collaboration: Strengthening collaboration between government agencies, law enforcement, industry, and consumer groups to share information and coordinate efforts to combat fraud. This could involve creating dedicated task forces or establishing a national fraud prevention strategy.

- Increased Investment in Technology: Investing in advanced technologies such as artificial intelligence (AI) and machine learning to detect and prevent fraud in real-time. This could involve developing sophisticated fraud detection systems and enhancing cyber security measures.

- Consumer Education and Awareness: Implementing public awareness campaigns to educate consumers about the different types of online fraud and how to protect themselves. This could involve providing practical tips on recognizing and avoiding scams, as well as reporting suspected fraud.

- Regulation of Social Media Platforms: Introducing stricter regulations for social media platforms to prevent them from being used as tools for perpetrating fraud. This could involve requiring platforms to implement robust verification systems, remove fraudulent content promptly, and cooperate with law enforcement agencies.