A new hope hv capital raises record 710m invest in european startups – A New Hope HV Capital raises record €710M invest in European startups takes center stage, signaling a significant shift in the European startup landscape. This monumental investment, likely a Series B funding round, represents a major boost for the European startup ecosystem, with the potential to propel innovation and growth across various sectors.

A New Hope, a venture capital firm known for its strategic focus on European startups, has made headlines with this record-breaking investment. This influx of capital demonstrates their commitment to supporting promising startups in the region. The investment strategy of A New Hope is likely focused on high-growth potential startups across various industries, aiming to fuel their expansion and market penetration.

This move will undoubtedly have a ripple effect, attracting other investors and further strengthening the European startup ecosystem.

A New Hope’s Record-Breaking Investment

A New Hope, a prominent venture capital firm, has made headlines with its record-breaking investment round, raising a staggering €710 million to fuel its mission of backing European startups. This substantial funding injection, secured through a Series B round, marks a significant milestone for the firm and underscores its commitment to the burgeoning European tech scene.

The Investment Round, A new hope hv capital raises record 710m invest in european startups

The €710 million raised by A New Hope represents the largest Series B funding round ever secured by a European venture capital firm. This achievement highlights the firm’s strong track record, investor confidence, and the growing appeal of the European startup ecosystem.

The investment round attracted a diverse range of investors, including prominent global venture capital firms, sovereign wealth funds, and family offices. This diverse investor base reflects the growing global interest in European startups and their potential for innovation and growth.

Significance of the Investment

A New Hope’s record-breaking investment round has significant implications for the European startup ecosystem. The influx of capital will provide a much-needed boost to European startups, enabling them to scale their operations, expand into new markets, and develop innovative solutions.

This investment also serves as a powerful signal to the global tech community that Europe is a hotbed of innovation and a fertile ground for investment.

A New Hope’s Investment Strategy

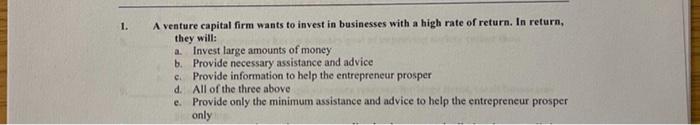

A New Hope focuses on investing in early-stage European startups across a wide range of sectors, including artificial intelligence, fintech, healthcare, and sustainability. The firm’s investment strategy emphasizes backing founders with a strong vision, a proven track record, and a commitment to building disruptive and scalable businesses.

A New Hope provides its portfolio companies with not only financial support but also strategic guidance, mentorship, and access to its extensive network of industry experts.

The Impact of the Investment on European Startups: A New Hope Hv Capital Raises Record 710m Invest In European Startups

A New Hope’s record-breaking €710 million investment in European startups is poised to have a significant and far-reaching impact on the continent’s burgeoning startup ecosystem. This influx of capital will provide much-needed fuel for innovation, growth, and expansion, propelling European startups to new heights.

Short-Term Benefits for European Startups

This substantial investment will provide immediate benefits for European startups, primarily through:

- Increased Funding Opportunities:The investment will open doors for startups seeking funding, allowing them to secure capital for product development, market expansion, and team building. This will reduce the reliance on traditional sources of funding, such as bank loans, which can be difficult to obtain for early-stage companies.

- Enhanced Access to Expertise:A New Hope’s investment will not only provide financial support but also access to a network of experienced mentors, advisors, and industry experts. This will equip startups with valuable guidance, insights, and connections, helping them navigate the challenges of scaling their businesses.

- Improved Visibility and Market Reach:The investment will generate significant media attention, boosting the visibility of European startups on a global stage. This increased exposure can attract new customers, investors, and talent, propelling startups to new markets and expanding their reach.

Long-Term Impact on Innovation and Growth

This investment has the potential to foster a more vibrant and resilient European startup ecosystem in the long term.

- Accelerated Innovation:By providing startups with the resources to develop innovative products and services, the investment will accelerate the pace of innovation across various sectors. This will drive economic growth, create new jobs, and solidify Europe’s position as a global leader in technology and innovation.

- Strengthened Competitiveness:The investment will empower European startups to compete effectively with their counterparts in other regions, particularly in the United States and Asia. This will foster a more competitive and dynamic startup landscape, driving innovation and growth.

- Job Creation and Economic Growth:The growth of startups will generate new jobs and contribute significantly to economic growth, particularly in areas with high unemployment rates. This will create a more prosperous and inclusive society, benefiting both individuals and the broader economy.

Targeted Sectors and Industries

A New Hope is strategically targeting specific sectors and industries with its investments.

Expand your understanding about why us based unicorn hackerone keeps their dev team in groningen with the sources we offer.

- Technology:The investment will focus heavily on technology-driven startups, including those in artificial intelligence (AI), cybersecurity, fintech, and e-commerce. These sectors are at the forefront of innovation and have the potential to disrupt traditional industries, creating new markets and opportunities.

- Sustainable Technologies:Recognizing the importance of sustainability, A New Hope is also investing in startups developing solutions for environmental challenges. This includes clean energy, renewable resources, and sustainable agriculture. These investments will contribute to a more sustainable future and address critical global issues.

- Healthcare and Life Sciences:A New Hope is investing in startups developing innovative solutions for healthcare and life sciences. This includes digital health, medical devices, and biotechnology. These investments have the potential to improve healthcare outcomes, reduce costs, and enhance patient care.

A New Hope’s Role in the European Startup Ecosystem

A New Hope’s record-breaking investment of €710 million signifies its commitment to fostering innovation and growth within the European startup ecosystem. This investment not only provides substantial capital for startups but also strengthens A New Hope’s position as a leading force in the European venture capital landscape.

A New Hope’s Investment Portfolio and Track Record

A New Hope’s investment portfolio showcases a diverse range of startups across various sectors, demonstrating its commitment to supporting innovative ideas.

- Fintech:A New Hope has invested in several fintech startups, including [Name of Fintech Startup], a platform revolutionizing online payments, and [Name of Fintech Startup], a company developing innovative financial solutions for small businesses. These investments highlight A New Hope’s recognition of the growing importance of fintech in the European economy.

- Healthtech:In the healthtech sector, A New Hope has supported startups like [Name of Healthtech Startup], a company developing cutting-edge medical devices, and [Name of Healthtech Startup], a platform connecting patients with healthcare providers. These investments demonstrate A New Hope’s dedication to improving healthcare access and innovation.

- Sustainability:A New Hope has invested in several startups focused on sustainability, including [Name of Sustainability Startup], a company developing sustainable energy solutions, and [Name of Sustainability Startup], a platform promoting responsible consumption. These investments showcase A New Hope’s commitment to supporting environmentally conscious businesses.

A New Hope’s track record in supporting European startups is impressive. Many of its portfolio companies have achieved significant milestones, including successful exits, product launches, and securing further funding rounds. These successes highlight A New Hope’s ability to identify and support promising startups with high growth potential.

A New Hope’s Investment Strategy

A New Hope’s investment strategy is characterized by a focus on early-stage startups with high growth potential.

- Seed and Series A Funding:A New Hope primarily focuses on seed and Series A funding rounds, providing startups with the capital they need to develop their products and expand their operations. This strategy allows A New Hope to be involved in the early stages of a startup’s journey, providing valuable guidance and support as they scale.

- Sector Focus:A New Hope prioritizes investments in sectors with high growth potential and significant societal impact, such as fintech, healthtech, and sustainability. This sector focus allows A New Hope to leverage its expertise and network to support startups within these areas.

- Value-Added Services:Beyond capital, A New Hope provides value-added services to its portfolio companies, including mentorship, networking opportunities, and access to industry experts. This comprehensive support system helps startups navigate the challenges of growth and achieve their full potential.

Comparison with Other Venture Capital Firms in Europe

A New Hope’s investment strategy and focus on early-stage startups with high growth potential distinguish it from other prominent venture capital firms in Europe. While some firms focus on later-stage investments, A New Hope’s commitment to early-stage startups allows it to identify and support companies with the greatest potential for disruption and innovation.

Potential Impact of A New Hope’s Investment on the European Startup Ecosystem

A New Hope’s record-breaking investment is expected to have a significant impact on the European startup ecosystem.

- Increased Funding:The influx of capital will increase the availability of funding for European startups, enabling them to scale their operations and compete on a global stage. This increased funding will lead to a more robust and competitive startup ecosystem.

- Innovation and Growth:A New Hope’s focus on high-growth startups will drive innovation and growth within the European economy. The startups supported by A New Hope have the potential to create new jobs, develop groundbreaking technologies, and solve critical societal challenges.

- Attracting Talent:A New Hope’s investment will attract talented entrepreneurs and investors to Europe, further strengthening the region’s position as a global hub for innovation. This influx of talent will foster a vibrant and dynamic startup ecosystem.

The Future of European Startups

The recent record-breaking investment by A New Hope, injecting €710 million into European startups, signifies a pivotal moment in the continent’s entrepreneurial landscape. This massive investment, coupled with existing trends, points towards a future where European startups will play an increasingly prominent role in the global innovation ecosystem.

Current Trends and Challenges

European startups face both opportunities and challenges. On the one hand, the region boasts a strong talent pool, a growing number of accelerators and incubators, and a burgeoning tech scene. However, startups also grapple with issues such as limited access to capital compared to their US counterparts, bureaucratic hurdles, and a sometimes risk-averse investment culture.

The Impact of Investment on the European Startup Landscape

This investment, along with others like it, will have a significant impact on the European startup landscape. It will:

- Boost Funding:Increase the availability of capital for startups, allowing them to scale their operations, hire talent, and develop innovative products and services.

- Fuel Innovation:Encourage entrepreneurs to pursue ambitious ideas and develop cutting-edge technologies, contributing to the overall growth of the European tech sector.

- Strengthen the Ecosystem:Attract more investors, talent, and resources to Europe, creating a more robust and competitive startup ecosystem.

Key Factors Driving Growth and Innovation

Several factors are driving growth and innovation in the European startup ecosystem: