Europe surpasses us in private spacetech investment for first time seraphim space research – Europe Surpasses US in Private Spacetech Investment for the First Time, According to Seraphim Space Research. This is a significant shift in the global spacetech landscape, signaling a new era of European dominance in the sector. The US has historically been the leader in private spacetech investment, but Europe has recently seen a surge in funding, driven by a number of factors, including government support, a thriving startup ecosystem, and a growing demand for space-based services.

The report highlights a number of key European spacetech companies that have attracted significant investment, including satellite technology companies, launch service providers, and space exploration firms. These companies are developing innovative technologies and projects that are pushing the boundaries of what is possible in space.

For example, one company is developing a new type of satellite that can provide high-speed internet access to remote areas, while another is developing a reusable launch vehicle that could significantly reduce the cost of space travel.

The Shift in Private Spacetech Investment

For decades, the United States has dominated the private space industry, leading the way in both innovation and investment. However, a recent shift has emerged, with Europe now surpassing the US in private spacetech investment for the first time. This change marks a significant milestone in the global space race, highlighting the growing competitiveness of the European space sector.

Historical Context of Private Spacetech Investment

The US has historically been the dominant force in private spacetech investment. Companies like SpaceX, Blue Origin, and Virgin Galactic have attracted billions of dollars in funding, propelling the development of reusable rockets, commercial space tourism, and satellite constellations. In Europe, private spacetech investment has traditionally lagged behind the US, with government-funded agencies like the European Space Agency (ESA) playing a more prominent role.

Factors Driving European Private Spacetech Investment

Several factors have contributed to the recent surge in European private spacetech investment.

- Increased Government Support:European governments have recognized the strategic importance of space technology and have implemented policies to foster private sector growth. Initiatives like the European Union’s Space Programme and national space agencies’ funding programs have provided significant support for startups and established companies.

- Emerging Space Technologies:Europe is home to a growing number of innovative spacetech companies developing cutting-edge technologies in areas like Earth observation, satellite communication, and space exploration. These advancements have attracted investors seeking high-growth opportunities.

- Focus on Sustainability:European investors are increasingly interested in spacetech companies that focus on sustainability and environmental monitoring. This aligns with Europe’s commitment to addressing climate change and promoting responsible space activities.

- Talent Pool:Europe boasts a strong talent pool in space engineering, science, and research, providing a fertile ground for innovative startups and established companies.

Investment Landscape Comparison

While Europe has surpassed the US in private spacetech investment, the investment landscape in both regions exhibits both similarities and differences.

Similarities

- Focus on Commercial Applications:Both the US and Europe are witnessing a shift towards commercial applications of space technology, with companies developing solutions for industries like telecommunications, agriculture, and logistics.

- Government Support:Both regions rely on government funding to support the development of key space infrastructure and technologies.

- Venture Capital Activity:Venture capitalists are actively investing in spacetech startups in both the US and Europe, providing crucial capital for growth and expansion.

Differences

- Investment Stage:While the US has a more mature spacetech investment ecosystem, with large companies attracting significant funding, Europe is seeing a surge in early-stage investments, supporting a growing number of startups.

- Investment Focus:European investors are increasingly focusing on sustainability and Earth observation applications, while US investors have traditionally been more interested in space exploration and commercial space tourism.

- Government Role:European governments play a more active role in supporting the space sector, with a greater emphasis on public-private partnerships.

Key Players and Their Contributions

The European private spacetech sector is brimming with innovative companies attracting significant investment. These companies are pushing the boundaries of space exploration and commercialization, contributing to a vibrant and competitive landscape. This section will delve into the prominent players, their areas of focus, and their notable contributions.

Leading European Spacetech Companies

The European private spacetech sector boasts a diverse range of companies, each with its unique strengths and contributions. Here are some of the prominent players:

- SpaceX, while headquartered in the United States, has a significant presence in Europe, particularly in Germany. SpaceX’s European operations contribute to its global launch services, satellite constellation, and space exploration initiatives. Their Starlink satellite internet service, for example, provides high-speed internet connectivity to remote areas in Europe.

You also can investigate more thoroughly about the best coding bootcamps in europe in to enhance your awareness in the field of the best coding bootcamps in europe in .

- OneWeb, a UK-based company, is a leading provider of satellite internet services. The company has launched a constellation of low Earth orbit (LEO) satellites to provide high-speed internet connectivity to underserved areas globally, including Europe. Their focus on providing affordable and reliable internet access has contributed to bridging the digital divide in various regions.

- Planet Labs, a US-based company with a strong presence in Europe, specializes in Earth observation. Their constellation of small satellites captures high-resolution images of Earth, providing valuable data for various applications, including agriculture, disaster management, and environmental monitoring. Planet Labs’ European operations contribute to their global data collection and analysis efforts.

- Airbus Defence and Space, a European aerospace giant, plays a significant role in the development and launch of satellites. The company offers a wide range of satellite-related services, including design, manufacturing, launch, and operation. Airbus Defence and Space’s contributions are crucial to the European space sector’s success.

- Satura, a German company, specializes in satellite communications. The company offers a range of satellite-based communication services, including high-speed internet, mobile connectivity, and broadcasting. Satura’s innovative solutions contribute to the development of advanced satellite communication networks in Europe.

Areas of Focus for European Spacetech Companies

European private spacetech companies are focusing on various areas, driving innovation and commercialization within the sector. Here are some key areas:

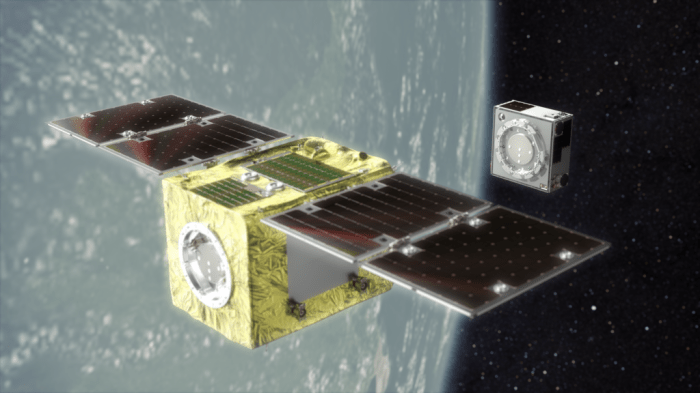

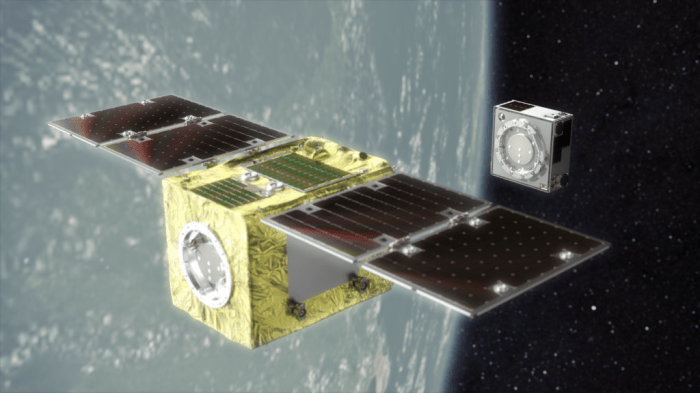

- Satellite Technology: Companies like Airbus Defence and Space and Satura are at the forefront of developing advanced satellite technologies. They are developing new satellite designs, improving communication capabilities, and exploring innovative applications for satellite data.

- Launch Services: The demand for launch services is increasing as more companies and organizations seek to launch satellites into space. European companies like Arianespace and Virgin Orbit are providing launch services for various payloads, including commercial satellites, scientific missions, and government payloads.

- Space Exploration: Europe is actively involved in space exploration, with companies like Airbus Defence and Space and Thales Alenia Space contributing to various missions. These companies are developing technologies and systems for deep space exploration, including spacecraft, rovers, and scientific instruments.

- Earth Observation: Earth observation is a critical area of focus for European spacetech companies. Companies like Planet Labs and Spire Global are utilizing satellite data to monitor Earth’s environment, track climate change, and manage natural resources.

Innovative Technologies and Projects

European spacetech companies are developing innovative technologies and projects that are shaping the future of space exploration and commercialization. Here are some examples:

- The European Space Agency’s (ESA) Gaia missionis a space observatory that is mapping the Milky Way galaxy. The mission has already produced a 3D map of over 1 billion stars, providing valuable insights into the structure and evolution of our galaxy. Gaia is an example of Europe’s commitment to scientific research and exploration.

- The European Union’s Galileo satellite navigation systemis an alternative to the US Global Positioning System (GPS). Galileo provides accurate positioning, navigation, and timing services to users across Europe and beyond. The system is crucial for various applications, including transportation, agriculture, and emergency services.

- The UK Space Agency’s OneWeb satellite internet constellationis providing high-speed internet access to remote and underserved areas in the UK and globally. OneWeb’s innovative approach to satellite internet connectivity is bridging the digital divide and promoting economic development.

Implications of the Shift

The surge in European private spacetech investment signifies a dramatic shift in the global space landscape. This newfound financial backing holds the potential to reshape the industry, impacting both the European space sector and the wider global spacetech ecosystem.

Potential Impact on the Global Spacetech Landscape

The increased investment in European spacetech companies has several potential implications for the global spacetech landscape.

- Increased Competition:The influx of capital will likely fuel innovation and drive competition within the space industry. European companies are poised to become more formidable players, challenging established American dominance in areas like satellite manufacturing, launch services, and space exploration.

- New Technologies and Services:With greater financial resources, European spacetech companies can invest in research and development, leading to the creation of new technologies and services. This could include advancements in areas like Earth observation, telecommunications, and space-based manufacturing.

- Diversification of the Space Industry:The emergence of a strong European spacetech sector will contribute to a more diversified global space industry, reducing reliance on a single dominant player. This diversification could lead to greater innovation, resilience, and stability within the sector.

Potential Benefits and Challenges for the European Space Industry, Europe surpasses us in private spacetech investment for first time seraphim space research

The shift in private spacetech investment presents both opportunities and challenges for the European space industry.

- Economic Growth and Job Creation:Increased investment will stimulate economic growth and create new jobs within the European space sector. This will boost the overall economy and contribute to technological advancement.

- Technological Leadership:The investment will allow European companies to compete at the forefront of spacetech innovation, potentially leading to technological leadership in specific areas. This could enhance Europe’s global competitiveness and influence.

- Access to Space:A thriving private spacetech sector will provide Europe with greater access to space, enabling the development of new space-based applications and services. This could benefit various sectors, including telecommunications, navigation, and environmental monitoring.

- Coordination and Collaboration:The European space industry will need to address challenges such as coordinating investments, fostering collaboration between companies and research institutions, and ensuring a robust regulatory framework.

- Talent Acquisition and Retention:Attracting and retaining skilled talent will be crucial for the success of the European space industry. This will require investments in education, training, and research, as well as creating an attractive environment for talented professionals.

Potential for Collaboration and Competition between US and European Spacetech Companies

The increased European investment in spacetech could lead to both collaboration and competition between US and European companies.

- Collaboration:The US and Europe have a long history of collaboration in space exploration and research. This collaboration could continue and even intensify as European companies become more competitive. Joint ventures and partnerships could be formed to develop and deploy innovative technologies and services.

- Competition:The increased competition between US and European spacetech companies could drive innovation and push both sides to develop more advanced technologies and services. This healthy competition could ultimately benefit the global space industry and accelerate progress in space exploration and utilization.

Future Trends and Opportunities: Europe Surpasses Us In Private Spacetech Investment For First Time Seraphim Space Research

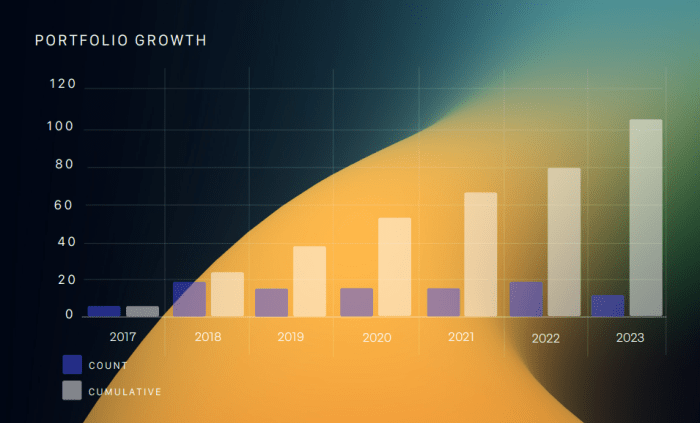

The surge in private spacetech investment in Europe signals a promising future for the sector. This trend is likely to continue, driven by a combination of factors, including government support, a thriving startup ecosystem, and a growing demand for space-based services.

Emerging Areas of Opportunity

Several emerging areas within the European spacetech sector hold significant potential for growth and innovation. These include:

- Space-based data analytics:The increasing availability of satellite data, coupled with advancements in artificial intelligence (AI) and machine learning (ML), is creating opportunities for data-driven insights across various industries. This includes applications in agriculture, climate monitoring, disaster management, and urban planning.

- New Space applications:The development of smaller, more affordable satellites, known as “New Space,” is opening up new possibilities for space-based services. These include Earth observation, communication, and navigation. This trend is further fueled by the growing demand for high-bandwidth connectivity, particularly in remote and underserved areas.

- Space tourism and infrastructure:The burgeoning space tourism industry, driven by companies like Virgin Galactic and Blue Origin, is creating demand for new space infrastructure, including launch vehicles, spacecraft, and spaceports. Europe is well-positioned to play a significant role in this emerging market, leveraging its expertise in space technology and infrastructure development.

The Potential for New Technologies and Applications

The advancement of new technologies is driving innovation and growth in the European spacetech sector. Some of the key areas of focus include:

- Quantum technologies:Quantum computing, sensing, and communication offer the potential to revolutionize space exploration and operations. For instance, quantum communication could enable secure data transmission between satellites and ground stations, while quantum sensing could improve navigation and Earth observation capabilities.

- Advanced materials:The development of lightweight and durable materials, such as composites and advanced alloys, is essential for building cost-effective and efficient spacecraft. This is particularly relevant for the growing New Space sector, where smaller, more affordable satellites are becoming increasingly popular.

- 3D printing:Additive manufacturing, or 3D printing, offers significant advantages in space manufacturing. It allows for the on-demand production of parts and components, reducing the need for bulky and expensive supplies. This could lead to the development of modular spacecraft and the construction of space-based infrastructure.