European unicorns lose value * after public markets fall – European Unicorns Lose Value After Public Markets Fall – a stark reality for many promising startups that rode the wave of venture capital investment in recent years. The once-booming tech scene across Europe has encountered a sudden shift, with valuations taking a hit as public markets tumble.

The recent decline, driven by factors like rising interest rates, inflation, and geopolitical uncertainty, has forced these unicorns to re-evaluate their growth strategies and adapt to a new economic landscape.

The rapid rise of European unicorns was fueled by a perfect storm of factors. Venture capitalists and private equity firms poured billions into promising startups, eager to capitalize on the potential of the European tech sector. This influx of capital allowed these companies to scale rapidly, attracting talent and disrupting traditional industries.

However, the public market downturn has cast a shadow over this growth, forcing these companies to confront the harsh realities of a less favorable funding environment.

The Rise and Fall of European Unicorns

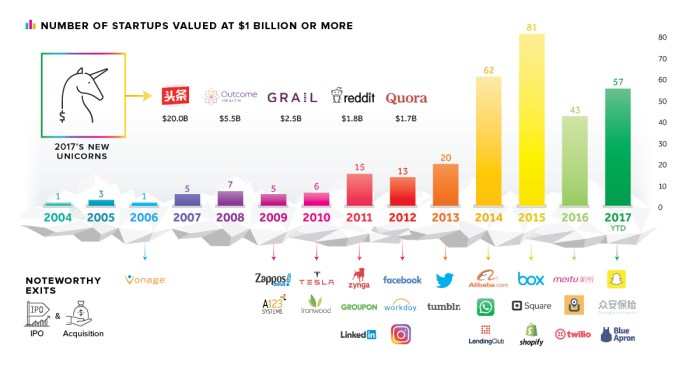

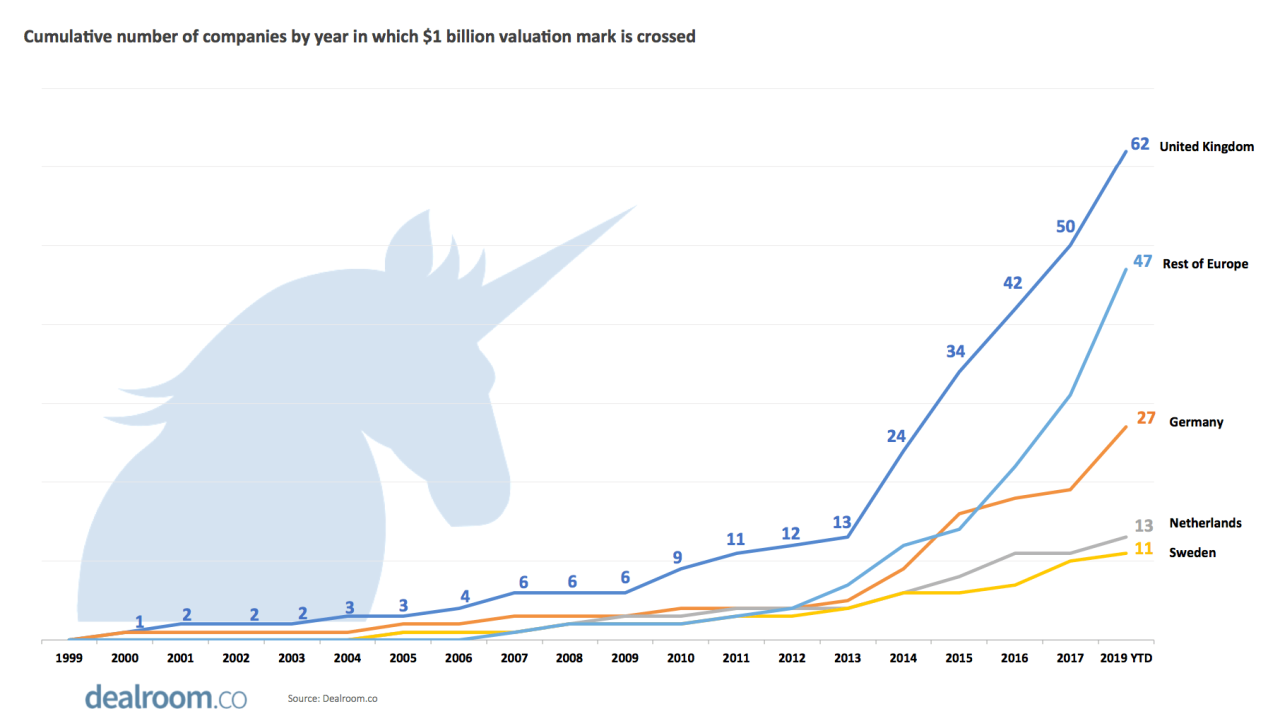

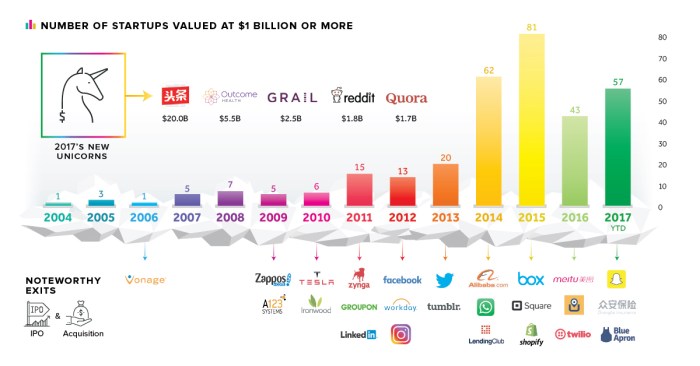

The past decade witnessed a surge in the number of European unicorn companies, startups valued at over $1 billion. This rapid growth was fueled by a confluence of factors, including increased venture capital investment, favorable regulatory environments, and a thriving ecosystem of talent and innovation.

However, the recent downturn in public markets has led to a decline in valuations for many European unicorns, raising questions about the sustainability of their growth and the future of the European tech landscape.

Factors Contributing to the Rise of European Unicorns

The rapid growth of European unicorns was driven by a combination of factors.

- Increased Venture Capital Investment:The European venture capital market experienced significant growth in recent years, with investors pouring billions of dollars into promising startups. This influx of capital provided European companies with the resources they needed to scale their operations and expand into new markets.

- Favorable Regulatory Environments:Many European countries have implemented policies designed to foster innovation and entrepreneurship, including tax incentives for startups and streamlined regulatory processes. These measures have created a more favorable environment for startups to thrive.

- Thriving Ecosystem of Talent and Innovation:Europe boasts a highly skilled workforce and a growing number of universities and research institutions focused on technology and innovation. This ecosystem has produced a pipeline of talented entrepreneurs and engineers who have contributed to the rise of European unicorns.

The Role of Venture Capital and Private Equity

Venture capital and private equity played a crucial role in fueling the growth of European unicorns.

- Early-Stage Funding:Venture capitalists provided early-stage funding to promising startups, enabling them to develop their products and services.

- Growth Capital:As startups matured, private equity firms provided growth capital to support their expansion into new markets and acquisitions.

- Strategic Guidance:Venture capitalists and private equity firms also provided strategic guidance to startups, helping them navigate the complexities of scaling their businesses.

Comparison with Other Regions

The European unicorn landscape differs significantly from that of other regions, such as the US and Asia.

- Number of Unicorns:While the US remains the dominant region for unicorns, Europe has witnessed a significant increase in the number of unicorns in recent years.

- Industry Focus:European unicorns are often focused on sectors such as fintech, e-commerce, and healthcare, while US unicorns tend to be concentrated in areas like software, artificial intelligence, and consumer technology.

- Investment Strategies:European venture capitalists tend to invest in companies at later stages of development compared to their US counterparts, often focusing on companies with proven business models and a track record of revenue growth.

Public Market Volatility and its Impact

The recent decline in public markets, particularly impacting European unicorns, can be attributed to a confluence of factors that have significantly impacted investor sentiment and valuation metrics.

Key Events Leading to Public Market Decline

The recent decline in public markets is primarily driven by a combination of factors, including:

- Interest Rate Hikes:Central banks around the world, including the European Central Bank (ECB), have been raising interest rates to combat rising inflation. This makes borrowing more expensive for companies, potentially impacting their growth and profitability, leading to a decline in valuations.

- Inflation:Persistent high inflation erodes purchasing power and reduces consumer spending, impacting companies’ revenue and profitability. This uncertainty makes investors more cautious, leading to a decline in stock prices.

- Geopolitical Uncertainty:The ongoing war in Ukraine, coupled with other geopolitical tensions, has created uncertainty in the global economy, impacting investor confidence and causing a decline in stock markets.

Impact on Publicly Traded Companies

These events have had a significant impact on publicly traded companies, including unicorns. The rise in interest rates and inflation has increased the cost of capital, making it more expensive for companies to finance their growth. This has led to a reassessment of valuations, with investors demanding higher returns for their investments in a riskier environment.

Examples of European Unicorns Affected

Several European unicorns have seen their stock prices decline significantly since their IPOs, reflecting the broader market downturn. For example:

- Wise (formerly TransferWise):The British fintech company, which went public in 2021, has seen its stock price fall by more than 50% since its IPO. The company’s valuation has been impacted by the rising cost of capital and concerns about its growth prospects in a slowing economic environment.

- Deliveroo:The British food delivery company, which went public in 2021, has also seen its stock price decline significantly. The company’s valuation has been affected by the slowing growth of the food delivery market and concerns about its profitability.

The Impact on European Unicorns

The decline in public markets has had a significant impact on the valuations of European unicorns, those privately held companies valued at over $1 billion. This downturn has created a ripple effect, influencing the funding landscape for these promising startups.

Obtain a comprehensive document about the application of slush revokes pitching competition winner immigrams controversial award that is effective.

Valuation Adjustments

The public market decline has directly affected the valuations of European unicorns. As public company valuations have fallen, investors have become more cautious about investing in private companies, leading to a reassessment of valuations. This reassessment has resulted in a downward adjustment of valuations for many European unicorns.

- A recent study by CB Insights found that the median valuation of European unicorns declined by 20% in the first quarter of 2023 compared to the previous quarter. This decline is attributed to the broader market downturn and increased investor risk aversion.

- Examples include companies like Wise, a cross-border payments platform, and GoCardless, a direct debit payment processor, which have both seen their valuations decline in recent months.

Funding Challenges

The current market environment has made it more challenging for European unicorns to secure funding. Investors are now demanding higher returns and are more selective in their investments. This has resulted in a decrease in the number of funding rounds and a tightening of terms.

- Many European unicorns are finding it difficult to raise capital at their previous valuations, leading them to either delay their fundraising plans or accept lower valuations.

- This is especially true for companies in sectors that have been hit hard by the market downturn, such as e-commerce and technology.

Comparison to Previous Market Downturns

The current market downturn is not the first time that European unicorns have faced challenging funding conditions. The dot-com bubble burst in the early 2000s and the global financial crisis of 2008-2009 also led to significant market volatility. However, the current downturn is unique in its scale and duration.

- The COVID-19 pandemic initially led to a surge in valuations for European unicorns, as investors sought to capitalize on the rapid shift to digital services. However, the pandemic also highlighted the fragility of many business models, leading to a reassessment of valuations.

- The current downturn is characterized by a combination of factors, including rising inflation, interest rate hikes, and geopolitical uncertainty. This has created a more challenging environment for European unicorns to navigate.

Potential for Recovery

Despite the challenges, there is potential for recovery for European unicorns. The long-term growth prospects for many of these companies remain strong, and investors are likely to return to the market once the economic outlook improves.

- The European tech sector is still relatively young and has significant potential for growth. Companies that can demonstrate strong fundamentals and a clear path to profitability will be well-positioned to capitalize on the recovery.

- The current market downturn could also lead to consolidation in the European tech sector, as weaker companies are forced to merge or exit the market. This could create opportunities for stronger players to acquire assets and expand their market share.

Strategies for Adaptation and Resilience: European Unicorns Lose Value * After Public Markets Fall

The current market downturn has presented European unicorns with a unique set of challenges. To navigate these turbulent waters, these companies must adopt strategic approaches to ensure their continued growth and success.

Strategies for Navigating Market Volatility, European unicorns lose value * after public markets fall

These strategies can be categorized into three main approaches:

- Cost Optimization and Efficiency:This involves reducing expenses, streamlining operations, and maximizing resource utilization.

- Shifting Focus to Profitability:This approach prioritizes revenue generation and profitability over rapid growth, emphasizing sustainable business models.

- Innovation and Diversification:This strategy encourages exploration of new markets, product lines, and revenue streams to mitigate risk and create new growth opportunities.

Cost Optimization and Efficiency

Cost optimization and efficiency strategies are crucial for European unicorns to weather the current market storm.

- Layoffs and Hiring Freeze:Many companies, such as Spotify and Netflix , have implemented layoffs and hiring freezes to reduce labor costs. This strategy, while necessary for survival, can negatively impact morale and innovation.

- Operational Streamlining:Optimizing processes, eliminating redundancies, and automating tasks can significantly improve efficiency.

Amazon is an example of a company that has implemented operational streamlining measures, including automation and process optimization.

- Cost Reduction Initiatives:Negotiating better deals with suppliers, reducing marketing expenses, and optimizing cloud infrastructure can all contribute to cost savings. Microsoft has implemented cost-reduction initiatives, including a hiring freeze and reduced marketing expenses.

Shifting Focus to Profitability

European unicorns can prioritize profitability by focusing on revenue generation and sustainable business models.

- Increasing Revenue:Companies can focus on expanding their customer base, increasing average order value, and exploring new revenue streams. Microsoft is an example of a company that has successfully increased revenue by focusing on cloud computing and enterprise software.

- Optimizing Pricing:Analyzing customer value and market dynamics can help companies optimize pricing strategies to maximize revenue.

Tesla has implemented price adjustments to increase demand and maintain profitability.

- Reducing Costs:As discussed earlier, cost optimization strategies are crucial for improving profitability.

Innovation and Diversification

Innovation and diversification strategies allow European unicorns to mitigate risk and create new growth opportunities.

- Product Development:Developing new products and services that address emerging market needs can generate new revenue streams. Apple is a prime example of a company that continuously innovates with new products and services.

- Market Expansion:Exploring new geographic markets can expand customer reach and mitigate dependence on any single market.

Microsoft has successfully expanded its global reach through its cloud computing services.

- Strategic Partnerships:Collaborating with other companies can provide access to new markets, technologies, and resources. Google and Meta have formed strategic partnerships to advance their artificial intelligence capabilities.

The Future of European Unicorns

The recent market volatility has undoubtedly impacted European unicorns, but their future remains bright. Several key trends and factors will shape the European unicorn ecosystem, influencing their ability to navigate challenges and achieve sustained growth.

Technological Advancements

Technological advancements are a driving force behind the growth of European unicorns. The emergence of artificial intelligence (AI), blockchain, and the Internet of Things (IoT) presents new opportunities for innovation and disruption across various industries. European unicorns are actively leveraging these technologies to develop innovative products and services, creating new markets and expanding their reach.

For example, AI-powered solutions are transforming healthcare, finance, and transportation, while blockchain technology is revolutionizing supply chain management and cybersecurity.

Regulatory Landscape

The regulatory landscape plays a crucial role in shaping the future of European unicorns. Governments and regulators are increasingly focusing on promoting innovation and fostering a favorable environment for startups. Regulatory frameworks that encourage responsible AI development, data privacy protection, and open data initiatives will support the growth of European unicorns.

Global Economic Conditions

Global economic conditions, including interest rates, inflation, and geopolitical events, can significantly impact the performance of European unicorns. A robust global economy with low interest rates and stable inflation is conducive to growth, allowing unicorns to access capital and expand their operations.

Conversely, economic downturns and geopolitical uncertainties can lead to reduced investment and slower growth.

The Role of Venture Capital

Venture capital plays a vital role in supporting the growth of European unicorns. Continued investment from venture capitalists will be essential for unicorns to scale their operations, develop new technologies, and enter new markets. The availability of capital and the willingness of investors to take on higher risk are crucial factors for the success of European unicorns.

The Importance of Talent

Access to talent is a key factor for the future of European unicorns. European unicorns need to attract and retain top talent in areas such as technology, engineering, and business development. Governments and universities can play a crucial role in fostering a vibrant tech ecosystem that attracts and develops talent.

Focus on Sustainability

Sustainability is becoming increasingly important for businesses, including European unicorns. Consumers and investors are demanding that companies demonstrate a commitment to environmental, social, and governance (ESG) principles. European unicorns that embrace sustainability practices and integrate ESG factors into their business models will be well-positioned for long-term success.