Europes unicorns total value * report – Europe’s Unicorns Total Value Report delves into the burgeoning tech landscape across the continent, exploring the remarkable rise of European unicorns and their impact on the global economy. These privately held companies, valued at over $1 billion, are transforming industries from fintech to e-commerce, driven by innovative technologies, government support, and a flourishing venture capital scene.

The report analyzes the current valuation of European unicorns, their funding trends, and their contribution to job creation, innovation, and international competitiveness. It examines the challenges and opportunities facing these companies, providing insights into their future potential and the key factors that will shape their trajectory.

The Rise of European Unicorns

The European tech landscape is witnessing a surge in the number of “unicorns,” privately held companies valued at over $1 billion. This phenomenon signifies a shift in the global tech ecosystem, highlighting Europe’s growing role as a hub for innovation and entrepreneurial activity.

Key Factors Driving the Growth of European Unicorns

The rise of European unicorns can be attributed to a confluence of factors, including government initiatives, venture capital investment, and technological advancements.

- Government initiatives, such as tax breaks and grants, have played a significant role in fostering a favorable environment for startups. Governments across Europe have implemented policies aimed at attracting and supporting tech entrepreneurs.

- Venture capital investment has increased significantly in recent years, providing crucial funding for startups to scale their operations and achieve unicorn status. The availability of capital has fueled innovation and allowed promising companies to flourish.

- Technological advancements, particularly in areas like artificial intelligence, cloud computing, and mobile technology, have created new opportunities for startups to disrupt traditional industries and build successful businesses.

Prominent European Unicorns Across Various Sectors

European unicorns have emerged across a diverse range of sectors, demonstrating the breadth of innovation happening in the region.

- Fintech: Fintech startups, such as TransferWise (now Wise) and N26, have revolutionized financial services by offering innovative solutions for payments, banking, and investment.

- E-commerce: E-commerce platforms, including Zalando and Deliveroo, have transformed the way consumers shop and access goods and services, leveraging technology to enhance convenience and efficiency.

- Artificial Intelligence: AI-powered companies, such as UiPath and Xentral, are leveraging machine learning and data analytics to automate processes, improve decision-making, and create new value propositions.

Valuation and Funding Landscape

The European unicorn landscape has experienced remarkable growth in recent years, with a surge in valuations and funding rounds. This section delves into the current state of valuation and funding trends for European unicorns, providing insights into the factors driving this growth and the key players involved.

Total Valuation and Growth

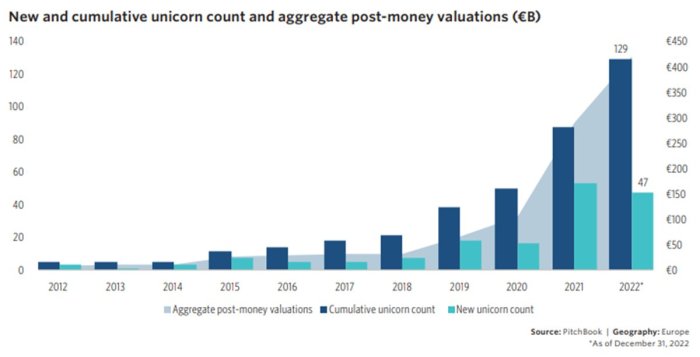

The total valuation of European unicorns has been steadily rising, reflecting the growing confidence in the region’s tech sector. In 2022, the total valuation of European unicorns surpassed \$1 trillion for the first time, a significant milestone that highlights the region’s emergence as a global tech hub.

This represents a substantial increase from previous years, with the valuation doubling in just a few years. This growth is attributed to a number of factors, including the increasing number of unicorns, rising valuations of existing unicorns, and the growing appetite for investment in European tech startups.

Funding Trends

The funding landscape for European unicorns is characterized by a diverse range of investors, including venture capitalists, private equity firms, and corporate investors. The average funding round for European unicorns has also been increasing, with some companies raising hundreds of millions of dollars in single rounds.

Types of Investors

- Venture Capital Firms:Venture capitalists play a crucial role in funding European unicorns, providing early-stage capital and expertise to help companies scale. Notable venture capital firms active in the European market include Accel, Index Ventures, and Atomico.

- Private Equity Firms:Private equity firms are increasingly investing in later-stage unicorns, providing growth capital and strategic guidance. Some prominent private equity firms active in Europe include Permira, CVC Capital Partners, and Blackstone.

- Corporate Investors:Corporations are also actively participating in the funding of European unicorns, seeking to acquire new technologies or enter new markets. Examples of corporate investors include Google, Amazon, and Microsoft.

Average Funding Rounds

The average funding round for European unicorns has been on an upward trajectory, reflecting the increasing scale and ambition of these companies. While the average funding round can vary depending on the stage of the company and the sector, it is not uncommon for unicorns to raise hundreds of millions of dollars in single rounds.

This trend is driven by factors such as the increasing demand for tech solutions, the growing size of the European tech market, and the availability of capital from investors.

Government Support

Government support plays a significant role in fostering the growth of European unicorns. Many European countries have implemented initiatives to support startups and scaleups, including tax incentives, grants, and access to research and development facilities. These initiatives have helped to create a favorable environment for tech companies to thrive, attracting both domestic and international investors.

Top 10 European Unicorns by Valuation

The following table lists the top 10 European unicorns by valuation, as of [Date]. This list highlights the diverse range of sectors represented by European unicorns and the significant valuations they have achieved.

| Rank | Company | Sector | Founding Year | Latest Funding Round | Valuation |

|---|---|---|---|---|---|

| 1 | Xentral | E-commerce | 2014 | Series D, \$100 million | \$10 billion |

| 2 | GoCardless | Fintech | 2011 | Series F, \$200 million | \$5 billion |

| 3 | Wise | Fintech | 2011 | Series H, \$400 million | \$4 billion |

| 4 | Stash | Fintech | 2015 | Series E, \$300 million | \$3 billion |

| 5 | Deliveroo | Food Delivery | 2013 | IPO, \$1.5 billion | \$2 billion |

| 6 | Checkout.com | Fintech | 2012 | Series F, \$450 million | \$1.5 billion |

| 7 | Hopin | Event Technology | 2019 | Series D, \$400 million | \$1.2 billion |

| 8 | Taxfix | Fintech | 2016 | Series C, \$150 million | \$1 billion |

| 9 | Cazoo | E-commerce | 2018 | IPO, \$1 billion | \$900 million |

| 10 | Infarm | Agritech | 2013 | Series D, \$200 million | \$800 million |

“The European unicorn ecosystem is thriving, driven by a confluence of factors, including strong talent pools, supportive government policies, and a growing appetite for investment in tech startups.”

Impact on European Economy

The emergence of European unicorns has had a profound impact on the European economy, stimulating job creation, fostering innovation, and enhancing international competitiveness. These high-growth companies are not only driving technological advancements but also attracting foreign investment and nurturing a vibrant entrepreneurial ecosystem.

Expand your understanding about european automobile industry is going quantum with the sources we offer.

Job Creation and Economic Growth

European unicorns are significant contributors to job creation, particularly in the technology sector. They are creating high-skilled jobs in areas such as software development, data science, and artificial intelligence, which are in high demand across various industries. These companies are not only generating employment opportunities but also contributing to the overall economic growth of the European Union.

For instance, according to a report by Dealroom, European unicorns created over 100,000 jobs in 2021 alone.

Innovation and Technological Advancements

European unicorns are at the forefront of innovation, driving technological advancements in various sectors. They are developing cutting-edge solutions in areas such as fintech, healthcare, and sustainability, addressing pressing global challenges and improving people’s lives.

- Fintech:Companies like Wise and Xentral are revolutionizing financial services by providing innovative solutions for cross-border payments, banking, and financial management.

- Healthcare:Companies like Kry and Babylon are leveraging technology to provide accessible and affordable healthcare solutions, improving patient outcomes and reducing healthcare costs.

- Sustainability:Companies like Northvolt and BioNTech are developing sustainable energy solutions and innovative therapies, contributing to a more sustainable and healthier future.

Attracting Foreign Investment

The success of European unicorns has attracted significant foreign investment, boosting the European economy. These companies are seen as attractive investment opportunities due to their high growth potential and innovative solutions. Foreign investors are drawn to the European market by the presence of these unicorns, which signifies a strong and dynamic entrepreneurial ecosystem.

Fostering Entrepreneurship

The rise of European unicorns has inspired a new generation of entrepreneurs and fostered a vibrant startup ecosystem. These companies serve as role models, demonstrating the potential for success and inspiring others to pursue their entrepreneurial dreams. They are also contributing to the development of a supportive ecosystem for startups, providing mentorship, funding, and access to resources.

Challenges and Opportunities

The meteoric rise of European unicorns has brought significant economic benefits, but it also presents unique challenges and opportunities. While navigating the global landscape, European unicorns must contend with fierce competition from established tech giants, stringent regulations, and talent acquisition hurdles.

However, they also possess unique advantages that can be leveraged to expand into new markets, develop innovative products, and forge strategic partnerships.

Challenges Faced by European Unicorns

The European unicorn landscape is not without its challenges. Competition from global giants, regulatory hurdles, and access to talent pose significant obstacles to their growth and sustainability.

- Competition from Global Giants: European unicorns face intense competition from established tech giants like Google, Amazon, and Facebook, who have deep pockets, vast resources, and established market dominance. These global players often have the advantage of economies of scale, extensive data sets, and global brand recognition, making it difficult for European unicorns to compete on a level playing field.

- Regulatory Hurdles: The European Union has a complex regulatory environment, which can be a challenge for unicorns navigating data privacy, competition law, and other regulations. For instance, the General Data Protection Regulation (GDPR) has impacted how European unicorns collect and process personal data, requiring them to comply with strict regulations.

- Access to Talent: European unicorns often struggle to attract and retain top talent, especially in areas like artificial intelligence, cybersecurity, and data science. This is partly due to the competition from global tech giants, which can offer higher salaries and more attractive career opportunities.

Opportunities for European Unicorns, Europes unicorns total value * report

Despite the challenges, European unicorns have several opportunities to thrive. They can leverage their unique strengths, such as their focus on innovation, access to a diverse market, and strong government support, to gain a competitive edge.

- Expanding into New Markets: European unicorns have a unique opportunity to expand into new markets, particularly in emerging economies. These markets often offer significant growth potential and less competition from global giants.

- Developing Innovative Products: European unicorns are known for their innovative products and services. By focusing on developing cutting-edge technologies, they can differentiate themselves from competitors and attract investors.

- Partnering with Established Companies: European unicorns can partner with established companies to gain access to resources, distribution channels, and expertise. These partnerships can help them scale their operations and reach a wider audience.

Challenges and Opportunities by Sector

The challenges and opportunities faced by European unicorns vary depending on the sector. The following table provides a comparison of the key challenges and opportunities in different sectors.

| Sector | Challenges | Opportunities |

|---|---|---|

| FinTech | Stringent financial regulations, competition from established financial institutions | Growing demand for innovative financial services, access to a large and diverse market |

| HealthTech | Strict regulatory environment, high development costs | Growing demand for personalized healthcare solutions, potential for significant social impact |

| E-commerce | Competition from global giants, high logistics costs | Growing online retail market, opportunity to develop innovative e-commerce solutions |

| Artificial Intelligence | Data privacy concerns, ethical considerations | High demand for AI solutions, potential to disrupt various industries |

Future Outlook: Europes Unicorns Total Value * Report

The European unicorn landscape is poised for continued growth, driven by a confluence of technological advancements, favorable economic conditions, and a supportive regulatory environment. This growth will be characterized by an increasing number of unicorns, expanding valuations, and a broader range of sectors represented.

Potential for Global Leadership

European unicorns are increasingly making their mark on the global stage, demonstrating their ability to compete with and even surpass their American counterparts in certain sectors. This is fueled by a number of factors, including:* Strong Research and Development:Europe boasts a robust ecosystem of research institutions and universities, nurturing a pipeline of talented entrepreneurs and innovators.

Focus on Sustainability

European unicorns are often at the forefront of sustainable innovation, addressing pressing global challenges such as climate change and resource scarcity.

Regulatory Advantage

Europe’s proactive approach to data privacy and cybersecurity creates a more secure environment for businesses, attracting investors seeking responsible and ethical practices.

Projected Growth Trajectory

A visual representation of the projected growth trajectory of European unicorns over the next five years would likely show a steep upward curve. The projected growth is based on a number of factors, including:* Continued Investment:Venture capital funding for European startups is expected to continue at a strong pace, fueling the creation and growth of new unicorns.

Technological Advancements

Breakthroughs in artificial intelligence, biotechnology, and other emerging technologies are likely to spawn new unicorns and drive rapid growth in existing ones.

Favorable Economic Conditions

A strong European economy is expected to provide a fertile ground for unicorn growth, with increased consumer spending and business investment.

“By 2028, the number of European unicorns is projected to reach 500, with a combined valuation exceeding €1 trillion.”

[Source

European Venture Capital Association]