Ai detects money laundering through cryptocurrencies on bitcoin blockchain – AI Detects Money Laundering on the Bitcoin Blockchain sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset. The rise of cryptocurrencies, especially Bitcoin, has brought about a new era of financial innovation, but it has also attracted nefarious actors seeking to exploit its anonymity for illicit activities, including money laundering.

Traditional financial systems, with their centralized structures and established regulations, struggle to effectively track and combat these crimes in the decentralized world of blockchain technology. Enter AI, the technological savior poised to revolutionize the fight against financial crime in the digital age.

AI’s ability to process vast amounts of data, identify patterns, and learn from past behavior makes it an ideal tool for detecting money laundering on the Bitcoin blockchain. By analyzing transaction history, network graphs, and user behavior, AI algorithms can identify suspicious transactions and patterns that might escape human detection.

This capability is particularly crucial in the Bitcoin ecosystem, where transactions are pseudonymous, making it challenging to trace the flow of funds. The use of AI in combating money laundering on the Bitcoin blockchain is not just a technological advancement; it represents a fundamental shift in the fight against financial crime, empowering financial institutions and law enforcement agencies to stay ahead of evolving threats.

Cryptocurrency and Money Laundering: Ai Detects Money Laundering Through Cryptocurrencies On Bitcoin Blockchain

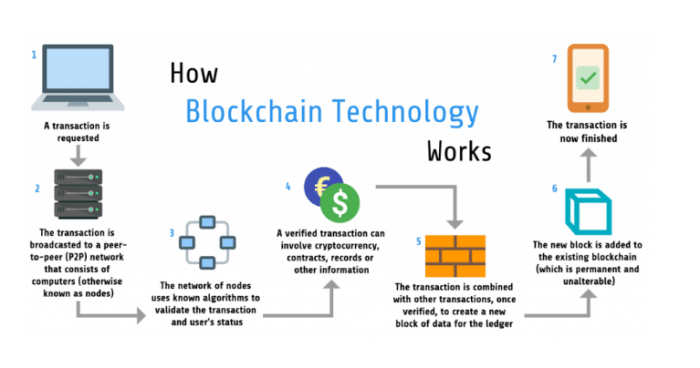

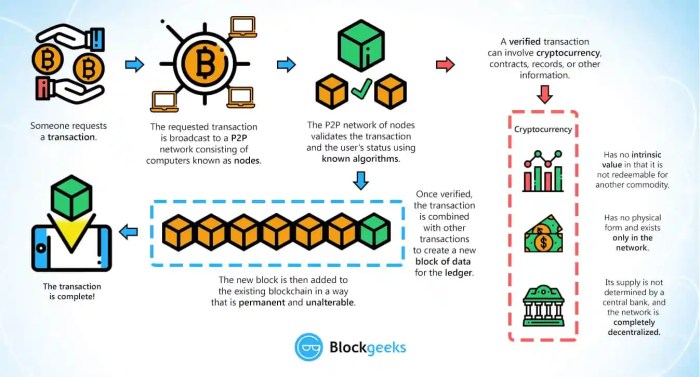

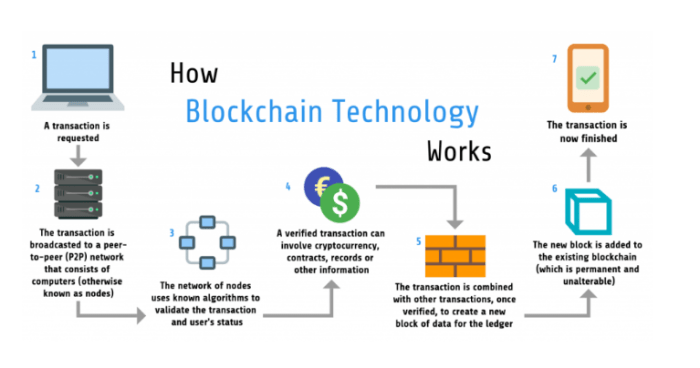

Cryptocurrencies, like Bitcoin, have gained immense popularity in recent years, revolutionizing the financial landscape. The underlying technology, blockchain, offers a decentralized and transparent system for recording transactions, eliminating the need for intermediaries. However, this very feature has also attracted illicit activities, including money laundering.The anonymity and pseudonymous nature of cryptocurrency transactions make them attractive to criminals seeking to conceal the origins of their ill-gotten gains.

Money launderers can easily move funds across borders without the scrutiny of traditional financial institutions.

Challenges in Detecting Money Laundering

Traditional financial systems have struggled to keep pace with the evolving landscape of cryptocurrency-related crimes.

- The decentralized nature of cryptocurrencies makes it difficult for authorities to track and monitor transactions.

- The lack of central oversight and regulatory frameworks poses significant challenges in identifying and preventing money laundering activities.

- The rapid growth of cryptocurrency exchanges and platforms has created a complex ecosystem that can be easily exploited by criminals.

AI’s Role in Combating Money Laundering

The fight against money laundering has been amplified by the rise of cryptocurrencies, with their decentralized nature making traditional methods less effective. Artificial intelligence (AI) emerges as a powerful tool to combat this evolving threat.AI’s ability to analyze vast amounts of blockchain data is crucial in detecting suspicious patterns and transactions.

By leveraging machine learning algorithms, AI can identify anomalies and red flags that might escape human scrutiny.

AI Algorithms for Detecting Suspicious Transactions

AI algorithms are designed to analyze complex data patterns and identify potential money laundering activities. Here’s how they work:

- Transaction Clustering:AI algorithms group transactions based on similarities, such as transaction amounts, sender and receiver addresses, and timestamps. This helps identify clusters of transactions that might indicate money laundering activities.

- Network Analysis:AI can map the relationships between different cryptocurrency addresses, revealing complex networks of transactions. This allows investigators to identify patterns that suggest money laundering, such as shell companies or money mules.

- Anomaly Detection:AI algorithms are trained to identify transactions that deviate from normal patterns. For example, a sudden surge in transactions from a previously inactive address could be a red flag.

AI-Powered Tools for Financial Institutions

Several AI-powered tools are available to financial institutions to help them detect and prevent money laundering:

- Chainalysis:This platform uses AI to analyze blockchain data and identify suspicious transactions. It provides insights into the flow of funds, helps track stolen assets, and identifies potential money laundering activities.

- Elliptic:This company offers a platform that uses AI to analyze cryptocurrency transactions and identify high-risk activities. It helps financial institutions comply with regulatory requirements and mitigate their risk exposure.

- CipherTrace:This platform provides a comprehensive solution for blockchain security and compliance. It leverages AI to track cryptocurrency transactions, identify illicit activities, and help institutions meet regulatory obligations.

Methods of Money Laundering on the Bitcoin Blockchain

While Bitcoin and other cryptocurrencies are often touted for their transparency and immutability, these features can also be exploited by criminals for money laundering purposes. The decentralized nature of the blockchain and the pseudonymous nature of transactions offer opportunities for concealing the origins of illicit funds.

Mixing

Mixing, also known as tumbling or coin mixing, is a common technique used to obscure the origin of Bitcoin funds. This process involves combining multiple Bitcoin transactions from different sources into a single pool. The mixed Bitcoin is then redistributed to different wallets, making it difficult to track the original source of the funds.Here’s how mixing works:* Multiple users deposit Bitcoin into a mixing service.

- The service combines these deposits into a single pool.

- The mixed Bitcoin is then redistributed to the users, with each user receiving an equivalent amount of Bitcoin.

- The original Bitcoin is effectively scrambled, making it difficult to trace its origin.

An example of a mixing service is CoinJoin. It works by combining multiple Bitcoin transactions from different users into a single transaction, making it difficult to identify the source of the funds.

Layering

Layering involves a series of transactions designed to break the link between the initial source of funds and the final destination. This technique involves multiple transactions with small amounts of Bitcoin, often through different exchanges and wallets. Layering can be implemented in several ways:* Using multiple exchanges:Criminals can use multiple exchanges to break the trail of their funds.

Creating multiple wallets

Learn about more about the process of ai powered grill cooks food up to 10x faster perfect steak in the field.

They can create multiple wallets and transfer funds between them, making it difficult to track the movement of funds.

Using mixers

Mixing services can be used to further obscure the trail of funds.

Integration

Integration is the final stage of money laundering, where illicit funds are converted into legitimate assets. This can involve using Bitcoin to purchase goods and services, or exchanging Bitcoin for fiat currency.Integration can be achieved through:* Purchasing goods and services:Criminals can use Bitcoin to purchase goods and services online or in person.

Exchanging Bitcoin for fiat currency

They can exchange Bitcoin for fiat currency through exchanges or over-the-counter (OTC) markets.

Real-world Examples

The Silk Road

This online marketplace for illicit goods was used by criminals to launder millions of dollars through Bitcoin. The site used a layering technique, where funds were transferred through multiple accounts and exchanges, making it difficult to trace the origins of the funds.

The AlphaBay

This dark web marketplace was also used for money laundering, with criminals using Bitcoin to purchase and sell illegal goods. The site used a mix of mixing and layering techniques to obfuscate the flow of funds.

AI Techniques for Detecting Money Laundering

AI algorithms can play a crucial role in identifying suspicious activities related to money laundering within the complex world of cryptocurrency transactions. By analyzing transaction histories, network graphs, and user behavior patterns, AI tools can detect anomalies and flag potential illicit activities.

Machine Learning Techniques, Ai detects money laundering through cryptocurrencies on bitcoin blockchain

Machine learning algorithms are particularly effective in identifying patterns and anomalies within vast amounts of data. By training on historical data of legitimate and fraudulent transactions, these algorithms learn to distinguish between normal and suspicious activities.

- Supervised learningalgorithms are trained on labeled data, where each transaction is classified as either legitimate or fraudulent. This allows the algorithm to learn the characteristics of each class and make predictions on new, unlabeled data.

- Unsupervised learningalgorithms, on the other hand, do not rely on labeled data.

They identify patterns and clusters within the data, highlighting unusual transactions that deviate from the norm.

Deep Learning Approaches

Deep learning, a subset of machine learning, utilizes artificial neural networks with multiple layers to analyze complex relationships and patterns within data.

- Recurrent neural networks (RNNs)are particularly suited for analyzing sequential data, such as transaction histories, where the order of events is crucial. They can identify temporal patterns and anomalies that might indicate money laundering.

- Convolutional neural networks (CNNs)excel at analyzing images and spatial data. They can be applied to network graphs, visualizing the flow of funds and identifying unusual connections that might suggest illicit activities.

Natural Language Processing

Natural language processing (NLP) techniques can analyze textual data associated with cryptocurrency transactions, such as user comments, forum discussions, and social media posts.

- Sentiment analysiscan identify negative or suspicious sentiments expressed in online discussions related to cryptocurrency transactions.

- Topic modelingcan identify emerging trends and patterns in online conversations, revealing potential money laundering schemes or illicit activities.

Challenges and Limitations of AI-Based Detection

While AI offers promising solutions for combating money laundering in the cryptocurrency space, it’s crucial to acknowledge the challenges and limitations that accompany these technologies. Understanding these constraints is essential for developing effective and robust AI-driven anti-money laundering (AML) systems.

Data Challenges and Biases

The effectiveness of AI models hinges heavily on the quality and quantity of data used for training. In the context of cryptocurrency AML, acquiring comprehensive and unbiased data poses significant challenges. The decentralized nature of blockchain transactions makes data collection more difficult compared to traditional financial systems.

Additionally, the evolving nature of cryptocurrency transactions and the emergence of new money laundering techniques can lead to data biases, potentially impacting the accuracy of AI models.

False Positives and False Negatives

AI-based detection systems are susceptible to false positives and false negatives. False positives occur when legitimate transactions are flagged as suspicious, leading to unnecessary investigations and potential disruptions to legitimate users. Conversely, false negatives occur when illicit transactions go undetected, allowing money launderers to escape detection.

The consequences of both false positives and false negatives can be significant, hindering the effectiveness of AML efforts.

Limitations in Detecting Sophisticated Schemes

While AI excels at identifying patterns in large datasets, it may struggle to detect sophisticated money laundering schemes that involve complex transactions or utilize novel methods. These schemes often involve intricate layering, structuring, and obfuscation techniques, making them difficult for AI models to identify.

Additionally, money launderers are constantly evolving their tactics, requiring AI systems to adapt and evolve alongside them.

Future Directions and Research

The fight against money laundering in the cryptocurrency space is a dynamic and evolving field. As technology advances, so too do the methods employed by criminals. AI-based solutions are at the forefront of this battle, and ongoing research is pushing the boundaries of what’s possible.

Emerging Technologies and their Impact

The emergence of new technologies like blockchain analytics and quantum computing presents both opportunities and challenges for AI-based money laundering detection.

- Blockchain Analytics: Blockchain analytics tools are becoming increasingly sophisticated, allowing investigators to trace the flow of cryptocurrency transactions with greater precision. This granular level of analysis provides valuable insights into suspicious activities, including identifying patterns of money laundering.

- Quantum Computing: While still in its early stages, quantum computing has the potential to revolutionize AI-based money laundering detection. Quantum algorithms can process massive amounts of data at unprecedented speeds, enabling the identification of complex patterns and anomalies that might otherwise go unnoticed.

AI-Based Detection: Future Outlook

The future of AI in combating financial crime is promising. AI is expected to play a more prominent role in:

- Real-Time Detection: AI algorithms are becoming increasingly adept at identifying suspicious activities in real-time, allowing for faster intervention and prevention of money laundering.

- Enhanced Risk Assessment: AI can analyze vast amounts of data to identify emerging money laundering trends and assess risk profiles of individuals and organizations, enabling more targeted interventions.

- Automated Investigation: AI can automate routine investigative tasks, freeing up human investigators to focus on more complex cases.

- Collaboration and Information Sharing: AI can facilitate collaboration and information sharing between financial institutions and law enforcement agencies, enabling a more comprehensive and coordinated response to money laundering threats.