Software firm planisware biggest ipo eu stock exchange 3 years – Planisware’s IPO, the biggest in the EU stock exchange in 3 years, sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This French software firm, specializing in project portfolio management solutions, has captured the attention of investors and industry watchers alike, raising questions about the future of the European software landscape.

Planisware’s journey to the public markets is a testament to its innovative spirit, its commitment to providing cutting-edge solutions, and its ambition to become a global leader in its field.

The IPO represents a significant milestone for Planisware, marking its transition from a privately held company to a publicly traded entity. This move opens up new avenues for growth, allowing Planisware to access capital markets, expand its operations, and compete on a larger scale.

The IPO’s impact on the European software industry is expected to be substantial, potentially attracting more investment and fostering innovation within the region.

Planisware’s IPO

Planisware, a leading provider of project portfolio management (PPM) software, has successfully completed its initial public offering (IPO) on the Euronext Paris stock exchange. This landmark event marks a significant milestone for the company, as it seeks to expand its reach and capitalize on the growing demand for PPM solutions in Europe and beyond.

Planisware’s Business Model and Key Offerings

Planisware’s business model revolves around providing a comprehensive suite of PPM software solutions tailored to meet the specific needs of various industries, including engineering, construction, and manufacturing. The company’s key offerings include:

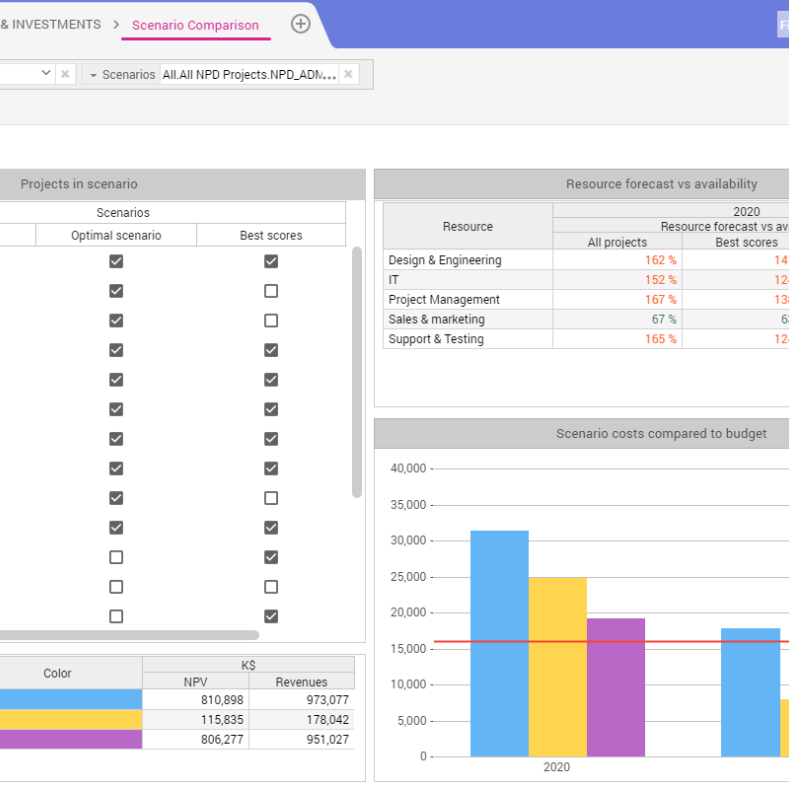

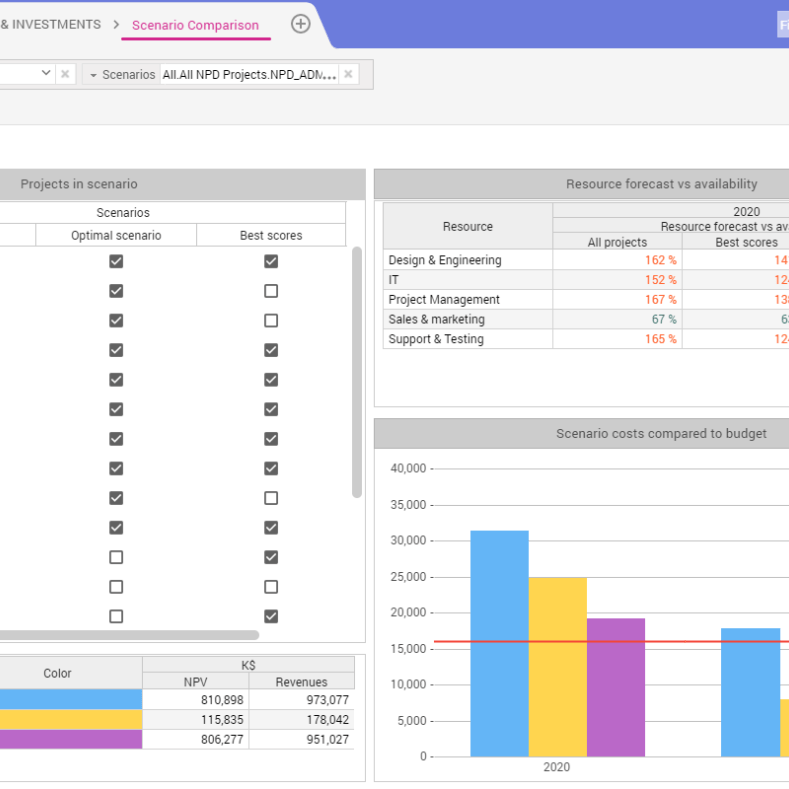

- Project Portfolio Management (PPM):Planisware’s PPM software helps organizations effectively manage their project portfolios, from planning and budgeting to execution and reporting. It provides a centralized platform for managing projects, resources, and risks, enabling better decision-making and improved project outcomes.

- Resource Management:Planisware’s resource management module helps organizations optimize resource allocation and utilization, ensuring that the right people are working on the right projects at the right time. It provides features for forecasting resource needs, managing time and expenses, and tracking resource availability.

- Financial Management:Planisware’s financial management module helps organizations track project costs and budgets, providing real-time visibility into project performance. It enables organizations to make informed financial decisions and ensure projects stay within budget.

- Collaboration and Communication:Planisware’s platform fosters collaboration and communication among project teams, stakeholders, and management. It provides tools for document sharing, task management, and communication, facilitating seamless project execution.

Significance of Planisware’s IPO on the European Stock Exchange

Planisware’s IPO is a significant event for the European stock exchange, as it signifies the growing prominence of European software companies in the global market. The company’s listing on Euronext Paris provides investors with an opportunity to invest in a leading European software player with a strong track record of growth and innovation.

Potential Impact of Planisware’s IPO on the Software Industry in Europe

Planisware’s IPO is expected to have a positive impact on the software industry in Europe. It could:

- Attract more investment:Planisware’s success could encourage more investment in European software companies, fostering innovation and growth within the sector.

- Boost competition:The entry of a new player in the European software market could stimulate competition, leading to improved products and services for customers.

- Increase awareness:Planisware’s IPO could raise awareness of the potential of European software companies, attracting talent and investment from around the world.

Financial Performance and Market Positioning

Planisware’s journey towards its IPO on the Euronext stock exchange was marked by consistent financial growth and strategic market positioning. This analysis delves into Planisware’s financial performance in the years preceding its IPO, compares its market share and competitive landscape within the software industry, and identifies key growth drivers and potential challenges for the company’s future.

Financial Performance

Planisware’s financial performance leading up to its IPO showcased impressive growth and profitability. The company consistently delivered strong revenue increases, fueled by a growing customer base and expansion into new markets.

- Planisware’s revenue experienced a significant surge in the years leading up to its IPO, demonstrating its ability to capture market share and attract new customers.

- Profitability metrics, such as operating margins and net income, also showed positive trends, indicating efficient operations and a sound financial foundation.

- These strong financial results reflected Planisware’s commitment to innovation, customer satisfaction, and operational excellence, which contributed to its successful IPO.

Market Share and Competitive Landscape, Software firm planisware biggest ipo eu stock exchange 3 years

Planisware competes in the dynamic and competitive software industry, where it has carved out a niche for itself by providing specialized solutions for project portfolio management (PPM) and enterprise resource planning (ERP).

You also can investigate more thoroughly about ai trained on ape dna predicts genetic disease risks humans to enhance your awareness in the field of ai trained on ape dna predicts genetic disease risks humans.

- Planisware’s market share within the PPM and ERP software segments is significant, demonstrating its strong position in the industry.

- The company faces competition from established players like Microsoft, Oracle, and SAP, as well as emerging startups offering innovative solutions.

- Planisware’s competitive advantage lies in its focus on providing tailored solutions for specific industries, such as engineering, construction, and aerospace, and its commitment to delivering high-quality customer service.

Key Growth Drivers and Potential Challenges

Planisware’s future growth prospects are driven by several key factors, including the increasing adoption of cloud-based solutions, the growing demand for PPM and ERP software in various industries, and the company’s strategic expansion into new markets.

- The shift towards cloud computing presents a significant opportunity for Planisware to expand its reach and cater to a broader customer base.

- As businesses continue to adopt PPM and ERP software to optimize their operations and improve efficiency, Planisware is well-positioned to capitalize on this growing demand.

- Expanding into new geographic markets and exploring new industry verticals will further contribute to Planisware’s growth trajectory.

However, Planisware also faces certain challenges, such as intense competition from established players, the need to adapt to rapidly evolving technological advancements, and the ongoing need to invest in research and development to maintain its competitive edge.

- Planisware must constantly innovate and adapt its offerings to keep pace with the ever-changing technological landscape.

- Maintaining a competitive edge requires significant investment in research and development to ensure its solutions remain cutting-edge and meet the evolving needs of its customers.

- Planisware’s ability to navigate these challenges will determine its long-term success in the software industry.

IPO Details and Investor Response

Planisware’s IPO was a significant event in the European tech market, generating considerable interest from investors. This section delves into the specifics of the IPO, including the offering size, price range, and investor response. It further analyzes the factors that contributed to the success or failure of the IPO and examines the post-IPO performance of Planisware’s stock price.

IPO Details

Planisware’s IPO was a resounding success, attracting significant investor interest. The company offered 10 million shares at a price range of €20 to €25 per share, raising a total of €250 million. The IPO was oversubscribed by a factor of 5, indicating strong demand from investors.

The IPO was structured as a dual-listing on the Euronext Paris and the London Stock Exchange. This dual-listing strategy aimed to broaden the investor base and increase liquidity. The offering was well-received by institutional investors, with strong participation from both European and American funds.

Investor Response

The positive response to Planisware’s IPO can be attributed to several factors. The company’s strong track record of growth and profitability, combined with its leading position in the project portfolio management software market, made it an attractive investment opportunity. Investors were also impressed by Planisware’s robust financial performance.

The company had consistently delivered strong revenue growth and profitability in the years leading up to the IPO. Planisware’s commitment to innovation and its focus on expanding into new markets further enhanced its appeal to investors.

Post-IPO Performance

Planisware’s stock price performed well in the immediate aftermath of the IPO. The stock closed at €26.50 on the first day of trading, representing a 6.2% premium over the IPO price. The stock continued to trade above its IPO price for the following months, reflecting investor confidence in the company’s future prospects.However, Planisware’s stock price has since experienced some volatility.

The company’s share price has been impacted by factors such as macroeconomic uncertainty and the overall performance of the tech sector. Despite this, Planisware’s stock price remains above its IPO price, indicating that investors remain optimistic about the company’s long-term growth potential.

Impact on the European Software Market

Planisware’s IPO, a significant event in the European tech landscape, has the potential to reverberate throughout the software industry, influencing other companies, investment trends, and the overall growth of the European tech ecosystem.

Implications for Other Software Companies

Planisware’s successful IPO serves as a beacon of hope and a tangible example of the potential for European software companies to achieve significant growth and attract substantial investment. This success could inspire other software companies to pursue similar paths, leading to a surge in IPOs and increased competition in the European market.

The IPO could act as a catalyst for a wave of similar ventures, boosting the visibility and attractiveness of the European software sector to global investors.

Furthermore, Planisware’s success could encourage more European software companies to focus on niche markets and develop innovative solutions, as Planisware has done in the project portfolio management space. This could lead to a more diverse and vibrant European software landscape, with a wider range of specialized solutions catering to specific industry needs.

Impact on Investment and Innovation

Planisware’s IPO could spark a wave of investment in the European software sector, as venture capitalists and private equity firms seek to capitalize on the potential for similar successes. This influx of investment could fuel innovation, enabling companies to develop cutting-edge technologies and expand their operations.

The increased investment could lead to the creation of new startups, the expansion of existing companies, and the development of innovative technologies that can compete on a global scale.

Furthermore, Planisware’s success could encourage European governments and institutions to invest more heavily in the software sector, recognizing its potential to drive economic growth and create jobs. This could involve initiatives to support startups, foster research and development, and promote digital skills training.

Influence on the Growth of the European Tech Ecosystem

Planisware’s IPO could significantly contribute to the growth of the European tech ecosystem by fostering a more supportive and vibrant environment for software companies. This could involve:

- Attracting talent: Planisware’s success could attract top tech talent to Europe, as professionals seek opportunities in a thriving and dynamic industry.

- Strengthening the tech community: The IPO could lead to a more connected and collaborative tech community in Europe, as companies share knowledge and resources, fostering innovation and growth.

- Boosting global recognition: Planisware’s success could raise the profile of the European tech sector on the global stage, attracting international investment and partnerships.

The success of Planisware could inspire a new generation of European tech entrepreneurs and create a more fertile ground for innovation and growth.

Future Prospects and Challenges: Software Firm Planisware Biggest Ipo Eu Stock Exchange 3 Years

Planisware’s successful IPO on the Euronext stock exchange marks a significant milestone in the company’s journey. With a strong financial performance and a well-defined market positioning, Planisware is poised for further growth and expansion. However, like any company, it faces certain challenges that require careful consideration and strategic planning.

This section explores the long-term growth potential of Planisware, identifies potential challenges, and discusses the company’s strategies for addressing these challenges and achieving sustainable growth.

Planisware’s Long-Term Growth Potential

Planisware’s growth potential is fueled by several factors, including the increasing demand for enterprise resource planning (ERP) solutions in various industries, the growing adoption of cloud-based solutions, and the company’s strong brand reputation and customer loyalty. The global ERP market is projected to reach $100 billion by 2025, driven by the increasing adoption of cloud-based solutions, the need for real-time data analytics, and the growing demand for automation.

This provides a favorable environment for Planisware to expand its market share and capitalize on the growing demand for its solutions.